Introduction

On July 3, 2024, EQT announced a definitive agreement to acquire Keywords Studios, a global leader in technical and creative services for the video game industry, in a £2.2 billion deal. This strategic acquisition highlights EQT’s growing interest in the burgeoning gaming industry, seeking to capitalize on the increasing demand for high-quality gaming experiences and creative content.

The transaction underscores a symbiotic collaboration: EQT aims to leverage Keywords’ established market presence and expertise, while Keywords anticipates benefiting from EQT’s operational and financial resources to accelerate its growth and innovation. Together, they aspire to enhance Keywords’ capabilities, expand into new markets, and redefine the creative and technical landscape of the gaming industry.

Companies Overview

Keywords Studios plc

Founded in 1988 in Leopardstown, Ireland, Keywords Studios plc has grown into a global leader in creative and technical services for the video game industry. The company specializes in supporting the world’s largest video game developers through three main divisions:

- Create: Game development and artistic services, contributing 43% of revenues.

- Globalize: Audio, localization, and testing services, accounting for 36% of revenues.

- Engage: Marketing and player support services, representing 21% of revenues.

Keywords Studios serves 24 of the top 25 video game companies globally, with a strong presence in the U.S. (35.48% of customers), the U.K. (22.58%), and Canada (8.06%). As of FY2023, the company generated €780 million in revenue, reflecting a 13% year-on-year increase despite challenges such as U.S. entertainment strikes. EBITDA rose to €158 million (+8% YoY), while operating profit declined by 35% due to industry constraints.

The company is at the forefront of technological innovation, investing in AI-enabled production tools and generative AI to enhance efficiency and quality. Strategic acquisitions in 2023, valued at €225 million, are projected to generate an additional €90 million in annual revenue. Keywords Studios is listed on the London Stock Exchange and, as of November 2024, has a market capitalization of $2.65 billion.

EQT Partners

EQT Partners, founded in 1994 in Stockholm, Sweden, is a global investment management firm specializing in private equity, growth equity, and venture capital. With a focus on fostering sustainable growth and innovation, EQT operates across multiple industries, employing over 1,800 people in Europe, North America, and Asia. The firm is listed on the Nasdaq Stockholm and, as of November 2024, has a market capitalization of SEK 349.3 billion.

In FY2024, EQT reported revenues of SEK 24.99 billion, gross profit of SEK 16.08 billion, and net income of SEK 3.31 billion. Its investment strategy prioritizes sectors with strong growth potential and innovation, including technology, healthcare, renewable energy, and industrial services. Notable investments include Sitecore, a leading provider of web content management software, and Certara, a biosimulation company driving pharmaceutical innovation.

The acquisition of Keywords Studios for £2.2 billion (2,450p per share) reflects EQT’s strategic focus on high-growth, technology-driven markets. While the gaming industry faces challenges such as reduced localization demand and the rise of generative AI, EQT aims to leverage Keywords’ established portfolio to expand into adjacent entertainment markets. By integrating innovative technologies and providing additional capital for Keywords’ value-accretive acquisition strategy, EQT seeks to enhance the company’s services and market presence.

Market Overview

The acquisition of Keywords Studios by EQT marks a pivotal moment in the gaming industry, a sector experiencing rapid transformation and increased consolidation. This transaction creates a powerhouse in video game services, combining EQT’s financial and strategic expertise with Keywords Studios’ leadership in creative and technical services. The gaming industry, valued at over $200 billion in 2023, continues to grow at a projected CAGR of 9.3% through 2028, driven by innovations in cloud gaming, mobile gaming, and immersive technologies like augmented and virtual reality (AR/VR). For its part, Keywords Studios serves 24 of the top 25 gaming companies worldwide and operates at the forefront of industry trends such as AI-enabled production, localization, and live-service game models.

While the gaming sector flourished during the pandemic due to increased consumer engagement, it has faced challenges in recent years. High inflation, rising interest rates, and global uncertainties have strained consumer spending and tightened studio budgets. These conditions led to slower growth in 2023, with reduced localization demand and the rise of generative AI threatening traditional revenue streams. Despite these headwinds, the sector remains resilient, bolstered by the ongoing shift to digital distribution, the expansion of esports, and the growing importance of cross-platform gaming experiences.

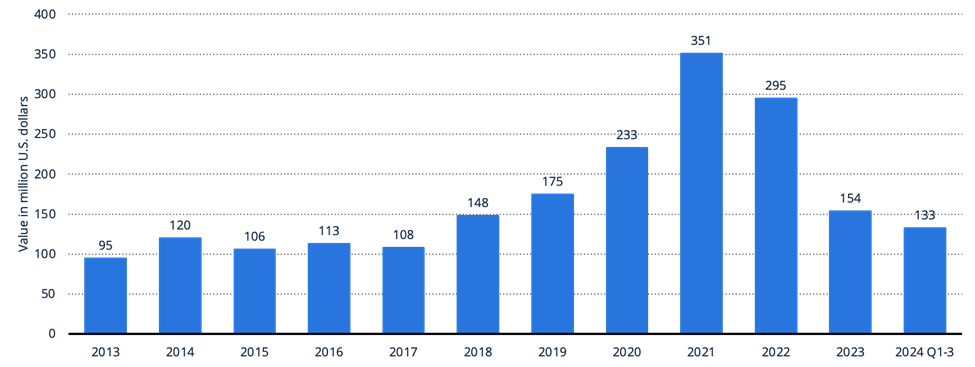

Annual games industry M&A transactions value worldwide 2013-2024 YTD

Source(s): Statista

Annual games industry M&A transactions volume worldwide 2013-2024 YTD

Source(s): Statista

The M&A landscape in gaming has mirrored this dynamic environment. Gaming giants like Microsoft, Sony, and Tencent have actively pursued acquisitions to bolster their ecosystems, while private equity firms like EQT have increasingly recognized the industry’s long-term potential. In 2023, M&A activity across the technology, media, and telecom (TMT) sectors saw significant fluctuations, with deal values decreasing by 44% compared to the previous year. Despite these declines, private equity firms are capitalizing on opportunities to acquire undervalued assets, setting the stage for a potential rebound in 2024.

Looking ahead, the gaming industry is expected to continue its upward trajectory, fueled by investments in AI, immersive technologies, and scalable solutions for game development. EQT’s acquisition of Keywords Studios aligns with this positive outlook, leveraging Keywords’ expertise to address the complexities of modern game production and positioning both companies to thrive in a competitive and evolving market.

Deal Rationale

The acquisition of Keywords Studios by EQT is driven by strategic, financial, and industry-specific considerations that align the goals of both companies.

Strong Strategic Fit

Keywords Studios has established itself as a global leader in video game services, offering end-to-end solutions in art, marketing, and quality assurance. EQT’s expertise in scaling technology and service-based companies complements Keywords’ focus on innovation and operational growth. With a history of expansion through over 60 acquisitions, Keywords is well-positioned to benefit from EQT’s financial backing and strategic guidance. This partnership will enable the company to continue its acquisition-driven growth while addressing industry concerns, such as the potential disruption from AI. EQT’s resources will support Keywords in adopting AI technologies that enhance its offerings, ensuring competitiveness in a rapidly evolving industry.

Financial Justification

EQT’s offer of £24.50 per share reflects a 66.7% premium over Keywords’ May 17 stock price, delivering significant value to shareholders. While slightly below the initial £25.50 offer, the revised valuation accounts for recent challenges, such as project delays and softer demand, while emphasizing the company’s long-term growth potential. The support of key investors like Franklin Templeton and Pictet reduces execution risk, reinforcing confidence in the deal.

Industry Tailwinds and Market Dynamics

Despite near-term headwinds, including market volatility and economic uncertainty, the video game sector remains a robust growth market. With marquee clients like Activision Blizzard and Tencent, Keywords Studios is well-placed to benefit from industry tailwinds such as digital distribution, esports, and the rising demand for localized content. Broader market conditions in the UK presented EQT with a strategic opportunity to acquire a high-value asset at a discounted valuation, positioning Keywords for future success.

Mitigating Risks and Unlocking Value

While Keywords has faced profit declines and revenue pressures, EQT brings operational expertise to stabilize and realign the company’s growth trajectory. Co-investors such as Temasek and the Canada Pension Plan Investment Board further enhance this potential, offering access to global resources, industry insights, and operational synergies. EQT’s strategic focus on technology integration will enable Keywords to optimize operations and capture emerging opportunities.

Expected Benefits Post-Acquisition

- Increased capital for acquisitions and R&D to stay competitive in a technology-driven market.

- Enhanced margins through EQT’s operational expertise, particularly in game testing and development support services.

- Immediate shareholder returns alongside long-term positioning for sustained growth and innovation.

Overall, this acquisition represents a timely and strategic partnership between EQT and Keywords Studios. By combining EQT’s private equity expertise with Keywords’ established presence in the gaming ecosystem, the deal creates significant value for stakeholders and reinforces Keywords’ position as a leader in the evolving video game industry.

Deal Structure

The acquisition of Keywords Studios by EQT was finalized in late October 2024 under a scheme of arrangement in accordance with Part 26 of the UK Companies Act. This structure transitions Keywords Studios from a publicly traded entity to a privately held company wholly owned by the EQT-led consortium. Shareholders of Keywords Studios will receive a cash offer of 2,450 pence (£24.50) per share, representing a 66.7% premium over the closing price of 1,470 pence (£14.70) on May 17, 2024. The total valuation of the deal amounts to approximately £2.1 billion on a fully diluted basis, with an enterprise value of £2.2 billion, implying a multiple of 15.9x Keywords Studios’ adjusted EBITDA of £139 million for the 12-month period ending December 31, 2023.

The transaction is financed through a combination of equity contributions from the acquiring consortium and available cash resources. Following the announcement of the acquisition in May 2024, Keywords Studios’ stock price surged significantly on the London Stock Exchange. While the final offer of 2,450 pence per share was lower than the initial offer of 2,550 pence (£25.50) per share, investor sentiment remained positive, with shares rising 3% in response to the finalized terms in July.

Upon completion, the acquisition is expected to provide Keywords Studios with greater operational flexibility and a strengthened growth trajectory. Bidco, the acquiring entity, has committed to maintaining Keywords’ investment in end-to-end capabilities, quality of service, and technological innovation, including sustained expenditure on research and development. The consortium views R&D as a critical driver of future innovation and growth, ensuring that Keywords Studios remains a leader in the rapidly evolving gaming industry. As a private company, Keywords will gain access to additional capital and resources, enabling it to accelerate its long-term strategic objectives.

The acquisition received unanimous board approval during a court meeting on August 30, 2024. Following the deal’s completion on October 23, 2024, Keywords Studios was delisted from AIM, with trading of its shares ceasing at 7:00 a.m. on October 24, 2024. Concurrently, the resignations of the company’s non-executive directors became effective, marking a new chapter in Keywords Studios’ evolution.

Authors: Marco Lodrini, Edoardo Simonetti, Luka Sulejic, Andrea Giuseppe Villa, Lorenzo Montagner

Bibliography:

- https://www.reuters.com/markets/deals/eqt-finalizes-acquisition-keywords-studios-22bn-deal-2024-10-23/

- https://www.ft.com/content/keywords-studios-gaming-eqt-acquisition-analysis

- https://www.statista.com/statistics/gaming-market-size-and-growth-2023-2028/

- https://www.pwc.com/gaming-m-and-a-report-2024

- https://www.cnbc.com/2024/05/17/keywords-studios-acquisition-by-eqt-announcement.html

- https://www.theguardian.com/business/2024/oct/24/eqt-keywords-studios-acquisition-gaming-industry

- https://www.bloomberg.com/news/articles/2024-10-23/private-equity-firms-and-the-future-of-gaming-acquisitions

You must be logged in to post a comment.