Campari Group’s legacy begins in 1860 when Gaspare Campari, a visionary and enterprising young man, created the first batch of the now-legendary aperitif in Novara, Italy. This vibrant red liquid, infused with a secret blend of herbs, spices, and fruit, quickly gained popularity for its unique and complex flavor profile. Initially sold as an elixir in Gaspare’s own café, Campari’s allure grew, fueled by the mystique surrounding its closely guarded recipe known only to a select few.

In 1867, Gaspare capitalized on a prime business opportunity by moving his operations to the newly built Galleria Vittorio Emanuele II in Milan, where he established Caffè Campari. This location, at the heart of Milan’s cultural and social scene, significantly boosted the brand’s visibility and popularity.

As demand for Campari Bitter surged, the company expanded its production capabilities, opening its first production plant in Sesto San Giovanni in 1904, which remains the company’s headquarters today. Gaspare’s son, Davide Campari, played a pivotal role in shaping the company’s future. By the 1920s, Davide had streamlined the company’s focus to two core products: Campari Bitter and Cordial Campari. His innovative spirit led to the launch of Campari Soda in 1932, the world’s first pre-mixed single-serve aperitif, which featured an iconic bottle design that remains unchanged to this day.

Throughout the mid-20th century, Campari continued to grow, leveraging groundbreaking advertising campaigns and collaborations with renowned artists, such as Fortunato Depero, to cement its brand identity. The company’s resilience and innovative marketing strategies helped it navigate through challenging periods, including World War II.

The 1990s marked a significant turning point for Campari as the global drinks market experienced consolidation. Recognizing the need for diversification, the company embarked on an ambitious acquisition strategy, starting with the purchase of the Italian operations of the Dutch Group BolsWessanen in 1995. This move laid the foundation for Campari’s extensive portfolio expansion.

Over the subsequent decades, Campari Group acquired numerous prestigious brands, including Aperol, Grand Marnier, Wild Turkey, and Forty Creek Whisky, among others. These acquisitions not only diversified its product offerings but also bolstered its market presence, transforming Campari into a major player in the global spirits industry.

Today, Campari Group owns more than 50 brands and distributes them across over 190 countries. Its strategic acquisitions and innovative spirit have positioned it as a leader in the branded spirits industry, continuing to build on its rich heritage and passion for excellence.

Courvoisier: History

Courvoisier’s history began in 1809 when Emmanuel Courvoisier and Louis Gallois established a wine and spirits company on the outskirts of Paris. Initially, they operated as traders, but their high-quality cognac quickly gained a reputation, drawing the attention of none other than Napoleon Bonaparte in 1811. According to legend, Napoleon was so impressed that he ensured his artillery companies had a ration of Courvoisier cognac, a story that has become a cornerstone of the brand’s legacy.

In 1828, Felix Courvoisier, Emmanuel’s son, relocated the business to Jarnac in the heart of the Cognac region to gain greater control over production and quality. This move proved pivotal as it allowed Courvoisier to cement its reputation for excellence. By 1869, the company was honored with the title of “Official Supplier to the Imperial Court” by Napoleon III, further solidifying its prestige.

The business transitioned to the Simon family in 1909, who continued to build on its legacy. They introduced the iconic Josephine bottle in 1951, named and shaped after Napoleon’s first wife, reinforcing the brand’s historical association with the French Emperor. The 20th century saw Courvoisier expand globally and innovate continuously, maintaining its status as a symbol of luxury and quality.

In the 1990s, Courvoisier experienced a resurgence in popularity, partly due to its association with hip-hop culture, where it was frequently referenced as a symbol of sophistication and success. Today, under the ownership of Beam Suntory and now part of the Campari Group, Courvoisier continues to produce some of the world’s finest cognacs, adhering to traditional methods while also embracing modern sustainability practices.

Courvoisier’s dedication to quality and craftsmanship is evident in their meticulous production processes, using only the finest ingredients and aging their cognacs in carefully selected oak barrels. This commitment has earned them numerous accolades, including the prestigious “Prestige de la France” award, which they remain the only cognac house to have received.

Business:

Campari Group, an Italian beverage company, is renowned for its extensive portfolio of premium spirits, which includes iconic brands like Aperol, SKYY Vodka, and Bulldog Gin. The group’s business strategy is centered around achieving and enhancing critical mass in key geographic markets. This strategic approach has enabled Campari to establish a direct presence in 26 markets and distribute its products across 190 countries worldwide. The group has a significant market presence in both Europe and America, supported by a robust manufacturing infrastructure comprising 22 plants globally.

Campari’s growth strategy has been characterized by aggressive acquisition activities, which have expanded its portfolio and market reach. Notable acquisitions include the purchase of the Italian branch of the Dutch group BolsWessanen in 1995, which marked the beginning of its portfolio expansion. Subsequent acquisitions of brands like Wild Turkey, Grand Marnier, and Forty Creek Whisky have diversified its offerings and strengthened its position in the global spirits industry. This M&A-driven growth has been crucial for Campari in scaling operations, optimizing production efficiencies, and leveraging brand synergies across different markets.

On the other hand, Courvoisier is one of the most prestigious cognac houses, recognized as one of the ‘big four’ historical cognac producers. In 2019, it received the prestigious Prestige De La France title, making it the only cognac house to win this award, underscoring its commitment to quality and craftsmanship. Courvoisier boasts a diverse range of products, from its core collection of VS, VSOP, and XO cognacs to high-end limited editions. This broad product spectrum allows Courvoisier to cater to a wide array of consumer preferences and market segments.

Despite being based in France, Courvoisier’s primary market is the United States, accounting for 60% of its net sales. Other significant markets include the United Kingdom and Ireland (16%) and China (9%). The brand has identified the Asia-Pacific region as a key area for future growth and is actively planning to expand its presence there. Courvoisier has historically employed various strategies to broaden its customer base, with the latest focus being on capitalizing on the rising popularity of cocktails. This approach aims to attract younger adult consumers to the cognac category by positioning cognac as a versatile ingredient for contemporary cocktails.

In summary, both Campari Group and Courvoisier have leveraged strategic acquisitions and market expansion to enhance their global footprints. Campari’s acquisition-driven strategy has allowed it to build a diverse portfolio and achieve significant market penetration, while Courvoisier’s focus on quality, heritage, and innovative marketing has solidified its status as a leading cognac producer with a broad market appeal.

Financials :

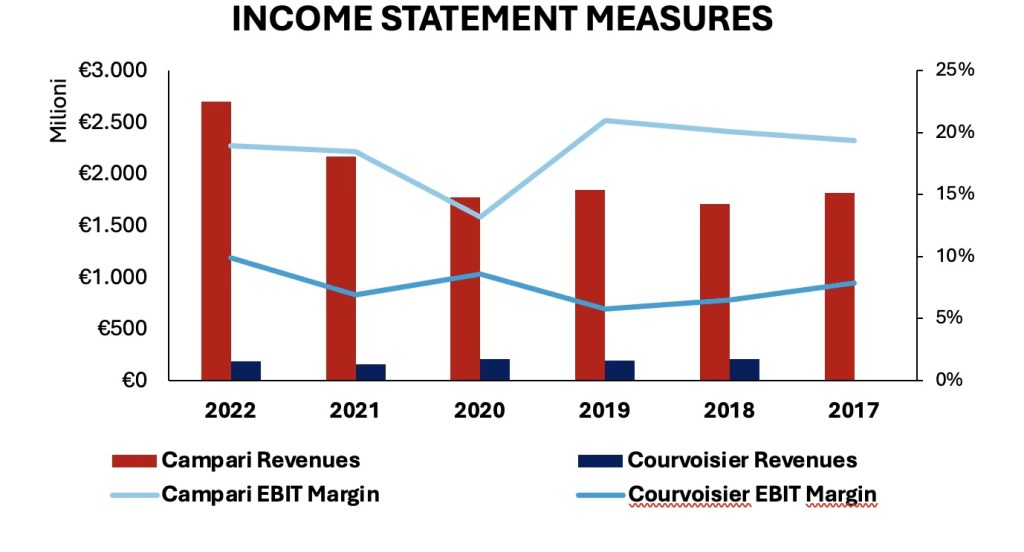

Campari Group reported net sales of €2,918.6 million for 2023, reflecting an 8.2% growth compared to the previous year, and achieved an EBITDA of €728.9 million. This robust performance is attributed to solid brand momentum, particularly in the Tequila, Bourbon, and aperitifs segments. Notably, Aperol’s sales soared by nearly 25%, driven by strong demand in Italy, Germany, the US, France, and the UK. Wild Turkey Bourbon also exhibited significant growth of 8.8%, with substantial contributions from the US, Australia, Japan, and South Korea.

Campari’s strategic focus on enhancing its market presence and optimizing its brand portfolio has enabled it to maintain a strong performance despite macroeconomic challenges and normalization of consumption post-pandemic. The group’s comprehensive distribution network spans 190 markets, supported by 22 manufacturing plants worldwide. This extensive reach and efficient production infrastructure have facilitated Campari’s consistent delivery of high returns to shareholders, with a total shareholder return increase of 6.6% since 2019.

Courvoisier reported sales of €202 million in 2022, with a Contribution After Advertising and Promotion (CAAP) of €72 million. However, by the end of October 2023, the net sales had declined to $148 million, marking a 33% decrease, and the CAAP dropped to $37 million. This decline is aligned with broader industry trends, including normalized consumption levels in the US following a post-COVID peak and destocking at the wholesale level. Despite these challenges, Courvoisier remains committed to expanding its market presence, particularly in the Asia-Pacific region, and continues to leverage its strong brand credentials and diverse product range to appeal to a broad consumer base.

MARKET OVERVIEW

The alcoholic beverages market in the United States is projected to grow by $52.82 billion between 2022 and 2027, with a compound annual growth rate (CAGR) of 2.95% over the forecast period. This growth, however, is expected to be more pronounced in Asia, driven by rising middle-class incomes and increased consumer spending on premium products, while Europe is anticipated to see slower growth compared to the US.

Key players in the alcoholic beverages industry include global giants such as Diageo, Pernod Ricard, Bacardi Ltd., Brown-Forman, Beam Suntory, Campari Group, Constellation Brands, E.&J. Gallo Winery, Mast-Jägermeister, and The Edrington Group. These companies dominate the market with a significant presence in the US and other major regions, leveraging strong brand portfolios and extensive distribution networks.

Recent market trends have influenced performance within the alcoholic beverages sector. Inflation and reduced consumer spending post-COVID-19 pandemic have led to a normalization of consumption levels and destocking at the wholesale level. Furthermore, as reported by McKinsey, sales of non-alcoholic beverages in the United States have exceeded $400 million, more than doubling since 2020, indicating a growing consumer preference for healthier alternatives.

In response to these dynamics, companies are increasingly focusing on the spirits segment, which has seen sales growth outpace that of beer and wine over the past decade. This shift is due to the higher profitability margins spirits typically offer. Companies are also exploring direct-to-consumer (D2C) models and introducing ready-to-drink (RTD) products to adapt to changing consumer behaviors.

The strategy of acquiring established smaller companies in the spirits production industry has become a key approach for achieving premiumization. The pandemic saw a temporary slowdown in M&A activity within the beverage industry, with deals decreasing from 47 in 2019 to 36 in 2020. However, 2023 marked a resurgence in notable acquisitions, such as Campari’s $1.2 billion move into Cognac, Treasury Wine Estates’ $900 million acquisition of Daou Vineyards, and Coca Cola HBC’s $220 million purchase of Finlandia Vodka. These acquisitions align with industry trends of “drinking less but better,” reflecting a strategic shift towards premium segments.

These strategic maneuvers by key industry players underscore the dynamic nature of the beverage sector and highlight the ongoing efforts to capitalize on emerging opportunities and foster growth. The market is expected to continue evolving with further consolidation and strategic investments in high-growth areas.

Sources: McKinsey, BCG, PwC, Campari Group

DEAL RATIONALE

The $1.2 billion acquisition of Courvoisier represents the largest acquisition in Campari Group’s history, marking a significant milestone for the company. This strategic acquisition positions Cognac as Campari’s fourth-largest segment, following aperitifs, bourbon, and tequila. Despite the significant investment, the market’s initial reaction was cautious, with Campari’s share prices declining by 6% upon the announcement in December 2023. Analysts expressed concerns about the short-term impact, noting that Courvoisier might reduce Campari’s gross margin by 80 basis points. Additionally, excess inventory and fragile consumer sentiment could hinder immediate performance.

Campari, however, remains optimistic, projecting a 9% increase in sales and a 2% rise in earnings per share (EPS) due to the acquisition. The primary goal of the deal is to enhance Campari’s position in the premium spirits market. Courvoisier is expected to benefit from Campari’s robust leadership, brand development expertise, and advanced operational infrastructure, promising significant portfolio enhancements and increased market presence, particularly in the U.S. and strategic Asian markets over the long term.

This acquisition occurs amid a global decline in Cognac sales, particularly in the U.S. and China, where post-pandemic destocking by wholesalers has impacted the market. Campari aims to rejuvenate Courvoisier’s sales through its powerful marketing strategies, positioning it as a “global icon for luxury” and integrating it into the luxury goods market. This approach is intended to revive the brand and boost its sales.

The deal aligns with Campari’s broader strategy to establish a stronger foothold in the U.S. market and diversify beyond its traditional offerings. This follows the acquisition of U.S. bourbon producer Wilderness Trail Distillery LLC in early 2022. By acquiring Courvoisier, which derives 60% of its sales from the U.S., Campari aims to create synergies and efficiencies with other French brands in its portfolio, such as Grand Marnier and Champagne Lallier. This acquisition is expected to enhance Campari’s leverage in the U.S. spirits market and transform its growth profile in Asia.

Courvoisier stands to gain from Campari Group’s established leadership, strategic focus, and expertise in brand development, utilizing the Group’s strengthened operational and commercial framework. This is founded on a track record of successful premium strategy execution, encompassing premium packaging and bottle enhancements, a commitment to age-statement offerings with premium pricing structures, prioritization of liquid quality, coherent and targeted brand messaging emphasizing superior quality, and a concentration on the core brand identity while phasing out flavor variations or value extensions.

Financial Rationale

This strategic move aims to elevate cognac within the Campari Group’s portfolio, positioning it as the company’s fourth-largest segment alongside aperitifs, bourbon, and tequila. Pro forma projections indicate that cognac would constitute approximately 8% of the total net sales in 2022.

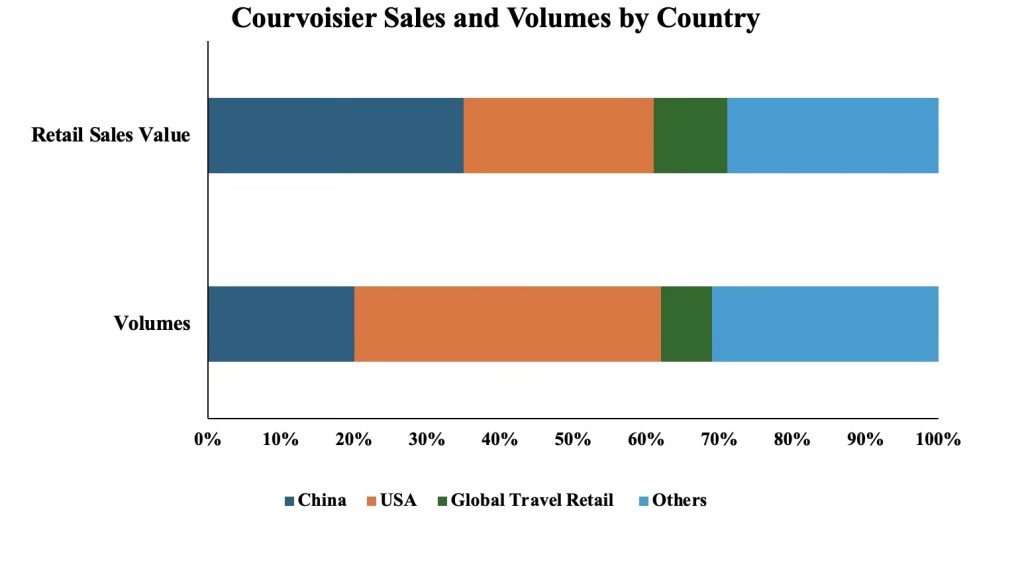

The United States represents the largest profit pool in the industry. With Courvoisier, Campari gains access to the lucrative US market and anticipates long-term growth opportunities in the Asia-Pacific region. In China, Courvoisier focuses on selling high-end products to maximize profits, while in the United States it prefers to offer slightly less expensive products in larger quantities. This is reflected in the data: although sales represent only 4% of the volume in China, they generate 9% of the total revenue. In the United States, sales account for 60% of the total, with volumes at 55%, suggesting a proportionally lower profitability compared to China, but still solid. In fact, the current geographic distribution emphasizes sales of VS and VSOP (Very Special and Very Superior Old Pale), with about 90% of sales occurring in the United States, compared to Prestige and VSOP+, which are the premium categories and make up just under 50% of sales in China.

After the acquisition of Courvoisier, Campari’s pro forma sales in the USA, starting from $1.3 billion, would be higher by 20%, while in China, starting from $13 million (10% of overall sales), they would increase by 170%.

Sources: Campari Group, Orbis

DEAL STRUCTURE

On December 14th, 2023, Campari announced the completion of a deal for the acquisition of Beam Holding France, which owns 100% of the share capital of Courvoisier. The purchase price was €1.11 billion (USD 1.20 billion at the December 14th, 2023, exchange rate). As part of the transaction structure, Beam Suntory was granted a put option, allowing it to sell the business at the specified price. The utilization of put and call options has been increasing in M&A transactions, particularly to provide sellers with protection and the ability to exercise their right to sell, mitigating the risk of the buyer withdrawing from the agreement.

In addition to the €1.11 billion, the transaction includes an €11 million earnout, contingent upon achieving specific net sales targets for the full year 2028, payable in 2029. This brings the transaction’s enterprise value to €1.22 billion (USD 1.32 billion at the December 14th, 2023, exchange rate). A critical metric for the liquor industry is Contribution after Advertising and Promotion (CAAP), reflecting the industry’s high competition and the necessity of substantial advertising to maintain market share, making post-advertising profitability a key performance indicator.

The acquisition was facilitated by bridge financing, a short-term loan lasting 24 months from the final deal closing date. The financing was provided by a consortium of investment banks, including Crédit Agricole, Intesa Sanpaolo, Bank of America, Goldman Sachs, and Mediobanca. Typically, such deals involve multiple banks to distribute the financial risk of a single large transaction. This process is known as syndication, where several banks work together to fund a significant loan, thereby sharing the risk.

As bridge financing is a temporary solution, Campari, in December 2023, approved the issuance of new ordinary shares, amounting to 69,667,738 shares, representing 5.7% of the company’s issued ordinary share capital post-offering. This raised approximately €650 million at an offering price of €9.33 per share. Additionally, Campari issued senior unsecured convertible bonds due in 2029, with an aggregate principal amount of €550 million. These bonds are convertible into new and/or existing ordinary shares, bearing an annual coupon rate of 2.375%, payable semi-annually starting from July 17th, 2024. The bonds, maturing on January 17th, 2029, have a principal amount of €100,000 each and can be converted into 8.089 shares, translating to a conversion price of €12.36, a 32.5% premium to the January 12th stock price of €9.32. The potential conversion of the bonds could result in 44.5 million new shares, diluting existing shareholders by 3.6% considering the new share issuance. The company retains the option to settle part or all of the share payment with cash to avoid shareholder dilution.

Upon announcing the acquisition, Campari indicated that if the acquisition were entirely financed by debt, the Debt to EBITDA ratio would rise from 2.6 on September 30 to approximately 10.4 at the transaction closing. Given that roughly 45.83% of the operation was financed through debt, the acquisition is expected to increase the Debt to EBITDA ratio to 6.17. Nonetheless, Campari projects that the cash flows generated by Courvoisier will significantly reduce the overall debt level in the coming years. For reference, Courvoisier generated €17 million in cash flow computed as Net Income before Depreciation and Amortization in 2022.

Goldman Sachs and PwC served as lead financial advisors to Campari, with Bank of America, Credit Agricole, and Mediobanca as additional advisors. Morgan Stanley advised Beam Suntory, the owner of the Courvoisier brand.

Written by:

Nathan Maria Zuccolo

Francesca Cantella

Alisha Haque

Lorenzo Passioni

Edouard Bougnoux

You must be logged in to post a comment.