Introduction

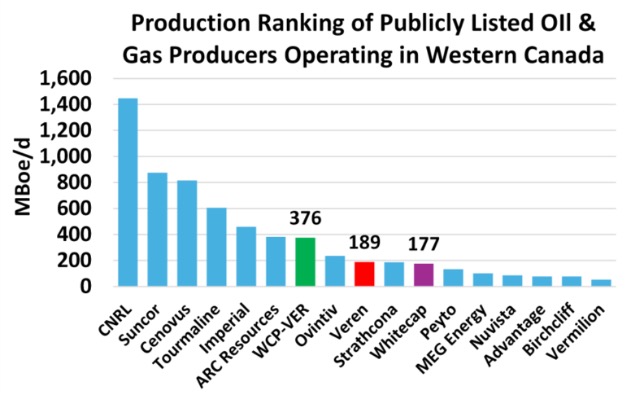

Whitecap Resources and Veren Inc.’s merger is a strategic move within the Canadian oil and gas sector, and it reflects the consolidation trend amongst big players within the industry. The deal, revealed in 2024 and valued at approximately $15 billion, will create a top light oil and condensate producer in Canada. Whitecap Resources, the sustainable oil and gas producer, and Veren, one of the premier producers of light oil in Alberta and Saskatchewan, have formed a strategic partnership to enhance operating efficiencies, grow their asset base, and solidify their presence in the competitive upstream oil business. This transaction creates the seventh-largest producer in the Western Canadian Sedimentary Basin, well set for long-term development and established market position. The merger also has the potential to provide operational synergies and improved ESG performance.

Company Overview – Veren Inc.

Veren Inc. is an oil and gas exploration and production company based in Calgary, Alberta, Canada. The company focuses primarily on light oil production in southern Saskatchewan and central Alberta.

Veren’s core Business Areas are:

- Light Oil Production

- Natural Gas Development

- Strategic Acquisitions.

Founded in 2001, Veren has become one of the leading companies in Canada for production of combustible fossils through a series of mergers and acquisitions. The first one dates to 2003 when Veren merged with Tappit Resources, and as part of the merger, the company converted to an income trust to reduce its taxation. In 2007, Veren acquired Mission Oil and Gas, becoming one of the top producers in Canada, finally converting back to a normal company in 2009.

The company employs approximately 746 people and primarily operates within Canada, focusing on the Western Canadian Sedimentary Basin. Moreover, In 2024, Veren Inc. achieved an annual average production of approximately 191,163 barrels of oil equivalent per day (boe/d), with about 65% comprising oil and liquids.

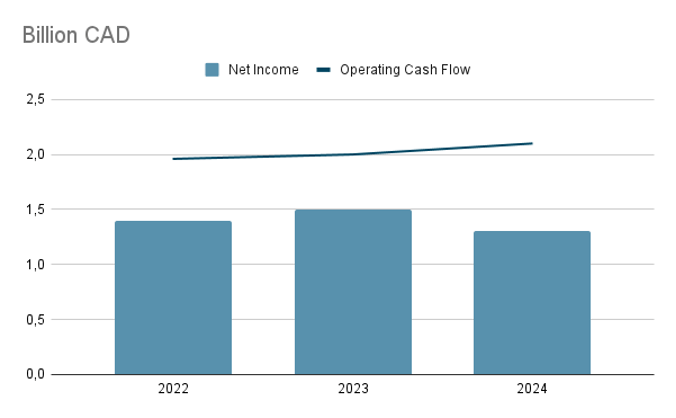

In FY2024 Veren has seen a reduction of its net income from CAD 1.5 billions to CAD 1.3 billions since last year. Although barrel production steadily increased, production costs also rose. Veren’s return on assets was 6.2%, while its return on invested capital stood at 9.5%.

The company has generated an operating cash flow of CAD 2.1 billion in FY2024, a slight increase from the year before, which was at CAD 2.0 billion. Veren’s financial year concluded with a strong asset portfolio and a solid balance sheet, giving it future merger and acquisition possibilities.

Company Overview – Whitecap Resources Inc.

Whitecap Resources Inc, headquartered in Calgary, Alberta, is a Canadian oil and gas company engaged in the production of crude oil and natural gas properties across Alberta, Saskatchewan, and British Columbia.

Whitecap’s core Business Areas are:

- Oil and gas Production

- Carbon Capture Leadership

Founded in 2009, Whitecap started its first acquisitions in 2010 by acquiring small private oil and gas firms. The significant expansion began in 2016, when it started acquiring assets from Husky Energy and merging with TORC Oil & Gas in 2021. Additional acquisitions of NAL Resources and Kicking Horse Oil & Gas in 2022 further boosted its production and asset diversity, reinforcing Whitecap’s strong presence in the Canadian energy sector.

In FY2024 Whitecap Resources Inc has seen a decrease of its net income from CAD 889.0 million in FY2023 to CAD 812.3 million. The decline of revenue is due to the fact that operating costs have increased and that commodity prices have shrunk.

The company generated a cash flow of CAD 1.63 billion in FY2024, compared to CAD 1.79 billion in the previous year. Finally, Whitecap concluded the year with a net debt of CAD 933.1 million, achieving a debt-to-EBITDA ratio of 0.34x, positioning the company favourably for future growth initiatives and possible acquisitions.

Valuation Overview

- Comparable Companies:

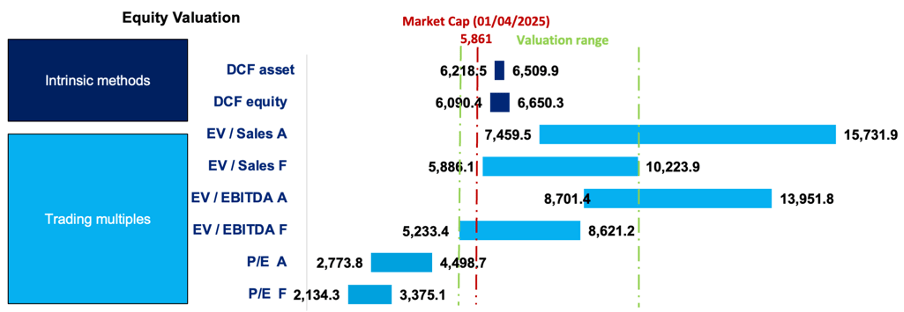

The EV/EBITDA multiples of 6x yield a valuation of CAD 9-9.1B, which is substantially higher than the P/E multiples of CAD 3.2-3.6B. This is due to Veren’s lower profitability, shown by the Net Income margins of 7%.

- Precedent Transactions:

The higher implied equity valuation of CAD 11-14B reflects control premiums, which average 24%, and expected merger synergies.

- DCF Analysis:

The stand-alone valuation of CAD 6.3B in equity uses a 7.94% WACC and 2% perpetual growth rate and includes no synergies, so it represents a conservative valuation baseline.

Industry Overview

North America Oil Extraction and production sector:

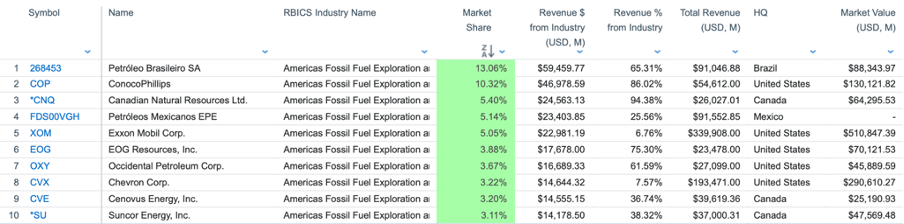

The upstream oil and gas sector is highly competitive and fragmented, with Petróleo Brasileiro SA (Petrobras) leading at 13.06% market share and generating US$59.5 billion in industry revenue. ConocoPhillips follows at 10.32%, with US$46.9 billion in industry revenue and the highest revenue percentage from the sector at 86.02%. Canadian Natural Resources Ltd. (5.40%) and Petróleos Mexicanos (5.14%) are also key players, with revenues of US$24.5 billion and US$23.4 billion, respectively. ExxonMobil (5.05%), despite its relatively smaller share, stands out with the highest total revenue at US$339.9 billion, showing its diversified operations. Whitecap Resources (0.54%) and Veren Inc. (0.61%) are smaller but notable players, generating US$2.4 billion and US$2.8 billion in industry revenue, respectively, with Veren maintaining a 96.41% revenue dependency on fossil fuel exploration, while Whitecap derives 100% of its revenue from the sector.

M&A Outlook:

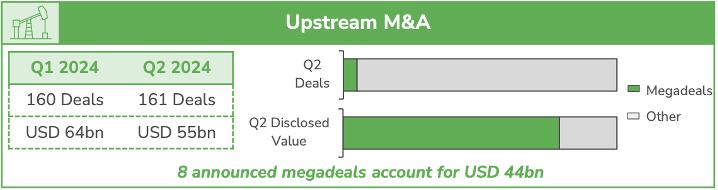

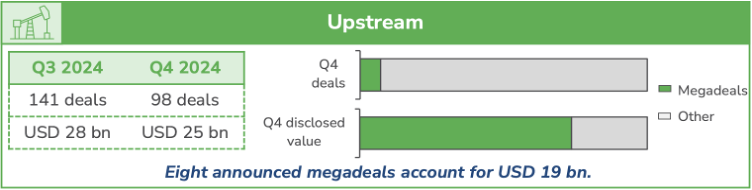

In the upstream sector the number of disclosed deals has remained similar throughout Q1 and Q2 (160 and 161 deals respectively), with total disclosed values of US$199B, but have then declined in the second half of the year to 141 deals in Q3 and 98 deals in Q4. In particular, the North American oil M&A market proves to be the most active in the world, with 10 megadeals out of 12 worldwide occurring in the North American region (7 in the U.S. and 3 in Canada). The disclosed value of these 10 megadeals amounted to US$ 31.5 bn, representing 67.3% of the global disclosed value. The biggest megadeal of the year was the Diamondback Energy and Endeavor Energy Resources merger. There were also a host of midsize deals, such as Chord Energy and Enerplus. All in all, the sector saw a shift toward scale deals, which comprised 86% of strategic M&A in excess of US$1 billion. The US Federal Reserve’s rate cuts in 2024, along with similar rate cuts by other central banks (including the European Central Bank and the Bank of England), have helped fuel the new M&A momentum to date.

In particular, the North American sector is expected to maintain a significant role in global M&A, with nearly US$80 billion in upstream opportunities currently on the market. Nonetheless, analysts project a decline in deal flow for 2025, attributing it to the culmination of major consolidation phases and a limited pool of attractive acquisition targets. Ongoing geopolitical tension in the Middle East and US President Donald Trump’s recent tariff impositions are also expected to weigh down on dealmaking going forward.

Source: Kroll

Source: Kroll

Possible future outcomes for the industry:

The main upcoming themes for the oil industry will be innovation and adaptability. 2025 will be a transformational moment for the industry, as technology and generative AI open up unprecedented possibilities, and climate-consciousness becomes a non-negotiable rather than a nice-to-have. Generative AI is predicted to unlock new potential in the upstream sector, offering breakthroughs in exploration and production. New AI models can analyse vast geological data, identifying optimal drilling sites with greater

accuracy, reducing operational costs and environmental risks. Moreover, by continuously monitoring equipment performance and predicting failures before they occur, these systems minimize downtime, reduce operational disruptions, and extend the life of critical machinery. Nonetheless, the increasing push for climate-consciousness presents significant challenges. Companies must innovate quickly to meet stricter emissions regulations and address investor and consumer demands for sustainability, all while maintaining profitability in an industry historically reliant on fossil fuels.

Source: FactSet

Deal Rationale

The merger presents a promising financial and long-term growth outlook for both Whitecap’s and Veren’s shareholders, with both strategic and financial motivations driving the transaction. Whitecap’s Board of Directors reached a unanimous agreement that the deal benefits the company’s growth objectives and is fair to the shareholders. However, questions have risen whether the merger might actually be a takeover because the leadership will consist solely of Whitecap’s executive team, and the Veren shareholders have been given a premium of about 30%.

Financial Drivers:

Starting with the financial reasons, the most obvious one is that the deal is 10% accretive on Whitecap’s funds flow per share and 26% on their free funds flow per share, which is the cash left over after capital spending for drilling, maintenance, etc. Moreover, the deal is expected to result in 200 million US$ of annual synergies due to an increase in operational, capital, and corporate efficiency. The integration of the two companies’ operations, especially given that they have a substantial alignment across conventional and unconventional assets, is a major contributor to these savings. Additionally, as stated by Veren’s President & CEO, Craig Bryksa, the combined balance sheet will strengthen the credit profile, and considering both Veren and Whitecap have a relatively low rating of BBB, this enhancement will potentially reduce the cost of debt.

Strategic Drivers:

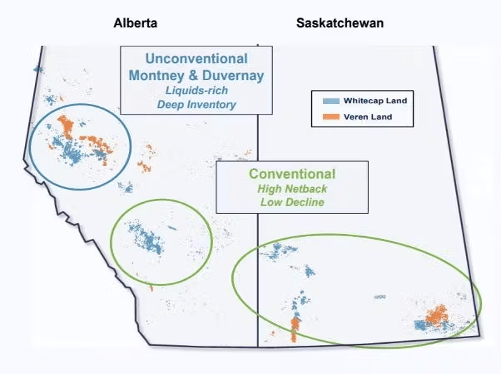

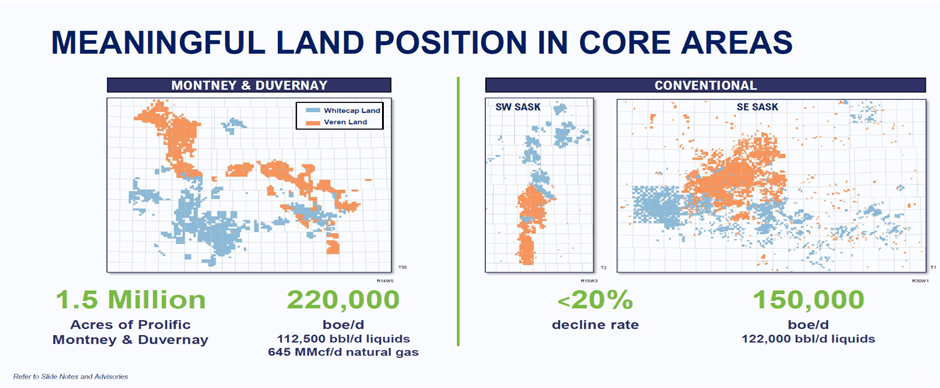

Moving onto the strategic motivations, the merged company positions itself as the leading Canadian producer focused on light oil and the seventh largest overall producer in the Western Canadian Sedimentary Basin. It also holds strong potential for future natural gas growth, as 63% of the total production of 370,000 boe/d are liquids. Liquids typically refer to crude oil and natural gas liquids, for both of which there is stronger market demand and higher prices than dry gas, so the 63% distribution suggests better profit margins.

Source: Oil & Gas Journal

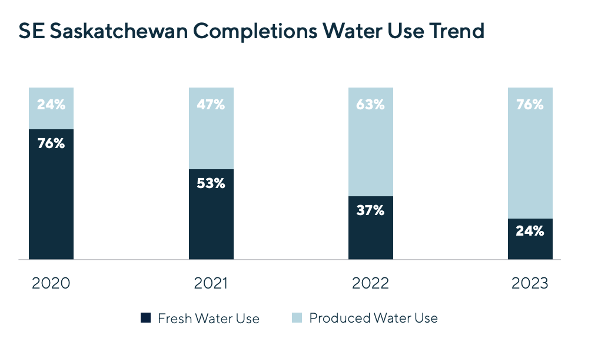

The combined company also has a strong, unified presence in western and southeastern Saskatchewan, a region known for its significant light oil reserves, which are usually economically resilient and could secure a stable cash flow for the company. Furthermore, since 40% of the conventional production will undergo the waterflood recovery technique, production will decline very slowly—only dropping by less than 20% per year. One of the most crucial results of the merger is the combined inventory of 7000 development locations, meaning more spots for drilling or wells, which will generate a steady inflow of cash even after covering capital expenditures. Finally, the merger may improve both companies’ ESG practices, seeing that they align on their set objectives. In Veren’s 2024 Annual ESG Report, the company reported a decline in GHG emission intensity and a reduction in freshwater use of over 50% in 4 years. If the combined entity continues to prioritize social and sustainability commitments, it can undeniably reach measurable ESG targets while enhancing its overall performance.

Source: Veren

Deal Structure

The Canadian oil and gas companies Whitecap Resources and Veren have entered into a definitive business combination agreement to combine in an all-share transaction valued at around US$15 billion, inclusive of net debt.

This merger aims to enhance operational efficiency and strengthen the financial position of the companies, providing greater flexibility for shareholder returns and long-term capital structure improvements. The merged company will operate under the Whitecap name and managemen; four directors from Veren, including CEO Craig Bryksa, will be members of the board.

The combined firm will have a production capacity of 370,000 barrels of oil equivalent per day (boe/d), with 63% being liquids. It will become the seventh largest producer in the Western Canadian Sedimentary Basin and the largest landholder in Alberta’s Montney and Duvernay regions, covering 1.5 million acres. The merger is expected to generate annual synergies of over CAD 200 million.

Source: RBN Energy LLC

Dividend payments:

Veren shareholders will receive 1.05 common shares of Whitecap for each Veren share held. This exchange values Veren at about US$6.84 per share, representing a 39.31% premium over its last closing price prior to the announcement. Normal course monthly dividend payments will continue to be made by Whitecap; Veren’s first quarter dividend will be paid in the normal course, after which Veren will not pay dividends, provided that, in the event that the transaction closes after May 31, 2025, Veren shareholders will be entitled to a Special Dividend comprised of a monthly dividend declared by the Veren Board and paid by Veren in respect of the month of May and every calendar month thereafter in which the Effective Date does not occur, in the amount of US$0.03833 per Veren share (one-third of Veren’s current quarterly dividend per Veren share). Upon closing, Whitecap shareholders will own approximately 48% of the combined entity, while Veren shareholders will hold the remaining 52%.

Source: Whitecap Resources Inc

Transaction structure:

The transaction is structured through a plan of arrangement in respect of the securities of Veren under the Business Corporations Act and is subject to the approval of at least two-thirds of the votes cast by holders of Veren common shares. The issuance of Whitecap common shares pursuant to the arrangement is subject to the approval of the majority of votes cast by holders of Whitecap common shares in connection with the transaction. Closing of the transaction will be subject to approval of the arrangement by the Court of King’s Bench of Alberta as well as other customary closing conditions, including the receipt of customary regulatory and Toronto Stock Exchange approvals.

The shareholders of the two companies are expected to approve the merger at a meeting held in May 2025, accordingly, the transaction is anticipated to close before the end of May, pending necessary shareholder, court, and regulatory approvals.

Advisors:

National Bank Financial Inc. and TD Securities are the financial advisors of Whitecap. National Bank Financial has provided a verbal opinion to Whitecap that the exchange ratio under the plan of arrangement is fair, from a financial point of view to the Whitecap shareholders.

BMO Capital Markets is acting as financial advisor to Veren, and Scotiabank is acting as financial advisor to the Special Committee of Veren. BMO Capital Markets and Scotiabank have each provided a verbal opinion to the Veren Board of Directors and the Special Committee, respectively, that the exchange ratio under the plan of arrangement is fair, from a financial point of view to the Veren shareholders and is subject to the assumptions made and the limitations and qualifications in the written opinions of BMO Capital Markets and Scotiabank.

Conclusion

The Whitecap Resources-Veren Inc. merger should be pursued. The transaction has strong strategic rationale, with significant synergies achieved through operational efficiencies, scale benefits, and complementary asset portfolios. The transaction strengthens Whitecap’s position in the Canadian oil and gas industry by consolidating high-quality, low-decline production assets and increasing free cash flow generation. The transaction also offers long-term value creation for shareholders. Based on the market environment and the alignment of the strategic goals of both firms, the transaction looks timely and value-accretive.

Authors: Francesco Savelli, Luca Dennert, Letizia Ianniciello, Francesco Casati, Greta Angelova, William Pigott, Luca Sagrillo

Appendix: Valuation

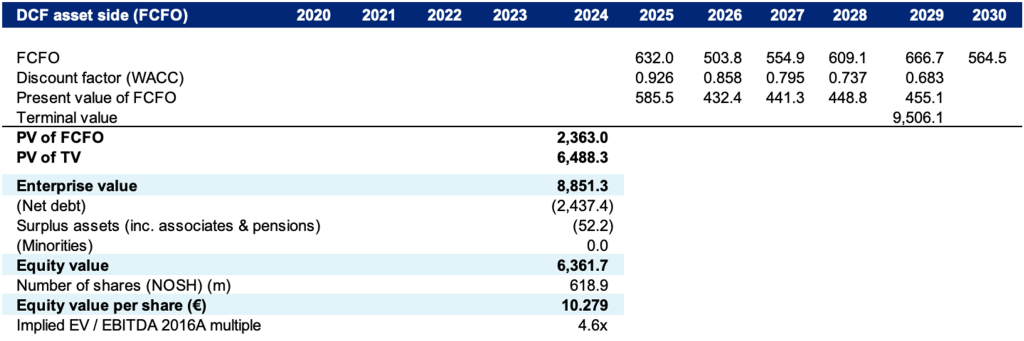

1. DCF Analysis

Overview: The WACC of 7.94% is calculated from the Cost of Equity, which is 10.1% (using CAPM), and the Cost of Debt, which is 4.12% pretax (estimated using a synthetic rating)

Key Observations:

- Cost of Equity:

The Beta of 1.26 has been calculated using an industry average beta rather than the company’s standalone historical beta. This mitigates the risk of underestimating the cyclical and volatile nature of the oil and gas industry. The Equity Risk Premium of 5.7% has been sourced from the Fernandez markets survey, which is commonly used among financial professionals and accurately reflects the general Canadian equity market risk expectations.

- Cost of Debt:

Using a synthetic rating method that indicated the cost of debt is 4.12%, which incorporates interest coverage ratios to estimate spreads, is forward-looking and aligns with the best practices of valuation methods, which ensure a market debt cost rather than a cost of debt-based purely on historical borrowing rates.

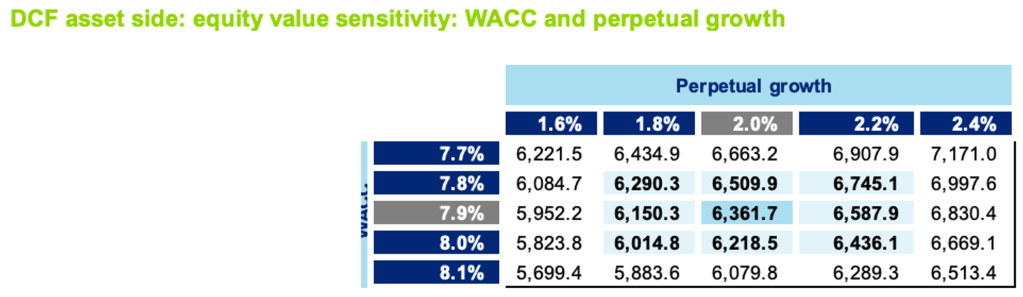

Sensitivity Analysis

The model highlights the valuation sensitivity to changes in WACC.

Baseline Case: WACC is 7.94% and yields a DCF equity valuation of CAD 6.3 B

Impact in changes of 1% in WACC:

Lower WACC of 6.94%: The effect is an increase in equity valuation by approximately 15% to CAD 7.3-7.7 B

Higher WACC of 8.94%: The impact is a decrease in equity valuation of roughly 13% to CAD 5.5-5.8B

This demonstrates that relatively moderate shifts in debt spread have a significant impact. Changes in WACC by 0.3-0.9% affect the valuation by roughly 5-10%

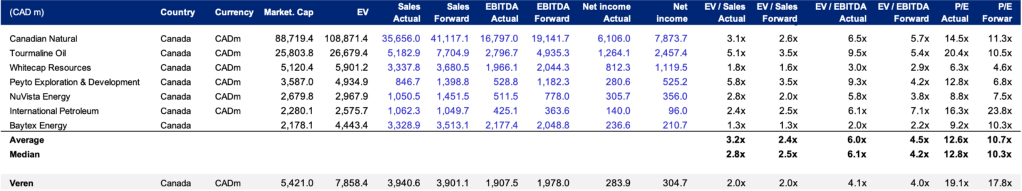

2. Comparable Company Analysis

We selected a comparable universe of peer companies based on the following criteria:

- Geography of operations: Companies with operations primarily focused in Canada, specifically regions in Alberta and Saskatchewan.

- Business model: Each company has a similar exploration and production (E&P) model within the upstream oil and gas sector.

- Size: Companies with similar market capitalisation, revenue, and enterprise value to Veren, indicative of comparable asset structures.

We used EV/Sales and EV/EBITDA multiples to estimate firms’ valuations because they are easy to use when comparing their performance and capital structure.

Applying the median EV/Sales multiple of 2.8x to Veren’s 2024 sales of CAD 3.97B implies an Enterprise value of CAD 11.1B. Applying the median EV/EBITDA multiple of 6.1x to Veren’s estimated EBITDA yields an implied Enterprise value of approximately CAD 7.9-8.5B. Adjusting for Net Debt of CAD 2.44B, the implied equity value range is approximately CAD 5.5-8.7 B, which makes the actual transaction equity value of CAD 6B very reasonable

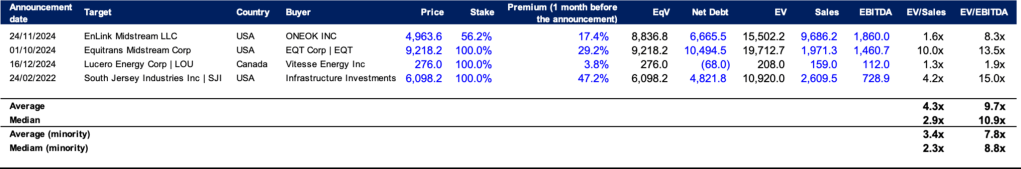

3. Precedent Transaction Analysis

We analysed four M&A transactions in the North American oil and gas sector in the past two years to derive relevant valuation multiples.

The precedent transaction analysis resulted in median multiples significantly above Veren’s (EV/Sales 2.1x and EV/EBITDA 6.1x), implying an Enterprise value of CAD 10.1-13.5B, considerably higher than the agreed CAD 8.44B. However, PTA typically yields higher valuations due to control premiums.

Possible reasons for lower valuation

- Deal structure factors: Since Whitecap’s stock has served as currency due to the deal composition of 100% equity, it set a natural cap on Veren’s valuation as Whitecap was unlikely to pay significantly above its multiples, which would risk the deal being excessively dilutive for its shareholders.

- Company-specific factors: Veren has high net debt levels and lower profitability, which limits its equity valuation as the elevated leverage causes increased financial risk, resulting in a conservative valuation.

Bibliography

Whitecap Resources Inc. (2025) Whitecap Resources Inc. Announces Record Annual Production and Strong 2024 Results. Available at: https://www.wcap.ca/investors/news-releases/details/whitecap-resources-inc.-announces-record-annual-production-and-strong-2024-results/1248.

Veren Inc. (2025) Veren Announces Q4 & Full Year 2024 Results. Available at: https://vrn.com/investors-media/news-releases/veren-announces-q4-full-year-2024-results.

PitchBook (n.d.) Whitecap Resources Company Profile. Available at: https://pitchbook.com/profiles/company/59668-84.

Grant Thornton (2025) A Promising Outlook for 2025. Available at: https://www.grantthornton.com/insights/articles/energy/2025/a-promising-outlook-for-2025.

PwC (n.d.) Deals Trends. Available at: https://www.pwc.com/gx/en/services/deals/trends.html.

Bain & Company (2025) Global M&A Report 2025. Available at: https://www.bain.com/globalassets/noindex/2025/bain_report_global_m_and_a_report_2025.pdf.

FactSet (n.d.) RBICS Market Share Report. Available at: https://my.apps.factset.com/workstation/universalscreening/?ACTION=OPEN_DOCUMENT&FILENAME=sample_screens%3ARBICS_MARKET_SHARE.usweb&GLOBAL_VARS=RBICSNUM%3D%2725101510%27&OPEN_SECTION=RESULTS&RUN_SCREEN=TRUE.

Kroll (2024) Global Oil and Gas M&A Outlook Q2 2024. Available at: https://media-cdn.kroll.com/jssmedia/kroll-images/pdfs/global-oil-and-gas-m-and-a-outlook-q2-2024.pdf.

Rystad Energy (2025) Braking Point: Could Upstream M&A Activity Be Poised for a Slowdown in 2025?. Available at: https://www.rystadenergy.com/insights/braking-point-could-upstream-m-a-activity-be-poised-for-a-slowdown-in-2025.

Veren Inc. (2024) 2024 ESG Summary Report. Available at: https://veren-website.files.svdcdn.com/production/documents/ESG/Sustainability-Reports/Veren-2024-ESG-Summary-Report-Final_compressed.pdf.

Oil & Gas Journal (2025) Whitecap Resources Map. Available at: https://img.ogj.com/files/base/ebm/ogj/image/2025/03/67cf01426fcb64b7e0cf8ed2-250310whitecapmap.png.

Marchese, A. (2025) ‘Whitecap Resources, Veren to Merge in a $10.4 Billion All-Share Deal’, The Wall Street Journal, 10 March. Available at: https://www.wsj.com/business/energy-oil/whitecap-resources-veren-to-merge-in-a-10-4-billion-all-share-deal-781c4c77.

NS Energy (2025) ‘Whitecap Resources and Veren Agree to Merge in $10.4bn Deal’, NS Energy, 11 March. Available at: https://www.nsenergybusiness.com/news/whitecap-resources-veren-merge-10-4bn-deal.

You must be logged in to post a comment.