INTRODUCTION

In a move that sent shockwaves through the energy sector, Exxon Mobil, the largest U.S. oil company, recently finalized its acquisition of Pioneer Natural Resources through a deal valued at $59.5 billion in stock.

This strategic maneuver marks Exxon’s most significant transaction of the century, eclipsing its Mobil acquisition two decades ago. With the inclusion of debt, the total transaction value stands at $64.5 billion.

Exxon’s play for Pioneer Natural Resources was followed closely by another major acquisition in the industry, with Chevron, a rival supermajor, making headlines with its $53 billion takeover of operator Hess.

These two mega deals, orchestrated by industry giants, signify a remarkable period of consolidation and transformation in the U.S. energy landscape, setting the stage for a new era of competition and strategic maneuvering.

INDUSTRY OVERVIEW

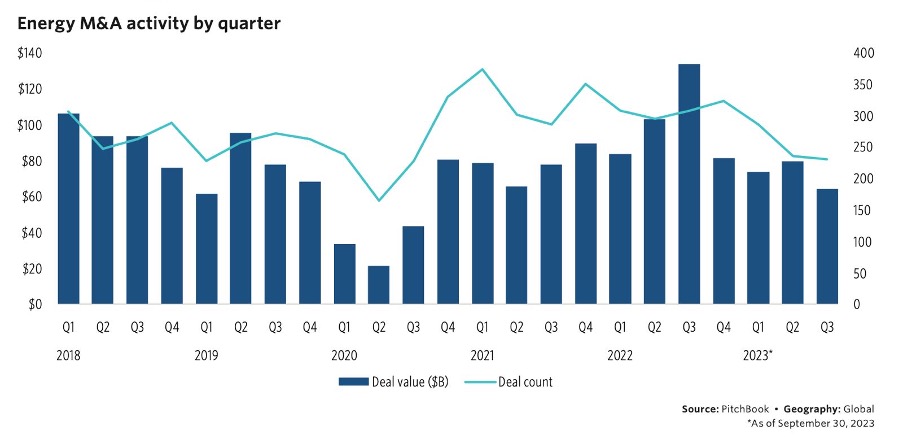

The energy sector has witnessed a surge in merger and acquisition (M&A) activity, particularly within the oil and gas industry. The acquisition of Pioneer by Exxon and the Chevron-Hess deal have together reshaped the industry landscape, making oil and gas a rare bright spot for Wall Street’s dealmakers. This boom in M&A activity has seen a 52% increase year-to-date, amounting to over $260 billion in transactions. In contrast, most other industries have experienced a 21% drop in M&A activity during the same period, according to Refinitiv.

These mega-deals are expected to act as catalysts, triggering industry-wide consolidation as major oil producers aim to secure prime drilling locations in the face of the dwindling inventory of such spots. The period characterized by drilling in shale rock is now in its twilight years, and companies have shifted their focus from organic growth to M&A as a primary avenue for expansion. The surge in oil prices following geopolitical events, including Russia’s invasion of Ukraine, has provided energy companies with the financial resources required to engage in these significant transactions.

Exxon and Chevron’s acquisitions have focused on securing their positions in the sprawling Permian Basin, the heart of the U.S. oil industry, with Exxon’s purchase of Pioneer having now a 15% share of the total crude production in the area. This trend towards supermajors getting larger is expected to prompt other significant players to follow suit in the industry, leading to further M&A activity. Companies like Conoco, Occidental Petroleum, Devon Energy, and Marathon Oil have all been mentioned as potential buyers. Smaller publicly listed Permian specialists, including Permian Resources and Matador Energy, as well as privately held groups like Endeavour Energy Resources, Mewbourne Oil, and CrownRock, could also become acquisition targets in the near future.

The current market environment, characterized by near-record valuations, has made it easier for all-stock transactions, allowing companies to manage risk in the event of fluctuating energy prices. Regulatory intervention in these transactions is unlikely, as the U.S. government avoids interfering in deals due to concerns about fuel price increases. In this dynamic landscape, investment banks like Goldman Sachs, Morgan Stanley, Citibank, and JPMorgan have positioned themselves as key advisers in the energy sector, benefiting from their roles in facilitating these transformative deals.

These deals are not only about securing valuable drilling locations but also about positioning for the future in a changing energy landscape. As the industry evolves, all eyes are on the supermajors and their strategic moves, as they set the foundation for the next decade of hydrocarbon businesses.

M&A deals in the energy industry by value and volume before the acquisitions of Pioneer and Hess.

COMPANIES OVERVIEW

ExxonMobil

Headquartered in Irving, Texas, ExxonMobil is one of the largest oil and natural gas corporations, meeting global demand for oil and natural gas, and refined products such as gasoline, lubricants, and petrochemicals. With more than 140 years of history tracing back to the foundation of Vacuum Oil Company, today ExxonMobil operates in 61 countries and counts 62,000 employees, with scientists representing 30% of the total workforce. The company’s vision is about empowering human progress, as providing accessible and affordable energy is a core foundation of prospect improvements in both quality of life and economic development. Its efforts as a global company place ExxonMobil at the forefront of core industry challenges such as scaling the use of hydrogen; advancing carbon capture capabilities; and progressing on decarbonizing transportation leveraging lower-emission fuel alternatives (LEF).

Exxon Mobil closed FY22 with robust financial performance, closing the year with earnings of $55.7 billion compared with FY21’s $23 billion, an increase of $32.7 billion. The company’s FY22 ROE of 27.5% and ROA of 15.1% denote financial health. The remarkable operational excellence of Exxon Mobil Corporation, listed on the New York Stock Exchange (NYSE) under the ticker symbol “XOM” has also been reflected on its stock price, which increased by 74% in FY22.

Pioneer Natural Resources

With a primary focus on upstream activities, Pioneer Natural Resources, headquartered in Irvin, Texas is a large oil and gas company comprehending a workforce of 2000 employees as of end FY22’. The company engages in the exploration, development and production of oil, NGLs and gas in the Midland Basin in West Texas. Pioneer history roots to the 1997 merge of Parker & Parsley with MESA Inc., the first had strong legacy wells in the Permian Basin, the second boasted heavy natural gas holdings, offshore drilling expertise and an attractive internal culture. Thanks to such partnership and joint expertise, Pioneer – that decided to remain a Permian Basin pure-play company – could build a solid competitive advantage in the area. Today its success resides in its highly economic wells and excellent acreage quality: driving sustainable and peer-leading free cash flow per BOE (Barrel of Oil Equivalent). Pioneer low leverage provides enough financial flexibility for share repurchases to supplement dividends.

The company is and stays committed to achieving operational excellence, innovation and safe work environment in the field.

As of last year, the company financials reported a great performance, with net income increasing from $2.1 billion in FY21 to $7.83 billion in FY22. From the business operations’ side, such increase has been mainly due to a +35% in average realized commodity prices per BOE in 2022 and a +5% in daily sales volume. Lastly FY22 ROA at 21.9% and ROE at 34.7% are indicators of such a high-performance phase for the corporation. Pioneer trades on the New York Stock Exchange (NYSE) under the ticker symbol “PXD”, with its stock price registering an increase of 25.5% during FY2022.

DEAL RATIONALE

The first incentive for Exxon to acquire Pioneer that comes to mind is the latter’s leading position in the Permian Basin. Pioneer is the Permian oilfield’s largest well operator, accounting for 9% of gross production, while Exxon occupies the No. 5 spot with 6%, according to RBC. This particular shale patch is known as the most productive oil and gas region in the world, producing nearly 6 million barrels of oil and 21 billion cubic feet of gas daily, and is deemed to have the most attractive low-carbon characteristics of any major onshore formation in the world. By combining its pre-acquisition 570,000 net acres in the Delaware and Midland Basins with Pioneer’s 850,000 net acres in the Midland Basin, Exxon undoubtedly becomes the Permian’s main player and boosts its unconventional inventory position within its Upstream and Downstream production profile. (Ed: Upstream refers to drilling, exploration, production, and all associated oilfield service activities, while Downstream unites refining, LNG, petrochemicals and derivative products, and export activity). Investment in the US-based oilfield also presents less uncertainty and more security, while benefiting the domestic economy.

Exxon estimates its Permian daily production to more than double to 1.3 million barrels of oil equivalent per day (mmboepd) and its total production to reach ~5 mmboepd vs. ~4 mmboepd pre-transaction in 2027. The company states its Permian resource will reach 16 billion oil-equivalent barrels, with 15 to 20 years of remaining inventory.

Pioneer’s tier-one acreage, which oil shales are now running out of, is highly contiguous and thus will also allow Exxon to take advantage of operational efficiency and economies of scale, for example, to reduce the cost of supply, optimize water usage, recycling and transport operations, minimize the number of truck trips, and maximize efficiencies related to both drilling and hydraulic fracturing scheduling.

DEAL STRUCTURE

On October 11, 2023, Exxon Mobil [NYSE: XOM] announced the acquisition of Pioneer National Resources [NYSE: PXD] for $59.5 billion, valuing the company at $253 per share.

The purchase was financed through the issuance of ExxonMobil shares, and the debt structure and repayment strategies will be subject to subsequent negotiations

This move followed initial talks about a potential merger, but it was only in September that Exxon [NYSE: XOM] approached Pioneer [NYSE: PXD] with a position of strength. Exxon’s shares were near historic highs, 119,17 USD in February supported by $30 billion in liquidity generated from high energy prices and highly profitable oil and gas production operations. In fact,the global oil and gas industry’s profits in 2022 jumped to some $4 trillion from an average of $1.5 trillion in recent years.

Despite Exxon’s [NYSE: XOM] ability to pay with a combination of cash and loans, the deal was structured as an all-stock transaction, allowing the two companies to overcome any pricing divergences. Exxon [NYSE: XOM] offered a relatively low premium, at 16% above the unaffected stock price and 9% above the previous day’s closing price for Pioneer [NYSE: PXD] shares.

Denbury’s CEO, Christian S. Kendal, expressed some reservations about the premium, considering it slightly low for a company with the scale and inventory quality held by Pioneer [NYSE: PXD]. However, with a total deal value of $59.5 billion, Pioneer shareholders will receive 2.3234 shares of Exxon [NYSE: XOM] for each Pioneer share.

Financially, the deal is expected to be significantly accretive for Exxon [NYSE: XOM], with an estimated EV/EBITDA multiple for 2024 of 6.5x compared to 5.4x pre-acquisition. Additionally, Exxon’s [NYSE: XOM] cash flow yield is expected to increase from 7% to 8% post-acquisition.

Negotiations were facilitated by the positive relationship between CEOs Darren Woods and Scott Sheffield, with the latter stating that “Darren has been very fair in the negotiations,” contributing to an unexpectedly swift transaction.

Further details of the agreement include Exxon’s [NYSE: XOM] purchase of Pioneer [NYSE: PXD] for $4.5 million for each high-quality position and $3.7 million for all positions, representing a strategic opportunity to create a leading company in the energy sector.

Additionally, Exxon’s [NYSE: XOM] EV/EBITDA valuation multiple is expected to increase post-acquisition, reflecting an improvement in its overall financial position.

The announcement of the acquisition triggered mixed reactions in the market, with an increase in Pioneer’s [NYSE: PXD] shares of 11% and a decline of the 2% in Exxon’s [NYSE: XOM] shares. This reflects the complexity of mergers and acquisitions in the energy sector, set against a backdrop of global oil price fluctuations.

This agreement between Exxon Mobil [NYSE: XOM] and Pioneer National Resources [NYSE: PXD] signals consolidation in the oil industry, suggesting a trend toward optimization and efficiency maximization among major industry players.

Sources: Financial Times, The Economist, Reuters, SEC, Exxonmobil.com, Forbes, Marketplace, Texas CEO Magazine, Associated Press News, Pxd.com

Authors: Lorenzo Cundari, Olga Nasledysheva, Jacopo Di Nicola, Giacomo Centonze, Louis Paget

You must be logged in to post a comment.