On September 11th, UniCredit announced the acquisition of approximately 9% of Commerzbank AG’s share capital and submitted regulatory filings to seek authorization to increase its stake to up to 29%. This bold strategic move highlights UniCredit’s ambition to solidify its presence in Europe’s largest economy and establish itself as a leading player in corporate and retail banking.

With nearly €1.3 trillion in combined assets under management and a shared focus on corporate banking, the merger promises significant synergies and operational efficiencies. However, the deal faces substantial hurdles, including stringent regulatory scrutiny and strong opposition from the German government, which could slow or even derail the acquisition process.

Companies Overview

UniCredit S.p.A

UniCredit S.p.A (BIT: UCG) is a pan-European commercial bank, serving Italy, Germany, Central and Eastern Europe. The bank was born in 1998 by the merging of two Italian banking groups into Unicredito Italiano. Since 2003, the bank has been known as UniCredit and today it is one of the largest groups in Europe.

Financial Institutions account for three quarters of the total shares, BlackRock Group being the largest shareholder with ca. 7% of shares; Retail Investors own 13% of the company while Foundations (Del Vecchio family, FactSet) own 4%; the rest is distributed between Sovereign Wealth Funds and other minor shareholders.

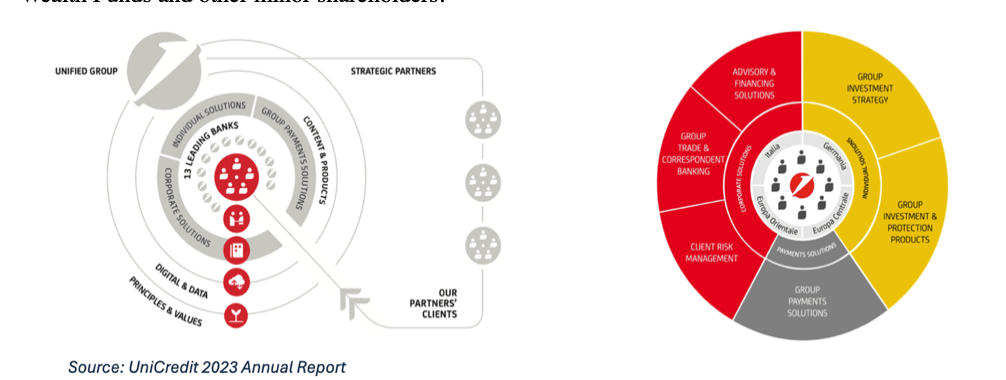

The bank’s offer is split into three business sectors: Corporate Solutions, Individual Solutions and Group Payments Solutions. Although Retail Banking is key in the group’s growth strategy, Corporate Banking accounts for slightly more than half of total revenues; Payments Solutions has a moderate share as was recently introduced. UniCredit is following an increasing path in terms of profitability, the strategy revolves around three key levers: cost, revenues and capital.

Financial Analysis:

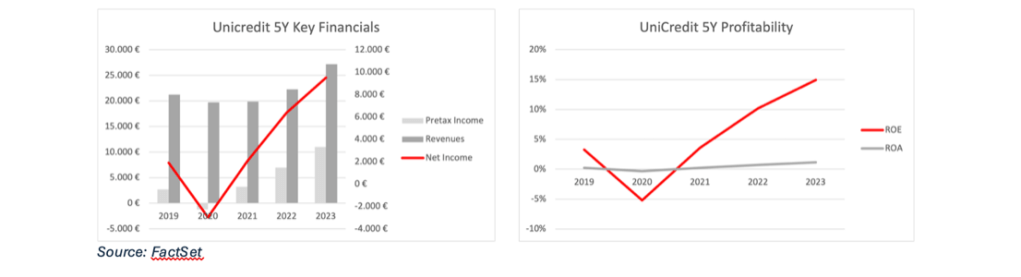

As of December 2023, operating costs decreased by 5.4% from FY2019, leading cost/income ratio (>40%); revenues surged almost 30% compared to FY2019 and the use of capital is efficient as the downward path of FCF is justified by large and profitable investments and a RoTE of 19.7% (3Q24). Capital adequacy is highly positive, the bank holds a CET1 capital ratio of 16.1% and T1 capital ratio of 17.8% (Annual Report 2023).

Commerzbank AG

Commerzbank AG (ETR: CBK) is the fourth largest bank in Germany with more than €400B in AUM. It was born in 1870 in Hamburg and now it serves mainly Central and Eastern Europe, although operative branches are widely spread across the world.

Almost 75 percent of the company’s shares are owned by Financial Institutions, the Federal Republic of Germany has recently sold 9% of shares to UniCredit S.p.A, however, it is still the largest shareholder (ca. 12%, FactSet). Roughly a quarter of the total shares is owned by Private Investors.

Retail Banking is Commerzbank’s main source of income; however, the corporate sector is growing as the group is #1 in SMEs lending in Germany. The strategic plan for 2027 is based on growth, the bank targeted €500M in customer business investments every year, aiming to reach RoTE>12% and €3.6B in net result.

Financial Analysis:

The company is approaching a new expansionary strategic plan. Revenues increased considerably post-pandemic; in FY2023 they surged 76% YoY. However, Net Income is not desirably high due to an increasing cost structure in the last 5 years (cost/income ca. 60%). Capital Adequacy is solid as CET1 capital ratio hit 14.7% in FY2023 and T1 ratio was 16.5%. Finally, Cash Flows are well managed based on FCF and liquidity. (Annual Report 2023).

Indicative Valuation by BSMAC:

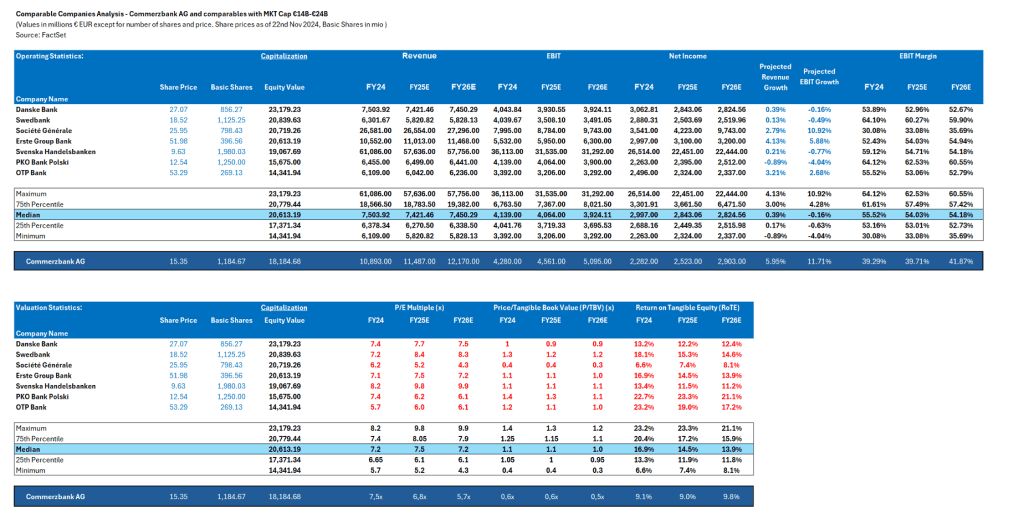

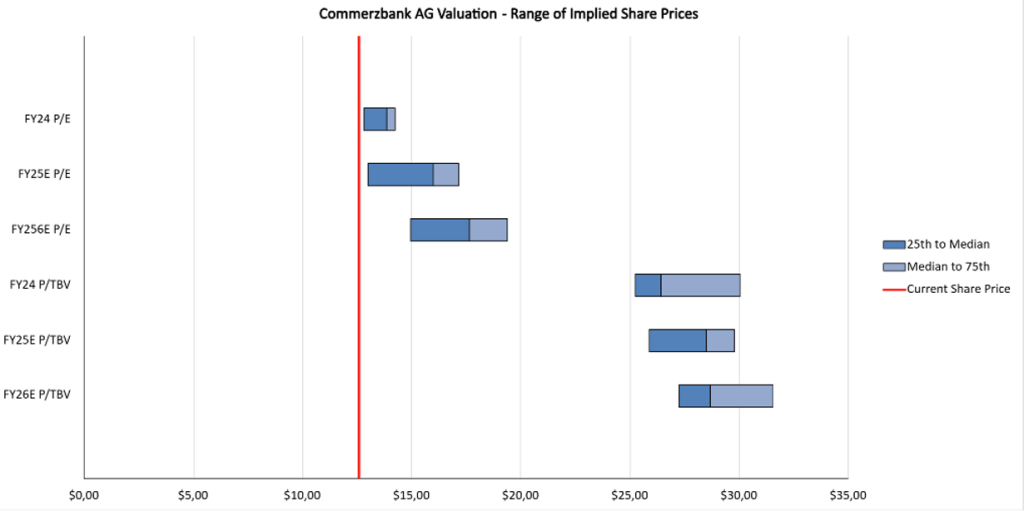

To better understand the valuation of Commerzbank AG, we conducted a Comparable Companies Analysis (CCA) to estimate a range of possible share price for the target. This analysis is based on Commerzbank’s share closing price of EUR 12.60 as of September 11th. It is important to emphasize that the valuation derived from trading comparables is not meant to be a precise measure but serves to establish broad parameters for the target company, reflecting current market conditions and sentiment, which may be influenced by irrational factors.

We selected seven companies operating in Europe with comparable industry characteristics, geographical presence, financial metrics (market capitalization, revenue growth, EBIT margin), and risk profiles. The analysis led to inconsistent results depending on the valuation multiple used. Using the Price-to-Earnings (P/E) ratio, we arrived at an implied price range of EUR 10.98 to EUR 15.80 per share. Meanwhile, the Price-to-Tangible Book Value (P/TBV) multiple suggested a broader range, from EUR 9.61 to EUR 33.63, based on the latest financial year data. On the day of the acquisition, the observed share price appeared undervalued compared to the industry median. However, the degree of undervaluation varied depending on the metric applied. Using the P/E ratio, Commerzbank’s valuation seemed only slightly below fair value, particularly in light of UniCredit’s acquisition price of EUR 13.20 per share. In contrast, the P/TBV multiple suggested a more significant discrepancy, with a notably higher valuation range.

In conclusion, the EUR 13.20 acquisition price aligns more closely with the median P/E multiple of comparable companies, suggesting a fair valuation based on earnings while highlighting potential upside when considering the broader P/TBV valuation metrics. Finally, it is noteworthy that the results obtained may be significantly influenced by the use of different dates for share prices. The prices of the peers were taken as of November 22nd whereas the price used for Commerzbank refers to September 11th.

Market Overview

Market Size and Dynamics:

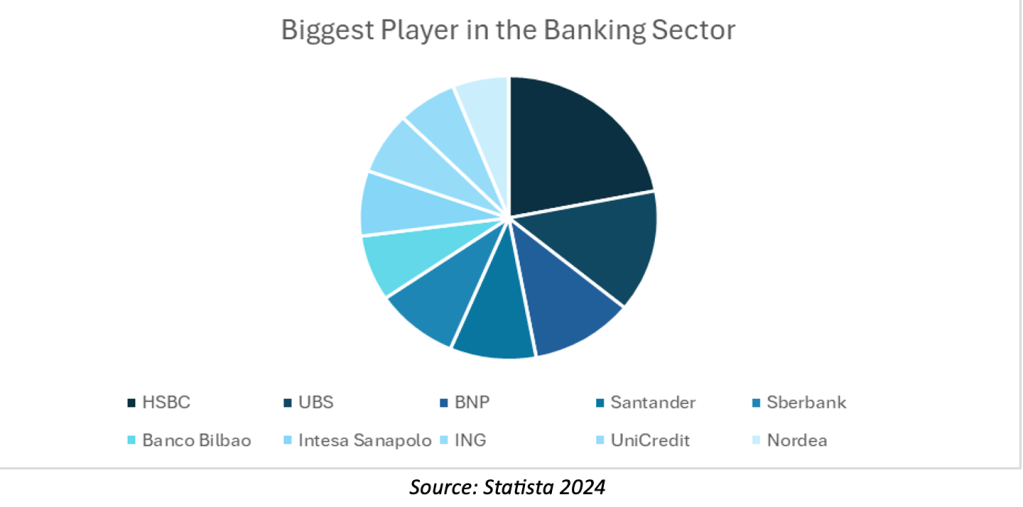

The European banking sector is highly segmented, encompassing retail banking, corporate banking, investment banking, and wealth management. Each segment caters to specific customer needs, from individual savings and loans to large-scale corporate financing and capital market operations. Major players like BNP Paribas, HSBC, UBS, and Santander dominate the market with their extensive presence and diversified service portfolios. Regional banks, such as Italy’s Intesa Sanpaolo and Finland’s Nordea Bank, also hold significant influence in their respective areas.

The past two years have been the best for banking since before the global financial crisis (GFC) of 2007–09, with healthy profitability, capital, and liquidity. Every key profitability indicator shows the great shape of the sector, especially the income and the ROE one which highly benefitted from the spikes in the interest rates.

However, the coming years are filled with uncertainty and questions for the banking industry as a decreasing interest rates scenario can be very stressful, especially for less strong players, like European ones. The second quarter of 2024 can give us a little sample of what to expect next, as is the first quarter after the interest rate cuts operated by both the ECB and the FED, and after all, the situation seems to be more optimistic than expected. Results show an impressive resilience, prompting more than half of banking leaders to upgrade their full-year guidance. Investors have taken note, lifting valuations by around 15% year to date. The average price-to-book ratio for major European banks, as of 1 August 2024, now sits at 0.75x vs. 0.67x at the start of the year.

Here are some key takeaways from the earnings that have been reported so far:

• Fee income rebounds: We’ve seen a 6% surge in revenue growth driven by a significant uptick in investment banking activities. Global deal-making hit a two-year high as confidence grew that policy rates have reached their peak. Additionally, wealth management has seen a resurgence.

• Net interest income holds strong: Investors had expected at the start of the year that net interest income growth would decelerate. That now appears to have been rather pessimistic. Deposit pricing pressures have eased more than anticipated across the board.

• Credit quality continues to surprise: Loan impairments stayed low, and banks reported no new signs of stress across their exposures.

Impact of M&A Deals:

Even though banking is the single largest profit-generating sector in the world, the market is skeptical of long-term value creation and ranks banking dead last among sectors on price-to-book multiples with a worrying 0.9.

But the situation differs widely from one continent to another. While American and Asian banks have surged ahead in global markets, European lenders have remained largely focused on fortifying their balance sheets and complying with stringent regulatory demands. Yet, as the landscape evolves, calls for consolidation and cross-border mergers are growing louder, with industry leaders advocating for “European super-banks” that could stand toe-to-toe with their global rivals.

The graph below shows how urgent is for European banks to mitigate this trend as only 5% of them have price ratios that indicate a foreseeable sustainable growth, whereas in other part of the world where the framework is more flexible or the sector is more concentrated, the situation is better.

However, consolidating in such a strict regulatory environment such as the European one, can still be terribly difficult and time-consuming. In fact, the recent BBVA’s €10bn approach to Sabadell has met with opposition from Spain’s government, which is wary of job cuts and branch closures — the traditional route to reducing operating costs following a merger. Moreover, the so-called “revenue synergies” between businesses can also be hard to achieve in practice, as it is often difficult to sell the same products in countries with different regulatory regimes or consumer preferences. Cost savings are also difficult, especially when expensive, risky and time-consuming IT integration projects are involved.

In conclusion, only time will tell if the European banks will be keeping up with the worldwide competition and adapting to the recent technological innovations, namely AI and Online banking that are now revolutionizing every process in the sector.

Deal Rationale

UniCredit Spa’s bid for Commerzbank has triggered widespread concerns and speculation regarding its potential impact, ranging from job cuts and a loss of control to implications for Germany’s governing coalition’s electoral prospects. When initial reports of the deal emerged, the German political establishment was taken aback and chancellor Olaf Scholz labeled the Italian bank’s interest an “unfriendly attack”.

Critics have highlighted that a sale to UniCredit could leave the German economy with only one nationwide German-based lender, Deutsche Bank, potentially resulting in adverse consequences for financial stability. Commerzbank, which handles approximately 30% of Germany’s foreign trade finance, plays a vital role in supporting German exporters. Consequently, some investors and businesses might seek alternative lenders to diversify their loan access immediately following such a merger.

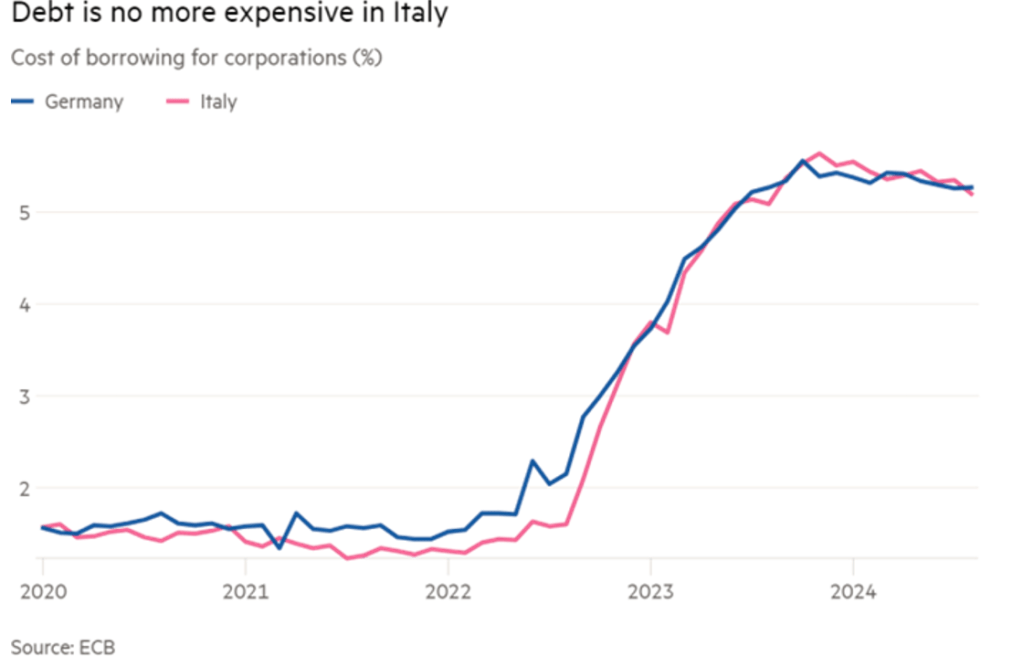

Nonetheless, it is important to emphasize that UniCredit would likely seek to expand, rather than reduce, its lending operations, as one of its primary motivations for the deal is to enhance its presence among German corporate clients. Furthermore, UniCredit’s extensive experience in serving medium-sized enterprises positions it to maintain and potentially strengthen customer loyalty post-merger. The transaction could also enhance the balance sheet and profitability of both institutions, creating a larger, more reliable partner for corporate clients. Since 2020, German firms have faced higher average interest rates on bank loans than their Italian counterparts, a disparity that could be mitigated by the merger (see graph below). By increasing its stake, UniCredit also aims to enhance its market positioning, reinforcing its leadership capabilities in the European banking sector. UniCredit’s management believes that Commerzbank holds considerable value that can be unlocked, either as a standalone entity or part of UniCredit, benefiting both Germany and the bank’s larger stakeholders.

Moreover, UniCredit perceives a significant opportunity to unlock value within Commerzbank, whether through independent growth or synergistic integration. A recent Goldman Sachs analysis estimates that this deal could lead to approximately €800 million in savings for Commerzbank, cutting its operating costs by over 15%. Additionally, Commerzbank’s profit before taxes is expected to rise by €3.4 billion, contributing to a 37% increase in UniCredit’s profit before taxes and a 29% boost in net profit. If the merger moves forward, the combined entity will oversee nearly €1.3 trillion in assets, close to €700 billion in loans, and €875 billion in deposits. Together, the firms are projected to generate approximately €12.3 billion in net profit.

On a broader level, the two banks appear to be well-matched. After undergoing extensive restructuring and streamlining, UniCredit has recently outperformed most of its European peers in terms of net returns and market valuation. Currently valued at twice the market capitalization of Commerzbank, UniCredit is an internationally diversified institution with substantial experience in restructuring. It already owns a significant mortgage unit in Germany, promising potential synergies. In contrast, Commerzbank, with its higher cost ratios and much smaller profits, may benefit from internal reforms. Furthermore, both banks maintain strong capital and liquidity positions.

Final Considerations:

From a European Union perspective, the potential merger offers compelling advantages. In a recent report on European competitiveness, Mario Draghi called for greater banking integration within the Eurozone, even proposing special legislation to facilitate such developments. This initiative could serve as a key milestone toward the financial union that the EU has long sought, enhancing operational synergies, cost efficiencies, and competitiveness, as supported by the European Central Bank (ECB).

Finally, it is worth noting that markets have responded positively to UniCredit’s acquisition strategy, signaling investor confidence in the prospects of both Italy and Germany. UniCredit’s flexible and adaptive approach, demonstrated by its commitment to stakeholder engagement and targeted investment, exemplifies a prudent strategy aimed at maximizing shareholder value.

Deal Structure

On September 11th, UniCredit announced the acquisition of an equity stake of approximately the 9% in the share capital of Commerzbank AG, submitting regulatory filing to request the authorization to exceed the 9.9% of the German bank, up to 29%. This happens because in the eurozone no one can buy more than 10 per cent of a lender without getting the approval from the European Central Bank. The institution will give its opinion within 60 days, extendable to 90.

As reported by the bank itself, this transaction has impacted its Common Equity Tier 1 ratio (core capital / risk weighted assets) by around 15 bps.

UniCredit outbidded all the other participants in a block sale of 4.5% offered by the government, that adds to another 4.5% which was precedently accumulated on the open market. The Italians paid €13.20 per share, an 4.76% premium if compared with the €12.60 closing price. However, this price was barely half of what the German government had paid back in 2009 to bail out Commerzbank in 2009 after the global financial crisis.

Moreover, on September 23rd the Italian institution acquired financial instruments that amount to an 11.5% stake of Commerzbank, the physical settlement of those derivatives may only occur after the required approval has been obtained.

This move allowed UniCredit to surpass the German government as the biggest shareholder, from being a minority investor. It has been defined as a “beautifully executed plan”, that enables the Italian bank to build up their position, making it difficult for the target to buttress its defence, for hedge funds to snap up shares and for potential competitors to make a counter-offer for the German bank.

At the core of this transaction there are contracts with Barclays and Bank of America, those financial instruments are total return swap agreements that are committed to replicating the economic performance of Commerzbank’s stock. The banks hedged their trades mostly through plain vanilla options, with settlements with Jefferies among the others, according to disclosures. The Financial Times reports that the two investment banks will each make €12 million in fees on the deal, which has a notional value of €2.3 billion.

This strategy was planned by Salvatore Di Stasi, a former UBS banker who is now head of equity and credit sales. The structure consists of opposing call and put options, thus locking in the price as of the end of September.

We could have to wait some months to discover the next steps of Andrea Orcel’s plan. In fact, according to sources with knowledge of the matter, the bank is working to hedge its Commerzbank exposition with the intent to mitigate the risk of share price declines. Given the volatility of these since the deal has started to build up.

If we look at the graph above, we can see how the stock price skyrocketed the day of the announcement, with an increase of 15.84% after the first day and an astonishing +24.8% after three days. As of today, the stock is trading at +27.36% compared to the 10th of September.

On September 23rd, the same day that UniCredit announced its exposition through financial instruments, the stock was up +10.68% in the next three days. This surge is due to the investors’ confidence in the strategic value of the deal, which is also evident when we observe the performance of the Italian institution’s shares, that have risen by ca. 17% between September 10thand the 5th of November (before the announcement of the Election results in the U.S.)

From Orcel standpoint this increase of the stock is crucial, it means that even if nothing happens the Italian bank will profit from this operation. Revenue would be made at today’s price, but even a sudden sharp decrease would not indicate a loss, thanks to the hedging positions.

According to Equita, a leading Italian investment bank, UniCredit could pay between €18,5-€19,5 with a 45-50% price premium, for the entire Commerzbank’s equity, without compromising its patrimonial stability or having to revise its dividend policy. This is because the merger is expected to yield substantial gross cost synergies, amounting to approximately 10% of the German institution’s expense, even under conservative assumptions.

In conclusion we will have to patiently wait for the next move in this regard, with Andrea Orcel remaining enigmatic, he might choose to sell his shares (probably with a net profit), to keep is majority stake or acquire all the bank’s shares. In any case the ECB opinion is awaited. There is no official anticipation of how the entire transaction might be structured. According to Fitch we are unlikely to see an all-cash transaction in case of a full merger, given that UniCredit has an excess of capital of €6.5 billion above its CET1 target and Commerzbank is worth more than €18Bn.

Final Considerations

The potential acquisition of Commerzbank AG by UniCredit S.p.A represents a pivotal moment for the European banking sector. Europe’s lack of large, cross-border banking players has perpetuated a cycle where domestic savings remain predominantly locked in local deposits, often reinvested in national debt, creating a “doom loop” of interconnected bank and government finances. Cross-border mergers could offer part of the solution, enhancing efficiency, profitability, and stability while advancing the long-sought unification of European fragmented capital markets.

For UniCredit, the deal offers significant strategic and financial advantages. With Commerzbank’s current valuation and the market’s positive response, UniCredit stands to unlock substantial synergies, bolster its leadership in the European banking sector, and reinforce its presence in Germany. On the other hand, also the German banking system could benefit from this operation, with better credit allocation and more advisory services.

Meanwhile, UniCredit’s recent voluntary public takeover offer for BPM on November 25th, though unrelated to the Commerzbank deal, reflects CEO Andrea Orcel’s broader expansion strategy. Despite BPM’s board rejecting the initial offer, this move underscores the favourable conditions for the banking industry and highlights UniCredit’s momentum in executing its ambitious growth agenda.

Sources

https://www.unicreditgroup.eu/en/strategy.html

https://www.unicreditgroup.eu/content/dam/unicreditgroup-eu/documents/en/Strategy-day/UniCredit_2021_Strategy-Day_Presentation.pdf

https://www.unicreditgroup.eu/content/dam/unicreditgroup-eu/documents/en/investors/financial-reports/2023/4Q23/2023-Annual-Reports-and-Accounts.pdf

https://it.wikipedia.org/wiki/UniCredit

https://my.apps.factset.com/workstation/navigator/company-security/snapshot/UCG-IT

https://my.apps.factset.com/workstation/navigator/company-security/snapshot/CBK-DE

https://en.wikipedia.org/wiki/Commerzbank

https://www.commerzbank.de/group/who-we-are/strategy-brand/

Commerzbank General presentation

Commerzbank Group Annual report 2023

https://www.ilsole24ore.com/art/unicredit-compra-45percento-commerzbank-702-milioni-AFNVN6pD

https://www.ey.com/en_gl/insights/financial-services/emeia/how-european-banks-defied-expectations-to-show-resilience-and-growth

https://www.ft.com/content/13d17e58-d002-4e25-baf5-29a0ce293087

https://www.statista.com/statistics/894915/return-on-equity-of-banks-in-european-countries/

https://www.statista.com/statistics/383406/leading-europe-banks-by-total-assets/

https://www.statista.com/statistics/1478246/eu-banking-system-total-operating-income/

https://www.mckinsey.com/industries/financial-services/our-insights/global-banking-annual-review

https://www.unicreditgroup.eu/en/press-media/press-releases-price-sensitive/2024/september/press-release.html

https://www.reuters.com/markets/deals/unicredit-commerzbank-deal-should-be-judged-financial-strength-bank-italy-2024-10-23/

https://www.bloomberg.com/opinion

https://www.ilsole24ore.com/

https://www.ft.com/content/80a2c45e-8d71-4123-8264-527eed12bdb7

https://www.ft.com/content/26f6f7b5-7ec2-440a-a50d-97ccd794b46e

https://www.ft.com/content/fc510e61-e1a6-4a7f-8495-c7ffccca40e5

https://www.unicreditgroup.eu/en/press-media/press-releases-price-sensitive/2024/september/unicredit-enters-into-additional-instruments-relating-to-commerz.html

https://www.fitchratings.com/research/banks/full-unicredit-takeover-of-commerzbank-could-strengthen-combined-group-30-09-2024

https://www.ft.com/content/65d85df6-aace-488b-ab17-c5ffa6842d5e

https://www.allsides.com/news/2024-10-24-0315/banking-and-finance-unicredit-taps-jefferies-hedging-optionality-commerzbank

https://www.milanofinanza.it/news/cino-ricci-e-louis-vuitton-premiati-dalla-ac-hall-of-fame-con-la-sir-sutton-medal-202411081202009043

You must be logged in to post a comment.