INTRODUCTION

Nasdaq, the renowned U.S. stock exchange, has concluded the acquisition of Adenza, a financial risk software firm, for $10.5 billion. The cash-and-stock purchase from software investor group Thoma Bravo is the largest of its kind, marking the expansion of the exchange’s capabilities to support financial institutions in data and risk management. This strategic move aligns with industry competitors who are similarly enhancing their technological services by strategically acquiring companies to diversify their portfolios.

INDUSTRY OVERVIEW

The Nasdaq and Adenza agreement aligned with CEO Adena Friedman’s strategy to transition Nasdaq into a financial technology entity. Fintech, redefining the finance landscape, denotes applying digital technology to financial services. Digital advancements are reshaping payments, lending, investment, insurance, and wealth management, notably expedited by the COVID-19 outbreak.

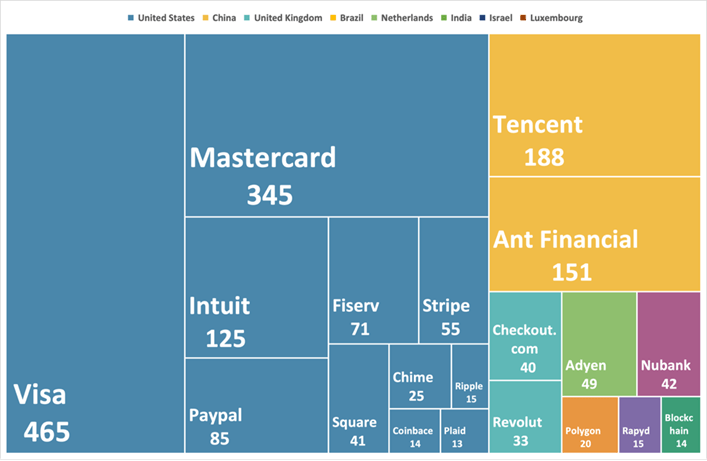

The majority of Fintech companies, 72% of the market, operate from the U.S., led by major players like Visa, Microsoft, Intuit, and Paypal. Following the U.S., China holds 19% and Brazil 3%. As per the BCG Global Fintech Report, North America will persist as a pivotal fintech market and innovation center. However, substantial growth is anticipated in Latin America and Africa. Latin America attracts investor interest and embraces advanced technologies. In Africa, a large portion of the population lacks banking services, making Fintech a potential solution for financial accessibility

Figure 1

Largest fintech companies worldwide by market cap, $ billions

Source: CNBC, Statista

Despite economic turbulence, the financial services industry maintains robust fundamentals, standing as a pivotal and highly profitable sector in the global economy. BCG reports the industry’s annual revenue at $12.5 trillion, generating an additional value of around $2.3 trillion. This results in an exceptional average profit margin of 18%, surpassing the industry average net margin of 10%.

Fintech, although in its nascent stage, accounts for less than 2% of the global annual financial services revenues, approximately $245 billion out of $12.5 trillion, signaling significant growth potential. Forecasts anticipate its remarkable expansion, predicted to amplify more than sixfold by 2030, achieving an impressive annual revenue of $1.5 trillion, reflecting a compelling 25.4% compound annual growth rate (CAGR).

A significant factor propelling industry expansion is the potential for wider access: presently, 1.5 billion adults worldwide lack access to formal banking services, and an additional 2.8 billion adults are categorized as underbanked, signifying the absence of credit card usage. This collective sum exceeds half of the global population. Fintech assumes a pivotal role in enhancing the accessibility and dispersion of financial services, particularly concerning affordability.

COMPANIES OVERVIEW

Acquirer – NASDAQ

- Foundation: 1971

- Headquartered in New York, New York, USA

- CEO: Adena Friedman

- Number of employees: 6,377 (at 31 Dec 2022)

- Market Cap: $31.91bn

- TTM Revenue: $600mln

- LTM EBIT: $165mln

- LTM P/E: 19.69

Nasdaq Inc. is a leading American financial corporation serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital and financial markets. The company’s core mission is propelled by three fundamental pillars: Transparency, aiming to seamlessly connect investors and corporations while reducing obstacles 1, Liquidity, focused on deploying cutting-edge technology to stimulate economies and revamp foundational structures, and Integrity, devoted to safeguarding the entirety of the financial sector and its stakeholders 3 5. These principles underscore the provision of comprehensive services encompassing data, analytics, software, exchange functionalities, and client-centric offerings, facilitated through three distinct divisions: Capital Access Platform, Market Services, and Financial Technology. This multifaceted approach empowers clients to optimize their strategies and execute business goals with assured confidence.

- Capital Access Platforms: The division encompasses data, listings, indexing, and business insights to distribute historical and real-time market data. Operating on diverse global listing platforms, it facilitates multiple global capital-raising solutions for public companies, fostering economic growth through transparency, client support, sustainability, and governance excellence.

- Market Services: They aim at improving the modernization of markets to create, long-lasting, diversified, and trusted financial networks enabling markets to reach their full potential and growth. This division includes the company’s foundational North American and European Trading Services Businesses.

- Financial Technology: It provides world class technology to solve the biggest challenges across risk management, regulatory compliance, and capital markets infrastructure. It is comprised of two distinct units: the Capital Markets Technology and Regulatory Technology.

Target – ADENZA

- Founded in 1997

- Headquartered in London, UK & New York, USA

- Former CEO: Didier Bouillard

- Number of employees: 2000

- Market Cap: $412.32bn

- LTM P/E: 6.73

Adenza, sourced from Thoma Bravo, a top software investment firm, offers pivotal risk management, regulatory reporting, and capital markets software to the financial sector. With over $131 billion in assets managed (as of Jun 30, 2023), Thoma Bravo stands among the world’s largest software investors.

Adenza collaborates with over 75 global strategic partners, meticulously chosen to aid clients in their evolution, broadening their scope by integrating and leveraging Adenza’s software. This varied partnership network supports clients in their transformation journey.

Employing private equity, growth equity, and credit strategies, Thoma Bravo invests in pioneering software and technology companies, nurturing their advancement. Leveraging their extensive sector knowledge, Thoma Bravo collaborates with portfolio firms, focusing on implementing operational excellence and driving growth initiatives. In the last two decades, the firm has acquired or invested in 440 companies, reflecting a total enterprise value exceeding $250 billion, encompassing both control and non-control investments.

DEAL RATIONALE

Nasdaq’s acquisition of Adenza for $10.5 billion signifies a strategic move to redefine its position in the global financial sector. This pivotal step underscores Nasdaq’s commitment to enhancing its risk management, regulatory reporting, and capital markets software for the financial services industry. Aligned with its vision, Nasdaq aims to become a trusted financial entity, supporting global institutions in navigating complex challenges of modern markets and regulations.

Beyond strategic alignment, Nasdaq anticipates substantial economic benefits from Adenza. Projections indicate improved revenue growth rates and operating margins. Nasdaq aims to achieve $80 million in annual net cost synergies and long-term revenue synergies of $100 million. To optimize these gains, Nasdaq is restructuring into three divisions—Capital Access Platforms, Market Services, and Financial Technology. This reorganization streamlines operations, fortifying Nasdaq’s ability to offer comprehensive financial solutions

The appointment of Holden Spaht, a Managing Partner at Thoma Bravo, to Nasdaq’s Board of Directors signifies more than a routine addition; it symbolizes a strategic collaboration acknowledging the value of diverse perspectives and a commitment to fruitful partnerships. Nasdaq’s approach reflects acute awareness of the evolving landscape and a determination to adapt its governance structure accordingly. The financial intricacies involve a combination of cash and stock, with Nasdaq securing $5.9 billion in debt. Nasdaq’s measured approach includes a commitment to achieving specific leverage targets within well-defined timeframes post-acquisition, highlighting a disciplined financial strategy that balances growth aspirations with prudent financial management.

Nasdaq’s acquisition of Adenza is more than a technical integration; it’s a strategic step towards operational enhancement and elevating client experiences. Beyond a financial transaction, this move signals Nasdaq’s commitment to the future of financial technology. The intent is to secure market leadership, leverage financial synergies, and prioritize innovation. Nasdaq’s holistic approach, spanning restructuring and governance expansion, aims to fully integrate Adenza’s capabilities into its vision for the global financial ecosystem. As the deal progresses towards completion in the next nine months, the industry anticipates the emergence of a unified force in financial technology

DEAL STRUCTURE

Nasdaq announced the acquisition of financial software producer Adenza on June 12, 2023, culminating in Nasdaq’s largest strategic move valued at $10.5 billion, comprising 58% cash and 42% stocks. The deal concluded on November 1, 2023, post-regulatory approval.

To secure the cash segment of $5.75 billion, Nasdaq had secured committed bridge financing and issued nearly $5.9 billion in debt to replace this commitment between signing and closure. This acquisition pushed Nasdaq’s leverage to around 4.7x and S&P Global Ratings lowered Nasdaq’s rating from BBB+ to BBB following the announcement. Nasdaq, however, aims to scale down leverage to 4.0x within 18 months and further to about 3.3x in 36 months.

The stock portion, valued at $4.75 billion, involved issuing 85.6 million shares based on the volume-weighted average price per share over 15 days before signing. The effective price was $4.2 billion due to lower share prices at closing. Adenza’s owners, primarily Thoma Bravo, obtained a 14.9% stake in Nasdaq, making Thoma Bravo one of the largest shareholders and securing a seat for its managing director, Holden Spaht, on Nasdaq’s board of directors.

Nasdaq’s shares tumbled over 10% at $52.39 to a nearly one-year low following the deal’s announcement as investors viewed it as an expensive bet. Indeed, the deal values Adenza at almost 18-times its expected 2023 revenues or 31-times EBITDA. However, the deal is expected to be accretive starting from year 2 due to synergies and is part of Nasdaq’s long term strategic plan.

Sources: Nasdaq’s Site, Adenza’s Site, FT, CNBC, Merger Market, Reuters, Yahoo Finance, World Bank, BCG, La Stampa

Authors: Maddalena Salterini, Cleve Lim, Lorenzo Villani, Polina Mednikova, Elias Emery, Guillaume Eelbode

You must be logged in to post a comment.