Introduction to the Oil and Gas Industry

The Oil and Gas industry is one of the largest sectors in the world in terms of dollar value, generating an estimated $5 trillion in global revenue as of 2022. At the same time, the oil and gas industry is one of the most exclusive and complex industries due to its dynamic nature, with its complexity resulting from the interaction of elements such as resources availability, geographical characteristics, institutional and political factors, technological advancements and innovations. The Oil and Gas industry has a pivotal role and profoundly influences the global economic framework, impacting diverse sectors ranging from transportation and heating to electricity, industrial production, and manufacturing.

The Oil and Gas industry operates through three distinct segments: upstream, midstream, and downstream.

- Upstream companies explore and extract oil and gas globally, playing a fundamental role in the initial phases of the industry’s value chain. These companies are commonly referred to as E&P (exploration and production) companies.

- Midstream companies are responsible for transportation from the wells to refineries.

- Downstream companies are responsible for refining and the sale of the finished products, completing the industry’s value chain.

Within this framework, drilling companies provide essential services by contracting with E&P firms for oil and gas extraction, while simultaneously, well-servicing companies engage in construction and maintenance activities at well sites.

As the sector grapples with the challenges of volatile commodity prices, geopolitical complexities, and the energy transition, M&A activities are key for companies aiming to bolster competitiveness and adapt to evolving market dynamics. This article delves further into the oil and gas industry, examining current trends, forecasting the M&A outlook, and closely scrutinising recent major transactions. By juxtaposing these deals, we aim to unravel the motivations driving M&A decisions and their consequential impact on the broader industry, providing insights into the strategic manoeuvres shaping the future.

Oil & Gas Industry: Overview and M&A Trends

Industry Overview and Trends

Inflation and Commodity Prices

Following the disruptions to the global supply chain induced by the COVID-19 pandemic and the onset of the war in Ukraine in 2022, the global economy witnessed a peak in commodity prices. Since then, prices have fallen but they are still elevated compared to historical norms. The ‘Global Trade Outlook: October 2023’ by the WTO highlights a potential risk of prices rebounding in late-2023 or early-2024, specifically in the northern hemisphere. This could pose a threat to the nascent economic recovery. In fact, the global average price of crude oil is still up 38% compared to the 2019 average, while natural gas prices in the EU and food products are up 133% and 46%, respectively.

Oil and Gas Insights

As reported by Sia Partners, Q3 2023 was marked by a significant increase of 28% in oil prices. Throughout the year, the cost per barrel held steady between $70 and $80, reaching its peak in this quarter at $90, the highest value since mid-November 2022. Despite a positive shift in macroeconomic sentiment due to inflation easing, these price increases were driven by OPEC’s announcement of new production cuts, along with Saudi Arabia and Russia extending export cuts until early-2024. OPEC+ changed the trajectory of oil prices with the implementation of production cuts since 2022 as a sign of commitment to maintain a certain level of oil prices. This alliance has decided to restrict combined oil production, influencing the recent surge in crude oil prices to a 10-month high. This recent surge in crude oil prices has therefore been primarily determined by Saudi Arabia’s cuts of 1 million bpd and Russia’s cuts of 300,000 bpd.

Gas markets experienced persistent heightened volatility, especially evident in the European benchmark TTF Natural Gas, due to Russia’s invasion of Ukraine. In North America, despite robust regional demand driven by prolonged heat waves, Henry Hub gas prices have declined 22%. In the Asia-Pacific markets, gas demand grew moderately during the quarter, poised to achieve an overall 3% growth for the year, with robust support from the power and industrial sectors. The European natural gas market was influenced by a combination of declining prices and EU’s commitment to achieve a strong 90% capacity. Nevertheless, the market remained volatile primarily fuelled by the sanctions against Russia and the partial embargo of gas exports.

Energy Transition and Deal Making Trends

In the Oil and Gas sector, the energy transition is drawing more and more attention, with new policies being increasingly introduced to accelerate the clean energy transition. The trend of shifting to renewable resources is currently strengthening with optimistic outlooks for the future deal making period, as increased levels of investments are expected in transactions that aim to complete green projects. While the increase in borrowing costs, commodity prices and supply-chain volatility partly explain the slow-down in M&A activity in this sector, some of this reticence to invest may be due to the executives that are awaiting details on a number of environment-related policies. For example, the European Union proposed the creation of an European hydrogen bank, which could develop a renewable hydrogen market, and it set out plans for carbon border adjustment mechanisms and the creation of a Social Climate Fund. Such policies and initiatives promote the energy transition and are forecasted to boost M&A, as they clarify how policy makers will support the energy transition and attract the needed amount of private investment.

M&A in the Oil and Gas Sector

Companies operating in the Oil and Gas market are driven to transform their business models due to a less secure geopolitical backdrop, decarbonisation and digitalisation. Investors are funnelling substantial capital into M&A transactions in order to capitalise on energy transition and security of supply chain opportunities. The main challenge is striking the right balance between satisfying the need of near-term shareholder value and building resilience in this newly shaped sector. Especially in the Oil and Gas industry, M&A activity incurs short-term challenges due to the above-mentioned factors impacting valuations and debt availability: high commodity prices, inflation, high interest rates and geopolitical instability. Consequently, near-term M&A strategies are expected to prioritise shareholders’ returns through the disposal of non-core assets and strategic acquisitions. In the medium term, Oil and Gas companies are expected to pursue sizable acquisitions aimed at consolidation and adapting their portfolio for the energy transition.

Oil and Gas M&A Data

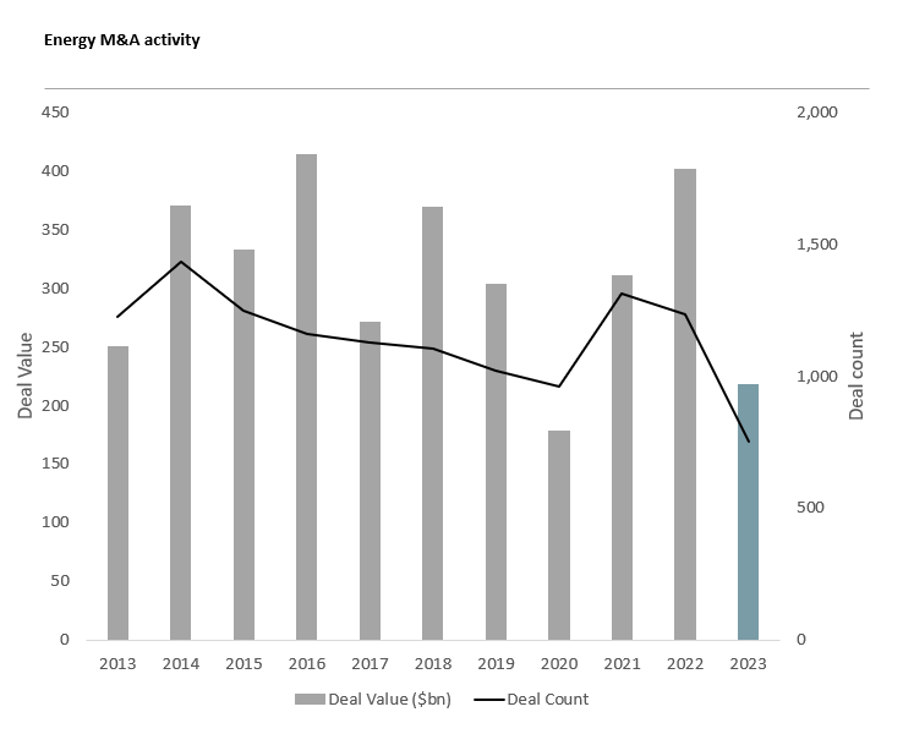

While the overall energy M&A activity remains subdued as deal activity continues to decline, the Oil and Gas sector continues to dominate the energy sector as the top five deals in the quarter with a combined value of $23.3 billion originated from the Oil and Gas industry. Deal value sits now at $217.2 billion, considerably less than the $418.8 billion witnessed in 2022, when the industry had investors looking to capitalise on higher prices and higher demand amid the energy crisis.

Evaluating Oil and Gas M&A activity through its supply chain, upstream M&A transactions remain the dominant subsector, experiencing a decrease of 14.7% but still representing 61.1% of deal volume. Midstream activity, accounting for 40% of disclosed total value, experienced a quarterly decline of 34.7%. The outlier is downstream activity, which has shown a quarterly increase of 22.7%, potentially driven by refinery modernization and investors seeking to diversify with value added products.

Source: Pitchbook, “Global M&A Report Q3 2023”

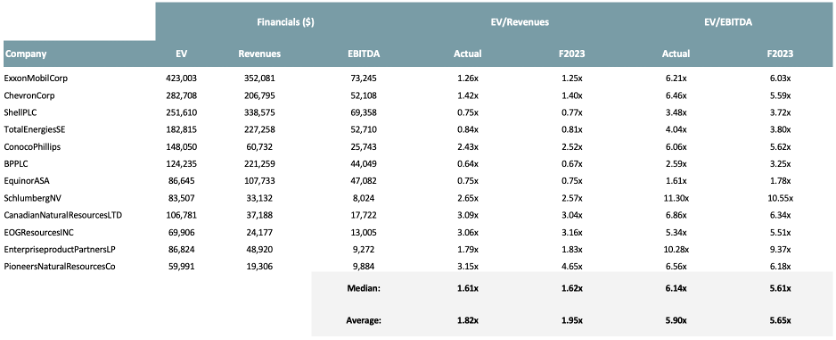

To get an analytical understanding of the value produced by M&A deals in this sector, a Comparable Transaction Analysis (CTA) of the most significant completed and publicly disclosed deals and Comparable Company Analysis (CCA) of the most relevant companies in the sector are conducted. Particular attention will be brought to Chevron Corporation, Exxon Mobil Corporation and their peers, as their latest transactions have been analysed in the next sections of this article.

Considering the largest transaction year-to-date, the average EV/Revenues is 2.60x, and EV/EBITDA is 6.89x. While Pioneer Natural Resources and Exxon Mobil Corporation transaction is quite in line with these values, having an EV/Revenues of 2.86x and EV/EBITDA of 5.61x, Hess Corporation and Chevron Corporation is a little bit of an outlier, with EV/Revenues of 5.59x and EV/EBITDA of 11.62x.

Source: MergerMarket

Considering the CCA, EV/Revenues is on average 1.61x and EV/EBITDA has a mean of 6.14x. Here, the acquirers of the transactions, hence ExxonMobil and Chevron, show consistent values: EV/Revenues of 1.26x and 1.42x respectively; EV/EBITDA of 6.21x and 6.46x. It can be also observed how these values are higher than their main competitors: Shell, Total Energies and BP.

Source: Bloomberg

Key Transactions Analysis and Comparison

In the past few months, major transactions in the Oil and Gas industry have been announced: the acquisition of Hess by Chevron and the acquisition of Pioneer Natural Resources by ExxonMobil.

Acquisition of Hess Corporation: A Paradigm-Shifting Deal

On 23rd October 2023, Chevron Corporation (NYSE:CVX) announced that it has entered into a definitive acquisition agreement with Hess Corporation (NYSE:HES). This all-stock transaction is valued at $53 billion, or $171 per share based on Chevron’s closing price on October 20th, 2023. Under the terms of the agreement, Hess shareholders will receive 1.0250 shares of Chevron for each Hess share; the total enterprise value, including debt, of the transaction is c. $60 billion. This marks a significant milestone in Chevron’s corporate history.

Chevron Corporation is one of the major companies operating in the Oil and Gas industry with an 11% market share. The company operates globally, with key assets in the Mexico Gulf, Texas, and the Gorgon Wheatstone in Australia. As of December 2022, the annual revenue amounted to $235.7 billion, a 51% increase from the previous year. The company had 11.2 billion barrels of net oil equivalent of proved reserves and Chevron produced a total of over 1.7 million barrels of oil and natural gas liquids per day in 2022, and operates mostly in the Permian Basin, Australia and Kazakhstan. The target, Hess, is among the biggest independent firms in the Energy industry, involved in the exploration and production of crude oil and natural gas. The company operates in Northern & Southern America, as well as Africa and Malaysia. As of December 2022, Hess’s annual revenue was $11.6 billion.

Strategic Rationale Behind the Deal

The deal comes within the dynamic landscape of the Oil & Gas industry, where major players are leveraging profits from 2022 to acquire competitors and expand market share. Chevron’s CEO Mike Wirth emphasised that acquiring Hess presents a “unique and compelling opportunity” to bulk up the company’s “offshore presence through the Guyana assets, while also entering the Bakken shale formation of North Dakota”.

Wirth addressed optimism about the industry’s future, asserting that Chevron is “not selling a product that is evil [but] a product that’s good”; this perspective could explain the intent of the transaction.

Chevron’s strategic focus on consolidation aligns with Wirth’s belief that the sector has “too many CEOs per BOE.” Moreover, as noted by Alex Beeker (Wood Mackenzie), the company is “underweight deepwater assets”. Acquiring Hess addresses this underweight position in deepwater assets, particularly in Guyana. Through the acquisition, Chevron accrues a material 30% interest in Guyana. Hess’s discoveries in the Stabroek block could contribute over 10% of Chevron’s total production next decade. This gives exploration and development potential, “adding scale and longevity to Chevron’s portfolio”. Finally, the transaction unlocks $15 billion in tax benefits, leveraging Hess’s past losses to enhance future cash flow. This tax shield is expected to provide hundreds of millions of dollars in extra annual cash flow over the next several years.

Deal Structure & Financing

The all-stock deal involves Hess shareholders receiving 1.0250 Chevron shares for each Hess share, valuing each share at $171 (10.3% premium). Additionally, Chevron will issue 317 million of common stocks. The EV/EBITDA multiple stands at 11.62x (LTM, last twelve months, 9.36x), while the EV/Sales multiple stands at 5.59x (LTM 5.17x), culminating in a total enterprise value of $59.7 billion.

Over the past twelve months, Hess Corp has achieved $11.6 billion in sales, showcasing a noteworthy year-over-year growth of 7.4%. EBITDA and EBIT reached $6.4 billion and $4.3 billion, respectively, with impressive YoY growth rates of 18.2% and 12.9%. Forecasting its NTM (next twelve months) sales to $12.13 billion, NTM EV/Sales multiple results at 4.93x. Projections for NTM EBITDA ($6.8 billion) translate to an NTM EV/EBITDA multiple of 8.86x, and an NTM EV/EBIT ratio of 13.47x, supported by a forecasted EBIT of $4.4 billion.

Acquisition of Pioneer Natural Resources: A $64.5 Billion Endeavor

On October 11th ExxonMobil Corporation (NYSE: XOM) announced that it has entered into a definitive acquisition agreement with Pioneer Natural Resources (NYSE:PXD). This all-stock transaction is valued at $59.5 billion, or $253 per share, based on ExxonMobil’s closing price on October 5th, 2023. Under the terms of the agreement, Pioneer shareholders will receive 2.3234 shares of Exxon for each Pioneer share, with the total enterprise value, including debt, reaching $64.5 billion.

Strategic Rationale Behind the Deal

As Pioneer is a leader in the Permian Basin, the acquisition allows ExxonMobil to solidify its presence in the region. Unlike Chevron’s approach, which diversified its portfolio with the Hess acquisition, ExxonMobil’s move concentrates its upstream portfolio. However, the increase of the risk profile is minimal compared to its wider, integrated business model. ExxonMobil outperformed Chevron on the Stock Market, as investors preferred a strategy aimed at reinforcing the company’s market share in the US. Through the transactions, ExxonMobil’s Permian production volume is set to more than double to 1.3 million barrels of oil equivalent per day (MOEBD), based on 2023 volumes, with projections indicating an increase to approximately 2 MOEBD by 2027.

Darren Woods, ExxonMobil Chairman and CEO, reaffirmed its commitment to lowering carbon emissions. The acquisition aligns with ExxonMobil’s environmental goals, aiming to accelerate Pioneer’s net-zero plan from 2050 to 2035. Expanding in the Permian provides a pathway to profitability, even in scenarios of significantly lower long-term fossil fuel demand, as the production cost estimations amount approximately at $35 a barrel.

Beyond many advantages from ExxonMobil’s side, the transaction is noted to be highly accretive for Pioneer by the company and financial analysts.

Deal Structure & Financing

The deal was all-stock, as Pioneer shareholders received 2.3234 Exxon share for each Pioneer share, valuing each of them at $253 (18% premium on the closing date, 9% premium to its prior 30-day volume-weighted average price on the same day). The EV/EBITDA multiple is 5.61x (LTM 6.65x), while the EV/Sales multiple was 2.86x (LTM 3.33x), resulting in a total enterprise value of $64.5 billion.

Pioneer’s sales over the past twelve months amounted to $19.5 billion, experiencing a YoY contraction of -21.4%. EBITDA and EBIT for the same period were $9.8 billion and $7.0 billion, with YoY growth rates of -26.0% and -34.2%, respectively. Despite challenges in 2023 due to market fluctuations, Pioneer maintains a great balance sheet, with total debt at $5.8 billion and net debt at $4.6 billion. With an expected rebound in its financials over the next twelve months, sales and EBITDA are forecasted to approach $21.5 billion and $10.4 billion, respectively.

Comparisons and Consequences on the Industry

Consequences and Rationale

The relevance of these two mega-deals happening in October results in many consequences for the Energy sector. Particularly, the deals mark an increased divergence with European players, which are committed to broader energy strategies in order to achieve carbon neutrality. Quite the opposite, US firms seem more optimistic about the future of fossil energy sources, as they are trying to fit green commitments through more traditional corporate strategies (e.g. by reducing Scope1&2 emissions).

Independent producers, as Pioneer and Hess were, could be tempted to follow their same path. Both deals are indeed inspired to a “the bigger, the better” principle, reflecting a trend of industry consolidation. Nevertheless, two of the largest independent firms decided not to be independent anymore. This could mean that other large-cap or mid-cap entities may contemplate reinforcing their market standing, opting for consolidation to ensure a robust future or seeking to secure their future in a bigger boat. Despite the CEOs of both Exxon and Chevron announcing that Oil and Gas demand will peak in the next decades, the strategic acquisitions will allow increased flexibility and ample room to manoeuvre in case energy transition accelerates.

Analysts at Wood Mackenzie are negative about the possibility to see other deals of this size in the industry, given the “stakeholder alignment concerns and lower valuation multiples”.

Financing

Exxon and Chevron’s decision to utilise their stock as currency in their recent acquisitions may unwittingly convey a reduced confidence to the market, suggesting that they perceive their shares to be fully valued.

As established prior, the average industry multiples for EV/Revenues and EV/EBITDA are 2.60x and 6.89x, respectively. While the multiples of ExxonMobil’s transaction aligns with the average industry multiples, the multiples of Chevron’s transaction are higher than the YTD closed transactions and Pioneer’s takeover from ExxonMobil.

The higher acquisition multiples in the acquisition of Hess can be attributed to several factors. The stronger operational performance and growth of Hess undoubtedly play a key role, with Pioneer suffering from the market volatility. Hess’ positive forward-looking projections, evident in the forecasted Hess NTM sales of $12.13 billion, and a strong balance sheet, likely have influenced Chevron’s willingness to pay a higher multiple.

Additionally, Chevron faced a notable concern related to portfolio concentration, underweight in deepwater assets. This is one of the reasons fuelling the acquisition of Hess, granting a significant 30% interest in Guyana and securing access to the world’s largest crude discovery. The strategic importance of venturing into a region renowned for its exponential growth potential undeniably contributed to the observed higher multiples in the transaction.

Oil & Gas Industry, Stock and M&A Outlook

Industry Outlook

In the coming months and years, it is expected that the Oil and Gas Industry will be dominated by 2 key themes: energy transition and OPEC cuts. First, there has been significant investment in renewable and clean energy alternatives that resulted in a reduced investment in hydrocarbon-based energy. Yet, the momentum to discontinue hydrocarbon drilling subsided in the early-2023, with a decline in environmental activism and a slowdown in the ESG initiatives. Numerous US oil companies are returning to the exploration and completion of oil and gas assets. However, analysts expect that a shift towards renewable energy will be a trend to dominate the Oil and Gas Industry, which will therefore likely also dictate M&A activity. In fact, the energy transition has been an area of opportunity for some time but investors needed clarity. EU is now introducing policies and legislations that could boost real investments in the Oil and Gas sector. For example, the European Council set out plans for a European hydrogen bank in order to create a renewable hydrogen market. Moreover, the UK published new bills on net-zero growth plans that include hydrogen and transport decarbonisation.

Second, in the third quarter of 2023, OPEC+ implemented oil supply cuts during a period of record demand, drawing criticism from major consuming nations. Saudi Arabia’s unilateral reduction of 1 million barrels per day, coupled with Russia’s export reduction, resulted in a substantial decline in OPEC production in September, hitting a two-year low. This has created concerns about a potential 1.2 million barrels per day supply shortfall by year-end, raising serious worries about commodity availability.

However, looking forward, according to the US Energy Information Administration, oil prices are expected to rise significantly in 2024 due to the limited supply growth by OPEC+ and the increasing global oil demand. Yet, the Oil and Gas prices are also affected by other factors. According to the International Reg Zone Report, for instance, recent Chinese data and new aid to the debt-laden real estate sector could be positive for the direction of the oil market in the near term. Moreover, the report noted that there are factors limiting the rise in oil prices in the United States, especially the growth in crude inventories and weak refining margins, which led to weak American demand.

M&A Outlook

Over the recent years, there has been a noticeable increase in M&A activity within the Oil and Gas industry,specifically in the upstream sector, with companies engaging in both national and international mergers and acquisitions. The United States stands out as the predominant hub for such transactions, with many deals over the past decades. This is particularly evident in the upstream industry, where the surge is not limited to cross-border deals but extends to impactful domestic investments. Looking at data provided by Bloomberg evaluating the energy, industrial, and tech sectors, there have been clear quarter-over-quarter deal volume increases this year through Q3. Specifically, the data suggests that the energy sector is poised to conclude the year as the top-performing sector, primarily due to its strong performance in the ongoing fourth quarter. This could be attributed in large part to Exxon Mobil Corp’s announced takeover and Chevron Corp’s announced acquisition.

These two major transactions demonstrate a significant consolidation trend in the Oil and Gas Industry and this trend is anticipated to persist in the coming months and year.

According to Deloitte, M&A activity in the Oil & Gas Industry will be primarily driven by energy and supply chain security, the energy transition and partnerships with low-carbon entities. Specifically, Deloitte notes that there has been a longer standing trend that saw Oil and Gas companies engaging in M&A to build a new core (e.g., low-carbon oil and gas development, cleaner energy solutions). To provide evidence, one sector that is attracting heavily new investment is the carbon capture, which is considered crucial to diminish the concentration of greenhouse gas emissions and it is projected to experience a compound annual growth of 20% in 2023-2032. Another area for new investment is green or blue hydrogen, especially in Europe. Given the abundant number of gas pipelines, several countries are developing hydrogen strategies and roadmaps in order to reach a low-emission capacity. This is boosting investment initiatives and some deals have already been concluded, like Macquarie’s €1.4bn sale of Open Grid Europe, transport hydrogen operator, to Publigas and Fluxys.

Additionally, the impact of the high inflationary backdrop is expected to be limited as the Oil and Gas Industry is generally characterised by healthy balance sheets with limited debt. Within these transactions, it is expected that Private Equity and Venture Capital companies will play a smaller role, with these investment firms divesting a significant portion of their Oil and Gas assets. This trend is primarily driven by higher cost of capital and a bigger appetite for low-carbon assets.

Role of Strategic Acquisitions in Shaping The Industry

While there is no certainty in how M&A will evolve through the following years and how strategic acquisitions will shape the industry, the Chevron and ExxonMobil deals provide a compelling signal. Pioneer and Hess, like many other independents, face strategic diversification dilemmas as they grow. In an environment of robust prices, both companies likely found the valuation appealing on a risk-adjusted basis, particularly considering the uncertainties stemming from the ongoing energy transition. The all-equity deal financing does signal that both Pioneer’s and Hess’ owners still have confidence in oil and gas, since they are obtaining ownership in the acquiring companies. In the future, independents with assets attractive to major oil and gas companies may find themselves enticed to pursue a similar course of action. Following the ExxonMobil and Chevron transactions, it is likely that other major Oil and Gas producers are evaluating their options, where the companies demonstrating strong performance are likely to attract the most attention, in a scenario of increasing scarcity premium. Could this show the initiation of a more robust wave of consolidation within the sector? The question looms large as industry players position themselves for the next phase of evolution in response to transformative deals by industry giants.

Sources: Science Direct, Pitchbook, Ft, Il Sole24ore, Kroll, Pwc, Reuters, S&P Global, Woodmac, WTO, Sia Partners

Authors: Pim Van der Klei, Edouard Jordan, Marco Di Marco, Giulia Veggetti, Edoardo Signorelli

You must be logged in to post a comment.