DEAL OVERVIEW

Buyer: Liberty Media Corporation

Target: Dorna Sports

Deal size: €4.2 billion

Buy side advisors: Goldman Sachs & Co. LLC, O’Melveny & Myers LLP

Sell side advisors: Moelis & Company LLC, Latham & Watkins LLP

INTRODUCTION

On April 1 2024, Liberty Media (Nasdaq: FWONA, FWONK) entered in definitive agreement for the takeover of Dorna Sports S.L., the exclusive commercial rights holder of the MotoGP™ World Championship. With 21 races across 17 countries and top speeds above 360 km/h, the world’s leading motorcycle racing championship is valued at EUR 4.2 billion ($4.53 billion). Liberty media, will acquire 86% of Dorna by the end of 2024, whereas the remaining 14% will be retained by Dorna management.

This move mark a significant consolidation in the live sports industry as Liberty Media already holds Formula One’s exclusive commercial rights. Carmelo Ezpeleta will retain his position as CEO of Dorna and expressed his enthusiasm for the acquisition: “This is the perfect next step in the evolution of MotoGP, and we are excited for what this milestone brings to Dorna, the MotoGP paddock and racing fans”.

COMPANIES OVERVIEW

Liberty Media

Liberty Media is an American mass media corporation founded in 1991. Since 2017, it is a single owner of Formula One. The company is split into 3 main segments: Liberty SiriusXM Group, Liberty Formula One Group, and Liberty Live Group. The company as a whole engages in media and entertainment industries, and through the abovementioned tracking stocks, holds many minority investments in these sectors.

Liberty Sirius XM Group operates two audio entertainment businesses: Sirius XM and Pandora. It reaches a monthly audience of approximately 150 million listeners. Liberty Formula 1 Group focuses on the global motorsport industry and is a sole owner of Quint, a provider of ticket and hospitality packages to sports and entertainment events. Formula One has commercial rights to the world’s most prestigious annual motorsport competition. Liberty Live Group, which became a tracking stock as of 2023 following the Atlanta Braves split-off, includes Live Nation, the largest live entertainment company on earth with segments consisting of concerts, sponsorship, advertising and ticket sales.

Source: FactSet

Financial Analysis

The Consolidated Group reported revenues of $12.5 Billion, an Operating Income of $2.063 Billion, and EBITDA of $3.093 Billion in 2023. Sirius XM Holdings held the highest portion of revenues attributable to Consolidated Liberty, followed by Formula 1 Group and Braves Group. The company has shown steady EBITDA margin in the preceding 5 years, with a decline in 2020.

Source: FactSet

Formula 1 Group showed tremendous success in 2023, with 25% revenue growth from Y-o-Y, and 5% growth in fan attendance. Its 3 main streams of revenue represent race promotion, media rights fees and sponsorship fees.

Liberty Media Corporation has maintained a positive Free Cash Flow of 1.353 billion in 2023 and 1.72 billion in 2022. Net change in cash was however negative in both years due to significant amounts of cash provided for financing.

Dorna Sports

Founded in 1988, Dorna Sports is a global leader in sports management, media, and marketing. Since 1991, it holds the exclusive commercial rights to the MotoGP™ World Championship after acquiring them from the International Motorcycle Federation (FIM).

With its headquarters located in Madrid, Spain, along with branches in Barcelona and a subsidiary in Rome, the company has grown consistently over the years. Initially focused only on MotoGP™, it now includes other premier motorcycle racing championships worldwide. These now include the MOTUL FIM Superbike World Championship (WorldSBK), the FIM JuniorGP™, the Idemitsu Asia Talent Cup, and the R&G British Talent Cup. The introduction of the Northern Talent Cup in 2020 marked the latest addition to the Road to MotoGP™ pathway. In addition to its core business of motorcycle racing, Dorna Sports also markets Ad-Time, a rotating LED advertising board system utilized in various sports such as football (soccer), volleyball, baseball, and basketball. The primary markets for Ad-Time are Spain and Japan.

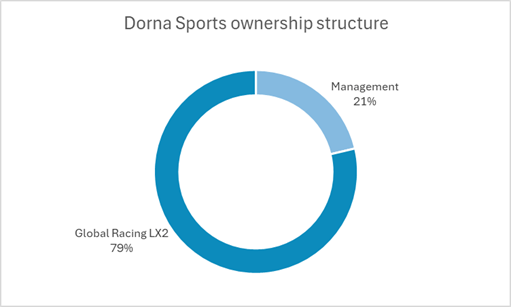

Prior to the acquisition, Bridgepoint controls Dorna Sports with 79% majority stake, through the Luxembourg-domiciled vehicle Global Racing LX2 (51% owned by Bridgepoint and 49% owned by Canada Pension Plan Investment Board). The remaining 21% of Dorna Sports is owned by the company’s management team.

Source: Mergermarket, Capital IQ, FactSet

Financial analysis

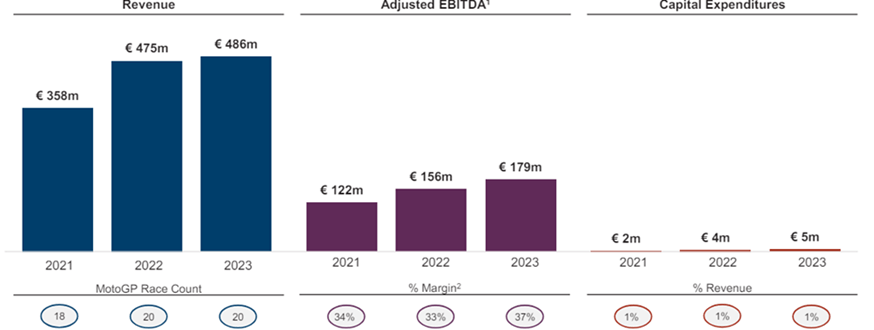

In 2023, Dorna Sports achieved a revenue of EUR 486 million, with Media Rights contributing at 40% and Race Promotion at 32%. Revenue remained consistent with the previous year and marked a significant increase of 35.7% compared to 2021. EBITDA margin for 2023 was strong at 37%, reflecting an increase over the figures from both 2021 and 2022. This growth was primarily attributed to fixed team fees, which are adjusted every five years and are contingent on the number of races.

However, Dorna Sports’ net financial debt amounted at EUR 900 million in 2022, reaching nearly 6 times the EBITDA. This was driven by the distribution of €422 million in dividends to shareholders and a €975 million loan from BNP Paribas (set to expire in 2029). By 2023, the net financial debt had decreased to EUR 702 million.

Source: Liberty Media investors presentation

MARKET OVERVIEW

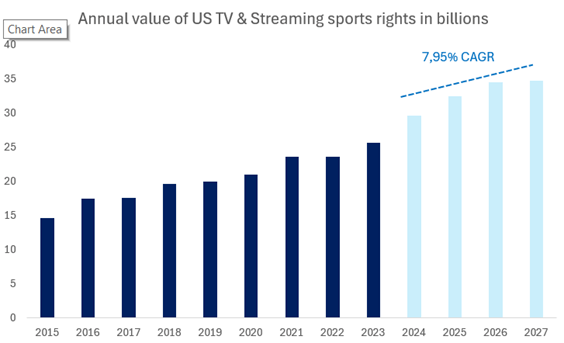

Despite the steady decline of traditional television subscriptions over the past decade, live sports content has proved to be resilient since it has been able to attract audiences and drive demand for both TV and streaming services. In addition to established giants like Comcast, Disney, Fox, Paramount, and Warner Bros., new players such as Apple, Amazon, and Alphabet have entered the media industry, attracted by the allure of live sports.

This increase in competition led to a surge in media rights deals and billions of dollars have been invested to secure broadcasting rights for premier sports events. Considering the United States alone, payments for television and streaming sports media rights are projected to reach a value of $34.72 billion in 2027, more than doubling the figure of 2015, and this trend is expected to continue.

Source: S&P Global

This growth is driven by lucrative agreements for major sports properties like the NFL, NHL, NASCAR, and MLB, as well as upcoming negotiations such as the NBA’s impending rights renewal. Comcast Corp. emerges as the world’s leading spender on sports media rights due to its significant investments in the NFL and global soccer content through Sky, closely followed by The Walt Disney Company, which has also made substantial investments in major sports properties. These traditional media giants face increasing competition from streaming platforms, as evidenced by Disney’s acquisition of Comcast’s stake in Hulu and the anticipated involvement of companies like Apple and Netflix in bidding for NBA rights. With current rights holders Disney and Warner Bros., the NBA, in particular, stands to benefit from the changing television landscape.

Discovery faces potential competition from the likes of Comcast’s NBCUniversal and streaming giants such as Apple and Netflix. Given the NBA’s global popularity, the league is exploring lucrative global rights deals to boost revenue.

NASCAR has recently secured a lucrative new rights deal that includes coverage from traditional broadcasters like FOX and NBC, as well as streaming newcomer Amazon Prime Video. This multi-platform strategy caters to the diverse preferences of modern audiences and reflects the evolving nature of sports broadcasting.

ESPN’s renewal of its agreement for the college football playoffs and acquisition of broadcasting rights for a package of NCAA championships have led to increased rights fees even for college sports. The expansion of women’s college basketball has also resulted in higher revenue and interest in the sport.

One thing is certain: both traditional and streaming platforms continue to rely on live sports programming, even as the landscape of live sports broadcasting undergoes changes. As cord-cutting trends reshape the industry, sports rights holders are adapting by shifting more content to their respective streaming services, ensuring that fans can access their favourite sports anytime, anywhere. The battle for live sports rights has never been more intense in this era of unprecedented choice and competition. Whether it’s on traditional television or streaming platforms, one thing is certain: the excitement of live sports will continue to unite fans and shape the future of media consumption.

DEAL RATIONALE

Historically, the bulk of MotoGP’s total revenues is derived from Southern Europe. MotoGP is due to hold 21 races globally this year, including four in its home country of Spain, but just one in the US and none in Latin America. While there are some overlaps with the F1 race map, MotoGP’s calendar also includes races in Thailand, Indonesia and India, countries that are large markets for motorbike manufacturers.

From the acquirer’s perspective, this represents a unique opportunity to buy into a global sport with lucrative commercial rights. Dorna Sports promotes several competitions, including the Superbike World Championship and an electric biking series called MotoE. It organises 251 races a year in 20 countries. By buying Dorna Sports, Liberty Media will bring together the world’s two leading motorsport contests under one entity. Liberty Media aims to boost MotoGP’s audience in the US and Latin America, where it has expanded the audience base for F1 beyond its traditional European markets. Liberty Media has reacted positively to the deal, with a 4.5% increase in its stock price in the 48 hours following the announcement. Additionally, at the end of April 2024 Berkshire Hathaway Inc. (NYSE:BRKa) has increased its stake in Liberty Media Corp, investing a total of $15.87 million in the company’s Series C Liberty SiriusXM Common Stock, reflecting confidence in the company’s value and prospects.

From the target’s perspective, this deal is an opportunity for organic growth beyond traditional markets in Europe. On 7 April 2024, Financial Times reported that Bridgepoint rejected a bid from TKO Group for MotoGP despite it being worth EUR 200mn more than what Liberty Media offered. It is evident that from MotoGP’s perspective, acquisition by a player which has proven its expertise and experience in growing a motorsports business is preferred. Liberty Media has successfully commercialized the F1 brand through large-scale partnerships such as with Netflix, kickstarting a new wave of fan engagements and increasing intergenerational spectatorship. MotoGP stands to tap on Liberty Media’s platforms and thereby grow its organic outreach by focusing on marketing efforts.

DEAL STRUCTURE

Liberty Media has agreed to acquire 86% stake in Dorna Sports, the exclusive commercial rights holder to MotoGP World Championship, from Bridgepoint and Canada Pension Plan Investment Board. MotoGP management will keep approximately 14% of their equity in the business. The transaction indicates an enterprise value for MotoGP of EUR 4.2bn and an equity value of EUR 3.5bn with the existing debt balance at MotoGP expected to remain in place after close. Under the terms of transaction, the equity consideration to sellers is expected to be formed by 65% cash (EUR 2.3Bn), 21% in shares (~EUR 735mn) of Series C Liberty Formula One common stock (Nasdaq: FWONK) and 14% of retained MotoGP management equity. Cash payment will be funded with a mix of cash and debt, subject to market conditions. The FWONK share consideration will be priced on a 20-day volume weighted average price prior to transaction close. Liberty Media retains an option at its sole discretion to deliver additional cash in substitution of FWONK common stock. Considering the synergies, the enterprise value of the transaction translates to multiples of 18.9x EBITDA and 7x Revenue.

Goldman Sachs & Co. LLC is acting as financial advisor to Liberty Media and has committed to provide an unsecured 364-day term loan bridge facility in an amount up to $2 billion, under the bridge facility to fund the cash component and pay fees and expenses incurred as a result of the transaction. O’Melveny & Myers LLP is acting as legal counsel to the Liberty Media. Moelis & Company LLC is acting as financial advisor to Dorna, and Latham & Watkins LLP is acting as legal counsel.

Greg Maffei, Chief Executive of Liberty Media remains confident of securing approvals given that both assets will be kept separate, and he believes that the market has evolved since a 2006 European Commission ruling. However regulatory scrutiny is still expected as post-acquisition, Liberty Media will control two biggest motorsport competitions in the world. Previously, private equity firm CVC Capital Partners was forced to sell MotoGP in 2006 as a condition of buying F1, after EU competition regulators raised concerns regarding the risk of price increases for the TV rights to these events and a reduction in consumer choice due to CVC’s concurrent ownership of F1 and MotoGP. As a result, CVC sold its stake in Dorna Sports to Bridgepoint Capital in 2006.

Authors: Marco Lodrini, Edoardo Simonetti, Luka Sulejic, Andrea Giuseppe Villa, Lorenzo Montagner

Sources: Liberty Media, MergerMarket, Dorna

You must be logged in to post a comment.