Introduction

As of February 25, 2025, Telia (TELIA.ST) has reached an agreement with Norwegian media company Schibsted Media to sell its entire TV & Media division including TV4, MTV Finland, and C More for nearly SEK 6.55 billion (€595.9 million). The deal is expected to close by Q3 2025, pending regulatory approval.

The transaction will enable Telia to reframe as a strategically focused telecom operator in the Nordic and Baltic regions after having acquired these assets in 2019 through Bonnier Broadcasting. As Sweden’s leading commercial channel, SVT4, alongside C More, and MTV3 form a strong multi-platform content offering, they are powerful industry broadcasters in Northern Europe that dominate the Finnish market.

The move comes after a long period of internal strategic thinking and market speculation. For a long time, Telia had already indicated its intention to divest from non-core non-basic assets and even prepared for the sale by writing off the value of the media division. On this transaction, Telia can deleverage and focus on connectivity while Schibsted Media greatly expands its grasp in the Nordic media landscape by adding premium TV content to its digital publishing business.

Company Overview – Schibsted Media

Schibsted Media formally became a distinct media company in June 2024, following the organizational separation of the former Schibsted ASA conglomerate. This intentional separation was aimed at fully realizing the potential of Schibsted’s core areas of business through the formation of two independent organizations: Schibsted Media, which is focused exclusively on news and editorial content, and Schibsted Marketplaces specializes in online classifieds advertisements and online marketplace websites. The 2024 spin-off enabled Schibsted Media to stand alone, with a precise mission to achieve editorial independence, invest in journalistic quality, and optimize reader engagement in the Nordic region.

Ownership Structure:

Schibsted Media is fully controlled by the Tinius Trust, which operates the company via its holding company, Blommenholm Industrier AS. The Trust was established in 1996 by then chairman Tinius Nagell-Erichsen to shield Schibsted’s media operations from the whims of the stock market and ensure they are directed by principles that serve the common good. Schibsted Media’s board of directors is now appointed directly by the Tinius Trust. This structure plays a crucial role in safeguarding editorial independence and ensuring the company’s adherence to long-term goals like freedom of the press, openness, and democratic values, rather than short-term financial profits.

Financial Analysis:

As of Q4 2023, just prior to its split from Schibsted ASA, Schibsted Media (reported at the time as the News Media segment) had revenues of about €355 million and an EBITDA of approximately €59.5 million, a 5% year-on-year growth. The results emphasized stable performance despite continued industry disruption, such as the transition to digital and evolving advertising dynamics.

After the corporate division, detailed financial information is not publicly available. Nonetheless, in January 2025, Schibsted Media made public a major 13% cut of its workforce, affecting approximately 240 employees. The layoffs are a part of the company’s strategy to reduce costs amid economic challenges and structural reforms confronting the media sector.

Despite the absence of up-to-date financial data, these events indicate that Schibsted Media is undergoing a phase of strategic reconfiguration, with the objective of equilibrating cost- effectiveness with its fundamental dedication to sustaining independent and high caliber journalism.

Company Overview – Telia Company

Telia Company has its origin in the early 2000s when Sweden’s state-owned operator Telia merged with Finland’s telecoms operator Sonera. The merger marked the beginning of Telia’s operation as one of the major telecommunications providers in the Nordic and Baltic states. During the early years, the company focused on an aggressive expansion into international markets in Eurasia such as Turkey, Russia, and Central Asia. But by the mid- 2010s, Telia was retreating from those markets to focus on its core northern European footprint.

Nowadays, Telia is working in the telecom sector, providing a full set of mobile, broadband, fixed line, and television services in Sweden, Finland, Norway, and the Baltics. The firm has also been interested in media consolidation, most recently with its 2019 acquisition of Bonnier Broadcasting, encompassing Swedish channel TV4 and MTV in Finland.

Telia company is an ordinary public company in its legal form, with executive management by a CEO, and corporate oversight by a board of independent directors.

Its strategic focus has shifted even more firmly toward the goal of simplification of operations as well as of leadership of digital infrastructure, with the sale of its media assets to Schibsted Media in the early part of 2025.

Financial Analysis:

In 2023, Telia saw a slight decrease in performance, with revenues falling from €8 billion t €7.7 billion. Operating income also declined, moving from €1.02 billion to €880 million, while EBITDA slipped from €3.25 billion to €3.14 billion. Between 2020 and 2024, the company’s Free Cash Flow showed a downward trend. It started at around €1.44 billion in 2020 and declined steadily to €639 million in 2024. Although the drop is not drastic, it reinforces a persistent negative trend observed in recent years. The downturn remains moderate, suggesting it could be part of a broader phase of market softening or strategic repositioning.

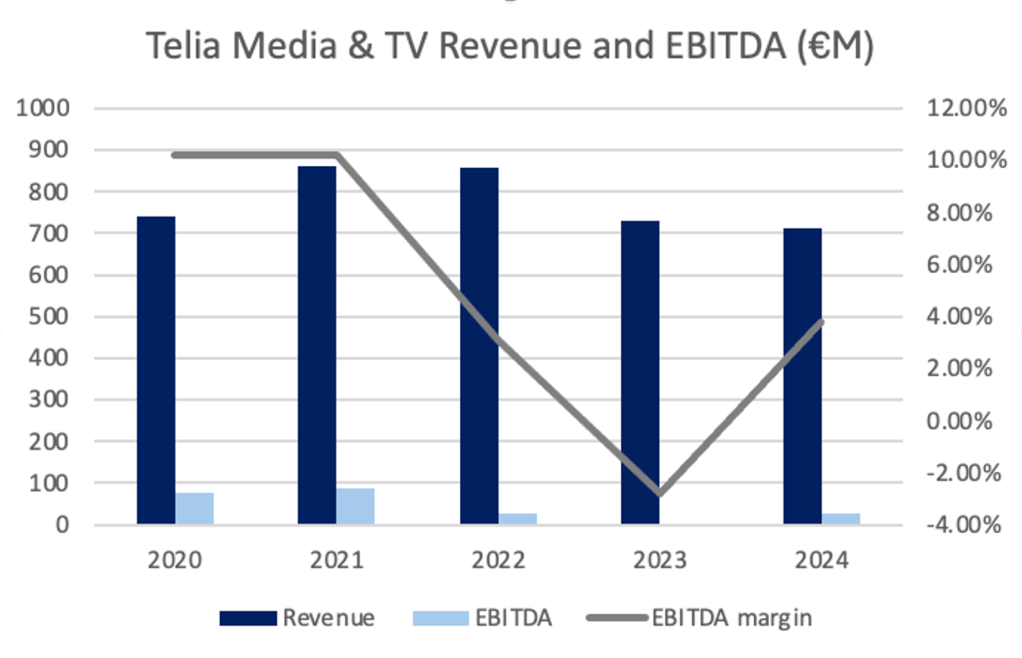

Telia’s TV and Media segment demonstrated similar performance. Revenues started declining during 2022, from €859.8 million in 2021 to €712.4 million in 2024. Additionally, the division’s adjusted EBITDA has been somewhat volatile throughout the previous 5 years, with the maximum margin reaching 10.2% and the lower bound being negative at –2.8%. This is a testament to the profitability issues the business line has been argued to have, and possibly what drove Telia to divest.

Valuation Overview

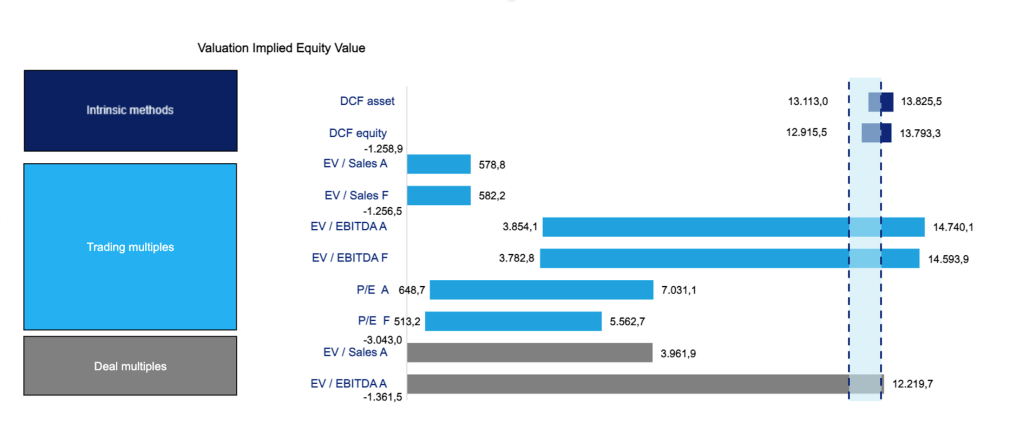

Due to the lack of public information for the TV & Media division of Telia alone, the BSMAC team provided an indicative valuation of the consolidated entity based on a DCF analysis, along with deal and trading multiples, and an indicative valuation of the TV & Media business separately based on deal and trading multiples applied to the division’s revenues and adjusted EBITDA.

Telia Consolidated Entity Valuation Summary

DCF Analysis

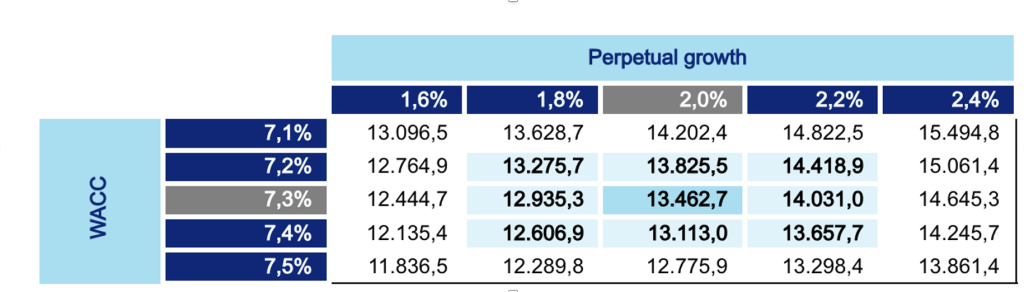

- The standalone DCF asset- and equity-side analyses yield an EqV range from €12.915 billion to €13.826 billion (taking into account the 25th and 75th percentiles of the indicative valuation range stemming from a sensitivity analysis). The calculated values however, €13.46bn (asset-side) and €13.33bn (equity-side) are based on a WACC of 7.3%, a levered cost of equity of 10.2%, with a perpetual growth rate of 2%.

Comparable Companies Analysis

- The EV/Sales Actual and Forward multiples of 0.8x show EqV ranging up to €582.2mm, a range significantly more conservative than ones stemming from other valuation methods. This result can be explained by falling revenues over the years and a relatively low industry average.

- EV/EBITDA multiples imply a broader range of EqV than other methods, explained by the heterogeneity in multiples across comparable companies. The median Equity Value, however, is determined to be at approximately €13bn, based on the actual and forward figures.

- P/E multiples yielded a somewhat lower range when considering the 1st and 3rd quartiles of the distribution. However, the valuation based on the average actual multiple of 25.4x yielded €17.22bn, whereas the EqV with the forward multiple of 25.8x yielded €13.62bn.

Precedent Transactions Analysis

- Analysing deal multiples resulted in somewhat lower implied results within a wide range. The average EV/Sales multiple of 1.2x led to an EqV of €3.26bn, whereas the surprisingly low average EV/EBITDA multiple of 3.4x showed an EqV of €4.72bn.

The somewhat heterogeneous valuation ranges led the BSMAC team to focus on average calculated figures. Therefore, the appropriate valuation of Telia’s equity is determined at approximately €12.5bn to €13.5bn .

Telia TV & Media Division Valuation Summary

Comparable Companies Anlaysis

- The EV of the TV & Media division separately was devised from the same average actual and forward Sales and EBITDA multiples that were used for valuing the consolidated entity. They were then applied to the respective Sales and Adjusted EBITDA figures drawn from the division’s most recent Annual Report. The EV/Sales multiple lead to the Enterprise Value of €591 million, whereas the EV/EBITDA multiples yielded an EV that is considerably lower due to the company’s recent profitability troubles.

Precedent Transactions Analysis

- Following the same method, the results show a somewhat higher Enterprise Value for the separated division. EV/Sales led to valuations of €867.7 million and €726.4 million respectively, whereas the actual and forward EV/EBITDA multiples yielded €92.3 million and €63.7 million, respectively.

Due to the lack of public information and the company’s recent profitability troubles, BSMAC chose EV/Sales as the most appropriate method of valuing the TV & Media division. Therefore, the division’s valuation should be in the range of €591 million and €867.7 million, relatively in line with Schibsted Media’s offer.

Market Overview

The Media & Entertainment (M&E) industry is a large sector that includes a broad range of companies that create, distribute, and monetize content across various platforms. This includes TV, movies, streaming services, publishing, advertising, gaming, music, and digital media. The industry is experiencing a rapid transformation, led by technological advancements, shifting consumer preferences and regulatory changes, with trends such as digitalization, subscription-based models, and AI content personalization shaping its future. Major players range from traditional broadcasters and publishers to tech giants and digital-first platforms, which are all competing for audience attention.

Industry Analysis:

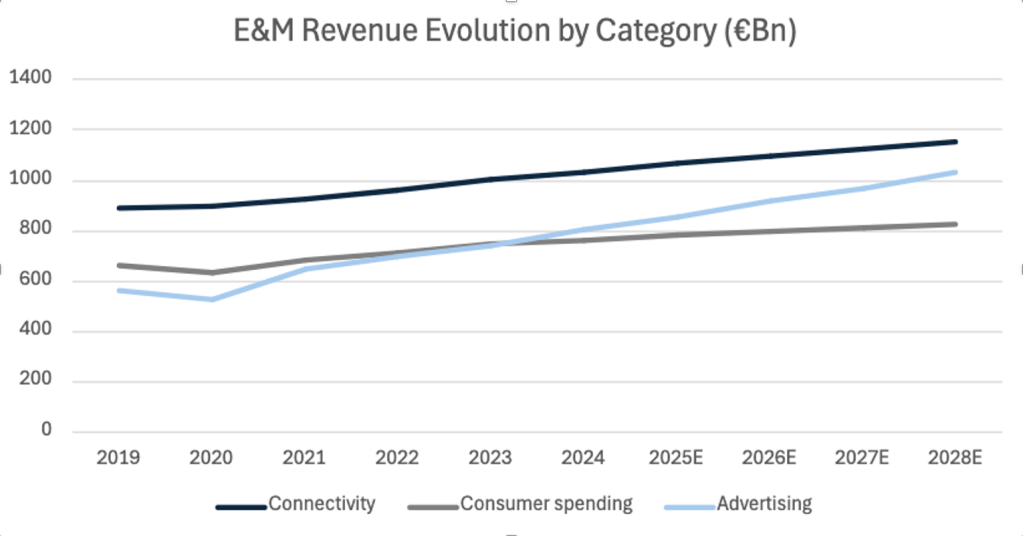

The Media & Entertainment industry generated a total global revenue of €2.46 trillion in 2023, representing a 5% increase with respect to 2022 – a faster growth pace than the one of the global economy. Over the next few years revenue growth is forecasted at a more moderate 3.9% CAGR, reaching a level of €2.9tn by 2028.

The key to accessing this new market share will be a reinvention of the business model, due to changing consumer preferences and technological advancements in the sector. An interesting trend that can be observed currently and will exacerbated soon is the change in the drivers of revenue. Revenue can be divided in 3 major categories:

- Consumer spending, which is the income generated directly from individuals paying to consume media content, services and experiences

- Connectivity, which is the revenue generated from providing infrastructure and services that allow consumers to access media

- Advertising, which is the revenue generated from businesses trying to reach new audiences and markets

It is increasingly challenging for industry players to increase revenue by selling media products directly to customers, while advertising revenue is growing increasingly fast and is forecasted to keep doing so.

The majority of ad revenue comes from online advertising (77% of overall advertising income). Companies will need to rethink the way in which they sell advertising and monetize data, which will create more sophisticated advertising models. An emerging trend that is fuelling this ad revenue increase is the emergence of “shoppable TV advertising”, which allows consumers to purchase products directly from the ad, not only for online streaming but also for traditional televisions (that need to have internet connection capabilities). This has been highlighted by Walmart’s acquisition of smart TV manufacturer Vizio, as the biggest US retailer is a big spender in marketing and advertisements.

Geographic focus:

The US, collecting more than one-third of global revenue in 2024, remains the world’s biggest M&E market for the combined advertising and consumer spending markets by a wide margin. But this large scale is due to industry maturity, and hence it showcases relatively slower growth, which is projected to run at a 4.3% CAGR through 2028, which is behind the global rate of 4.6% (excluding connectivity).

Emerging countries like China, India and Indonesia are among the fastest growing, all with revenue growing at a CAGR above 7% until 2028.

The tale in Europe, instead, is different. The market is more saturated and mature, with a growth rate even lower than the American one, except for a few Eastern European countries like Czech Republic, where revenue is forecasted to grow by 5.20% annually until 2028. In the Nordics average growth will be around 2.5%, with Sweden as the fastest-growing market with a CAGR of 3.2% (still well below the global rate for the period). The European market is facing slowdown in growth because of multiple factors, that have been exacerbated by the COVID-19 pandemic. COVID, indeed, hit advertising revenue hard in the Old Continent, but the former quickly bounced back to pre-pandemic levels in 2021. A driving factor for the slowdown in growth for traditional media businesses has been the competition from foreign (especially American) online players, like Netflix, Disney + and Amazon Prime Video. But in Europe traditional TV remains in strong demand among consumers, with 71% of consumers still watching TV channels for movies and tv series at least once a month. TV also remains the most often used source for news, reaching 75% of the European population weekly.

Technological advancements:

The main technological advancement in the sector has been the rise of online streaming services, which has shaped the landscape in the last decade. These platforms, and in particular Subscription Video on Demand (SVoD) ones (e.g. Netflix, Disney +…), have introduced significant competition for the time and attention of viewers, especially among younger generation.

In Europe a notable substitution effect for pay-TV subscriptions has been observed, with 59% of consumers that have replaced or are considering replacing their TV subscription with streaming services. And among the European SVoD users, 43% reported that they are likely to spend more time watching movies and series on these platforms instead of traditional TV channels in the next 6 months. Among SVoD providers, the 3 largest American players (Netflix, Amazon Prime and Disney +) capture 71% of the overall market share. Traditional broadcasters are responding to this trend by introducing their own on-demand online streaming services.

This shift has been accelerated by the COVID-19 pandemic, with global subscription revenue for SVoD platforms almost doubling from 2019 (€37bn) to 2021 (€64bn). But in 2024, even streaming platforms are starting to face some challenges, as with the growth in the the number of providers and subscribers, the market is reaching a form of saturation. The number of subscriptions is still forecasted to grow at a 5% CAGR, reaching 2.1bn subscribers in 2028, but the average revenue per subscriber is forecasted to plateau, with a CAGR of 0.9% until 2028 (reaching €59.5). This effect is due to the slowdown in consumers’ marginal willingness to pay for digital goods and services. In this scenario, even SVoD players are shifting to a more advertising-based revenue model, introducing cheaper, “hybrid” subscription plans that incorporate some ads in the online streaming experience.

An additional technological advancement that has been affecting all sectors in the last year is the surge of AI. This will also affect the M&E industry, both through traditional uses, including the automation of front- and back-office processes and transactions, and the application of Generative AI for content production, facilitating more efficient content distribution, scaling personalized marketing efforts and fueling monetization.

M&A activity:

The Media & Entertainment industry has witnessed a strong rebound in M&A activity in 2024, with deal activity in the year up 82% compared to 2023. The stagnant activity in 2023 was due to macroeconomic challenges, including persistent inflation and rate hikes, which led to one of the worst dealmaking years in the last 2 decades.

The main drivers for the resurgence in 2024 were the accumulated dry powder by private equity firms and major strategic players, which allowed them to aggressively pursue acquisitions to increase market share, streamline operations, and enter high-growth segments. Many deals involved shedding non-core assets or realigning business units to drive long-term value. Examples of recent activity include the spin-off from its parent Vivendi and listing of French television channel Group Canal +, valued at €3.3 bn, and the Joint Venture Star India Private Limited between Reliance Industries Limited, Viacom 18 Media Private Limited and The Walt Disney Company, valued at $8.5bn, which was approved by Indian antitrust authorities in November 2024.

The outlook for 2025 appears cloudier, with the first quarter marked by a slowdown in M&A activity across the board, amidst a raging trade war between the US and the rest of the world, increasing geopolitical tension and political instability in Europe. In addition, the merger approval process looms over the consolidation landscape. While impossible to predict with certainty in the current political environment, an extended regulatory review is likely, based on the experience of recent transactions in media and other industries. Media leaders pursuing big deals in 2025 must get comfortable navigating through ongoing industry disruption during what promises to be a lengthy and uncertain sign-to-close period.

Deal Rationale

Telia will be in a position to further pursue its strategic goal of expanding its core strengthening its core connectivity business following the divestment of its Media and TV businesses. The deal will allow Telia to shift its focus on providing world-class connectivity services in the Baltic and Nordic regions. This divestment also reflects the Telia’s extensive portfolio management approach which will ensure that all its investments are highly concentrated in areas where it is possible to achieve and sustain the most competitive advantage.

Several financial and strategic benefits are expected to arise upon the completion of the transaction. Apart from the opportunity to streamline operations and focus on telecommunications and digital services (which are a key for long term growth), the deal, with an indicative valuation of betwen €591 million and €867.7 million drawn by the BSMAC team, will provide Telia with significant amount of capital which will be used for deleveraging and reinforcing its financial health.

Despite the sale, Telia has entered into a multi-year distribution agreement, which will ensure that its customers retain access to TV4 and MTV content – a move which will keep customer satisfaction levels high.

Furthermore, although Telia’s 2025 Free Cash Flow expectations from have been revised downwards from €720mm to €675mm, the company’s overall targets for 2025-2027, including the projected revenue service growth of c. 2%, adjusted EBITDA growth of at least 5%, and CAPEX (licensing, spectrum and rights of use assets fees excluded) of €1.28bn, have remained unchanged, which signals confidence in its core business lines.

Acquiring Telia’s TV and Media businesses allows for the consolidation of Schibsted Media’s power in the Nordic media market and the reinforcement of its strategic position. The addition of MTV and TV4 will enhance the company’s current portfolio, already comprising strong digital media brands such as Svenska Dagbladet, Aftonbladet, Pomne, and Omni. Integrating these new assets will help the company get closer to achieving a multi-platform ecosystem including news, entertainment, and sports media.

Furthermore, Schibsted Media will be able to reinforce its commitment to independent journalism, which is why it also might be argued that this is a deal of an activist nature. Tinius Trust as a principal owner is fully supportive and encourages this transaction, given that they will increase the company’s capacity to deliver reliable news and entertainment, all while maintaining public trust and enhancing its role as a cornerstone of democracy. Schibsted Media’s publications will continue to showcase credibility and autonomy, giving it an important edge in an era where journalism faces increasing challenges and pressures.

Deal Structure

The definitive agreement between Telia and Schibsted was made on the 25th of February 2025, and the deal is expected to close at the end of Q3 this year, meaning that no regulatory hurdles are to be expected in the closing stages of the transaction.

The deal is an acquisition of assets for Schibsted Media, who is acquiring the TV & Media Business of Telia in Sweden and Finland in an all-cash €616.24mm transaction. The deal is financed most likely with dry powder cash. In early March 2025, The Tinius Trust Foundation unloaded over 15% of its shares in Schibsted ASA, cashing in around €218mm in total, lowering the total ownership percentage from over 26% to less than 23%. This indicates that they are utilising their liquid position in Schibsted ASA to fund a part of the €616mm all-cash transaction.

Furthermore, it could be implied that since the foundation only sold shares to cover circa 30% of the transaction price, it would already have enough dry powder cash to go through with the transaction. However, it is crucial to note that this may not be the case due to the unconventional role of the foundation as the largest shareholder of Schibsted ASA. The foundation is committed to ensuring that the Schibsted Group is run such that it respects values such as free press, human rights, and democratic principles. In order to ensure this, the foundation cannot tolerate extensive equity dilution, perhaps limiting the extent to which its position in Schibsted ASA can be considered a pool of liquidity to fund other operations.

Another rationale behind the foundation’s decision to liquidate the position by the size they did is that selling off a larger portion could have sent mixed signals to the markets, making the public believe that the foundation is losing interest and/or trust in its investment in the public entity. This could in turn translate to negative sentiment regarding the stock of Schibsted ASA, and limit it as a tool for the foundation to fund its other strategic ventures, such as the acquisition of Telia’s Media & TV business, if the stock price starts falling.

No official information has been published related to post-transaction management structure at either TV4 or MTV. However, the synergies created between the rest of the portfolio and the new TV & Media Business will differ drastically compared to those under Telia’s ownership. Telia made large bets on potential synergies between its broadband services and its TV & Media business, which required for niche leadership skills to unlock them. Given that Schibsted Media’s acquisition is driven by the Tinius Trust’s goal to provide independent and unbiassed media services across the Nordics, a different set of skills may be required in the leadership of TV4 and MTV. Furthermore, as the acquiror’s media portfolio is already rather extensive in the Nordics, we may see a strategic change on how the two TV businesses are managed, moving from a more independent command structure to a more centralized one covering all the large assets in Schibsted’s media portfolio. This structural move from multiple independently ran TV & Media assets to a centralized Nordics-focused control structured would allow the foundation to reach its target through its assets more efficiently.

Final Considerations by BSMAC

Telia’s divestment of its TV & Media business represents a strategically sound move for both sides. It allows Telia to focus on its core connectivity business and deleverage, while also allowing Schibsted Media to solidify its TV & Media presence in the Nordics. Despite the challenges faced by the BSMAC team in the valuation of TV & Media as a separate business entity, caused by lack of available financial data, the Enterprise Value derived from EV/Sales multiples is roughly in line with the offer price. This transaction also serves as a testament to the industry trends of portfolio realignment, and the consolidation within the Media space. However, with the deal expected to close no earlier than Q3 2025, we have yet to witness how regulatory reviews and potential strategic shifts within Schibsted Media will unfold and impact the long-term success of the deal.

Appendix: Valuation

1. DCF Analysis

Overview: The WACC of 7.3% is calculated from the Cost of Equity, which is 10.2% (using CAPM), and the Cost of Debt, which is 4.68% pretax (estimated using a synthetic rating)

Key Observations:

- Cost of Equity:

The Beta of 1.35 is based on an industry average, as opposed to the historical standalone beta of Telia. The method is aligned with the general best practices when conducting valuations. The Equity Risk Premium of 5.4% has been sourced from the Fernandez markets survey, which is commonly used among financial professionals and accurately reflects the general market risk expectations.

- Cost of Debt:

The cost of debt was calculated using the synthetic method, incorporating interest coverage ratios to estimate spreads. This method ensures that the cost of debt is not solely based on historical borrowing costs.

Sensitivity analysis

Available below is the analysis of the changes to Equity Value under the asset-side DCF with respect to changes in WACC for a given perpetual growth rate. The lower bound WACC of 7.1% shows an Equity Value of €14.20bn ,whereas the upper bound gives a valuation of €12.78bn.

2. Comparable Company Analysis

- Due to the sale of a specific business line of Telia, the comparable companies upon which the valuation is based are gravitating towards TV & Media in their operations as opposed to solely telecommunications, so as to incorporate the appropriate level of risk that are in line with the TV & Media division.

- The companies are based in Continental Europe, with a focus on Sweden, where Telia operates.

- Given the focus on TV & Media, although of different sizes, these companies represent the closest comparables to the Target.

3. Precedent Transaction Analysis

- We conducted the analysis based on several Continental Europe based M&A transactions in the 3-year period preceding the acquisition of Telia TV & Media by Schibsted Media.

- The precedent transaction analysis yielded an average (median) EV/Sales multiple of 1.2x (1.0x), and an average (median) EV/EBITDA multiples of 3.4x (2.4x).

- Applying these multiples to the combined entity’s revenue and EBITDA resulted in a valuation significantly lower than one devised by DCF. Both the DCF equity- and asset-side-implied EV/Sales multiple is 2.5x, whereas the EV/EBITDA multiple given by DCF equity- and asset-side are 6.0x and 6.1x, respectively.

Available below are the Enterprise and Equity Values of Telia stemming from PTA.

Authors: Luka Sulejic, Felix Lehtonen, Lorenzo Montagner, Michele Rossini, Zhi Yi Chen.

Bibliography

PWC. (2024). Perspectives from the Global Entertainment & Media Outlook 2024–2028. Retrieved from https://www.pwc.com/gx/en/issues/business-model-reinvention/outlook/insights-and-perspectives.html

European Commission. (2024). The European Media Industry Outlook. Retrieved from https://digital-strategy.ec.europa.eu/en/library/european-media-industry-outlook

EY. (2025). Top five media and entertainment trends to watch in 2025. Retrieved from https://www.ey.com/en_us/insights/tmt/five-media-and-entertainment-trends-to-watch-in-2025

EY. (2024). Key trends to watch in the media and entertainment industry in 2024. Retrieved from https://www.ey.com/en_us/insights/media-entertainment/media-and-entertainment-industry-trends-2024

FTI Delta. (2024). Resurgence of Media and Entertainment M&A in 2024. Retrieved from https://www.ftidelta.com/insights/perspectives/resurgence-of-media-and-entertainment-m-and-a-in-2024

Business Wire. (2024). Vivendi: Information Regarding the Listings of Canal+, Havas and Louis Hachette Group. Retrieved from https://www.businesswire.com/news/home/20241216044436/en/Vivendi-Information-Regarding-the-Listings-of-Canal-Havas-and-Louis-Hachette-Group

Telia Company. (2025). Telia Company enters agreement to divest TV & Media business to Schibsted Media. Retrieved from https://www.teliacompany.com/en/press-releases/telia-company-enters-agreement-to-divest-tv-media-business-to-schibsted-media-2025-02-25-06-00-00

Schibsted Media. (2025). Schibsted Media agrees to acquire TV4 in Sweden and MTV in Finland from Telia Company. Retrieved from https://schibstedmedia.com/news/schibsted-media-agrees-to-acquire-tv4-in-sweden-and-mtv-in-finland-from-telia-company/

Nasdaq. (2025). Telia Company enters agreement to divest TV & Media business to Schibsted Media. Retrieved from https://view.news.eu.nasdaq.com/viewid=b3980a29bad6baf974094a5f21634564b&lang=en&src=listed

Reuters. (2025, February 25). Telia sells TV unit to Schibsted Media for $615 mln, books loss. Retrieved from https://www.reuters.com/business/media-telecom/telia-sells-tv-media-schibsted-media-615-mln-2025-02-25/

Nordicom. (n.d.). Nordicom. Retrieved from https://nordicom.gu.se

Telecoms. (n.d.). Telecoms.com – The leading provider of global news, comment and analysis for the telecommunications industry. Retrieved from https://telecoms.com

You must be logged in to post a comment.