INTRODUCTION

On August 18, 2023, Apollo Global Management acquisition of the lightweight metals manufacturer Arconic Corp. was finalized in a $4.6bn all-cash deal.

As stated by the chairman of the board of directors of Arconic, Fritz Henderson:

“This transaction represents a realisation of value for Arconic shareholders at a meaningful premium and enables the company to execute its long-term strategic vision. The board decided to approve this transaction after thorough and thoughtful review of a range of value creation opportunities for shareholders.”

While the backing of a private equity giant will certainly have a significant impact on the company’s operations, our analysis provides the prospects of this buyout.

COMPANY OVERVIEW

Arconic Corp.

Arconic Corp. was formed in 2016 as a spin-off from Alcoa Corporation and named Arconic Inc. It was previously a business unit within Alcoa, a well-known aluminum manufacturer. In 2019, Arconic Inc. split into two separate companies: Howmet Areospace Inc. and the newly spun-off, tax-exempt Arconic Corp.

Headquartered in Pittsburgh, Pennsylvania, Arconic Corp. is a manufacturer of lightweight metals and architectural products; the company’s product portfolio includes a broad range of aluminum sheets, plates, and extrusions, as well as innovative architectural products that advance the ground transportation, aerospace, building and construction, industrial and packaging end markets.

As of the end of 2022, Arconic Corp. presented these financial data:

- Revenues: €8.96bn

- Total Assets: €6.015mn

- Net loss of €182m ( ̴54% better then 2021 YoY)

- EBITDA: €646mn

As we will discuss, in 2023, Apollo Global Management agreed to acquire Arconic Corp in an all-cash transaction valued at $4.6bn, including debt.

Apollo Global Management Inc.

Apollo Global Management, Inc. is a worldwide alternative asset management firm that provides solutions for asset management and retirement services. The company was established in 1990 by Leon Black, Joshua Harris, and Marc Rowan, and has grown to become one of the largest and most influential alternative asset managers globally. The Company is involved in raising, investing, and managing funds, accounts, and other vehicles for pension, endowment, and sovereign wealth funds, as well as other institutional and individual investors. To be more specific, in 2022 Apollo merged with Athene, and, thanks to the merger, the combined entity Apollo Global Management, Inc., led by Chief Executive Officer Marc Rowan, has now two principal subsidiaries: Apollo Asset Management (formerly Apollo Global Management, Inc.), its alternative asset management business, and Athene, its retirement services business.

The retirement services business, Athene, offers a range of retirement savings products to assist clients in achieving financial security while also acting as a solution provider for institutions.

The asset management enterprise centers around three primary investment strategies: yield, hybrid, and equity. The company provides financing solutions across private and public markets through its yield franchise. Its hybrid strategies offer capital solutions tailored to the needs of companies, financial sponsors, and intermediaries. Additionally, its equity franchise supports business transformation, management teams, and growth under its funds’ ownership.

As of September 30, 2023, Apollo had approximately $631bn of AUM.

(Total AUM increased $108bn, or 21%, YoY primarily driven by $95bn of inflows from Asset Management and $58bn of inflows from Retirement Services)

Irenic Capital Management LP

Irenic Capital Management was cofounded in 2021, by Adam Katz and Andy Dodge. The firm, based in New York, invests across the capital structure in unique special situation opportunities.

MARKET OVERVIEW

The Primary Metal Manufacturing Industry is forecast to be ~ $254,360mn in 2023 and to change by -14.1% from 2022 to 2023 in US. The industry will be $253,598.9 million dollars in 2024 and is forecasted to change by -0.3% from 2023 to 2024.

Source: Wharry Shape Research

The early months of 2022 marked a robust period for the metals and mining sector, driven by record-high commodity prices, supply chain constraints, and increasing demand related to the energy transition. However, as we moved into the middle of the year, macroeconomic conditions deteriorated, resulting in diminished expectations for near-term demand and a decline in commodity prices. Looking ahead to 2023, we analyze the prominent trends confronting the industry, emphasizing that while short-term risks may pose challenges, they should only serve to amplify supply-side opportunities associated with medium-term constraints.

METALS MARKET: GROWTH DRIVERS

Rapid Growth in Automotive Industry – The production of vehicles requires large amount of sheet metal. Furthermore, the advantages provided by the sheet is the prime factor that is expected to drive the sales of sheet metal in the Automotive industry. As per recent statistics, the revenue generation by the global automotive industry by 2030 is projected to reach at $9tn.

Recent Advances in Chemical Industry – The focus of the government and expenditure made the chemical industry to grow. This has propelled the Indian chemical industry to grow by a CAGR of 10% with a revenue of $300bn by 2025.

Increased Level of Electronics Industry – As per recent estimates, it was calculated that the revenue generated by the US electronics industry in 2019 stood up at $300bn.

High Expenditure in Research & Development – World Bank released the global expenditure made in Research and Development sector which showed that in 2020 it was 2.63% of the total GDP. This is an increase from year 2.14% of total GDP in 2016.

Industry Exit multiples statistics

Source: MergerMarket

DEAL RATIONALE

Apollo Global Management (APO.NYSE) and Arconic Corporation announced on May 4th, 2023 that Apollo Funds, together with a minority investment of Irenic Capital Management, acquired all of the outstanding shares of Arconic stock at $30 per share, resulting in the company’s delisting from the New York Stock Exchange.

The deal, valued at $4.6bn, was driven by several factors that align with Apollo Funds’ investment strategy and the potential value that Arconic presents in the market, even if it was seen as a surprise by many analysts, given the current interest rate environment and the fact that it was a leveraged buyout.

The three main drivers of the acquisitions:

- Apollo’s strong track record in the aluminum business (Showa Denko’s deal)

- Arconic’s EV/EBITDA ratio and its future growth prospects

- Arconic’s core activity performance in the last year

Apollo’s strong track record in the aluminum business

One of the key rationales behind this acquisition is the proven track record of Apollo Funds in successfully investing in companies operating in the aluminum business, such as Constellium, Novelis and Alcoa Corporation. These investments have displayed strong returns and provided Apollo Funds with valuable expertise in the industry, and this deal certainly has all the characteristics to allow the fund to capitalize on its experience and create further value in the aluminum sector.

Arconic’s EV/EBITDA ratio and its future growth prospects

Additionally, one of the reasons behind this deal was the recognition of Arconic’s potential for growth and profitability, a key aspect that certainly attracted Apollo’s appetite for this investment. If we look at the financial data of the company, we can see that Arconic’s EV/EBITDA ratio, valued at 8.72, is relatively higher compared to the one of the other companies operating in its sector, which is at an average of 6.58. Usually, companies that have a higher multiple than their peers are believed to have strong growth prospects and the potential for increased profitability, but they also can be perceived as having higher risk, since the company might have a high level of debt to support its growth initiatives, or it can be evidence of the fact that the company is operating in a cyclical industry, making it more susceptible to economic downturns. In this case, though, it must be taken into consideration that Apollo is a firm with significant experience in leveraging growth opportunities and managing risks in a way that could lead to maximize profitability for this investment.

Arconic’s core activity performance in the last year

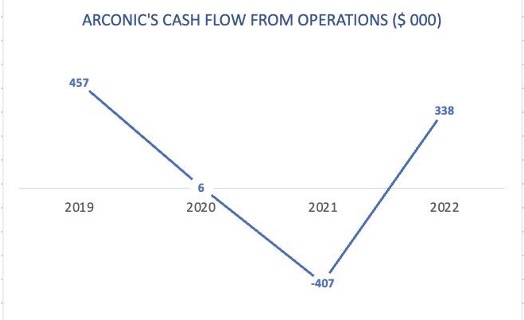

Furthermore, this acquisition could have been driven by Arconic’s performance in the last year. By looking at data available from financial reports, it can be observed that the company significantly improved its cash flow generated from operations, as well as its net income, indicating a positive trend in its financial performance.

If we consider this with what Arconic officials said to the press about their strategic initiatives to enhance operational efficiency and drive growth, it becomes apparent that Apollo Fund saw an opportunity to capitalize on the positive momentum and further fuel Arconic’s growth trajectory in the aluminum sector.

In conclusion, the deal is expected to benefit both companies as it will result in enhanced access to expertise and financial resources for Arconic that will support its growth and profitability objectives, while also providing Apollo Fund with a potential avenue for increased returns and value creation in the aluminum sector.

DEAL STRUCTURE

In line with the terms of the transaction, Apollo, along with Irenic and co-investors, successfully acquired all outstanding shares of Arconic. Its shareholders will receive $30.00 in cash per share, representing a 33% premium over the Company’s undisturbed closing stock price on February 27, 2023. With the completion of the transaction, Arconic’s shares are no longer listed on the New York Stock Exchange, marking the company’s transition to a private entity.

Apollo has managed to syndicate a financing package of $2.125bn to support the buyout. To fund the acquisition, a group of banks led by JPMorgan Chase and Wells Fargo sold $700mn in junk bonds and a $1.425bn leveraged loan.

This transformative move is expected to pave the way for strategic investments, including key machine center upgrades to fully maximize Arconic’s unique production capabilities, technological advancements aimed at bringing the Company’s plants and process controls up to state-of-the-art standards, as well as substantial investments in projects aimed at fostering better environmental conditions within the communities where Arconic operates.

Fritz Henderson, Chairman of the Arconic Board of Directors, expressed his satisfaction with the deal, emphasizing its importance in delivering enhanced value to Arconic shareholders and enabling the Company to execute on its long-term strategic vision. The Board approved this transaction after conducting a comprehensive examination of a spectrum of value creation opportunities for shareholders.

KEY FIGURES

Enterprise Value: $4.6bn

Net financial position: $1.5bn

Equity Value: $3.1bn

EV/EBITDA: 8.12x

Final offer price: $30.00 (no offer price revisions)

Premium: 33.04% based on the price 1 Day Prior Announcement of $22.55.

Sources: Apollo Corporate Website, Arconic Corporate Website, Bloomberg Law, Business Wire, Financial Times, Irenic Corporate Website, MergerMarket, Orbis Company Information, Private Equity Insights, Reuters, Yahoo Finance

Authors: Andrii Ovcharuck, Giacomo Bonoli, Nathan Maria Zuccolo, Marco Ferrero, Vedant Majmundar

You must be logged in to post a comment.