On May 9th 2024, BBVA announced its hostile takeover bid for Banco Banco de Sabadell, aiming to acquire a 100% stake in an all-share offer valued at €11.38 billion. The acquisition could potentially create Spain’s second-largest bank surpassing the more renowned Santander. The proposed merger is expected to generate €850 million in annual synergies, primarily from cost reductions and operational streamlining, while also reinforcing BBVA’s digital leadership.

The acquisition is part of the greater European banking consolidation to create some competitive banks at a global scale. The proposed mergers have been positively received by the European Central Bank. BBVA’s bid reflects not just strategic ambition, but a vision aligned with the EU’s push for stronger, pan-European financial institutions. The aim of the article is to raise awareness on the current unique situation of such a large and fragmented sector.

Company Overview – Banco Bilbao Vizcaya Argentaria, S.A.

Banco Bilbao Vizcaya Argentaria, S.A. (BME: BBVA) is a global financial group serving more than 71 million customers in 25 countries. The company was founded in 1857 as Banco de Bilbao. Afterwards, in 1988 it merged with Banco de Vizcaya and was to adopt its current brand in 1999 following the privatization and integration of former Spanish public bank Argentaria.

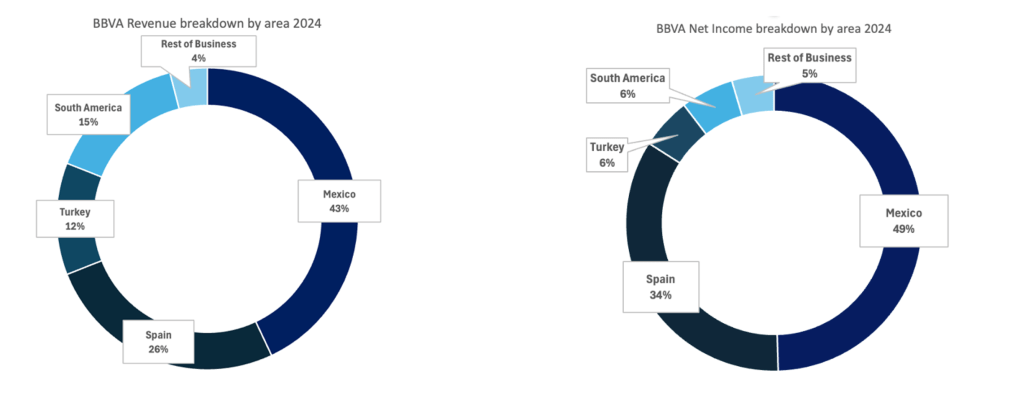

The main activities of the group revolve around four sectors: Commercial Client solutions, Retail Client solutions, Digital Banks and Corporate & Investment Banking. Each of them is carried out in five different business areas: Spain, Mexico, Turkey, South America, and Rest of Business, except for the latter (CIB), which is dealt with by BBVA in each of the 24 countries where this segment operates.

Indeed, BBVA plays a significant role in the Spanish and the Mexican markets, representing 69% of the total revenues and 84.1% of net attributable profits for 2024.

Source: Conference Call Deck 2024 BBVA

Institutional investors hold 63% of capital, Blackrock Inc. (6.8%) and Vanguard Group Inc. (4.1%) being the largest shareholders, followed by other financial institutions and sovereign wealth funds. Instead, retail investors account for 37% of outstanding shares.

Financial Analysis:

BBVA’s key financials grew steadily from FY2020 to FY2024, showing a clear expansionary path. Return In Tangible Equity (RoTE) increased by a double-digit 11.9%, ending at 19.7%, with cost-to-income ratio decreasing by more than 5% in the last four years and reaching 40%. A record customer growth (+11.4 million in 2024) and +14.3% loan growth in 2024 were the key drivers.: Capital adequacy is sound, CET1 has increased to 12.9%, with low sensitivity to market downturns. Moreover, the main liquidity ratios are solid and LCR and NSFR are well above the 100% requirements, standing at 159% and 119% respectively.

Source: FactSet, values in Millions €EUR

Company Overview – Banco de Sabadell, S.A.

Banco de Sabadell, S.A. (BME: SAB) is a Spanish banking group founded in 1881. With more than 12 million customers and 19,000 employees, it is strongly positioned in the domestic market, with an 8% share in Spanish loans and 7% in deposits.

The group’s business is split in the three macro-areas where it operates: Banking Business Spain, offering retail, business and corporate solutions; Banking Business UK, where its TSB franchise serves retail customers; Banking Business Mexico, covering its corporate and commercial segments.

The Spanish market is the most relevant in terms of revenue and profits, which account respectively for 71,5% and 83% of the totals. Nonetheless, the group expects TSB’s profitability to increase significantly in 2025 and 2026 as a result of a higher net interest income and higher cost efficiency.

Source: FY2024 Financial report Sabadell

Ownership is balanced among retail investors and institutional investors, which detain 52% of capital. The most important holdings are those of BlackRock Inc. (6,5%), Zurich Investment Management Ltd. (4,1%), and Vanguard Group Inc. (3,8%), followed by other financial institutions.

Financial Analysis:

Banco de Sabadell’s key financials regularly grew since 2020. During FY2024 net income recorded an upsurge, growing by 38.4%. Similarly, RoTE followed an increasing path, reaching 14.9% with a 14% target for 2025. The cost-to-income ratio has improved by 2.8% in FY2024, ending at 48,7%. The requirements for CET1 capital are met, the ratio stood at 13% at the end of 2024, slightly decreasing from 2023, while NPAs were progressively reduced during the same period. The liquidity ratios are well above average: LCR reached 210%, with NSFR following at 142%.

Source: FactSet, values in Millions €EUR

Valuation by BSMAC

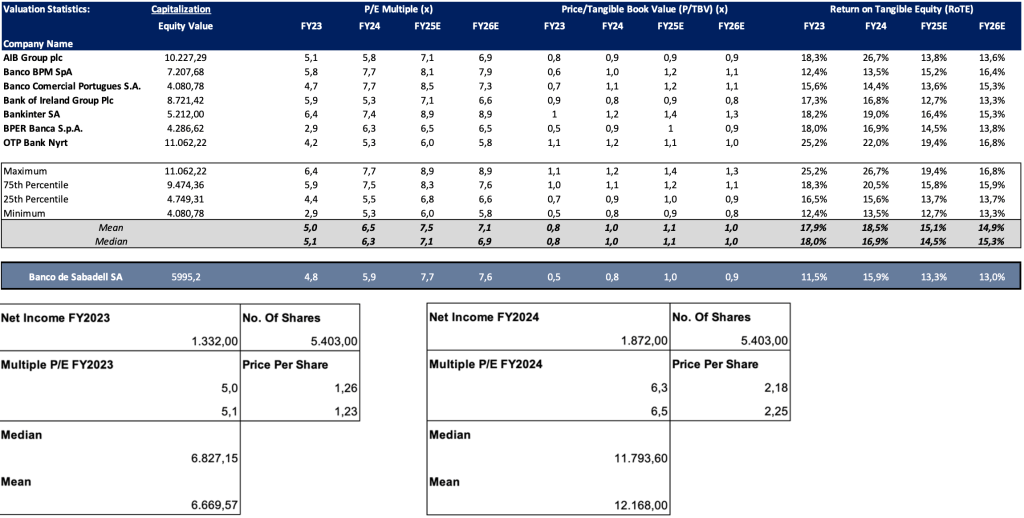

We conducted a valuation of Banco de Sabadell using market multiples and precedent transactions.

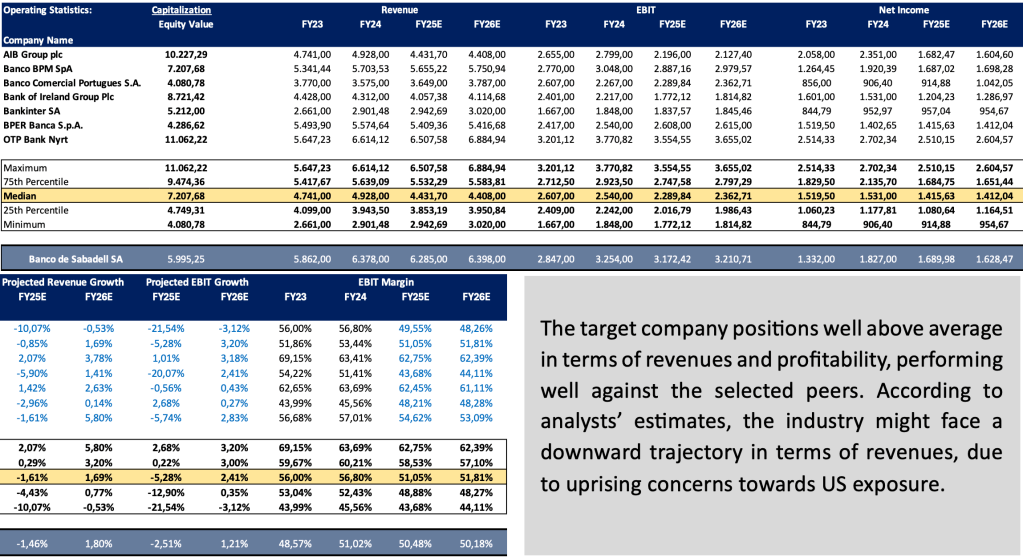

Regarding the market multiples, we focused on a selected peer group, these were the assumptions:

- Market cap between 3B and 15B of European listed banks, that are major institutions in their region.

- Comparable business model, retail and commercial banking.

- Similar geographic exposure and positioning in the respective home country.

We deliberately excluded institutions like Mediobanca and FinecoBank, despite having similar market capitalizations. Mediobanca operates primarily in investment banking and wealth management, which makes its earnings and capital structure less comparable to Sabadell’s traditional banking model. FinecoBank was also excluded due to its fintech-driven business model and reliance on fee-based income, making its valuation multiples less representative for a traditional retail and commercial bank like Sabadell. Other excluded companies were Poste Italiane, which combines logistic and insurance with banking, and Nexi, which operates in the digital payments space. The valuation relies primarily on the FY2023 figures, going back to the time of the original valuation. Moreover, we considered FY2024 consolidated results and expected 2025 and 2026 figures.

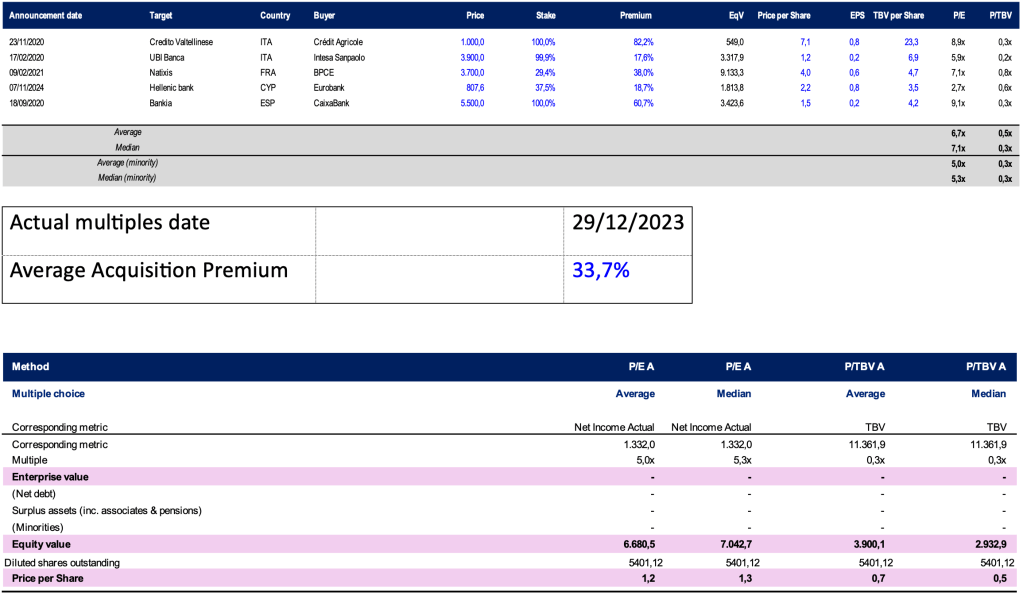

For what concerns the precedent transactions, we considered relevant M&A transactions in the FIG industry over the past 5 years. Taking into account an average 33% premium one month before the announcement of the deal, we analysed similar deals by rationale and size.

Financial overview of the selected companies:

Source: FactSet

Market Multiples:

Deal Multiples:

Assumptions: the proposed Price per Share calculated from the Trading Multiples method is in a range of €1,08 – €1,45, which is in line with the actual Price per Share as of 29th December 2023 of €1,11.

Regarding the Deal Multiples method, we did deliberately not consider the Bankia-CaixaBank deal, considering it an outlier. The proposed Price per Share derived from the Deal Multiples is in a range of €0,65 – €1,74, being the precedent transactions more diversified.

Valuation Considerations:

The comparable companies’ analysis reveals that Banco de Sabadell is trading at a discount across most valuation multiples relative to its peers. Based on its 2023 net income of $1,442 million, applying peer P/E multiples yields an implied equity value range of approximately €5.9 billion (at the 4.4x 25th percentile) to €7.8 billion (at the 5.9x 75th percentile), with a mean of €6.7 billion (5.0x). Sabadell’s actual market capitalization of €5.99 billion places it just below the lower bound of this range, reinforcing the view that it is priced toward the lower end of sector valuations. Looking specifically at P/E ratios, Sabadell’s FY2023 multiple stands at 4.8x, versus a median of 5.1x and mean of 5.4x. The same pattern appears in other valuation metrics such as Price/Tangible Book Value and Return on Tangible Equity (RoTE), where Sabadell remains below peer averages.

This consistent discount points to a modest undervaluation of Sabadell’s equity, especially considering its improving margins and solid earnings projections. Analysts generally support this view, noting that the bank’s relatively low multiples — particularly its P/E — reflect untapped value. In this light, the valuation appears conservative and could present upside, particularly if BBVA’s proposed acquisition unlocks synergies and accelerates Sabadell’s digital and operational transformation.

Market Overview

Inside Spain’s Banking Sector

Spain’s banking industry has undergone massive transformation since the 2008 financial crisis. Through a decade of mergers, acquisitions, and institutional restructuring, it has become one of the most consolidated banking markets in Europe. From over 40 major institutions in 2009, the system is now dominated by a handful of large players.

Source: S&P Global Ratings

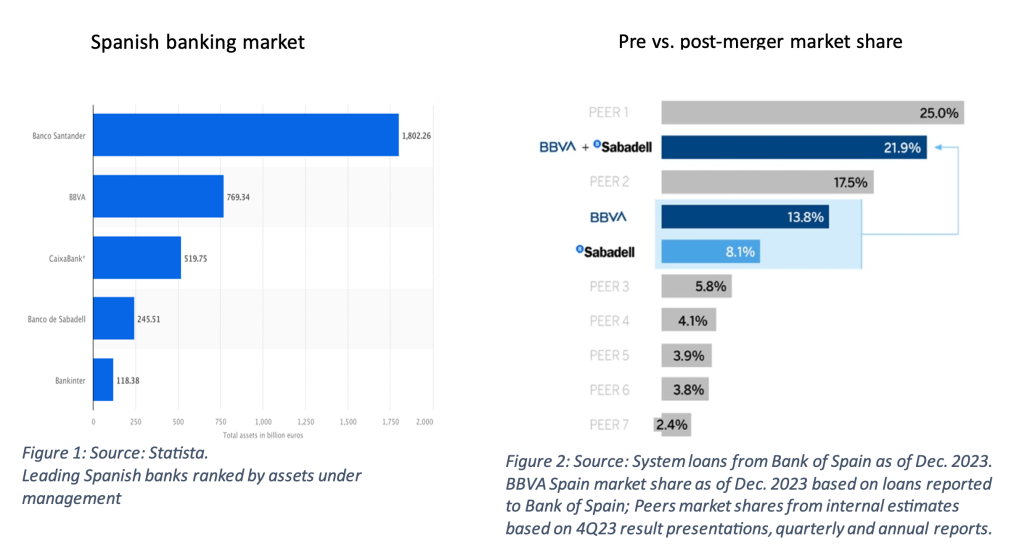

The top three banks by domestic assets as of Q3 2024 are CaixaBank (€596.4 billion), Santander (€490.0 billion), and BBVA (€441.2 billion), as shown in the S&P Global Ratings chart. These institutions have acquired and absorbed dozens of smaller savings banks (“cajas”) and lenders over the past 15 years, often under regulatory pressure or government encouragement. Mid-sized banks such as Banco Sabadell (€183.4 billion), Bankinter (€104.7 billion), and Unicaja (€93.6 billion) form the second tier. Other players like Abanca, Kutxabank, Ibercaja, and Cajamar operate with more regional profiles. According to Fitch Solutions’ 2024 report, Spain’s banking sector holds over €3.6 trillion in total assets. However, growth has slowed since the post-pandemic rebound. The current phase is defined by steady but moderate expansion, improving profitability, and a growing focus on operational efficiency.

Fitch forecasts a compound annual growth rate (CAGR) of just over 3% through 2026, largely driven by increased demand for retail and SME lending. Profitability is improving gradually, though still below pre-2008 levels. Interest rates have risen in 2023–2024, slightly driving up margins, but intense competition and rising costs limit revenues. A key priority in the industry is reducing cost-to-income ratios, mainly through digitalization and structural reforms.

One of the most defining trends is digital transformation. As of 2024, over 70% of banking customers use digital channels as their main point of contact, and more than 50% rely primarily on mobile apps, according to Statista and IMF data. Customers now expect 24/7 service, seamless onboarding, and access to a full range of products — loans, insurance, investments — through a single app. This shift is forcing traditional banks to move from relationship banking toward platform-based models. Digitalization also affects cost structures. BBVA reports that digital customers are 50% cheaper to serve and generate higher cross-sell rates than traditional ones. Spain’s broader economy supports moderate banking growth. According to the IMF, GDP is expected to grow by 2.1% in 2025, while unemployment continues to decline. However, persistent core inflation, volatile energy and food prices, and modest wage growth create uncertainty. While loan volumes are projected to rise, profitability remains under pressure due to rising costs and regulatory burdens. Monetary policy is also shifting. The ECB is winding down post-pandemic stimulus and reducing system liquidity, which has increased banks’ reliance on interbank markets and retail funding. This puts additional pressure on balance sheets and makes funding more expensive.

As consolidation continues reshaping the Spanish banking market, the regulatory environment is also evolving, oftentimes making it tougher for M&A dealmaking. Spanish banks still follow the EU’s Basel III framework, and overall capital positions remain solid — most large banks report CET1 ratios above 12%. But beyond the core banking rules, several domestic changes have started to bite. One of the biggest shifts was the introduction of a temporary tax on banks’ “extraordinary profits,” which has been extended into 2025. It pulls in around €1.5 billion a year from the sector and puts pressure on net income. Spain has also reactivated a 0.5% countercyclical capital buffer to guard against rising credit risk.

The CNMC (Spain’s competition authority) has become more active, especially around mergers. Any deal that increases market concentration or risks job losses, such as BBVA’s bid for Sabadell, will face a close scrutiny. On top of that, the Spanish government still holds “Golden Power” rights, allowing it to block or condition deals in strategic sectors like banking.

The Consolidation Wave: over the last 15 years, Spain has experienced one of the most intense consolidation cycles in European banking. According to data from the ECB via Statista, the number of credit institutions in Spain has fallen from over 360 in 2008 to fewer than 190 in 2023.

Source: European Central Bank

This dramatic reduction reflects a deliberate strategy to build stronger, more efficient, and better-capitalized institutions capable of withstanding economic shocks and competing in a digital, low-margin environment. The BBVA–Sabadell deal is the latest and most significant move in this ongoing wave. Announced in late 2024, the €12.8 billion all-share offer would position BBVA as Spain’s second-largest bank by domestic assets, overtaking Santander, and significantly expanding its footprint in SME lending and in regions like Catalonia and Valencia.

Size matters, but in fact the scope of the deal goes far beyond that. BBVA aims to integrate Sabadell into its advanced digital ecosystem and deliver €850 million in annual cost synergies by cutting branch overlap, streamlining operations, and optimizing IT systems. However, the deal faces hurdles. The CNMC has extended its review due to concerns about local market dominance. Politicians and trade unions have raised alarms about possible job cuts and reduced access to banking services. While the risk of government intervention under the “Golden Power” clause remains low, it’s not off the table. We will discuss these topics more in-depth later.

At a broader level, the BBVA–Sabadell deal is part of a much larger trend unfolding across European banking. In France, consolidation is steadily reshaping the sector, with major players like Crédit Agricole and Société Générale actively repositioning themselves through domestic mergers and strategic exits. But it’s in Italy where things have become especially dynamic. The so-called “Risiko” — the ongoing race to restructure and gain market share — has intensified. Unicredit has recently received approval from CONSOB to launch a public exchange offer (OPS) for Banco BPM, with the offer period set from April 28 to June 23. Meanwhile, Crédit Agricole has been cleared by the ECB to raise its stake in BPM to 19.9%, reinforcing its role as the bank’s largest shareholder. At the same time, other major institutions like Generali, Monte dei Paschi di Siena, and Mediobanca are part of a fluid and competitive consolidation game.

Across Europe, the pattern is clear: banks are under pressure to scale up, digitize, and drive down costs. The European Central Bank has encouraged this direction, openly supporting the creation of stronger, more competitive banking groups that can operate effectively across borders. While cross-border mergers remain rare due to regulatory hurdles, national champions are becoming the dominant model. BBVA’s move on Sabadell aligns perfectly with this trend — it is not just a bid to grow internally, but a strategic step towards building a bank that can meet the challenges of digital transformation, regulatory complexity, and tighter margins. Following this rationale, it’s more than a Spanish merger, it’s a clear reflection of the European banking sector’s next chapter.

Deal Rationale

The primary motivation for BBVA’s acquisition of Banco Sabadell is to create a more solid, competitive, and profitable banking entity capable of addressing challenges in the financial landscape. According to Morningstar, BBVA’s share of Spanish deposits would increase from 15% to 23%, crowning it as the second-biggest bank in the country and one of Europe’s largest financial institutions. Managing over €100Bn in assets combined and more than 100 million customers worldwide will increase BBVA’s ability to compete on a global scale in the banking and FinTech sector. (Figure. 1)

The merger aligns with the European Central Bank’s broader push for banking consolidation within the eurozone. The ECB has long advocated for cross-border and domestic mergers to strengthen the European banking sector, improve efficiency through economies of scale, and enhance competitiveness on the global stage.

European banks remain significantly smaller than their overseas counterparts, both in terms of market capitalization and profitability. In the last decade, they tried to grow organically, prioritizing customer acquisition and strengthening capital positions to meet stringent regulatory requirements. As interest rates begin to decline, the strategic incentive to consolidate is increasing, particularly considering evolving customer expectations for tech-driven banking and increased competition from non-traditional financial service providers. Achieving economies of scale and cross-border capabilities is becoming critical for European banks to remain competitive. The main point is they may represent a significant opportunity for the continent’s economic growth. Their size and financial strength facilitate easier access to capital for households and businesses, supporting investment and consumption.

The U.S Based competitors stand out for their substantial investments in companies developing advanced technologies, fuelling innovation and productivity. Moreover, their scale makes them more competitive and resilient in times of economic stress, helping to stabilize the broader financial system, which represents the main objective of the ECB. Finally, their international presence and reputation allow them to attract top-tier talent, which further enhances their capacity to lead and sustain long-term economic development across the continent.

By encouraging mergers like BBVA-Sabadell, the ECB hopes to foster the emergence of “European champions” that can invest in innovation, better absorb shocks, and compete more effectively with large international players. The deal is expected to generate substantial cost and revenue synergies, estimated at approximately €850 million gross per year.

In particular, the merger is expected to generate significant synergies and opportunities:

• €450 million from overhead and technology cost reductions, achieved by eliminating duplicate systems and processes.

• €300 million through personnel cost optimization.

• €80 million from reduced borrowing costs, reflecting the merged entity’s stronger financial position.

• €5 billion in increase capacity lending in the real economy.

• Expanded cross-selling opportunities across complementary customer segments, given the differing market focuses of the merging banks.

• Enhanced product offerings, leveraging the combined expertise and capabilities of both institutions.

• Greater capacity to finance larger transactions and better support for companies pursuing international expansion.

According to BBVA estimates, this transaction will increase the EPS by 3.5% from the first year after the deal, due to the cost savings that derive from synergies. The bank’s shareholders would even benefit from a higher return on invested capital (close to 20%), with a limited impact on CET1. Furthermore, the two banks combined would have nearly 7000 branches and ATMs worldwide. This is twice the number of Sabadell’s, having 1143 branches and 2500 ATMs in Q2 2024. Netting only the closure of 870 branches within a radius of less than 500 meters, customers would benefit from the exceptional capillarity of the new entity. These synergies would significantly enhance the combined entity’s profitability and efficiency, creating value for shareholders of both institutions. Given the abovementioned facts, Fitch has revised BBVA’s outlook from stable to positive, anticipating improved financial performance from the Spanish franchise, partly driven by the potential benefits of the Sabadell deal.

The combined entity would establish a formidable market position: benchmark status in Spain by volume of assets, loans, and deposits, enhanced scale to compete effectively in the European and global banking landscape, leadership in digital banking capabilities, building on both institutions’ strengths, and improved ability to invest in innovation while maintaining profitability.

Nevertheless, the deal might face some obstacles. For what concerns regulatory hurdles, the transaction requires approvals from Turkey’s and Spain’s antitrust entities. Competition concerns, particularly in regions like Catalonia and Valencia, where the combined entity would build a significant market concentration. Lastly, the Spanish government has expressed opposition to the merger based on competition concerns. Moreover, Sabadell’s CEO has warned that the merger could result in 4,000 job cuts, basing his affirmation on BBVA’s projection of saving €300 million from personnel expenses. According to analysts from the investment bank Berenberg, the Spanish bank would need to execute 3,700 layoffs to achieve its declared target.

On the other hand, BBVA is promising not to shut down branches in areas where there are few or no other banks, preventing consumers from reducing access to banking services and committing to keep their activity for at least 36 months. The merged entity is committed to maintaining commercial terms for individuals and small firms in postal codes served by fewer than four financial institutions. Additionally, it agreed to uphold all existing working capital lines for these companies for 18 months following the merger. Furthermore, it will preserve the total volume of credit available to SMEs exclusively banking with BBVA and Sabadell.

Lastly, branch closures resulting from post-merger rationalization would be limited to less than 10% of the combined branch network. These reassurances come after Spain’s National Commission on Markets and Competition (CNMC) warned of a potential risk for Spanish small and medium-sized enterprises, which could face reduced access to credit, especially in areas where the merger of the two banks would lead to excessive market dominance.

Deal Structure

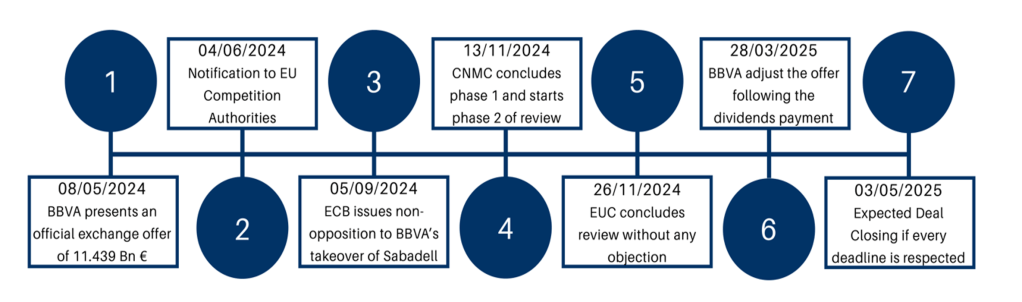

On May 1st, 2024, Banco Bilbao Vizcaya Argentaria SA (BBVA) with a private letter, launched a private and non-binding offer to the Sabadell Board worth €11.38bn which consisted of an exchange of 1 BBVA share with 4.83 Sabadell ones. Five days later, Sabadell’s board officially declined the offer and on May 8th BBVA responded by launching a public hostile tender offer directly to the shareholders. The takeover offer from BBVA, which was advised by JP morgan and UBS, was centred around the same exchange rate of 1 BBVA share for 4.83 Sabadell’s which brought the deal value slightly up to €11.439bn since the BBVA stock surged from €9.78 to €10.17 per share. The deal covered the ownership of 99.82% of Sabadell’s share capital (BBVA already owned 0.18% of Sabadell), which consisted of 5.43bn of shares, resulting in an issuance of 1.12bn of new BBVA shares. The stock issuance will represent the payment method of 94% of the deal value, whereas the rest will be paid in cash. Therefore, the deal initially valued at €11.439 billion. The offer was adjusted twice to account for dividends paid by the two banks during the process with the aim of not impacting the deal value at all. The first adjustment occurred in October, when BBVA added €0.29 in cash to its shares per 5.0196 shares, and the second in late March, when an additional €0.70 in cash was offered per 5.3456 shares. These changes have now brought the total deal value to €11.047 billion, but it does not account for the adjustment for the BBVA dividend, which should have been executed on 8th April 2025, reestablishing the initial offer of €11.38bn.

To complete the acquisition, the offer must be accepted by the majority of Sabadell’s shareholders and approved by the relevant regulatory authorities. Between June 4th and June 19th 2024, the deal was notified to various competition authorities, including the European Central Bank (ECB). The response from international regulators was mostly positive: the French, Portuguese, and Mexican competition authorities, along with the ECB, approved the transaction without requiring further inquiry. However, the process at the national level was less straightforward. On November 7th, the Spanish National Commission on Markets and Competition (CNMC) announced that the transaction would require a Phase 2 review, delaying the potential closing of the deal. In an effort to gain approval from the Spanish authority, BBVA submitted a set of commitments on November 21st. These included promises not to close branches in areas without nearby alternatives, to maintain current commercial terms for individuals and SMEs in regions with fewer than four financial institutions, and to preserve SME credit lines and total loan volumes for companies that work exclusively with BBVA and Sabadell for at least 18 months.

Once the deal is approved, the “acceptance period” for the bid will begin—likely between the second and third quarters of 2025. Final authorization will also be required from two additional institutions: the market supervisor and the Spanish government. During the acceptance period, Sabadell shareholders will have between 30 and 70 days to vote on the offer, thus the deal closing is now expected to be around May 5th per MergerMarket.

Despite continuous delays, the market is anticipating and partially pricing in a potential takeover, most analysts expect BBVA to sweeten the offer during the acceptance phase. Antonio Reale, Analyst at Bank of America, suggested that BBVA could add €1–2 billion in cash and still achieve a return on investment of 18–19%, making an improved offer more likely. However, the deal is not guaranteed at all, even if BBVA will be granted with the permit from the CNMC the government might still block a full merger between the two banks. In that instance, BBVA might be able to integrate Sabadell at a later stage, banking and supervisory sources said, and in the meantime keep Sabadell as a separate unit. Despite it not being BBVA’s favoured outcome, the bank is confident to being able to achieve most of the same cost savings.

Conclusion

The BBVA–Sabadell deal stands as a landmark moment in the ongoing reshaping of the European banking landscape. By acquiring Sabadell, BBVA aims to create a more robust, efficient, and digitally integrated institution, capable of competing with international giants and supporting Europe’s economic development. The potential benefits are considerable, enhanced by market share and customer reach to meaningful cost synergies and increased lending capacity. Moreover, the merger aligns with the European Central Bank’s push for consolidation, a necessary step to build banking groups with greater resilience, innovation capabilities, and scale. However, the road ahead is far from smooth. Regulatory hurdles and political resistance continue to cast uncertainty over the transaction. The outcome will largely depend on BBVA’s ability to balance its strategic objectives with the social and economic implications of the merger. Should the deal succeed, it would send a strong signal across Europe, that building regional champions through consolidation is no longer just a possibility, but a strategic imperative. As European banks face increasing pressure to adapt, the BBVA–Sabadell merger may well become a blueprint for the sector’s next phase. Farsighted fiscal and regulatory policies within the EU should encourage Financial Institutions to raise competitiveness and close the gap between them and large US banks. The European Union carries the burden of managing such a stratified continent, especially in this very period where extremism seems to be king. Acting as one and join forces are likely to be key drivers for the next years.

Authors: Authors: Riccardo Consalvo (Head of FIG Division), Federico Trossero, Michele Pinto, Giovanni Pio Corsini, Luigi Antonazzo, Marco Peron, Luigi Wang (Valuation Team)

Bibliography

Banco Sabadell. (n.d.). OPA. Retrieved from https://comunicacion.grupbancsabadell.com/opa/

Reuters. (2025, February 28). BBVA’s battle for Sabadell heads to next hurdle with competition regulator rule. Retrieved from https://www.reuters.com/markets/deals/bbvas-battle-sabadell-heads-next-hurdle-with-competition-regulator-rule-2025-02-28/

S&P Global Ratings. (2024, February 28). BBVA’s proposed acquisition of Banco Sabadell could strengthen its franchise and earnings diversification. Retrieved from https://www.spglobal.com/_assets/documents/ratings/research/101612105.pdf

International Monetary Fund. (2024, March). Spain: Staff Concluding Statement of the 2024 Article IV Mission. Retrieved from https://www.elibrary.imf.org/view/journals/002/2024/154/article-A001-en.xml

Banco de España. (2023, October 9). The Spanish banking sector: Recent developments and challenges. Retrieved from https://repositorio.bde.es/bitstream/123456789/34715/2/IIPP-2023-10-09-hdc-en.pdf

Statista. (n.d.). Banking sector in Spain – statistics & facts. Retrieved from https://www.statista.com/topics/7605/banking-sector-in-spain/

Santander Bank. (n.d.). The future of retail banking in Spain. Retrieved from https://www.santander.com/en/press-room/insights/the-future-of-retail-banking-in-spain

Fitch Ratings. (2024, July 8). Spanish banks to benefit from improving operating environment. Retrieved from https://www.fitchratings.com/research/banks/spanish-banks-to-benefit-from-improving-operating-environment-08-07-2024

Bank for International Settlements. (2018, October 11). Speech by Mr. Pablo Hernández de Cos, Governor of the Bank of Spain. Retrieved from https://www.bis.org/review/r181011c.pdf

Fitch Solutions. (2025, February 14). Sabadell merger would consolidate BBVA’s position as Spain’s second bank; execution risks remain. Retrieved from https://www.fitchsolutions.com/bmi/banking-financial-services/sabadell-merger-would-consolidate-bbvas-position-spains-second-bank-execution-risks-remain-14-02-2025

BBVA. (n.d.). Carlos Torres Vila: Both BBVA and Banco Sabadell shareholders will become the owners of a bank better prepared for the future. Retrieved from https://www.bbva.com/en/economy-and-finance/carlos-torres-vila-both-bbva-and-banco-sabadell-shareholders-will-become-the-owners-of-a-bank-better-prepared-for-the-future/

White & Case. (n.d.). Joined-up thinking: Could a wave of European banking consolidation be on the way? Retrieved from https://mergers.whitecase.com/highlights/joined-up-thinking-could-a-wave-of-european-banking-consolidation-be-on-the-way

Leonteq. (2025). Bank Index. Retrieved from https://www.leonteq.com/news-and-media/news/investment-themes/2025/bank-index?language_id=1

S&P Global Ratings. (2024, March 1). BBVA’s proposed acquisition of Banco Sabadell: Potential credit implications. Retrieved from https://www.spglobal.com/_assets/documents/ratings/research/101612443.pdf

El País. (2024, May 10). BBVA-Sabadell merger aided by ECB’s policy of creating European champions. Retrieved from https://english.elpais.com/economy-and-business/2024-05-10/bbva-sabadell-merger-aided-by-ecbs-policy-of-creating-european-champions.html

BBVA. (n.d.). Corporate Information. Retrieved from https://www.bbva.com/en/corporate-information/

BBVA. (2025, February). Corporate Presentation 4Q24. Retrieved from https://www.bbva.com/wp-content/uploads/2025/02/CORPORATE-PRESENTATION-4Q24-ENG.pdf

BBVA. (2021, February). 4Q20 Corporate Presentation. Retrieved from https://shareholdersandinvestors.bbva.com/wp-content/uploads/2021/02/4Q20_BBVA_Corporate_Presentation_Eng.pdf

BBVA. (2025, February). Annual Report 2024. Retrieved from https://shareholdersandinvestors.bbva.com/wp-content/uploads/2025/02/Informe-anual-2024_ENG.pdf

Wikipedia contributors. (n.d.). Banco Bilbao Vizcaya Argentaria. In Wikipedia. Retrieved from https://en.wikipedia.org/wiki/Banco_Bilbao_Vizcaya_Argentaria

S&P Capital IQ. (n.d.). Banco Bilbao Vizcaya Argentaria, S.A. Company Profile. Retrieved from https://www.capitaliq.spglobal.com/web/client#company/profile?id=4151699

S&P Capital IQ. (n.d.). Banco de Sabadell, S.A. Company Profile. Retrieved from https://www.capitaliq.spglobal.com/web/client#company/profile?id=113904

Banco Sabadell. (2025, February). 4Q24 Quarterly Financial Report (Excel). Retrieved from https://www.grupbancsabadell.com/corp/files/6000238388028/4q24_quarterly_financial_report.xlsx

Banco Sabadell. (2025, February). 4Q24 Quarterly Financial Report (PDF). Retrieved from https://www.grupbancsabadell.com/corp/files/6000238403335/4q24_quarterly_financial

You must be logged in to post a comment.