On December 14th, 2023, Bain Capital Private Equity LP, the private equity firm, acquired Guidehouse LLP, the local provider of management consulting, risk management consulting, strategy, and technology consulting services, from Veritas Capital Fund Management LLC, another private equity firm. The deal was closed for 5.3 billion USD in cash, allowing Bain Capital to acquire 100% ownership of Guidehouse. This operation, an exception in a 2023 characterized by a substantial depression in M&A activity in the consulting sectors, is aimed at supporting the company’s strategic growth plans as it continues to capture global market share in a sector considered to have great long-term potential.

Companies Overview

Acquirer – Bain Capital

- Founded in 1984.

- Headquarters: Boston, Massachusetts

- CEO: John Connaughton

- Employees: 1700+

- Market Cap: $971.02 Mln

- EV: 5.87 Bln

- LTM Revenues: $284.37 Mln

- LTM EBITDA: $267.91 Mln

- LTM EV / Revenue: 20.64

- LTM EV / EBITDA: 21.91

Bain Capital is one of the world’s leading private investment firms with approximately $185 billion in assets under management. It is a significant player in world of alternative investments and one of the most well-known and respected names in the industry.

The company is known for fostering a consulting-based approach strictly and closely related with management teams to offer insights able to challenge traditional thinking and to build successful business operations. Its broad investments span across multiple sectors, industries, and geographies granting the firm a significant competitive advantage for its people.

Bain Capital was founded in 1984, from the former Bain & Company partners, as a new private partnership focused on deploying management consulting strategies to private equity investing.

From its founding, Bain has extended its approach across diverse investment avenues such as private equity, credit, venture capital and real estate to build one of the strongest alternative asset platforms in the world.

Bain’s philosophy and core values, cantered on building exceptional partnerships, challenging conventional thinking, and working tenacity, have enabled the company to deliver a long-lasting lasting impact and value creation for a wide array of investors, including pensions, endowments, foundations, and individuals.

Target – Guidehouse Consulting

- Founded in 2018

- Headquarters: Washington D.C.

- CEO: Scott McIntyre

- Employees: 12,000

- 2022 Revenues: $5.5 Bln

Guidehouse is a top-tier worldwide provider of consulting and managed services to government and business clients. Based in McLean, Virginia, Guidehouse boasts wide-ranging skills in management, technology, and risk advisory. The firm’s knowledge spans various sectors, such as defence & security, energy, infrastructure & sustainability, financial services, and health. Recognized as the third-largest healthcare consulting firm by Modern Healthcare, Guidehouse has made a significant impact in this vital sector.

- Defence & Security: Cooperates with all six branches of the U.S military, together with diplomatic, intelligence, and law enforcements agencies to succeed in an evolving security environment.

- Energy, Sustainability & Infrastructure: Helped solving challenges for 60 of the world’s largest electric, water, and gas utilities.

- Financial Services: Experience in guiding eight of the ten largest U.S banks to address evolving risks and regulations, adapt to shifting markets and customer demands and drive innovation.

- Health: Works with seven of the nation’s top ten hospital systems (by member hospital beds) to solve their most complex issues and delivers innovative services to organizations across the healthcare ecosystem.

Originally a member of the PricewaterhouseCoopers (PwC) network, Guidehouse underwent a notable transformation after being acquired by Veritas Capital. This pivotal moment sparked a period of significant growth, highlighted by strategic acquisitions like the government division of Grant Thornton and Navigant, effectively expanding the company’s capabilities and influence.

Merging public and private sector knowledge, Guidehouse assists clients in tackling their toughest challenges and managing substantial regulatory pressures with a focus on transformative change, business resilience, and technology-led innovation.

Under the guidance of CEO Scott McIntyre, whose leadership and previous position at PwC have been crucial, Guidehouse has charted a course of expansion and achievement. With him at the top, the company is not only expanding its operations but also committed to nurturing resilience and creativity for clients worldwide.

With a workforce exceeding 17,000 experts in more than 55 locations globally, the organization crafts scalable, inventive solutions that enable clients to outsmart complexity and position themselves for future progress and success. Guidehouse is overseen by seasoned professionals with established and varied proficiency in traditional and emerging technologies, markets, and pivotal issues that steer national and global economies.

Market Overview

The Guidehouse deal comes as the pace of consulting revenue growth slows for many providers of these services. U.S. consulting has grown by 8% to $94 billion in 2023, down from 10.5% last year and from 11.1% in 2021, according to consulting-industry data provider Source Global Research. Globally, the consulting market is projected to expand by 8% this year to about $250 billion, following a 10.7% increase in 2022, Source Global said.

The growth of the consulting services market is influenced by several factors. Increased complexity in business operations, evolving technology landscapes, and a growing focus on strategic decision-making drive demand. Companies seek external expertise to navigate challenges, implement digital transformations, and enhance overall efficiency. Globalization, regulatory changes, and the need for innovative solutions also contribute to the expanding market. Additionally, the increased awareness of the benefits of consulting services among small and medium-sized enterprises further fuels the market’s growth. The COVID-19 pandemic benefited the market, owing to the rise in remote working and the expanding digital transformation of enterprises. Businesses are looking for business processes that are seamless, efficient, and accessible from any location.

Market Size and Dynamics

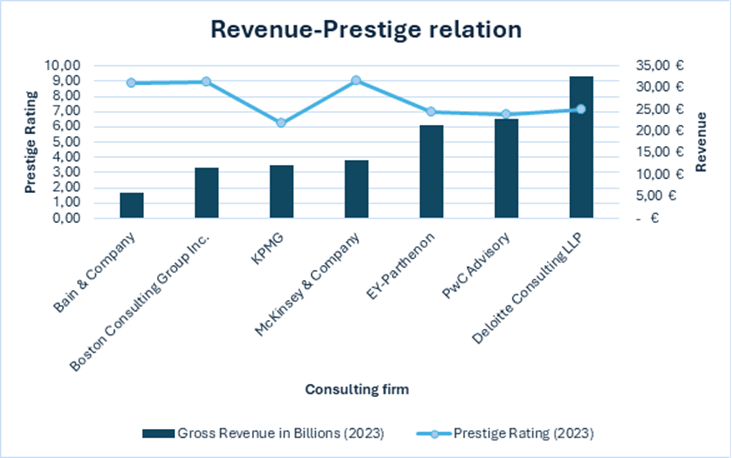

The consulting service market is highly fragmented, IBISWorld estimates that there are approximately 901,751 consulting firms in the United States, however, the vast majority of these firms are small businesses, with only a handful of large consulting firms dominating the industry. The market has relatively low exit barriers, which encourages new enterprises to participate and established firms to withdraw when profits are low. Of all the consultancy firms, the best known are the Big Four, who account for almost 40 percent of the global market. The Big Four consists of the firms Deloitte, PwC (Pricewaterhouse Coopers), EY (Ernst & Young) and KPMG, however when it comes to consulting services, size does not necessarily amount to prestige.

Source: Statista, Forbes

The prestige ranking used in the graph above is based on surveys made by Vault conducted among consultants from various firms and regions. They were asked to rate each consulting firm on a scale of 1 to 10, excluding their own firm, and focusing only on those they were familiar with.

The consulting branch, even though is part of the knowledge sector which adapt to changes at a much slower pace usually, is currently exploiting innovations by studying the effects of AI on the day-to day tasks. This summer, McKinsey rolled out a generative AI platform called Lilli, which promises the ability to search years of playbooks, case studies and research to anticipate questions, test arguments and let its people spend more time with clients. A study conducted by “The Financial Times” on various consultants shows that the general reaction to the future possibility of a greater implementation of AI in their sector is uncertain to say the least. Almost every consultant who responded to the callout thought some of their work could be done by models such as this in future but few expected AI to cause huge upheaval. At the end of the day, consulting is a people-focused business, and people trust people. AI could take some rudimentary tasks away from teams but could not implement their recommendations. Even the M&A sector is moving in that direction as shown by the two recent deals such as the acquisition of Giant Machines made by Deloitte in January 2024 to emphasize the technological transition that will help the latter strengthen their ability to provide clients with a full suite of engineering services to deliver strategy and scale solutions, and the Incapsulate’s acquisition by Accenture to exploit the AI opportunities in the sector.

Furthermore, the consulting sector is adapting to the increased demand for sustainability and ESG consulting, and the impact of the Covid-19 pandemic on the industry. According to a report by Grand View Research, the global sustainability consulting market is expected to grow at a CAGR of 10.8% from 2021 to 2028, driven by the growing demand for sustainable business practices and the need to comply with government regulations.

Impact of M&A Deals

Even though the market is in expansion the merger and acquisition activity in the consulting industry have seen a lull, mirroring the overall landscape for deals in the US as buyers and seller across sectors butt heads over pricing. And, with the geopolitical picture looking increasingly divisive the majority of deals prioritised opening up new sectoral opportunities, as opposed to cross-border opportunities. A report made by Bain is highlighting this trend estimating the drop in the M&A market at around 15% as a consequence of the misalignment between buyers and sellers. EBITDA valuation multiples however were stable over 2023 as markets, buyers and investors look to the future and anticipated lower demand and growth rates.

There are several reasons why a consulting firm might decide to make an acquisition.

- The first of them is surely the possibility of broadening a firm expertise obtained by acquiring a company with complementary skills that allows the consulting firm to expand its service offerings. For example, if a firm specializes in financial consulting, it might acquire a company that offers legal consulting services to provide a more comprehensive range of services to clients.

- Another main reason that can lead to an M&A in the industry is to widen the pool of clients of a firm. Acquiring a company can give access to an established client base and can help to quickly expand their market presence and increase revenue.

- However, the most relevant goal of an acquisition is probably the industry consolidation. In a highly competitive industry like consulting, acquisitions can be used to consolidate the market. A firm might acquire a competitor to reduce competition and increase its market share by eliminating expansion possibilities for others.

- Moreover, when buying another related company, one can access tonew technologies and know-how. Acquiring a company that possesses advanced technologies or specialized expertise can allow the consulting firm to improve its offerings and stay ahead of industry trends.

- Lastly,Synergies and efficiencies play, as always, a key role in the process of acquiring a company. In fact, it can lead to synergies and operational efficiencies, such as through resource sharing, cost reduction, or optimization of operations. This can help to improve the overall profitability of the firm.

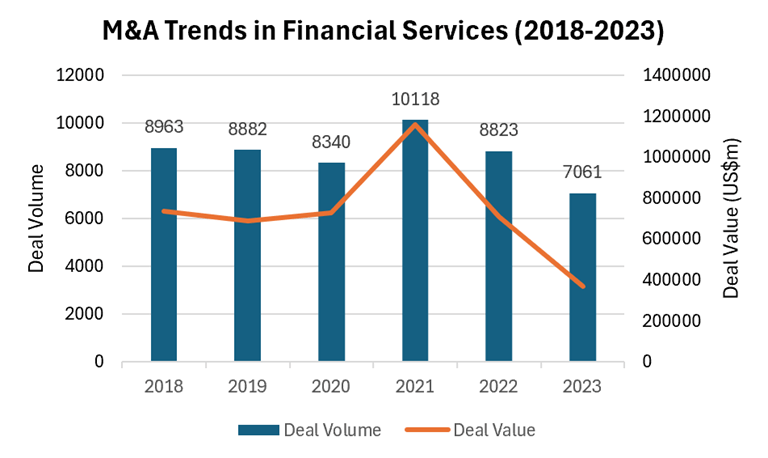

More generally, moving to the global financial institution sector, 2023 was the worst bear market in a decade. In 2023 the deal volume and even more the deal value of M&A operations registered an important decrease that foster the negative trend began in 2021.

Source: PwC M&A Trends 2023 and 2024 Outlook

However, dealmakers entered 2024 with a greater sense of optimism, reflecting on 2023 as a low point in which uncertainty created by macroeconomic factors such as high inflation, rising interest rates and lower economic growth projections dampened M&A activity. While macroeconomic conditions and geopolitical tensions remain challenging, recent gains in the financial markets and positive signals about interest rates from central banks are slowly inspiring the return of investor confidence.

Current market conditions, combined with necessary ongoing initiatives such as digitalisation, sustainability and workforce challenges, put pressure on FS players to accelerate their transformation to remain relevant and profitable. Besides internal measures, M&A continues to be an essential part of the transformation journey, especially as organic growth faces severe challenges in the current macroeconomic environment. M&A-related transformation steps may include acquisitions to enhance capabilities and drive future growth through economies of scale and scope. Alternatively, divestitures may help to improve operations and recalibrate business models.

Deal Rationale

The deal was a strategic move by both parties to achieve some longer-term goals. For Bain Capital, Guidehouse adds value as due to its expertise in providing management consulting services, especially in the public sector and healthcare industries. This complemented Bain’s existing portfolio and allowed for synergies in client offerings and market reach. Guidehouse’s expertise in these fields also sets Bain up for future expansion into the industries, with these sectors probably being identified as having significant growth potential in the long-term and aligns with Bain’s strategy.

Moreover, recent developments regarding Guidehouse’s notable performance, backed up by a wide service portfolio and strong financials, have made it an appealing target for Bain Capital. Guidehouse says its annual revenue has grown from $600 million in 2018 to a projected $3 billion in 2023. With the deal valued at $5.3 billion, the high multiple is indicative of the high growth potential and profitability of Guidehouse. Additionally, the recent port private loan and ongoing worldwide expansion plans of Guidehouse demonstrate the strategic foresight and value of Guidehouse’s consulting capabilities and market presence.

For Guidehouse, the deal provides an opportunity for growth and expansion, a significant part of its strategic growth plans. It sees the transaction as an endorsement of its business and track record of “best-in-class client delivery capabilities”. The investment from Bain also could lead to an increase in hiring and expansion of services, supporting Guidehouse’s strategic growth plans.

This acquisition also could improve market positioning of Guidehouse, capitalising on marketplace dynamics and bringing the firm to the next level with greatly enhanced client delivery capabilities. This is also at a time where pace of consulting revenue growth has been slowing, with US consulting expected to grow 8% to $94 billion in 2024, and this acquisition can help Guidehouse tap into this growth.

Risks and Challenges

To sum up, Guidehouse’s acquisition by Bain Capital is an opportunity for the firm to expand its investment portfolio and capitalise on the growing global demand for consulting services. The combination of Bain Capital’s financial acumen and Guidehouse’s consulting capabilities is expected to result in operational efficiency, improved service offerings, and long-term value creation for stakeholders. As Bain Capital and Guidehouse partner to seek new pathways and markets, the consulting sector is expected to undergo considerable transformation. Clients may expect an enhanced service experience underpinned by a strong blend of financial knowledge and consultancy ability.

Indeed, the industry’s intricacy and the macroeconomic landscape’s vast unpredictability present numerous risks linked to this transaction. The most significant uncertainty lies in the growth potential of the management consulting sector. Exceptional efforts would be required from Guidehouse’s management to steer the business operations in a way that they surpass the market and yield a satisfactory risk-adjusted return for Bain Capital.

In addition, while Guidehouse has a competitive advantage in offering technology-driven consultancy, its fundamental business strategy is encountering escalating competition from larger management consultancy firms. As a result, Guidehouse’s capacity to resist this growing competition introduces a substantial uncertainty, exerting pressure on both its EBITDA margin forecast and Bain’s investment IRR.

Furthermore, given the challenging margin scenario, the transaction value of $5.3 billion, one of the largest in the management consulting industry, raises a crucial question – what are the exit strategies? To attain a favourable IRR, Bain Capital may be forced to exit at a significantly higher valuation. However, this suggested exit valuation could be unappealing for other private equity investors, even if they are part of a consortium.

Also, considering the infrequency of transactions in the management consultancy sector that are comparable to Guidehouse’s scale, either financially or strategically, it might pose a challenge for Bain Capital to exit to a strategic partner in the future. Consequently, an IPO appears to be a viable exit strategy. However, the protracted and complex process of an IPO also carries a considerable amount of uncertainty that might obstruct Bain Capital from achieving optimized returns.

Taking all factors into account, even though there are obstacles, various elements that presently contribute to unpredictability could evolve into favourable circumstances for Bain Capital going forward. Consequently, the investors have shown a favourable response to the transaction’s strategic promise, aiding in the optimistic perspective of the combined organization. Industry specialists have provided their insights on the Bain Capital-Guidehouse deal, highlighting its significance amidst the evolving landscape of the consulting field, which is progressively focusing on cohesive solutions and global growth.

Deal Structure

On December 14th, 2023, a month after the deal has been announced, Bain Capital completed the acquisition of Guidehouse LLP acquiring 100% of Guidehouse for $5.3 billion paid entirely in cash. Previously owned by Veritas Capital Fund Management since 2018, Guidehouse will continue operating under its current management team. Typically, such a change in ownership would entail replacing the existing debt. However, Guidehouse’s private credit lenders expressed a desire to maintain their involvement.

Peculiarity of the Deal

Private lenders, led by Blackstone Inc., improved the terms of Guidehouse Inc.’s existing debt before its acquisition by Bain Capital Private Equity. This strategic move effectively prevented banks from providing financing for the buyout.

In today’s competitive lending environment, the concept of “portability” has emerged as a crucial negotiation point between lenders and borrowers. This feature allows credit to remain with a business even after changes in ownership, which is particularly attractive to investors during periods of challenging or expensive financing. Private credit providers tout the benefits of their asset class, emphasizing greater flexibility, customization, and a more streamlined lender base compared to syndicated loans. While “portability” is not yet ubiquitous, industry sources note a growing willingness among private credit providers to incorporate it into loan agreements, reflecting evolving dynamics in the lending market, where syndicated loans are typically repaid via change-of-control provisions.

Blackstone and HPS Investment Partners lowered the interest rate on Guidehouse’s $3.075 billion loan and $250 million revolver to dissuade Bain from seeking refinancing with banks. By reducing the rate to 5.5 percentage points over the Secured Overnight Financing Rate from the previous 6.25 percentage points, the lenders made their offer more competitive.

This private debt financing, arranged in late 2021, supported Guidehouse’s acquisition of The Dovel Group and facilitated a shareholder dividend. It marked a departure from Guidehouse’s previous debt issuances in the syndicated loan market. In February 2021, Guidehouse arranged a syndicated loan that repriced its first-lien term loan and included an add-on term loan.

Both private equity sponsors and private credit lenders point to Guidehouse’s financing as an example of how portable loans can streamline the sale process. They argue that such deals work well when the asset is robust, and lenders would want to provide debt regardless of the private equity owner.

Guidehouse’s private lenders also offered the option to pay 2 percentage points of interest with additional debt, known as payment in-kind, for up to two years. Additionally, they extended the loan’s maturity from 2028 to 2030. In exchange for these adjustments, the lenders introduced new call protections, ensuring a higher payoff if Guidehouse chooses to repay the loan early. As part of the acquisition, Bain is injecting fresh equity into the company.

HPS will maintain a $500 million preferred equity investment in Guidehouse, with interest paid entirely in-kind at a rate of 13.75%. However, this rate will decrease to 12.75% if Guidehouse reduces its overall leverage over time.

Final Considerations

With this operation, Bain Capital, one of the world’s leading private investment firms, acquired Guidehouse, one of the most prominent players in the consulting industry, betting on a reversal of the downtrend that has affected the financial sector in recent years. As a new year begins, the dealmakers enter 2024 with a great sense of optimism. New challenges such as digitalization, sustainability, and the diffusion of AI systems necessitate renovation and transformation, suggesting that M&A will be an important instrument for maintaining pace. In our opinion, Bain Capital’s bet will be a winning one. Guidehouse is experiencing significant revenue growth and becoming a key player in its industry. Moreover, despite the uncertain geopolitical situation, the realization of favourable interest rates is concrete offering the possibility of future exits with a positive investment IRR.

Authors: Giovanni Fusco, Lorenzo Villani, Federico Trossero, Michele Pinto, Riccardo Consalvo

Sources: Bain Capital, Guidehouse, Factset, Reuters, Wall Street Journal, Business Times, Financial Times, PwC, MSN, Mergersight, Mergermarket, Bloomberg

You must be logged in to post a comment.