Introduction

On December 23, 2024, Nissan and Honda announced a memorandum of understanding to explore a merger by 2026, aiming to create the world’s third-largest automaker. The goal: combine R&D, electrification, and autonomy efforts to compete with rising EV giants like BYD and Tesla. But by February 2025, talks collapsed over governance disputes—particularly Honda’s push to make Nissan a subsidiary.

The failed deal underscores the urgency facing Japan’s legacy automakers amid rapid EV disruption, intensifying Chinese competition, and shifting geopolitical and consumer dynamics. This article explores the rationale, breakdown, and wider implications for the global automotive industry.

Company Overview – Nissan

Nissan Motor Co., Ltd., founded in 1933 as part of a merger between Nihon Sangyo and DAT Motors, is a Japanese multinational automaker headquartered in Yokohama. Today, the company operates under two core brands—Nissan and Infiniti—covering nearly every vehicle category, from compact cars to SUVs, light trucks, and performance models.

By the mid-2000s, Nissan was among the top five global automakers by volume, selling over 3 million units annually, a figure that peaked above 5.8 million in 2018. The company made its international mark by offering affordable, reliable vehicles, such as the Sentra, Altima, and Rogue, which became staples in the U.S. market. Nissan also maintains a significant manufacturing footprint, with over 30 production facilities worldwide, including major plants in Japan, the U.S., China, Mexico, and the UK.

Nissan distinguished itself as an early innovator in electric mobility with the launch of the Nissan LEAF in 2010, the world’s first mass-produced electric vehicle. The LEAF went on to sell over 500,000 units globally, positioning Nissan as a leader in EV adoption during the early 2010s. Though the company’s early momentum in electrification has slowed in recent years, its foundational role in bringing EVs to market remains a notable achievement in automotive history.

Business Evolution and Alliance Strategy:

After rapid global growth in the 1970s and 1980s, Nissan entered the 1990s with over ¥2 trillion (~US$$18 billion at the time) in debt and just 1.4% operating margin. In 1999, Renault acquired a 36.8% stake in Nissan for ¥643 billion (~US$5.4 billion), forming the Renault-Nissan Alliance. Under Carlos Ghosn, Nissan cut 21,000 jobs, closed 5 domestic plants, and slashed purchasing costs by 20%, returning to profitability by FY2001.

The alliance generated major synergies—saving over €5 billion annually by the 2010s—but structural imbalances persisted: Renault had voting control over Nissan, while Nissan’s 15% stake in Renault carried no voting rights. After Ghosn’s arrest in 2018, trust eroded rapidly. In 2023, the companies agreed to rebalance their cross-holdings: Renault reduced its stake to 15%, and transferred the excess 28.4% to a French trust with suspended voting rights, effectively creating parity between the firms.

The new structure gives Nissan more freedom to chart its strategic path, especially in EV and software development, while still allowing collaboration in shared platforms and procurement. With global alliance vehicle sales having peaked at over 10.6 million units in 2017, the question remains whether this reshaped partnership can remain competitive in a fragmented, fast-moving industry.

Performance and Market Position:

As of FY2023, Nissan employed approximately 133,000 people worldwide and recorded global vehicle sales of 3.37 million units, representing a modest 4.1% year-over-year increase, yet still well below the 5.8 million units sold in FY2018. The company’s global market share has slipped to around 4%, with notable declines in key regions. In the U.S., Nissan’s market share fell from over 8.5% in 2017 to around 5.8% in 2023, while in Europe, it hovers below 2%, undermining the brand’s relevance in developed markets.

Profitability remains a major concern. Operating margin for FY2022 stood at 2.6%, compared to 6–10% margins enjoyed by Toyota and Hyundai. In response, Nissan has implemented aggressive cost-cutting initiatives, including the closure of underperforming plants, a reduction in global production capacity by 20%, and a 30% reduction in the number of nameplates offered globally by 2024.

Despite these efforts, the company continues to lag in critical areas such as EV scalability, digital ecosystem integration, and brand equity. While rivals invest heavily in vertically integrated EV platforms and software-defined vehicles, Nissan’s slower rollout of next-generation products has left it playing catch-up. The firm’s mid-term plan targets operating margin improvement to 5% by FY2026, but execution remains uncertain in a hyper-competitive environment.

A Look into the Supply Chain:

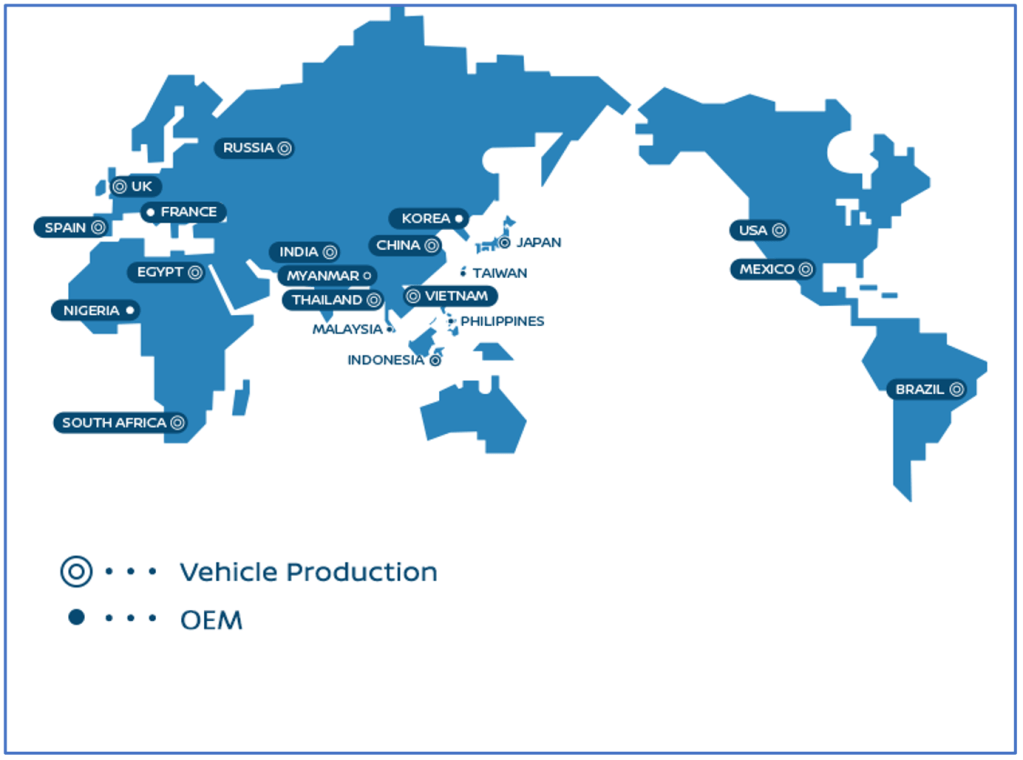

Nissan operates a global manufacturing and sourcing network, with over 35 production facilities across key regions including Japan, the United States, China, Mexico, India, Spain, and the United Kingdom. Collectively, these plants have an estimated annual production capacity exceeding 5 million vehicles, although actual output in FY2023 stood at just over 3.3 million units, reflecting strategic downsizing in response to shifting demand and cost pressures. The company’s manufacturing strategy is based on a hybrid model combining in-house assembly with a global supplier network spanning over 6,000 suppliers.

Nissan sources key components—semiconductors, lithium-ion battery packs, drive control units, and infotainment systems—primarily from East and Southeast Asia. The automaker relies heavily on Tier 1 and Tier 2 suppliers in China, South Korea, Thailand, Malaysia, and increasingly, Vietnam, particularly for semiconductors and electronic modules. For example, lithium-ion cells used in the LEAF and Ariya are supplied by Envision AESC, a former Nissan subsidiary with facilities in China, the UK, and the U.S.

To mitigate long-term risk, Nissan has launched local sourcing initiatives in North America and Europe, targeting a 20% increase in local content by 2025. Additionally, it has begun rolling out digital procurement platforms to enhance supply chain visibility and agility. Pilot programs in the U.S. and UK aim to integrate real-time tracking of component flows and supplier health metrics, though full-scale implementation remains uneven. Emerging markets, in particular, face challenges related to digital infrastructure and supplier compliance. Despite these efforts, Nissan’s supply chain remains exposed to volatility in raw material prices, currency fluctuations, and global logistics bottlenecks.

Source: Nissan Motor Co.

EV Transition, Threats, and Opportunities:

Nissan was one of the first movers in electric vehicles with the launch of the LEAF in 2010, selling over 500,000 units globally by 2020. However, the company failed to build on that lead. By 2023, LEAF sales had dropped below 50,000 units, while Tesla and BYD reached 1.8 million and 1.5 million EV units sold respectively. Nissan’s current EV portfolio is limited, with only the LEAF and the Ariya, resulting in a global EV market share of < 2%.

The recent appointment of Ivan Espinosa as CEO reflects a renewed push for competitiveness in the EV space. His priorities include faster product cycles and platform consolidation. With global EV sales expected to exceed 60 million units by 2030, Nissan has a window to regain relevance—but only if it accelerates execution, strengthens its pipeline, and leverages the flexibility gained from its rebalanced alliance with Renault.

Company Overview – Honda

Founded in 1948, Honda Motor Company is a leading manufacturer of automobiles and motorcycles, headquartered in Tokyo, Japan. Its mechanical breakthroughs in motorcycle manufacturing quickly led it to expand into the automotive industry. Honda’s first cars were known for their technological advancements, fuel efficiency, and lightweight design—marking the beginning of Honda’s commitment to producing reliable, high-quality vehicles.

In the 1990s, the release of SUV and minivan models helped the company gain significant traction in North America and solidify its status as a top global manufacturer. Today, Honda is the world’s largest producer of internal combustion engines, with an annual output exceeding 14 million units. It stands as Japan’s second-largest automobile manufacturer, although its operations span far beyond automobiles alone.

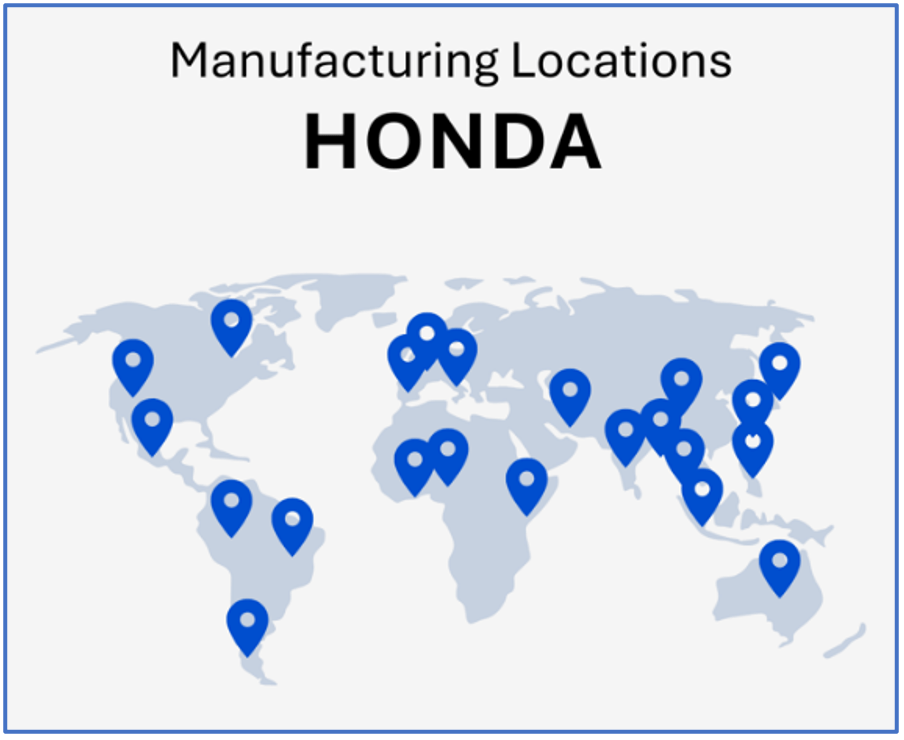

In the past, Honda forged strategic partnerships and joint ventures with companies like Dongfeng Motor Corporation and Guangzhou Automobile Group to strengthen its foothold in the Chinese market. More recently, Honda has focused on acquiring software and navigation system startups to bolster its digital capabilities. With over 30 manufacturing facilities worldwide, Honda continues to invest heavily in electric vehicle production and hydrogen fuel cell technology.

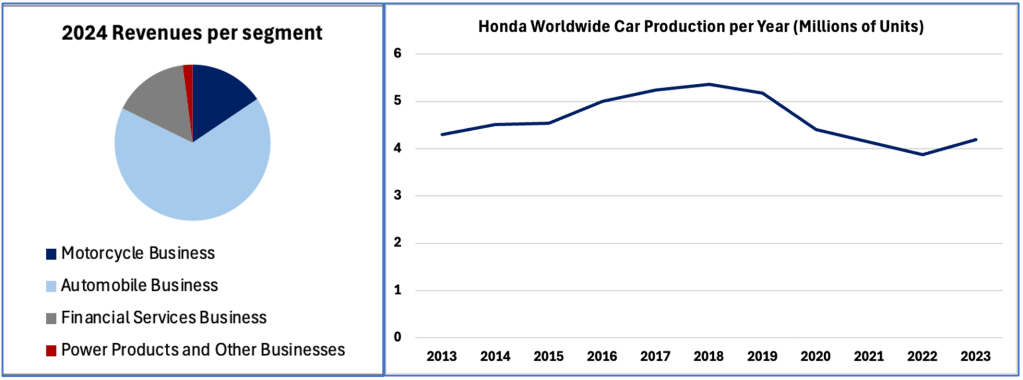

In addition to automobiles, Honda’s operations extend into power products, including generators, lawn mowers, and other vehicle-related services. While automotive sales are the company’s primary revenue source, its motorcycle segment remains the most profitable, while its Power Products and other business segments operate at a loss. Honda has achieved several notable milestones, such as becoming the first Japanese company to be a net exporter from the United States, the first automaker to establish a distinct luxury brand, and the first to produce a humanoid robot capable of performing tasks like climbing stairs.

Supply Chain and Manufacturing:

Honda’s supply chain and manufacturing operations are highly decentralized, providing the flexibility to adapt quickly to local market conditions. With major production facilities in Europe, the U.S., China, and Japan—alongside smaller facilities in Africa, Asia, South America, and Indonesia—Honda effectively minimizes transportation costs and avoids tariffs while maintaining a strong presence and responding rapidly to the preferences of key markets. This strategic approach also allows the company to remain agile in its operations.

Honda focuses on cost reduction by optimizing inventory management and creating efficient production lines. The company works closely with its suppliers to use recycled materials, reduce waste, and minimize environmental impact. Since 2004, all of Honda’s vehicles have been at least 90% recyclable.

To incentivize improved practices, Honda has implemented an award system with three categories: value, sustainability, and quality/delivery. This system recognizes suppliers who excel in these areas, fostering a more efficient and sustainable supply chain overall.

Financial Performance:

Honda’s financial performance has greatly benefited from its diversified product line, allowing the company to navigate recent global disruptions with relative success. Earnings in Asia and North America have remained robust, helping to cushion the impact of various challenges. However, Honda’s investments in new energy technologies and electric vehicle (EV) production have yet to be reflected in strong sales, causing the company to lag behind its competitors. Despite its long-standing reputation for innovation and high-quality products, customers have been slow to embrace Honda’s hybrid and electric models. That said, Honda’s strategic alliances and ongoing work in fuel cell development still offer opportunities to strengthen its position in the rapidly growing EV market.

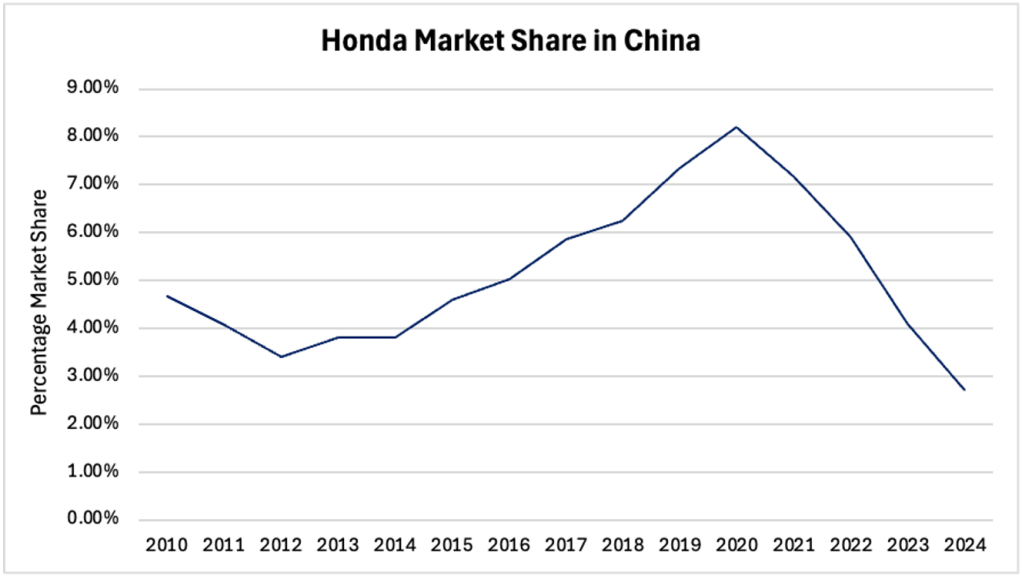

A significant financial challenge for Honda at present is its declining performance in the Chinese market. Staying competitive in China has become increasingly costly, particularly in the EV segment, where both local and American automakers are gaining significant market share. Honda has struggled to keep up with competitors such as BYD, Tesla, and Toyota in the development of hybrids and EVs. The ongoing loss of market share in China, which has been steadily falling since 2020, underscores the need for Honda to reassess and update its approach to this key market.

Market Overview

The global automotive industry in 2025 is being reshaped by a number of factors including electrification, geopolitical fragmentation, shifting consumer demands, and the aggressive rise of new players—especially from China. While vehicle sales have gradually recovered from the COVID-19 lows of 2020, it is crucial to look at the category of cars sold. Electric vehicles (EVs) now account for 16.5% of new global car sales, up from just 3% in 2019, signalling the irreversible decline of the internal combustion engine.

China has emerged as the biggest player in this shift. Over half of all new vehicles sold there in 2024 were electric or hybrid, and local manufacturers like BYD, NIO, XPeng, and Geely are now expanding aggressively overseas. BYD overtook Volkswagen as the best-selling brand in China in 2023, marking a historic power shift. Backed by state subsidies, vertically integrated supply chains, and cost competitiveness, Chinese automakers are outpacing legacy automakers in both speed and scale.

Japanese automakers who were once the model of efficiency and quality are under enormous pressure. In China, Toyota, Honda, and Nissan each reported double-digit sales declines in 2024. Despite pioneering hybrid technology, their hesitation on full EV adoption has left them vulnerable. Nissan, once an early leader with the 2010 LEAF, failed to build momentum. Honda’s EV portfolio remains thin and heavily reliant on partnerships like its Ultium alliance with GM. Toyota, the largest by volume, only launched its mass-market EVs in 2022. The proposed Nissan–Honda merger was a reaction to this lag: a bid to consolidate R&D, scale battery investments, and regain competitiveness against faster-moving rivals. Compounding these challenges, Chinese automakers are outcompeting rivals in production costs, offering EVs at significantly lower price points. For instance, BYD’s Seagull model is priced around $10,000, while many U.S. electric vehicles cost an average of $55,000. This substantial price difference has intensified the competitive landscape, further pressuring Japanese manufacturers to adapt swiftly.

Adding to the pressure is a volatile geopolitical landscape. In March 2025, the Trump administration reintroduced 25% tariffs on non-North American vehicles and components, directly impacting Japanese exports to their most profitable market—the United States. China retaliated with tariffs on U.S.-made vehicles, escalating the risk of a trade war. Meanwhile, U.S. industrial policy under the Inflation Reduction Act incentivizes domestic EV production, further sidelining foreign automakers unless they localize operations at significant cost. In early April 2025, the Trump administration escalated trade tensions by imposing a 104% tariff on Chinese goods; in response, China announced an 84% tariff on U.S. goods, intensifying the trade conflict and leading to significant volatility in global financial markets. The automotive industry faces increased uncertainty as these tariffs not only disrupt supply chains but also raise costs for manufacturers relying on international trade.

Consumer behaviour is also rapidly evolving. Younger, urban buyers increasingly favor electric and connected vehicles, prioritizing range, software, and autonomy over brand heritage. Tesla has redefined the modern car as a rolling software platform, with competitors scrambling to match its tech stack and update cycle. While Nissan and Honda have introduced systems like ProPILOT and Honda Sensing, their autonomy and UI offerings still trail leaders like Tesla, BYD, and Mercedes.

The new competitive landscape is defined by four structural forces: the global pivot to EVs, trade and regulatory fragmentation, a shift to software-defined vehicles, and the rapid global expansion of Chinese automakers. The failed Nissan–Honda merger is best understood through the aforementioned factors, but this deal also revealed the deeper structural inertia within Japan’s auto sector at a time when flexibility, scale, and speed are more critical than ever.

What a Merged Nissan and Honda Would Have Looked Like

Had the two Japanese carmakers merged, they would have formed a US$~60Bn behemoth, fourth in the world in vehicle sales behind Toyota, Volkswagen, and Hyundai. The combined entity would have initially employed approximately 400,000 people and produced over half a million units just last month. The new entity’s added scale would have increased its competitiveness, given the pressures from Chinese EVs and US tariffs threatening their two largest foreign markets.

Both companies would have strategically benefitted from each other’s unique capabilities. For instance, Nissan has the full-size SUV frame from the Armada, a market where Honda does not compete. On the other hand, Honda’s CR-V is among the worldwide leaders in the midsize SUV market segment. Also, Honda was the world leader in motorcycle sales in 2024, nearing 10 million units, a segment where Nissan lacks a presence entirely.

Furthermore, a merger would have consolidated their varying presence by region. For instance, their combined market share in the United States would place them among the leading three automakers in the country, with ~16% of nationwide sales. Also, Nissan is among the leaders in automotive sales in South America, with the Nissan Versa and the Nissan Kicks ranking 5th and 8th by sales, respectively. At the same time, Honda has a more substantial presence in the Asian market.

Indicative Valuation

Methodologies:

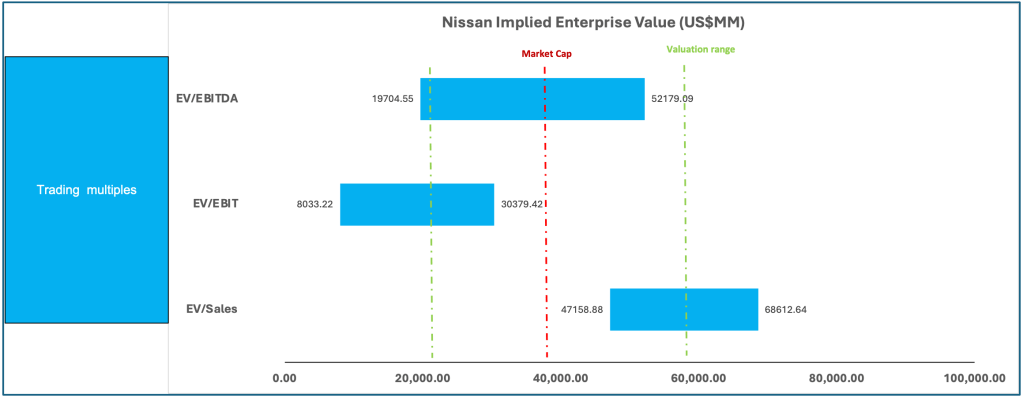

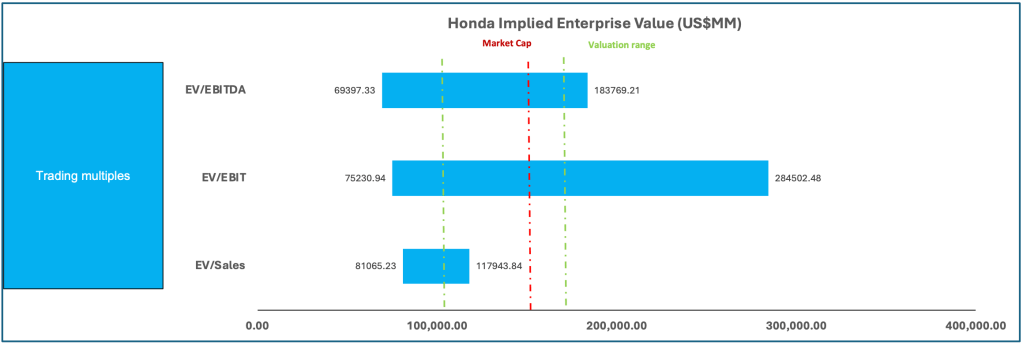

We employed comparable company analysis to value Nissan and Honda. We used the same universe of comparables for both, primarily focusing on global automakers. The images attached below summarize our findings.

We estimate the median multiples on EV/Sales as 0.62x, on EV/EBIT as 9.60x, and on EV/EBITDA as 7.26x. These findings yield valuation ranges for Nissan and Honda’s enterprise value, which we summarize in the following football fields.

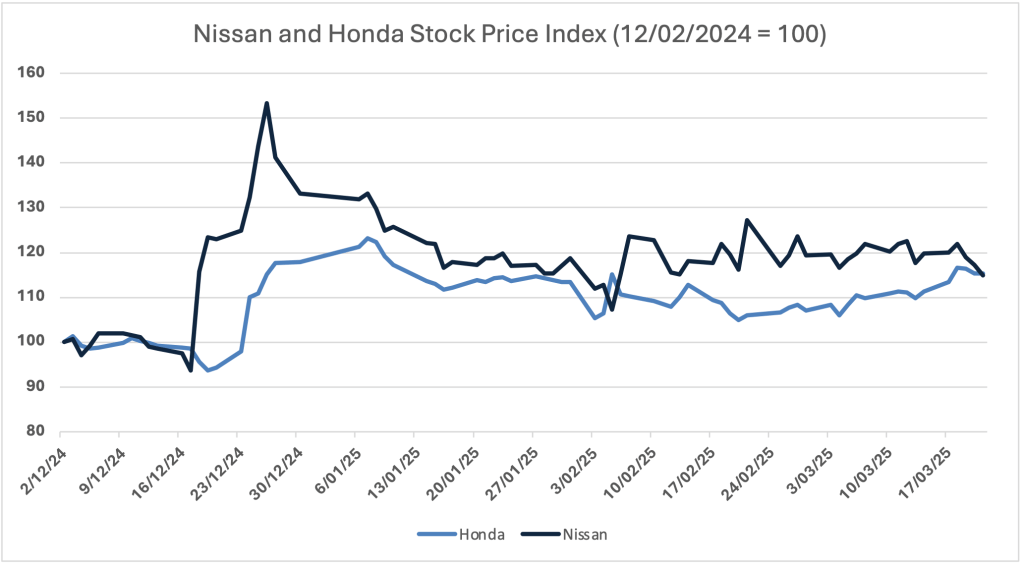

Event Study

The first news about the merger came out on December 17th, 2024. The Financial Times and several other newspapers, including the Nikkei Asia, reported that the two companies were holding exploratory talks. The market’s immediate reaction was reflected primarily in Nissan’s stock performance: It experienced an impressive +23% day-to-day price increase and climbed more than 6% the next day. On the contrary, Honda’s investors didn’t take it particularly well, as the company shed 3% in value.

The two companies’ official announcement came on December 23rd, and this time, both stocks surged: Nissan enjoyed a healthy +6%, while Honda boasted a more than 12% hike.

Nissan shares continued to rally until December 26th; by that point the stock had gained 63% in less than 2 weeks. The stock backtracked in the next few weeks, losing 30% from the Dec 26th peak. On the other hand, Honda experienced a more prolonged but less steep increase, and at its January 7th peak, the stock had gained 25% since December 13th.

After Honda modified its original proposal, demanding that Nissan become a subsidiary, the two parties halted talks. The official announcement from both parties came a week later, on the 13th. Nissan investors reacted positively, and the stock added 7% in value, while Honda lost 4%, as the market saw the rejected plans most favourable for Honda.

Renault and Mitsubishi, heavily involved third parties, reacted very differently. Renault, which has had a multi-decade collaboration with Nissan and owns around a third of the Japanese carmakers, was indifferent to the events and showed no significant correlation. Mitsubishi, where Nissan holds a 27% stake, conversely mirrored Nissan’s movements.

The Merger’s Ultimate Failure

Honda entered negotiations with a leading position for the same reasons the merger would have relieved Nissan from years of declining sales. So, when discussing Nissan’s role in the merger, the companies’ leadership ultimately disagreed.

Nissan’s board walked away from Honda’s “take it or leave it” offer to become a wholly owned subsidiary, clinging to hopes for a merger of equals. Simultaneously, Honda was critical of Nissan’s slow-moving restructuring, which they deemed essential for the merger. Consequently, the memorandum of understanding to join forces was terminated, as Nissan stated in early February of this year.

The collapsed merger talks have opened the door for Nissan to seek partnerships elsewhere to revitalize the declining legacy automaker. Among the names thrown around is Foxconn, boasting an EV division led by Nissan’s former No.3 executive.

Authors: Emilio Cornejo, Aimen Beloued, Alberto Jimenez, Gianfranco Soverigno, Gioacchino La Rosa, Mikolai Nowakowski, Tommaso Denaro.

Bibliography:

Financial Times (2025) ‘Honda and Nissan unveil plan for $58bn merger by 2026’. Financial Times. Available at: https://www.ft.com/content/dbad4d4d-effc-4926-b2c7-c573d5d6deca

Financial Times (2025) ‘Nissan pushes out chief Makoto Uchida after collapse of Honda merger talks’. Financial Times. Available at: https://www.ft.com/content/c8dedea4-5410-461b-90ec-8ea734f4c60b

Financial Times (2025) ‘Nissan and Honda hold merger talks’. Financial Times. Available at: https://www.ft.com/content/bb17e194-d518-4f61-8efa-104b2fa0dc81

Financial Times (2025) ‘Honda open to resuming Nissan talks if Japanese rival’s chief executive steps down’. Financial Times. Available at: https://www.ft.com/content/bddf8c35-5594-49f1-9855-674ba449514b

Financial Times (2025) ‘What the Nissan-Honda merger talks mean for Japan Inc’. Financial Times. Available at: https://www.ft.com/content/696b4d53-1415-47ae-a832-b2a6ceb4cc77

Financial Times (2025) ‘Nissan searches for new partner as $58bn Honda merger talks collapse’. Financial Times. Available at: https://www.ft.com/content/75ba40d6-2e97-40d2-8d3e-df0d950178cb

CNN (2025) ‘Carmakers Nissan and Honda call off merger talks’. CNN Business. Available at: https://edition.cnn.com/2025/02/13/cars/japan-nissan-honda-merger-talks-ended-hnk-intl/index.html

CNN (2025) ‘Nissan says is in “various discussions” with Honda after reports the two will end merger talks’. CNN Business. Available at: https://edition.cnn.com/2025/02/05/business/nissan-honda-merger-talks-intl/index.html

CNN (2024) ‘Nissan and Honda announce merger plans to create world’s no. 3 automaker’. CNN Business. Available at: https://edition.cnn.com/2024/12/23/business/nissan-honda-merge-automakers-intl-hnk/index.html

CNN (2024) ‘Honda and Nissan are in merger talks’. CNN Business. Available at: https://edition.cnn.com/2024/12/17/business/honda-nissan-merger-talks/index.html

Car and Driver (n.d.) Nissan Vehicles: Reviews, Pricing, and Specs. Available at: https://www.caranddriver.com/nissan

Car and Driver (n.d.) Honda Vehicles: Reviews, Pricing, and Specs. Available at: https://www.caranddriver.com/honda

Nissan Motor Co. (2025) Nissan and Honda terminate MOU for consideration of business integration. Available at: https://global.nissannews.com/en/releases/250213-00-e

Honda Motor Co. (2024) Nissan and Honda sign MOU to consider business integration. Available at: https://hondanews.com/en-US/honda-corporate/releases/release-9a77be77e8b9566b9b0d7fa91d016681-nissan-and-honda-sign-mou-to-consider-business-integration

The Guardian (2025) Nissan and Honda end $60bn merger talks. Available at: https://www.theguardian.com/business/2025/feb/13/nissan-honda-end-60bn-merger-talks

The Guardian (2025) Honda and Nissan’s £48bn merger ‘close to collapse’; UK borrowing costs lowest since December in boost for Reeves – as it happened. Available at: https://www.theguardian.com/business/live/2025/feb/05/uk-new-car-sales-fall-again-yuan-slips-us-china-trade-tensions-uk-economy-business-live-news

Reuters (2025) How Nissan and Honda’s $60 billion merger talks collapsed. Available at: https://www.reuters.com/markets/deals/inside-collapse-nissan-hondas-60-billion-mega-deal-2025-02-12/

Reuters (2025) Nissan, Honda may call off merger talks, Asahi says. Available at: https://www.reuters.com/markets/deals/nissan-honda-may-call-off-merger-talks-asahi-says-2025-02-04/

The Nikkei (2025) ‘Honda, Nissan abandon merger plan after failing to agree on preconditions’. The Nikkei. Available at: https://asia.nikkei.com/Business/Business-deals/Honda-Nissan-abandon-merger-plan-after-failing-to-agree-on-preconditions

The Nikkei (2025) ‘Nissan to suspend merger talks with Honda’. The Nikkei. Available at: https://asia.nikkei.com/Business/Business-deals/Nissan-to-suspend-merger-talks-with-Honda

Encyclopaedia Britannica (2025) ‘Nissan Motor Co., Ltd. | History & Facts’. Britannica Money. Available at: https://www.britannica.com/money/Nissan-Motor-Co-Ltd

Encyclopaedia Britannica (2025) ‘Honda Motor Company, Ltd. | Definition, History, & Facts’. Britannica Money. Available at: https://www.britannica.com/money/Honda-Motor-Company-Ltd

FactSet (n.d.) ‘Deal Detail: Nissan and Honda Merger’. FactSet. Available at: https://my.apps.factset.com/workstation/navigator/deals/deal-detail/4228057MM

FactSet (n.d.) ‘FactSet Charting Tool’. FactSet. Available at: https://my.apps.factset.com/workstation/charting/

You must be logged in to post a comment.