Introduction

On December 19th, a significant event reshaped the French football landscape as John Textor and his company, Eagle Football, successfully acquired a majority stake in Olympique Lyonnais (OL). Initially scheduled for July 2022, the transaction was completed a few months later, valuing the French club over €800 million. Eagle Football will now own 77.49% of the OL Group and proceed with a separate €86 million capital increase. This strategic move has enabled John Textor to assemble a portfolio of clubs, including Botafogo, Molenbeek, and Crystal Palace. This article will begin by analyzing the evolving dynamics of sportive mergers and acquisitions. Subsequently, we will examine how Jean Michel Aulas’ strategy has recently transformed the club in past decades. Lastly, we will assess the potential impact of this transaction on the future structure of OL.

European Sport, a Booming Industry Attracting Investors

The sports industry is a rapidly expanding market encompassing various activities, from professional leagues and teams to amateur sports organizations and equipment manufacturers. With increasing fan interest, technological advancements, and investments from financial institutions, this billion-dollar industry continues to grow. According to a Deloitte report, the global sports industry reached a market value of $614 billion by the end of 2022.

Within this industry, European football clubs present a significant growth opportunity, generating a revenue of $27.6 billion in the 2021 season. Notable examples of high-profile transactions include Qatar Sports Investment’s acquisition of PSG for approximately $80 million in 2012 and the Saudi Arabian Public Investment Fund’s purchase of Newcastle for $415 million in 2020. These deals have propelled these clubs to become some of the most valuable and successful football teams, attracting top players and fans worldwide.

As companies view sports teams as business entities, they have implemented aggressive strategies to expand their operations and optimize financial returns. In recent years, valuations have been fueled by the entry of private equity firms and other financial institutions into the industry. Notable examples include CVC Capital Partners’ acquisition of a 28% share in the Top14 rugby union tournament and Silver Lake’s purchase of a 10% stake in Manchester City’s parent company. These investments highlight the increasing financial potential of the sports industry in the medium term.

Among the major European football leagues, the French Ligue 1 has emerged as particularly active in terms of ownership changes over the past decade. In the last five years alone, over a third of the 20 Ligue 1 clubs have undergone ownership transitions. For instance:

- Clermont Foot 63 was purchased by Core Sports Capital, which also has ownership stakes in Austria Lustenau and FC Biel-Bienne 1896.

- OGC Nice was sold to Jim Ratcliffe, the British billionaire and funder of the chemical group Ineos.

- ESTAC Troyes was acquired by City Football Group and Mansour Al-Nahyan, owning 13 clubs worldwide, including Manchester City.

- LOSC Lille is owned by the British company Merlyn Partners.

- Toulouse FC is held by RedBird Capital Partners, a private investment firm that owns AC Milan.

- Girondins de Bordeaux was bought by Gérard Lopez, who also owns Boavista FC.

The latest club to change ownership is Olympique Lyonnais. However, unlike most clubs, this transition signals a significant transformation that marks a new chapter in the history of French professional football.

A Sports Success Story Based on Young Talents in France and Abroad

Olympique Lyonnais (OL) is an important monument in French football history as it is one of the most renowned and titled teams. Founded in 1950, the club experienced its most successful era in the early 2000s, securing seven consecutive league titles in Ligue 1. While reaching the Champions League semi-finals in 2009-2010 and 2019-2020, OL fell short against the formidable German powerhouse, Bayern Munich, on both occasions. The club’s trajectory has been shaped by the strategies of its emblematic president, Jean-Michel Aulas.

When Aulas acquired the club in 1987, the club evolved in the French second division and was burdened with significant debt. However, the club regained its competitive edge through an efficient strategy centered around training young players and astute transfers. In 1989, OL returned to Ligue 1, qualified for the European Cup in 1981, and clinched the French League Cup in 2001. Over three decades, the club’s budget grew exponentially, expanding from €2 million to €250 million (as of 2022).

OL is also a trailblazer in women’s football. While the men’s team has yet to replicate its past successes, Lyon’s women’s team has emerged as one of the strongest in Europe. OL Féminin has won 8 UEFA Women’s Champions League titles between 2011 and 2022, surpassing any other team in the competition’s history.

In addition to building a competitive team, the club has garnered a reputation for identifying and nurturing young talent, allowing them to shine on the field and attract interest from larger clubs. Lyon has played a pivotal role in developing global superstars such as Karim Benzema and Éric Abidal. Aulas has demonstrated strategic prowess in negotiating transfers, ensuring favorable fees for outgoing players while securing clauses that provide financial benefits from potential future success. This shrewd transfer policy not only bolsters Lyon’s finances but also contributes to the growth of the club’s youth academy. Transfers have consistently generated substantial recurring revenues for the club, enabling it to foster development and autonomously finance its operating budget. This trend remained evident in recent years, with Lyon ranking as the 6th largest net beneficiary of transfers from 2018 to 2022, amassing profits of €210.96 million over the period, according to Transfermarkt.

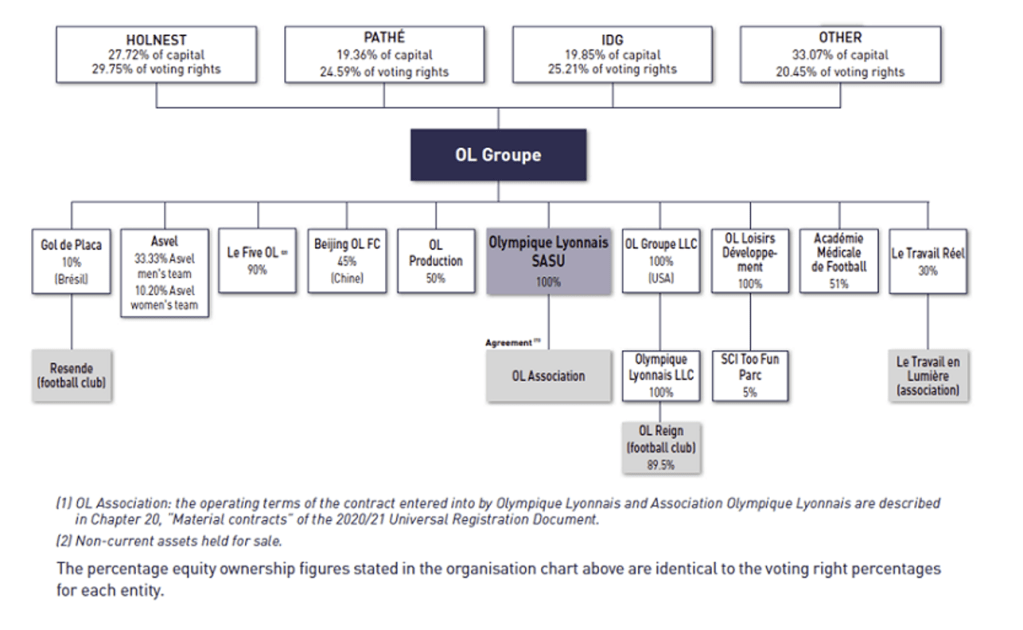

Furthermore, the club has pursued an expansion strategy by diversifying its activities beyond football and extending its brand influence. Over the years, OL Group has taken significant ownership stakes in various sporting clubs both within and outside of football, including:

- LDLC ASVEL Basketball: The club currently holds a 33% stake in LDLC ASVEL (men’s team) and a 10% stake in LDLC ASVEL Féminin (women’s team), both owned by Tony Parker and participating in the EuroLeague.

- LDLC OL E-sport: In 2020, the club partnered with LDLC to operate an e-sports team competing in games such as League of Legends, CS: GO, Rocket-League, FIFA, WRC, and NBA2K23.

- OL Reign: In 2019, OL acquired Reign FC, North America’s top women’s football team.

- Gol de Placa: In 2019, OL acquired a 10% stake in the company that manages the Club of Resende and the “Pelé Academia.”

Parallel to its sporting strategy, the club has developed another pillar for its development diversification into entertainment, leisure, and live performances.

An Ambitious Diversification Towards Entertainment

The diversification strategy implemented by the club has resulted in a remarkable transformation, positioning it as a unique entity within the French landscape. OL has moved beyond traditional revenue streams such as matchday income and broadcast rights and actively pursued alternative sources of revenue. Cultural events, including concerts, conferences, and other gatherings, have become integral to the club’s calendar, generating additional income, and reducing reliance on football-related revenue.

This forward-thinking approach has paved the way for an ambitious real estate project, OL Vallée, which involves a substantial investment of €420 million. The goal is to create Lyon’s largest leisure and entertainment venue, hosting between 80 and 120 events each year and regular sporting fixtures. The expansive complex encompasses more than 17 concessions, including multiple restaurants, a tennis academy, a 240-room 3-star hotel, and 5,000 square meters of office space.

At the heart of OL Vallée lies the Groupama Stadium, a strategic asset that provides a competitive advantage over its French counterparts. Among the 20 clubs in Ligue 1, only three own their stadiums (AJ Auxerre, AC Ajaccio, and OL). The new facility positions the club at the forefront of European infrastructure standards, on par with renowned Champions League clubs such as Arsenal, Bayern Munich, and Real Madrid. This development has also allowed the club to maximize ticketing revenue and expand its hospitality capabilities. The seating capacity has increased from 35,000 to 59,000 people (+45%) compared to the previous Gerland Stadium, with VIP seats rising from 400 to 1,500 (+375%). These premium seating options serve as vital sources of revenue and financial stability for clubs, benefiting from captivating performances and a devoted fanbase.

In addition to the Groupama Stadium, the club is on track to inaugurate a new venue, the LDLC Arena, by the end of 2023. This state-of-the-art facility will be the home of the LDLC ASVEL basketball team, a permanent member of the Euroleague championship. With a capacity of over 16,000 people, the arena will host various events, including concerts, spectacles, and e-sport competitions.

OL Group has formed strategic partnerships to ensure a consistent flow of events for the new arena. Firstly, the group has secured a 15-year hosting agreement with Live Nation, the global leader in the entertainment market (Ticketmaster, Live Nation Concerts, and Live Nation Sponsorship). Through this collaboration, Live Nation will organize concerts in the Arena for numerous international artists. Additionally, OL Group has established a 50% joint venture with Vivendi-Olympia Production, aiming to develop new tours and concerts, further enhancing the club’s entertainment offerings.

A Perfect Storm: Development Expenditure, Financial Disappointments, and Sporting Struggles

The development plans undertaken by the club have required substantial capital expenditure, and it will take several years for them to yield results and generate cash flows. Concurrently, the club has faced challenges with poor sporting performances and financial disappointments. In recent years, increased competition, inefficient transfer dealings, and underperformance on the pitch have seen Lyon fall behind old rivals like PSG, AS Monaco, and Olympique de Marseille. With the entry of Eagle Football, Lyon fans hope this trend will change. Despite their ambitious development strategy, the club’s current financial situation has become a concern. Since the rise of Qatar-funded Paris Saint-Germain, Lyon, has gradually faded from the limelight of the French topflight. Nonetheless, experts and fans still consider the club a sleeping giant due to its history of success, which continues to resonate with a dedicated fanbase.

Furthermore, three significant factors have affected the club. Firstly, the COVID-19 pandemic has dramatically impacted ticketing revenues, particularly for a club with considerable emphasis on developing live performances and leisure activities.

Secondly, poor sporting performances in Ligue 1 have resulted in significant revenue losses. Lyon finished 7th in 2019-2020, 4th in 2020-2021, and 8th in 2021-2022. These results have prevented the club from participating in European competitions resulting in losses in terms of TV rights. These disappointing results have also had a detrimental effect on the sale of merchandise and derivative products.

Thirdly, the disastrous negotiations for Ligue 1 TV broadcasting rights have adversely affected the club. Mediapro France, the leading broadcaster of Ligue 1 and 2, filed for bankruptcy and failed to fulfil its payment obligations of €800 million to the French Professional Football League. As a result, the broadcasting rights were reauctioned and awarded to Amazon for only a quarter of the previous agreement (€200 million). This debacle not only impacts the short-term TV revenues of clubs but also has long-term implications. It immediately affects the income from broadcasting the current season’s matches. It tarnishes the reputation of the rights purchaser, undermining the value of Ligue 1 and Ligue 2 rights in the long term. This situation has widened the gap between the value of domestic broadcasting rights for the French Championship (€582 million) and those of the other top five leagues: Premier League (£1.6 billion), Bundesliga (€1.1 billion), La Liga (€990 million), and Serie A (€825 million).

The revenue decrease has significantly impacted the club’s net income and free cash flow. Figures for the available financial years indicate that the net income amounted to €6.20 million in 2019, (€36.5 million) in 2020, (€107 million) in 2021, and (€55 million) in 2022. Similarly, the free cash flow figures were (€3.60 million), (€51.3 million), (€101 million), and (€123 million) for the respective years. This situation has substantially increased the group’s net debt, rising from €210 million in 2019 to €410 million.

Given the deteriorated financial situation and disappointing sporting results, it can be inferred that Jean-Michel Aulas sought new investors with financial stability to restore the club’s economic and sporting performance. The decision to sell the club to John Textor and his holding company, Eagle Football, was further accelerated by the intentions of IDG Capital and Pathé to exit the group’s capital.

A Difficult Acquisition Marking a Change of Era

On December 19th, 2022, Eagle Football acquired a 77.49% stake in Olympique Lyonnais (OL) for €529.46 million. The acquisition was based on obtaining 176,487,533 outstanding shares, valued at a cash offer price of €3 per share, and the purchase of 789,824 ORSANE (convertible obligation) valued at €265.57 each, and assuming the existing debt of the club. As a result, the group’s total value is estimated to be around €800 million. Although the sale was initially agreed upon in July 2022, with a target completion date set for September 2022, it was subsequently delayed multiple times.

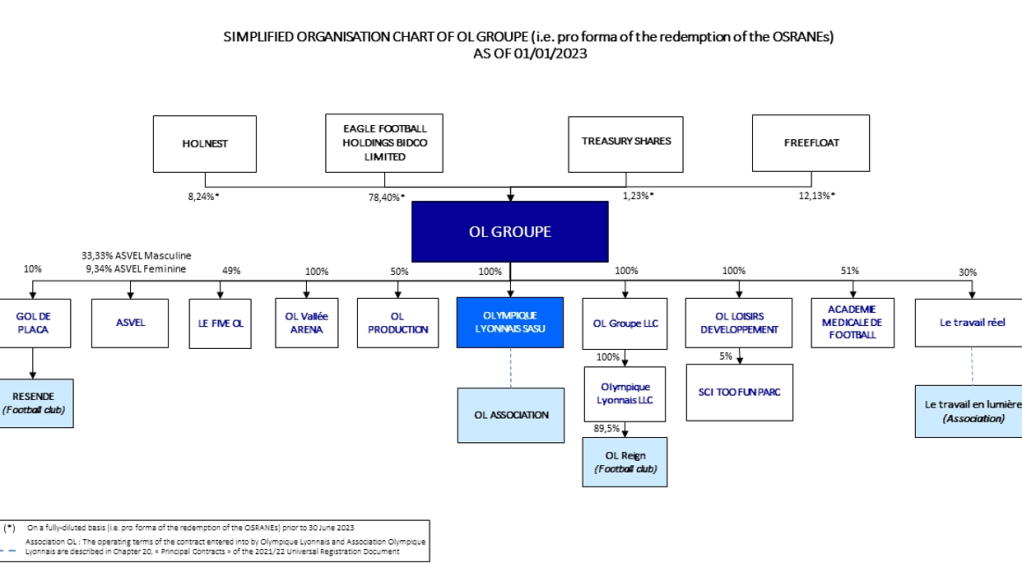

The investment holding company has first acquired a 39% stake from Olympic Lyonnais’s principal historical shareholders, Pathé and IDG Capital. Pathé, a France-based cable television and film production services provider, and IDG Capital, a China-based investment firm, were interested in selling their stakes as part of their exit strategy. Pathé and IDG Capital have wholly divested from the OL group, while Holnest, Jean-Michel Aulas’s holding company, retains 8.24% of the capital.

Alongside the acquisition, an agreement was reached for a separate capital increase of €86 million, which was approved by the shareholders’ general meeting on July 29th, 2022, and implemented by the Board of Directors on December 19th, 2022. With this capital increase, Eagle Football now owns 77.49% of the share capital of Olympique Lyonnais Group on a non-diluted basis (78.40% on a fully diluted basis).

Shareholder structure after the acquisition

Shareholder structure after the acquisition

The deal structure for Eagle Football’s acquisition of Olympique Lyonnais involves two essential third parties financing the transaction. Firstly, Ares Capital provided a $400 million loan to Eagle Football from its dedicated allocation of $3.7 billion for the sports and entertainment industry. This loan was instrumental in facilitating the transaction.

Secondly, Iconic Sports Management, a consortium of investors, made a direct equity investment of $75 million in Eagle Football. According to reports from the Financial Times, part of the deal includes agreements for a potential merger between Eagle Football and Iconic Sports Acquisition Corp, a Special Purpose Acquisition Company (SPAC) established in 2021 and listed on the New York Stock Exchange (NYSE). Analysts suggest that in the event of a listing, Eagle Football is aiming for a valuation of $1.2 billion. The successful execution of this plan will depend significantly on John Textor’s ability to restore the club’s performance and the prevailing market conditions.

What is its strategy with Eagle Football’s strategy, and Who is John Textor?

John Textor is a prominent American businessman known for his early advocacy of the convergence of entertainment media and technology. He has played a pivotal role in developing creative content and digital distribution business models. Textor gained recognition as the former Co-Chairman of Digital Domain, a renowned visual effect, and digital production company. Notably, Digital Domain achieved a breakthrough in visual effects by delivering a believable digital human actor in the film “The Curious Case of Benjamin Button,” which earned the company the 2009 Academy Award for Achievement in Visual Effects.

In addition to his role at Digital Domain, Textor has served as the CEO of FaceBank Group, a leading developer of digital human likenesses for celebrities and consumers. He was also the former Executive Chairman of fuboTV. This famous American streaming television service primarily broadcasts international soccer and sports, including NBA, NFL, NHL, MLB, and MLS.

Textor’s latest venture, Eagle Football, is a recently established group exploring new football team possibilities. Over the past two years, Eagle Football has acquired stakes in several clubs globally, including Crystal Palace in the Premier League, Botafogo in Brazil, and RWD Molenbeek in the Belgian second division. This multi-club approach allows for synergies, cross-promotion, and the implementation of standardized methodologies among the various clubs within the group. This strategy aligns with the policy recently adopted by OL but on a larger scale with greater leverage. The objective is to leverage synergies, foster collaboration, and support each other through mutual youth system development and community-driven effects.

Source: CIES Sports Intelligence

The clubs in which Eagle Football is investing all have a rich history and a strong emphasis on academic development. The group carefully selects its investments based on geographical relevance to talent pools. With locations in South London, Rio de Janeiro, and the suburbs of Brussels, each club in Textor’s portfolio is situated in regions known for producing top-level footballers. Olympique Lyonnais, a club renowned for nurturing global superstars like Karim Benzema, Alexandre Lacazette, Samuel Umtiti, and Nabil Fakir through its youth system, fits perfectly within this strategy.

The multi-ownership business model, in which a single entity holds stakes in multiple clubs, has gained popularity in the industry, particularly with the growing interest of American investors in European football. According to Deloitte, there are currently over 70 multi-club groups worldwide. However, it’s important to note that this model has drawn UEFA’s attention, leading to strict regulations to prevent anti-competitive behaviours and arrangements at the European level.

What’s next for OL

The multiple delays in finalizing the deal have accelerated the deterioration of the club’s situation. Therefore, John Textor has emphasized the importance of implementing remedial measures regarding sports performance and financial stability. First and foremost, it is crucial to improve the team’s performance in the domestic championship and at the European level. This improvement would help regain the fanbase, restore stable revenues, and strengthen the club’s financial position. Additionally, enhancing the club’s situation is vital for stabilizing the debt incurred by Eagle Football and the one incurred by OL. The current period is particularly strategic for the team as securing 5th place in the French Championship would enable participation in the qualification phase for the UEFA Europa League, generating significant broadcasting revenues. However, the team is currently in the 7th position.

Initially, the agreement to transfer OL Group stipulated that Jean-Michel Aulas would remain CEO and retain executive management responsibilities for at least three years after the signing. However, due to the situation’s urgency, John Textor has modified the original plans. Tensions between Jean-Michel Aulas and John Textor have intensified following the team’s undignified performance against Nantes in the semi-finals of the Coupe de France, leading Textor to take over direct management of the club. Consequently, Jean-Michel Aulas was forced to resign from his CEO position and was appointed “Honorary President” as a consolation.

In the long term, these clubs aim to operate sustainably. In an era of skyrocketing transfer fees, Textor is placing its bet on the organic development of young talents and a modern community engagement strategy. Shortly after Eagle’s involvement with the clubs above, fans from different teams could already be seen actively engaging with each other on social media. While adept operators may have somewhat orchestrated this, it quickly raises brand awareness for the Eagle portfolio clubs worldwide and, in the medium term, could generate much-needed marketing revenue.

Regarding women’s football, recent news from the sporting journal L’Équipe suggests that OL is considering selling a majority stake in the women’s division to Michele Kang, an American businesswoman. This transaction would have yielded more than €52 million in proceeds, which could have been used to alleviate the club’s financial burden. However, the club has contradicted these rumors, stating that its aim is, on the contrary, to expand the OL brand internationally and establish a specialized structure for women’s football with multiple clubs in Europe, America, and Asia. The exact outcome of this process is still uncertain. Furthermore, it appears that the fate of OL Reign is also undetermined.

Authors: Kurt Niklfeld, Meric Cavus, Alessandro Gallone

You must be logged in to post a comment.