INTRODUCTION

In a landmark transaction that reverberated through the corridors of the amusement parks industry, Cedar Fair and Six Flags, two stalwarts in the realm of entertainment, announced their merger. This monumental deal, set to reshape the industry’s landscape, brings together two formidable companies under the banner of Six Flags, heralding a new chapter of growth.

With Cedar Fair’s acquisition of Six Flags, valued at $4.3 billion, the industry witnessed a convergence of vision and strategic intent. The decision to merge underscores a commitment to unlocking shareholder value and fortifying their competitive position in the industry.

As articulated by Richard Zimmerman, President and CEO of Cedar Fair, “This merger represents a pivotal moment in the evolution of our industry. By joining forces, we aim to create a more robust operating model, enhance financial performance, and elevate the overall guest experience.”

INDUSTRY OVERVIEW

The amusement parks industry, as evidenced by a comprehensive study conducted by Global Markets Insight (2022), was valued at $63.9 billion, with an estimated CAGR exceeding 5.5% for the forthcoming forecast period spanning from 2023 to 2032. Projections for the industry’s value in 2032 stand notably higher at $109.3 billion. However, the outbreak of the COVID-19 pandemic severely impacted the industry, particularly in North America, where attendance at the top 20 theme parks plummeted by 72%. Globally, the International Association of Amusement Parks and Attractions estimated economic losses of $23 billion attributable to the pandemic’s adverse effects.

In response to this unprecedented challenge, post-pandemic strategies have seen a significant rise in ticket prices, notably in regions such as the Middle East, Europe, and North America, with highest increases in Middle East (26%) followed by Europe (21%) and then North America (20%). Consequently, this uptick in ticket pricing has resulted in a notable escalation in per capita spending at theme parks, as demonstrated by visit spend data released by key industry players including Cedar Fair, Six Flags, and SeaWorld. Specifically, average per capita spending at selected theme parks has surged between 30% and 50%, primarily driven by increased in-park spending.

In 2022, the North American region accounted for approximately 36% of the market share within the amusement parks industry. This substantial market presence is poised to undergo significant expansion, driven by the escalating household expenditure on recreational activities alongside a thriving tourism sector. The region’s anticipated growth is further propelled by the diverse entertainment preferences among customers and an increasing inclination towards immersive experiences. Key contributors to this growth trajectory encompass investments in theme parks, advancements in technology, and strategic partnerships within the industry.

Supported by a favorable economic scenario and a cultural inclination towards leisure, North America’s prospects within the amusement parks industry remain highly promising. Notably, despite pandemic-related disruptions, the amusement park sector in the United States exhibited remarkable resilience, achieving a notable 43% growth in 2021 to reach a valuation of $12.37 billion. This robust performance underscores the industry’s developmental phase and suggests a trajectory marked by consistent advancements in profitability and market expansion.

Impact of the merger

This merger carries significant implications for the amusement parks industry. As of 2023, Cedar Fair represented approximately 7.8% of the total industry revenue and showcased a market capitalization of $2.03 billion. The merger is projected to generate pro forma revenues of $3.4 billion and an adjusted EBITDA of $1.2 billion.

The primary revenue streams for amusement parks are derived from ticket sales, which account for 52% of total revenue, followed by revenue from F&B, merchandise, and, to a lesser extent, resorts and hotels.

The combined entity resulting from this merger will encompass a diversified portfolio, comprising over 27 amusement parks, 15 water parks, and 9 resorts across North America, aiming to increase ticket revenues by implementing additional loyalty programs, thereby contributing to an overall growth in industry revenues.

Main players

The main player is Disney Parks & Resorts, holding the top position with a market capitalization of approximately $210 billion and accounting for 36.2% of industry revenues. The combined entity resulting from the merger could become a strong competitor for Disney within the region. However, a critical metric for comparison between the two competitors is their debt-to-equity ratios. Disney’s debt-to-equity ratio stands at 47.35%. In contrast, the combined entity from the merger, with an implied equity value of $3.6 billion, will have to manage a substantial debt of $4.4 billion, resulting in a high debt-to-equity ratio of 122%. Such high debt levels are likely to impact the financial flexibility.

Overall, the industry is currently experiencing a period of growth following the pandemic. However, operational efficiency remains challenging due to factors such as seasonality and reliance on weather conditions.

COMPANIES OVERVIEW

Six Flags: history

Six Flags Theme Parks traces its origins back to 1961 with the establishment of Six Flags over Texas (SFOT). The name of the firm was referred to the flags of the six different nations that have governed Texas (Spain, France, Mexico, the Republic of Texas, the United States of America, and the Confederate state of America). Texas real estate developer Angus G. Wynne decided to develop this idea after he visited the newly opened Disneyland in California. The development of the 205-acre park, with a final cost of $10 million (equivalent to $100 million in 2024 dollars), marked a significant milestone in the industry. Notably, the park pioneered the “Pay One Price” model, introducing a simplified single admission fee encompassing access to all rides and attractions—a concept that even Disneyland had not yet adopted at the time.

The original logo, representing the Six Flags of the different nations that have governed Texas.

During the 1970s and 1980s, Six Flags underwent significant expansion through a series of park openings and acquisitions, attracting the attention of Blackstone, which acquired Six Flags in 1991 for a sum of $750 million along with BV Investment Partners.

In April 1998 the firm was acquired by Primer Parks, one of the leading competitors in the industry, for an estimated $1.86 billion. Leveraging the allure of the Six Flags brand, Premier Parks strategically rebranded several of its existing parks.

Despite the expansion, Six Flags’ financial health began to deteriorate in the early 2000s, leading the company to sell its operations in Europe, a decision driven by the demanding nature of the industry, which necessitates ongoing maintenance and investment in new attractions. Moreover, as interest rates rose, the burden of servicing the substantial debt incurred for acquisitions became overwhelming.

Eventually, Six Flags faced a confluence of broader economic challenges, including the global financial crisis of 2007-2008 which led to a drop in park attendance. This underscores the vulnerability of theme park industry to macroeconomic fluctuations, as evidenced by families’ propensity to curtail spending on discretionary items during periods of economic uncertainty.

In June 2009, Six Flags filed for Chapter 11 bankruptcy protection due to its inability to refinance its debt. The bankruptcy allowed Six Flags to reset its financial structure and focus on improving its offerings and profitability. The company also shifted its focus from acquiring new parks to maximizing the profitability and customer experience of its existing properties.

Despite the strategic realignment, the company tried to benefit from the growth of developing market such as China and the UAE through licensing agreements. Regrettably, both initiatives failed to materialize as expected and were ultimately terminated due to the licensee’s non-compliance with the agreed-upon terms.

Cedar Fair: history

The origins of Cedar Fair can be traced back to 1870, with the establishment of Cedar Point as a bathing beach resort on Lake Erie, Ohio. The company underwent a significant transformation in 1983, when it was restructured into Cedar Fair Limited Partnership, following its acquisition of Valleyfair amusement park. The adoption of the name “Cedar Fair” symbolically combined Cedar Point and Valleyfair under one entity.

Throughout the 1990s, Cedar Fair further expanded its portfolio through strategic acquisitions, including Knott’s Berry Farm, Camp Snoopy indoor park, and Worlds of Fun. This facilitated the firm’s continued growth trajectory.

In the 21st century, Cedar Fair continued its expansion efforts through additional acquisitions. Notably, in 2004, the company inaugurated its first indoor waterpark at Castaway Bay, Ohio. Additionally, in the same year, Cedar Fair seized the opportunity to acquire Six Flags World of Adventure due to its competitor’s financial distress. Subsequently, in 2006, Cedar Fair undertook a significant acquisition, investing $1.24 billion to procure all five Paramount Parks.

In the past decade, under the leadership of former Disney Cruise President Matt Ouimet (who served as CEO of Cedar Fair from 2011 to 2017), the company implemented a strategy of closing and divesting various parks to enhance operational efficiency and profitability in the aftermath of the Global Financial Crisis (GFC). Subsequently, the company pursued further expansion initiatives. Notably, in 2019, Cedar Fair declined a takeover bid from Six Flags amounting to $4 billion.

Business

Six Flags in red, Cedar Fair in Blue.

Six Flags is recognized as the largest regional theme park operator worldwide and holds the distinction of being the largest operator of water parks in North America. With a presence in 13 locations, the company oversees a total of 27 parks, with each location featuring multiple parks, comprising both amusement parks and water parks. It is noteworthy that only 23 of these parks bear the Six Flags branding. Geographically, the majority of Six Flags’ theme parks, totaling 24, are situated within the United States, complemented by two parks in Mexico and one in Montreal, Canada.

Similarly, Cedar Fair manages 13 locations, for a total of 25 parks, comprising 11 amusement parks and 14 water parks. Of these locations, 12 are situated within the United States, with one additional location in Toronto, Canada. Upon analysis of the geographical distribution depicted in the provided map, it is evident that the locations of the two companies exhibit strategic alignment. While some parks are concentrated in densely populated areas such as California, Texas, Washington DC, and Philadelphia, many others are positioned in more remote locations, suggesting a complementary distribution in terms of geographic coverage.

Historically, Six Flags’ pricing programs have been heavily focused on discounts. Since 2022, the firm focused on eliminating many of the historical discounts, including free and ultra-low-priced tickets. According to Six Flag’s 2022 annual report, the company has settled on a streamlined product architecture that balances attendance and revenue. In 2022, as a result of this shift, attendance decreased by 26%, while spending per capita increased less than proportionally by 23% as shown in the table below. On the contrary, Cedar Fair announced that it recovered low priced attendance channels in 2023. Overall, the two companies have a comparable number of guests, who, on average, spend similar amounts.

Historically, Six Flags has predominantly employed pricing programs centered around discounts. However, since 2022, the company has embarked on a strategic shift aimed at reducing many of the historical discounts, including free and ultra-low-priced tickets. According to Six Flags’ 2022 annual report, this strategic realignment has culminated in the establishment of a streamlined product architecture, aimed at achieving a balance between attendance and revenue generation. Consequently, in 2022, this shift led to a 26% decrease in attendance, coupled with a less than proportional increase of 23% in spending per capita, as illustrated in the table below. In contrast, Cedar Fair announced the reintroduction of low-priced attendance channels in 2023. Overall, both companies exhibit a comparable number of guests, who, on average, spend similar amounts.

| Six Flags | Cedar Fair | |||

| 2022 | 2021 | 2022 | 2021 | |

| Attendance (In millions) | 20.4 | 27.7 | 26.9 | 19.5 |

| In-park spending per capita | $65.15 | $53.00 | $61.65 | $62.03 |

A noteworthy characteristic within the theme park industry is the availability of season passes, providing customers with unlimited entries to a single park for the duration of one year. Additionally, Six Flags previously offered the legacy membership, permitting unlimited entries to all parks and renewable on a monthly basis, although this offering was discontinued in 2022. The season pass holds considerable significance in the industry, with many viewing it as a key consideration in potential deals. In fact, after the transaction, the park offering of the merged entity will increase significantly, improving the appeal of the season pass to customers. It is also worth noting that in 2022 season pass customers accounted for 54% of total parks entries for Six Flags (the same data is not disclosed by Cedar Fair).

Both Cedar Fair and Six Flags derive revenues from similar sources, with the primary revenue stream for both companies consisting of park tickets, which collectively contribute more than 50% of total income. Subsequently, revenue is generated from food and beverages, realized through customer purchases at in-park dining establishments and coffee shops.

Data from Annual Reports

Financials

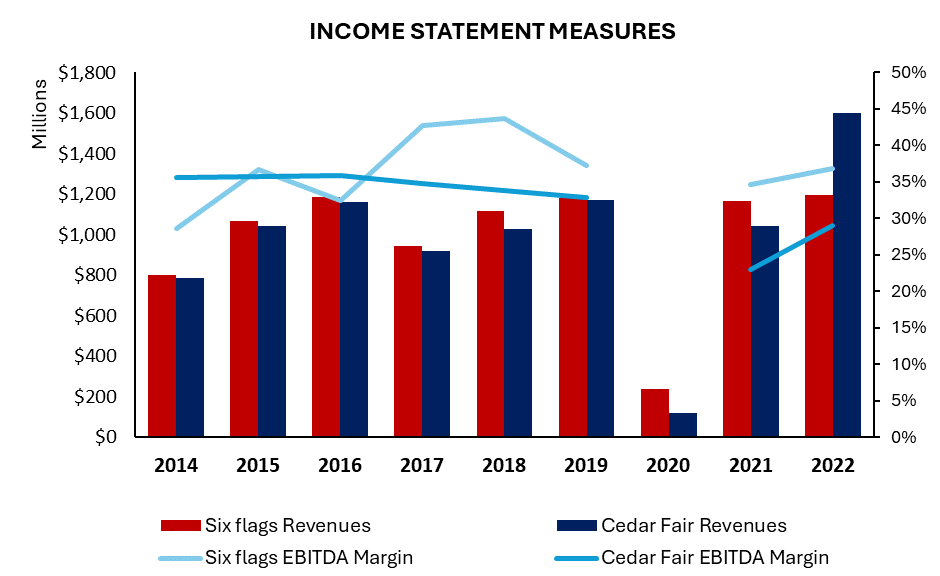

Before Covid, in the period from 2015 to 2019, Cedar Fair’s Revenues grew at 3.7% CAGR, instead Six Flags’ grew at 3.3%. EBITDA margins (data for 2020 is non-relevant due to negative EBITDA) have been laying around 30% and recently Cedar fair has demonstrated lower margins than Six Flags. Furthermore, Cedar Fair earns more revenues per acre of land. In fact, Six Flag’s parks occupy approximately 5850 acres (2370 hectares) of land, while Cedar Fair’s has developed approximately 2850 acres (1150 hectares) of land. This might be happening as Six Flags has a wider presence in more remote locations in the Mid-West.

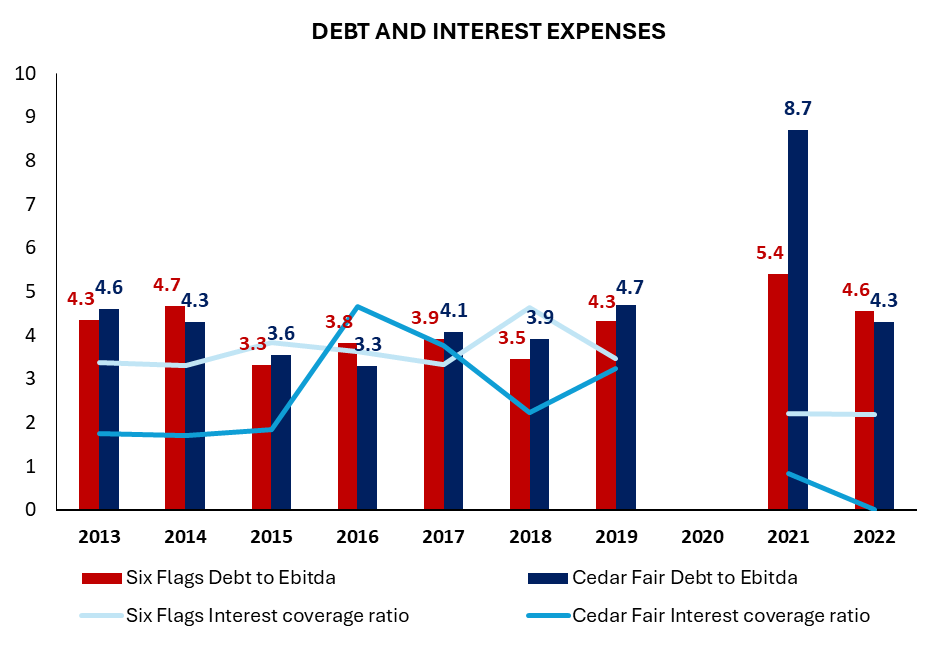

Finally, as mentioned throughout the article the industry relies heavily on debt and one of the deal goals is to allow the merger entity to lower financial expenses. Six Flags’ debt to EBITDA ratio has reached 4.5x in 2022; for reference in 2008, just before filing for Chapter 11, the ratio laid around 8x and reached 11 in 2009, just before going bankrupt. Cedar Fair’s debt to EBITDA was reported at 4.3x in 2022, going down from more than 8x in 2021. Both companies have improved as the pandemics effect waned and EBITDA margins recovered.

Furthermore, as shown by the interest coverage ratio, in 2022 Six Flags spent half of its EBIT to serve interest expenses and has often incurred higher costs to serve its debt than Cedar Fair. These costs severely impact the bottom-line profitability of the two companies and therefore the fact that the merger might improve the debt situation should be seen positively by investors. Overall, Six Flags bottom line profitability seems to be more affected by the debt burden. Here below is a graph detailing what just mentioned. As before, 2020 data is not reported due to negative EBITDA.

DEAL RATIONALE

The combined entity, named Six Flags after one of the merging firms, will become one of the largest operators of amusement parks globally, with a portfolio of 42 parks and 9 resorts. Additionally, the company possesses a valuable portfolio of intellectual property, including iconic brands such as Looney Tunes and DC Comics, which it intends to leverage in the development of new attractions characterized by compelling characters, immersive environments, and captivating storytelling.

Despite both Cedar Fair and Six Flags operating across North America, there is minimal geographic overlap between their respective locations. This strategic positioning allows them to diversify their presence across varied regions, thereby mitigating the impact of seasonality and reducing earnings volatility. This aspect holds particular significance given the susceptibility of the amusement park sector to adverse weather conditions in certain regions of the USA, such as heatwaves, which have historically deterred park visitation. The merger operation serves to enhance the companies’ resilience against both anticipated and unforeseen disruptions.

Richard Zimmerman, President and CEO of Cedar Fair, emphasizes that the merger will engender a “more robust operating model” for the combined entity. Moreover, the consolidation yields an improved financial profile, driven in part by substantial cost savings. The companies anticipate annual synergies amounting to $200 million, with $120 million expected to be realized within two years of closing the deal. A significant portion of these synergies will stem from reductions in administrative and operational expenses. Furthermore, leveraging their complementary operational capabilities is projected to yield an additional revenue uplift of approximately $80 million in incremental EBITDA within three years of completing the transaction, resulting in a total revenue generation of $3.4 billion.

The increased free cash flow of the combined company, estimated at $826 million, will allow it greater flexibility to invest in new rides and attractions, as well as enhance food and beverage offerings, ultimately elevating the overall guest experience. This strategic focus aims to stimulate higher per capita spending, a key strategic objective identified by the companies, while concurrently driving increased attendance and bolstering profitability.

DEAL STRUCTURE

The transaction entails Cedar Fair acquiring a 100.00% stake in the target company through a merger of equals via a stock swap arrangement. The total deal value stands at $4.3 billion, with the stake acquired valued at $2.0 billion, while the target’s net debt amounts to $2.4 billion.

Upon completion of the merger, the combined entity will bear a pro forma enterprise value of approximately $8 billion, considering both companies’ debt and equity values as of October 31, 2023. Operated under the name Six Flags, the NewCo will trade under the ticker symbol FUN on the NYSE and will be structured as a C Corp.

The exchange ratio for the merger stands at 0.58, signifying that Six Flags shareholders will receive 0.58 shares of common stock in the newly combined company for each share they currently own. It is noteworthy that prior to the merger announcement, Cedar Fair shares were trading at approximately $37 per share, while Six Flags shares were trading at approximately $21 per share. This implies a minimal premium of only 3.6% paid to target shareholders relative to the closing share price one day prior to the announcement.

The target’s multiples, derived from the target’s TTM period, encompass EV/Revenue at 3.07x, EV/EBITDA at 9.16x, EV/EBIT at 12.15x.

Following the transaction, Cedar Fair shareholders are projected to hold around 51.2% ownership, while Six Flags shareholders will possess approximately 48.8% of the combined entity.

The merger, which has received unanimous approval from the Boards of Directors of both companies, is anticipated to be concluded in the first half of 2024, pending approval from regulatory authorities and fulfillment of customary closing conditions.

Following the transaction, it is anticipated that earnings per share for shareholders of both companies will improve within the first 12 months. Moreover, the combined entity aims to sustain a pro forma leverage ratio of around 3.7x net debt to Adjusted EBITDA, incorporating synergies ($120 million is expected to occur within the first 2 years through cost cutting focusing on redundant administrative positions and high fixed costs1), with plans to reduce the leverage ratio to approximately 3.0x within two years post-closing.

Authors: Nathan Zuccolo, Alisha Haque, Edouard Bougnoux, Lorenzo Passioni, Aimen Beloued

You must be logged in to post a comment.