Introduction

On October 3, 2024, the Italian Ministry of Economy and Finance, along with Retelit S.p.A., moved to file a binding offer worth €700 million for the acquisition of a 100% stake in Sparkle, the subsea cable unit of Telecom Italia. Sparkle is vital in Italy’s digital connectivity, connecting the country to global hubs via subsea cables.

As of December 18, 2024, Asterion’s investment committee, the owner of Retelit, has given the green light to the deal. The agreement would grant the Ministry of Economy and Finance (MEF) a 70% controlling stake, with the remaining 30% retained by Retelit. Although the offer was initially expected by November 30, the deadline was extended as Sparkle’s and Retelit’s executive committees required additional time for review, delaying any potential agreement to early 2025. However, a binding offer now appears to be finalized.

The transaction underlines Sparkle’s strategic value, having been coveted for acquisition during the last ten years: in 2009 by an unnamed buyer-its purchase negotiations broke down; by 2015, it was the State Grid Corporation of China’s target, while the bid was blocked because of Italian regulatory worries; and then in 2016 by F2i Fondi Italiani per le Infrastrutture, though it later did not follow up its offer. This has been underlined by a further unidentified bidder for Sparkle and TIM’s Telsy Electronics subsidiary in 2017, while in 2021, US private equity player KKR weighed an acquisition of TIM, hence including Sparkle. More recently, in early 2024, it was reported that KKR was once more considering the sale of Sparkle, valued at some €600 million; this was rebuffed, however, and they have pulled out.

Companies Overview

Retelit S.p.A.

Retelit S.p.A. is an Italian telecommunications and infrastructure provider specialized in fiber networks, cloud solutions, and cybersecurity. The company boasts a vast infrastructure with more than 43,000 kilometers of fiber-optic cables across four continents, placing it as one of the main players in Italy’s connectivity market. Since its acquisition in 2021, Retelit has operated as part of Asterion’s network of infrastructure companies. Asterion is a private equity firm focused on mid-market infrastructure investments and has built up a portfolio of telecommunications assets across Europe with the aim of consolidating and enhancing connectivity assets that underpin the digital economy.

Under Asterion, Retelit has undergone a series of infrastructure-based acquisitions. In 2022, Asterion acquired 78.4% in Irideos from F2i Sgr and announced the merger of Irideos with Retelit into one of Italy’s largest alternative telecom players. Collectively, the group operates 42,000 km of fiber and 34 data centers, making it a good base for further expansion in the B2B connectivity segment in Italy and Europe

Financial Analysis

In its financial statements for 2023, Retelit reported substantial growth, while total revenues and operating income in 2023 reached €284.12 million, up 42% on €199.71 million in 2022. This growth is indicative of the increasing demand for Retelit’s services in the fields of fiber networks, cloud solutions, and cybersecurity. Furthermore, EBITDA increased from €71.39 million in 2022 to €87.41 million in 2023, thus demonstrating increased operational efficiency and profitability in the context of a growing client base and extended service offerings.

Notwithstanding this substantial growth in revenue and EBITDA, net income decreased significantly from €18.26 million in 2022 to €8.86 million in 2023. The probable causes for such a decline would be increased investments, higher integration costs related to the recent acquisitions, or higher financing expenses associated with the expansion of Retelit’s infrastructure footprint.

The following charts highlight the performance of Retelit by detailing its 2023 revenue from various markets and service categories. These charts demonstrate how value is created for Retelit within core markets such as wholesale, enterprise, and public administration, along with the company’s respective service offerings in connectivity, cloud and cybersecurity, ICT, and solutions.

Source: Retelit S.p.A. 2023 Consolidated Financial Statements

Italian Ministry of Economic and Finance (MEF)

The MEF is a central institution responsible for Italy’s fiscal policy, public investment, and economic growth initiatives. One of the main focuses of MEF in recent years is the protection of Italian assets considered to be strategic for national security and economic sovereignty and strengthening the position of critical industries, such as telecommunications, in the global arena.

The planned acquisition by MEF of Sparkle represents another piece in Italy’s controlled privatization strategy through the “Golden Power” law, which allows the Italian government to prohibit or exercise control over foreign investment in sectors considered critical for national security. Through a majority stake in Sparkle, MEF will ensure Italy retains control of important undersea infrastructure, the cornerstone of Italy’s international flow of data and connectivity. This transaction fits within Italy’s current regime of “privatizzazione controllata” in conjunction with securing assets relevant to the state’s national and economic security interests. Third, the MEF is considered “parte correlata” under IAS 28, an international accounting standard, since it represents the majority interest in this transaction as evidenced by the acquisition of Sparkle. According to the explanation provided by Telecom Italia, this classification means compliance with governance rules related to related-party transactions of strategic relevance.

Telecom Italia Sparkle S.p.A.

Telecom Italia Sparkle S.p.A. is an international telecommunications service provider and a wholly owned subsidiary of Telecom Italia S.p.A. (BIT:TIT). The company was established in 1987 as Telemedia International Italia Ltd., to develop the global solutions business of Telecom Italia. Rechristened Sparkle in 2003, the company has since grown into the sixth largest player in the world and the second largest in Europe by the number of direct and indirect customers. Today it serves over 1,500 customers worldwide, including mobile and fixed network operators, as well as multinational corporations, and is present with offices and subsidiaries in 33 countries.

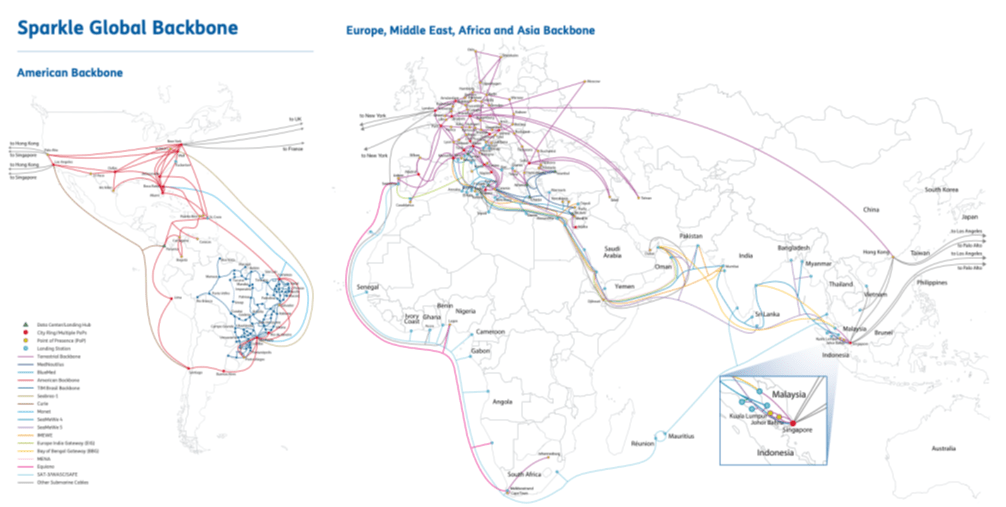

Telecom Italia Sparkle operates the Tier 1 network of the Telecom Italia group. A Tier 1 network is the highest level of Internet networking whereby a network can reach all other parts of the Internet through only its own infrastructure and via peering with other such networks. Tier 1 networks are considered the backbone of the Internet, since they handle a lot of data and make its speedy and efficient transportation over large distances possible, thus helping smaller providers connect to most regions of the world. Sparkle’s Tier 1 network, Seabone, is made up of a proprietary system with nearly 600,000 kilometers of fiber optics, terrestrial and submarine cable systems, data centers, and landing stations. The network also boasts over 1,200 Points of Presence, or access points, from which users can reach the network and provide far-reaching connectivity around the world.

Source: Telecom Italia Sparkle official company presentation

Sparkle’s extensive network infrastructure supports a range of services across five main platforms. The Corporate Platform offers global networking solutions, including VPN, Ethernet, communications, media services, and IoT integration. The IP & Data Platform provides data transit, capacity services, and Ethernet connectivity to ISPs, content providers, and carriers. The Mobile Platform supports mobile operators with messaging, roaming, and signalling services. The Voice Platform delivers voice termination, origination, and fraud protection services. Finally, the Cloud & Data Center Platform offers cloud and data center solutions for enterprises and service providers.

Financials Analysis

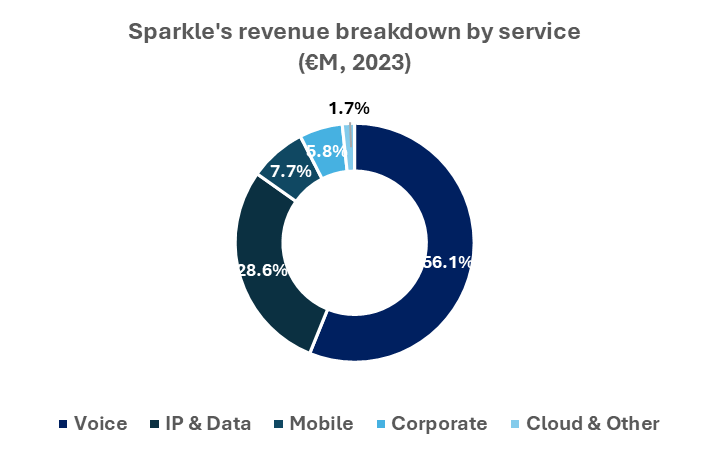

In 2023, Sparkle reported total revenue of €1.02 billion, with the largest contributions coming from the Voice and IP & Data segments, which together accounted for over 80% of the company’s revenue. The remaining revenue was generated from Mobile, Corporate, and Cloud services. Geographically, Sparkle derived 55% of its revenue from Europe, 18% from North America, 7% from Central and South America, and 21% from other regions globally.

Source: Telecom Italia Sparkle 2023 Consolidate Financial Statements

Sparkle’s total revenues for 2023 were €1.02 billion, representing a 3% growth compared to the previous year. The company managed to stabilize revenues at around €1 billion over the next few years, following the big revenue drop of €325 million in 2019 due to the planned reduction in low-margin voice traffic. Operations were not significantly impacted by the Covid-19 pandemic. The EBITDA margin showed relative stability between 2019 and 2023, around the 12% level. In 2023, even though the company reported an EBITDA of €121.5 million, it still had a negative EBIT of €9.3 million, mainly due to high depreciation and amortization (D&A) expenses of €130.9 million, which is in line with the trend over the previous four years. This is normal for the capital-intensive industry in which Sparkle operates.

In the preceding five years, the company has consistently reported a net loss, which has diminished annually from 2019 to 2023, ultimately amounting to €42.4 million in 2023. This reduction can be largely attributed to a rise in Sparkle’s interest expenses.

Source: Telecom Italia Sparkle Consolidate Financial Statements (2018-2023)

Free cash flow from operations (FCFO), which measures cash generated by a company’s core activities, also declined over the past five years, reaching approximately -€75 million in 2023. This decrease mainly reflects high capital expenditures related to the development of new infrastructure networks, including the Blue & Raman backbone, which will connect Mumbai to Europe, and the GreenMed submarine cable, which will link Italy to the Balkans and central-eastern Mediterranean countries. The sector is characterized by a need for large investments, especially due to the growing demand for IP infrastructure, which is expected to increase by 30% annually from 2023 to 2026.

Sparkle’s net debt has deteriorated materially in recent years, with a sharp increase in 2021, as shown in the chart below. This is due to the distribution of an exceptional dividend to the parent company, TIM, on 26 July 2021. The dividend was financed by using €85 million of the company’s cash reserves and by obtaining an additional €315 million in debt, thus contributing to the above-mentioned increase in interest expenses.

Market Overview

Submarine communication cables, better known as “subsea cables,” carry 97%[1] of the world’s internet traffic. These create a complex network of routes under the oceans that loop around and connect continents worldwide. Such subsea cables make it possible to transmit large sums of data, enabling people and organizations to stay connected and operate in real-time across continents.

Submarine telecom industry outlook

The submarine cable industry has proven resilient and continues to grow after COVID-19 pandemic-related disruptions, with the longer-term implications of these disruptions now being seen in project timelines. Those projects already well underway prior to the pandemic largely went ahead, but those at an early stage suffered from delays, and this caused a lag in installations. This recovery gathered strength, with 2024 recorded as the highest year on record with 24 new systems installed, reversing a downtrend since 2020.

Regional activity has been mixed, with EMEA being the leader in system additions and total cable kilometers laid over the past five years, while the Indian Ocean region is trailing. Almost 200,000 kilometers of cable were laid worldwide in 2024, buoyed by strong contributions from EMEA and Transpacific regions. Future deployments will focus on the replacement of aging infrastructure and high-capacity connectivity demands, with the Transpacific and AustralAsia regions expected to lead installations through 2027.

Source: 2024 Submarine Telecoms Forum

The outlook for submarine cable deployments from 2025 to 2027 points to sharp regional variations, with the Transpacific region leading the projections at 65,000 kilometers of cable, accounting for 32% of planned installations. This growth addresses the need to replace aging infrastructure and strengthen connections between North America, South America, Australia, and East Asia. AustralAsia follows closely behind, with 47,000 kilometers (24% of the total), thus underlining the growing need for massive connectivity over long distances. On the other hand, the Indian Ocean region has the lowest estimate, at 12,000 kilometers, relying on vast, multi-regional systems rather than autonomous projects. The Polar region, which is a niche area, envisages adding 17,000 kilometers of connectivity to the Arctic.

The EMEA and the Transatlantic are stable contributors at 21,000 and 23,000 kilometers respectively, to support network resilience. Challenges do exist, however, for global submarine cable development, especially in obtaining Contract in Force (CIF) status, which is the critical milestone marking secured contracts and funding. Indeed, only 20.59% of planned systems have reached CIF—down from 48% last year—which reflects the geopolitical tensions, rising inflation, and tightened lending standards. These economic hurdles have slowed project timelines, while some systems risk delays or cancellation without secured financing. Despite these obstacles, the industry’s focus on replacing old systems and expanding high-capacity, low-latency networks remains a key driver of global connectivity.

Technological advancements

Technological innovations, such as Space Division Multiplexing (SDM), are now driving the submarine cable industry, increasing data throughput without added costs. The feature of SDM to have multiple optical paths in a single cable makes it all the more suitable for new deployments. Moreover, with the arrival of 400G wavelengths, high-speed internet and cloud applications extend the lifespan of networks with better performance.

Open cable systems, where many operators share the same infrastructure, are gaining popularity due to their flexibility, especially in consortiums and hyperscalers. Threat resilience, such as cyber-attacks and natural disasters, is cable performance optimization, and predictive maintenance using AI and Machine Learning. These technologies will further increase the reliability and efficiency of the systems. In the field of telecommunications, 5G network expansion requires fiber-optic infrastructure and, therefore, forces investment in backhaul systems. Companies like Sparkle are expanding their networks to meet the 5G bandwidth needs.

Moreover, software-defined networking (SDN) and network function virtualization (NFV) are revolutionizing telecommunications operations, facilitating adaptable network management and economic efficiency. These developments empower providers to deliver scalable, tailored solutions and enhance the quality of service.

Main operators in the submarine cable industry and recent M&A activity

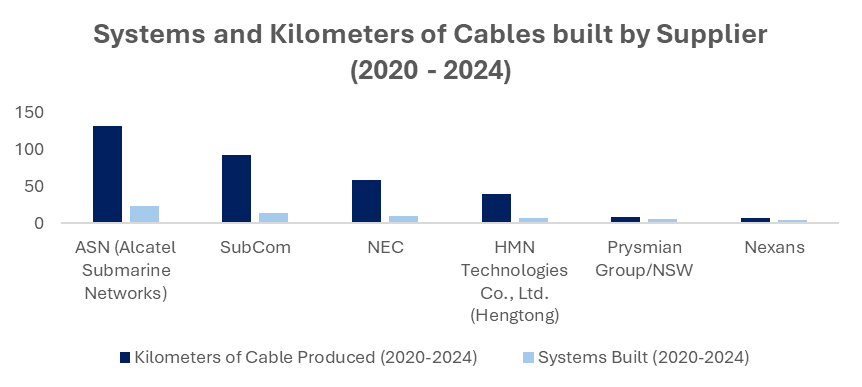

Few players monopolize the submarine cable market with their leading technological edge and strategic positioning, which empowers them to lead the industry. Alcatel Submarine Networks is mainly owned by the French government and holds a strong presence in Europe and Asia. Through pioneering research on spatial division multiplexing and improvement of the sustainability of the industry, Alcatel Submarine Networks continues to set standards in the industry.

SubCom is strong in the Americas, with a record of exemplary system design, deployment, and maintenance. A further emphasis on sustainability and integrated project delivery strengthens this competitive advantage. NEC Corporation, with a very strong presence in the Asia-Pacific area, is one of the most powerful companies regarding optical networking and advanced technologies such as software-defined metro and 400G wavelengths.

Hyperscalers—first and foremost, Google, Amazon, and Microsoft—are taking private subsea networks to a completely new level with breathtaking investment activities. A nice illustration of this commitment in investing in high-speed, low-latency connectivity among data centers across the planet can be seen in, for example, initiatives by Google.

Other players have also entered the ring of Global Cloud Xchange to fill this regional void in the connectivity scenario. One class of participants leads affordable solutions, especially for undersea markets that remain relatively unexplored but are seeing rising global footprint. Together they bring innovation, capacity building, and sustainability to the submarine telecommunications industry at large.

Source: 2024 Submarine Telecoms Forum

M&A activity in the submarine cable industry has reached unprecedented levels, driven by growing demand for global connectivity and technological advancements. Hyperscalers like Google, Amazon, and Microsoft have invested billions in private subsea networks to support the increasing demand for cloud and data centers. A key deal in this space was Nokia’s sale of Alcatel Submarine Networks (ASN) to the French government for €350 million, reflecting Europe’s focus on securing critical infrastructure amidst rising geopolitical tensions. ASN is a global leader in submarine cable systems, known for its advanced SDM technology.

Another significant deal was Lightstorm’s acquisition of all RTI Cables’ assets, which includes the Japan-Guam-Australia North and South cable systems, extending Lightstorm’s reach across the rapidly growing Asia-Pacific market. The OMS Group raised $292.5 million to expand its subsea telecommunications fleet, signaling strong investor confidence in the sector’s future.

Additionally, SubCom has strategically raised its stake in the Americas through key mergers and acquisitions, while NEC Corporation continues to strengthen its position in the Asia-Pacific region with technological expertise and regional partnerships, aiming to lead in optical networking solutions. The submarine cable industry remains fiercely competitive, with hyperscalers and traditional telecom players battling for dominance in this critical infrastructure.

Regulatory Framework

Changes in the European Union regulatory framework are having a profound impact on the telecommunications sector. The Digital Agenda for Europe and the push toward a single digital marketplace have given way to more stringent rules on network neutrality and data protection, such as the GDPR. These pose challenges in terms of compliance for Sparkle and its parent company, TIM, which operate globally with high volumes of cross-border data.

The EU has encouraged investment in high-speed broadband infrastructure through subsidies, to the advantage of companies like Sparkle. On the other hand, regulatory requirements—such as costly data security measures and price controls to promote competition—may affect those margins. Meanwhile, increased demand for fast internet and data services has been created by changes in consumer habits due to COVID-19. The recent boost in reliance on cloud-based services and remote work has increased the need for stable, high-speed connectivity, further raising demand for Sparkle’s services around the globe in IP transit and data exchange. This evolution puts into focus the strong necessity for continuing investment in submarine cables and high-quality network infrastructure

Sparkle Indicative Valuation by BSMAC and Deal Rationale

Telecom Italia S.p.A. indicative valuation by BSMAC:

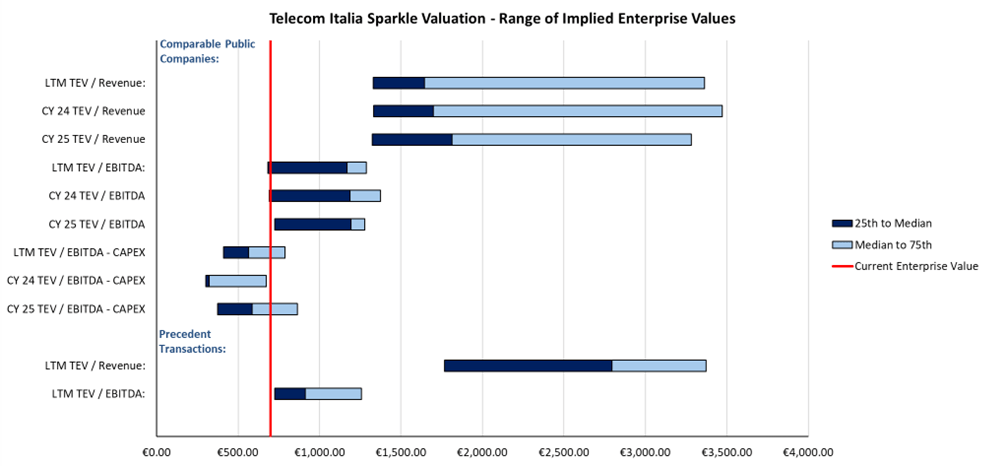

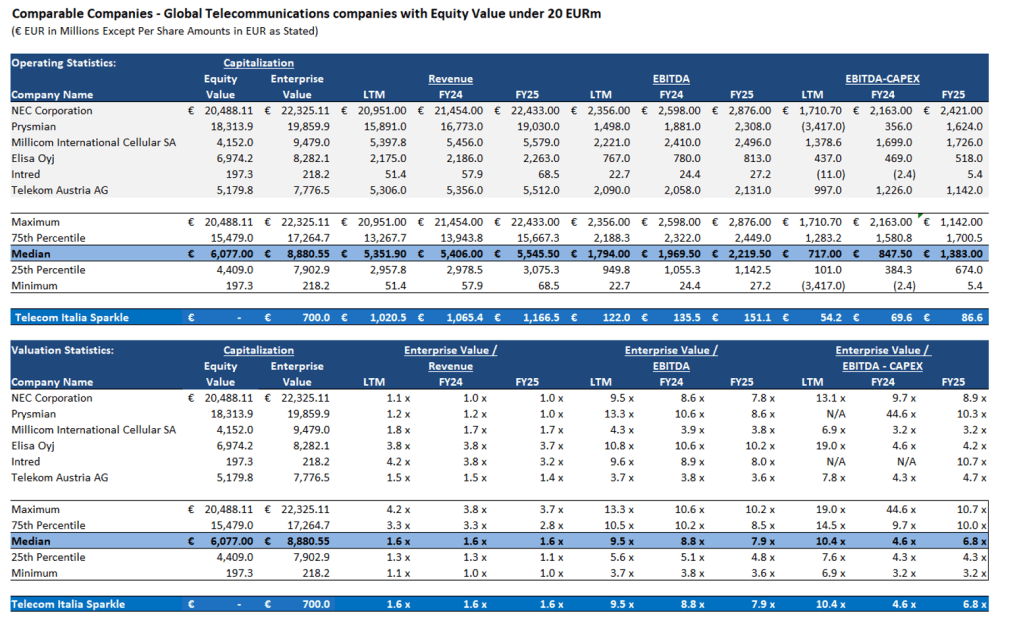

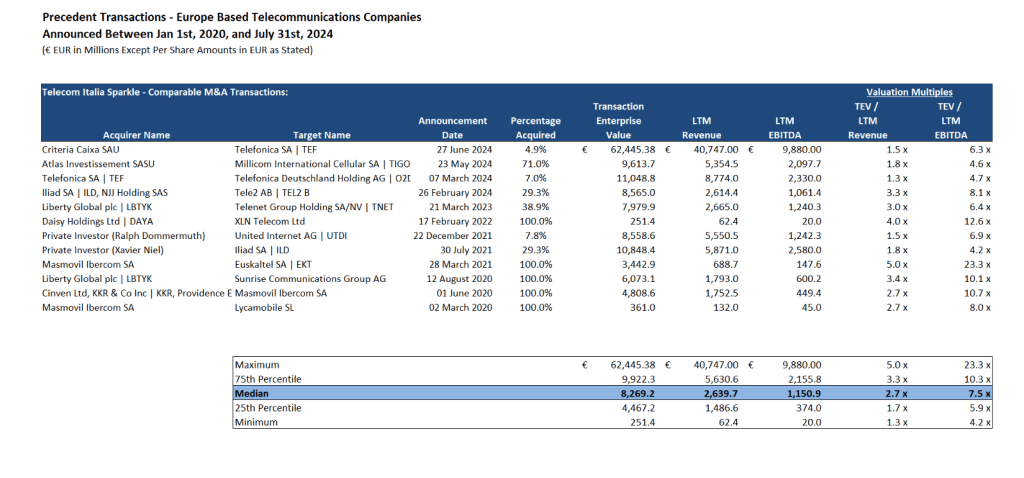

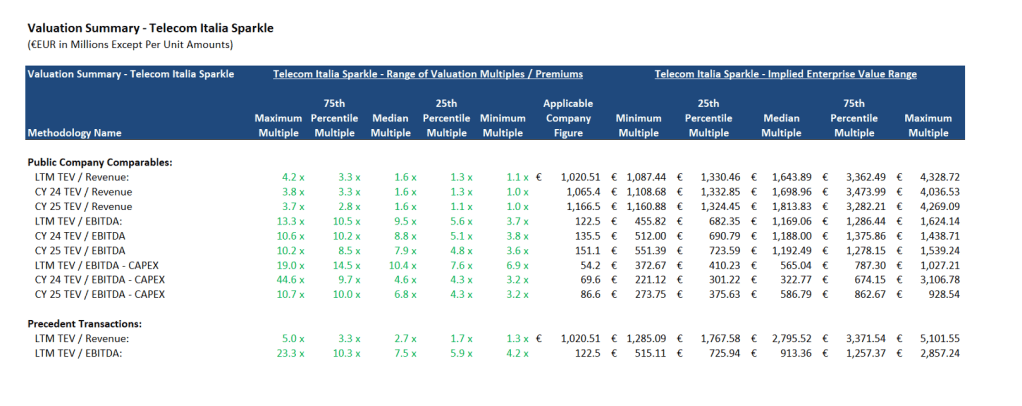

Sparkle’s final indicative Enterprise Value was obtained according to the market approach, focusing on EV/Sales, EV/EBITDA, and EV/(EBITDA-CAPEX) multiples analysis of six trading comparable companies and twelve relevant precedent transactions.

The comparable companies upon which the analysis was based include NEC Corporation, Prysmian, Millicom International Cellular SA, Elisa Oyj, Intred, and Telecom Austria AG, chosen on the basis of similarity in the business model to that of Telecom Italia Sparkle, and their size, mainly indicated by the equity value in the range of €0-20 billion. They have shown median LTM, FY24 and FY25 EV/Sales multiples of 1,6x in all three periods. Further, Median EV/EBITDA multiples were 9.5x, 8.8x, and 7.9x respectively, while median EV/(EBITDA-CAPEX) multiples reached 10.4x, 4.6x and 6.8x, respectively.

Forward comparable company multiples (FY 24, 25) were calculated using revenue, EBITDA and CAPEX estimates for the following two years. The forward revenue figures for Sparkle were based on median historical (4Y) growth of the two main revenue sources, Business Services and Sales of Goods, which were then summed to generate total forecasted revenue. The process for EBITDA forecasting was based on average historical (5Y) EBITDA margin, which was then applied to the forecasted revenue figures, while the calculation of forward CAPEX was based on average historical (5Y) growth rate.

Among all transactions in the telecommunications space in the past 4 years, the most relevant ones produced median LTM EV/Revenue multiple of 2.7x and EV/EBITDA multiple of 7.5x. Such a selection of transactions was based on criteria like geographic proximity to Europe and similarity to the Sparkle-Retelit deal in order to ensure representativeness. This approach acknowledged regional and industry-specific variations in multiples.

The LTM and forecasted revenue, EBITDA, and (EBITDA-CAPEX) were used in determining the indicative valuation range for Sparkle, which is visually represented on the football field chart below. Having applied the multiples to Sparkle’s financials, BSMAC concluded that Sparkle could have a valuation anywhere between €700 and €900 million, mainly based on EV/EBITDA and EV/(EBITDA-CAPEX) multiples. These profitability-oriented metrics provide more insight into Sparkle’s cash generation ability and, more specifically, EV/(EBITDA-CAPEX) is particularly seen to be a robust multiple for valuing telecommunication companies. In contrast, EV/Revenue had a much wider range and was less effective at narrowing the valuation estimate.

Deal Rationale:

A potential Sparkle acquisition by Retelit would mean very substantial opportunities for vertical integration, adding value to Retelit’s services through subsea assets combined with its current portfolio of fiber and cloud services. Its controlled subsidiaries, including Retelit Digital Services, focused on advanced digital and cloud solutions; Irideos S.p.A., which provides integrated telecom services to businesses; and Brennercom S.p.A., specializing in connectivity in Northern Italy and cross-border regions, further increase its ability to offer integrated, end-to-end solutions. This portfolio is further completed by the subsea cable network of Sparkle, making Retelit an even stronger player in the field of telecommunications. Furthermore, Asterion’s policy of consolidating telecommunications assets across Europe is in line with this acquisition, using Retelit’s know-how to enhance Sparkle’s capabilities and further solidify Asterion’s investment in Italy’s telecommunications sector.

From TIM’s perspective, the divestiture of Sparkle aligns with its strategic goal of optimizing operations and reducing debt levels while, at the same time, enabling greater focus on domestic telecommunications services and 5G expansion. This move also reduces TIM’s exposure to the capital-intensive subsea cable sector, which is in line with its shift toward a more asset-light business model.

The Italian Ministry of Economy and Finance (MEF) points out that exercising control over essential infrastructure, such as submarine cables, is of strategic importance due to their critical role in national security, economic stability, and international communications. These assets are integral to global connectivity and defense, hence subject to the most rigorous oversight under Italy’s “Golden Power” regime, which may have a bearing on the conditions set for Retelit’s planned acquisition of Sparkle.

The deal offers synergies by combining Sparkle’s global subsea network with Retelit’s domestic fiber and cloud services, but the big challenge will be how these are to be overcome with their difference in market focus and operational scale. Strategic and operational alignment requires the dissipation of these disparities, along with regulatory compliance. Additionally, heavy investments are needed in governance, security, and compliance in order to protect sensitive subsea networks and ensure successful integration.

Appendix and Tables

Authors

Authors : Marco Lodrini, Luka Sulejic, Lorenzo Montagner, Edoardo Simonetti, Frederick Stafford

Sources:

A&O Shearman. “Foreign Direct Investments in Italy: The Revised Golden Power Regime.” A&O Shearman. Last modified 2024. https://www.aoshearman.com/en/insights/foreign-direct-investments-in-italy-the-revised-golden-power-regime.

Asterion Industrial Partners. “Asterion Industrial Further Expands Its Exposure to Fibre and Data Centres in Italy Through the Acquisition of a Majority Stake in Irideos.” Asterion Industrial. Last modified 2024. https://www.asterionindustrial.com/asterion-industrial-further-expands-its-exposure-to-fibre-and-data-centres-in-italy-through-the-acquisition-of-a-majority-stake-in-irideos/.

CAIDA. “AS Rank: A Ranking of the Largest Autonomous Systems (AS) in the Internet.” CAIDA. Accessed 2024. https://asrank.caida.org.

Deloitte. “2024 Telecommunications Industry Outlook: Perspectives on the Telecommunications Industry.” Deloitte. Last modified 2024. https://www.deloitte.com/global/en/Industries/tmt/perspectives/telecommunications-industry-outlook.html.

Il Sole 24 Ore. “Sparkle: Soci Investitori Cercasi Ma La Vendita Non Decolla.” Il Sole 24 Ore. Last modified 2024. https://www.ilsole24ore.com/art/sparkle-soci-investitori-cercasi-ma-vendita-non-decolla-AFWN2nVD.

ING. “Telecoms Outlook: M&A Activity Slowly Moving Forward in the TMT Sector.” ING. Last modified 2024. https://think.ing.com/downloads/pdf/article/telecoms-outlook-ma-activity-slowly-moving-forward-in-the-tmt-sector.

Mergermarket. Accessed 2024.

PwC. “2024 Global M&A Industry Trends in Technology, Media, and Telecommunications.” PwC. Last modified 2024. https://www.pwc.com/gx/en/services/deals/trends/2024/telecommunications-media-technology.html.

RSM. “European M&A Trends Report 2024.” RSM. Last modified 2024. https://www.rsm.global/sites/default/files/media/PDF/European%20M%26A%20trends%20report%202024.pdf.

Retelit. “Wholesale International Backbones & Infrastructures.” Retelit. Accessed 2024. https://www.retelit.it/en/infrastructures/wholesale-international-backbones-infrastructures/#:~:text=FIBER%20OPTIC%2C%20MANs%2C%20DUCTS,East%20and%20the%20United%20States.

Statista. Accessed 2024.

Telecom Italia Sparkle. “Sparkle Products Presentations.” Telecom Italia Sparkle. Accessed 2024. https://www.tisparkle.com/sites/all/themes/sparkle/media/our_brochure/pdf/SPARKLE_BROCHURE.pdf.

Telecom Italia Sparkle. “Official Corporate Presentation, September 2024.” Telecom Italia Sparkle. Accessed 2024. https://www.tisparkle.com/sites/en/files/2024-11/Sparkle%20Corporate%20Presentation%20November%202024.pdf.

Telecom Italia Sparkle. “TI Sparkle Financial Statements, FY18, FY19, FY20, FY21, FY22, FY23.” Telecom Italia Sparkle. Accessed 2024. https://aida-r1.bvdinfo.com/version-20230825-7-1/Search.QuickSearch.serv?product=AidaNeo&.

TIM Group. “Press Release: NetCo Deal Closing.” TIM Group. Last modified July 1, 2024. https://www.gruppotim.it/en/press-archive/corporate/2024/PR-Closing-NetCo-1-luglio.html.

TIM Group. “Sparkle: The Power of International Connections.” TIM Group. Last modified 2024. https://www.gruppotim.it/en/group/about-us/news/Sparkle-the-power-of-international-connections.html.

Factset. Accessed 2024.

[1] Guiot, Bertrand. 2023. “Subsea Cables – The Underwater Backbone of the Digital Age.” https://home.cib.natixis.com/articles/subsea-cables-the-underwater-backbone-of-the-digital-age

You must be logged in to post a comment.