Introduction

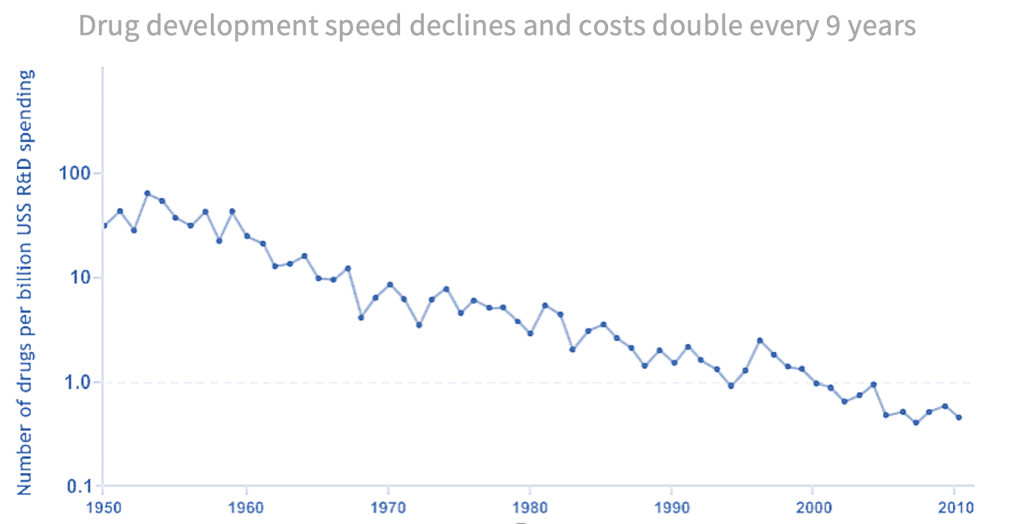

Although improvements in medical technology have accelerated at breakneck speed over the past decades, drug discovery has been seemingly inverting this trend. Since the 1950s, the chances of a drug successfully passing clinical trials and becoming a new molecular entity (NME) have been steadily declining. This was the observation that researchers at Sanford Bernstein first published a paper on in the early 2010s, humorously titling it “Eroom’s Law”, Moore’s Law, but backwards. Unlike its tech counterpart, which states that the number of transistors on an integrated circuit roughly doubles every two years, Eroom’s Law highlights the opposite effect in the pharma industry: the speed of drug development is declining, and the costs associated with that development are roughly doubling every nine years.

Eroom’s law

| Source: Nature (2012), Diagnosing the decline in pharmaceutical R&D efficiency |

But around 2010, that downward spiral began to reverse. By 2018, companies were launching 0.7 more NMEs for every billion dollars spent on R&D, a small, but meaningful shift. We see this change not just with the raw count but also the value-weighted count of drugs. All signs point to the trend reversing over the last ten years. So, what changed? Two things: the data got better, and pharma companies have gotten far better at using i

For the latter, we now know that several cognitive biases can be particularly important in drug R&D, including overvaluing optionality, optimism bias, and loss aversion, which can set the threshold to terminate failing programs at too high a level. For the former, we notice an increasing emphasis on the use of human genetic data in understanding disease[1].

The Clinical Trial Bottleneck

While advancements in biotech, including AI-led drug discovery, have significantly accelerated the early stages of research and preclinical validation, passing the clinical stage remains the most difficult and resource-intensive barrier for biotech firms. Most of the strain associated with clinical development revolves around high attrition rates, strict regulatory scrutiny, and unpredictable human responses, none of which can be mitigated by technology alone.

| Source: DiMasi et al.’s (2016) |

One of the problems surrounding biotech is the fact that predicting the success of a molecule making it through clinical trials is completely unrealistic. Our best approximations rely on primitive methods, like looking at the average probability of passing a clinical development phase and just guessing based off that. Another challenge AI biotech faces is translating predictive accuracy from computational models into clinical outcomes. While AI algorithms can rapidly identify promising drug candidates based on large datasets, real-world biological systems are immensely complex and often unpredictable.

There’s also a notable tension between innovation speed and trial duration. AI’s biggest promise lies in claims of accelerating discovery tenfold, even twenty times over, but clinical trials are inherently lengthy and rigorous. Phase II and III trials can cost tens to hundreds of millions and span 3 to 7 years. A lack of cash runway, drier funding environment, and general investor impatience means that these two contradictory timelines can never reconcile and have led many AI biotech startups to crash and burn before getting to keep true to their promises.

Company Overview – Recursion Pharmaceuticals

In 2009, Recursion co-founder Christopher C. Gibson discovered just how complex these real-world biological systems really can be. A failure in a research experiment studying a brain disease called cerebral cavernous malformation (CCM) led him to take on a different approach than the tried-and-tested methods his lab researcher peers had:

„I convinced our lab to engineer a phenotypic screen of thousands of drugs applied to diseased and healthy cells, using machine learning (ML) to detect subtle differences in the ways cells appeared under a microscope in a more objective and quantifiable way. We then asked humans to compete against the machine. It turned out that our ML algorithm had a much higher probability of predicting hits (…) than humans,” Gibson said in a follow-up interview with the University of Utah.

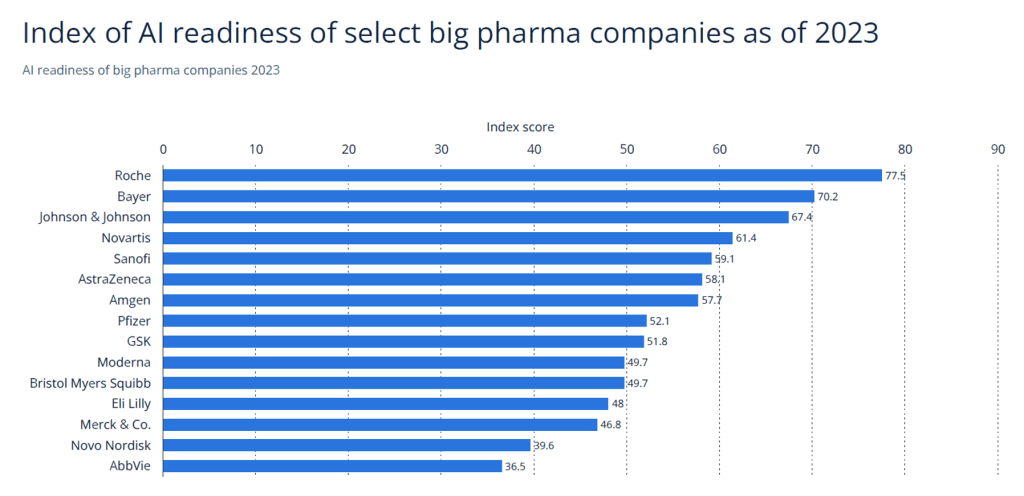

This experiment was a turning point in the researcher’s career, and out of his idea was born Recursion Pharmaceuticals in 2013. Fast forward a decade, and Recursion has emerged as a key player in the newly-defined sector of techbio, employing hundreds of life scientists working alongside computer scientists and engineers. “When we founded the company, Recursion was one of only a handful of companies attempting to harness technology to improve drug discovery,” Gibson wrote. “Today (…) we’re at the forefront of an entirely new sector known as techbio. (…) together we’re not only building a company, we’re also building an entire category,” he noted. Their strategy paid off, with Recursion having now secured partnerships with heavyweight pharma players including Bayer and Roche-Genentech.

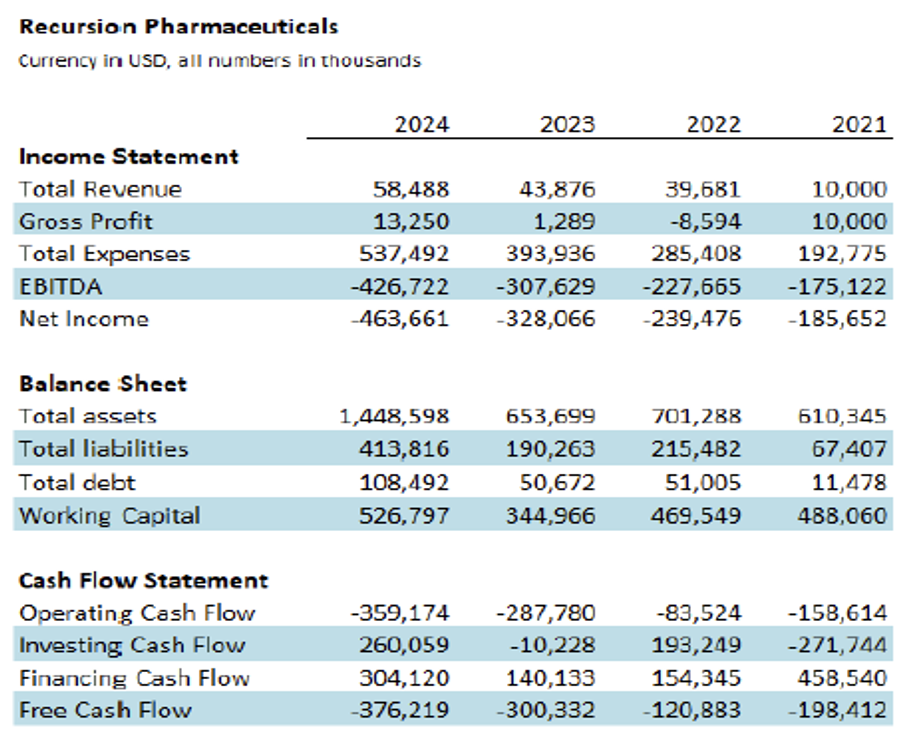

Since Recursion is a clinical stage biotech/techbio company heavily relying on in-house drug discovery and development, R&D costs have been steadily increasing YoY, thus ranking the company among the top investors in pharma as of 2023. From its outset in 2013, Recursion Pharmaceuticals was involved in multiple mergers and acquisitions, including the buyouts of two companies in May 2023: Valence, focused on applying deep learning to drug design, was acquired for $47.5M, and Cyclica, specialized in AI-enabled drug discovery, for $40.0M.

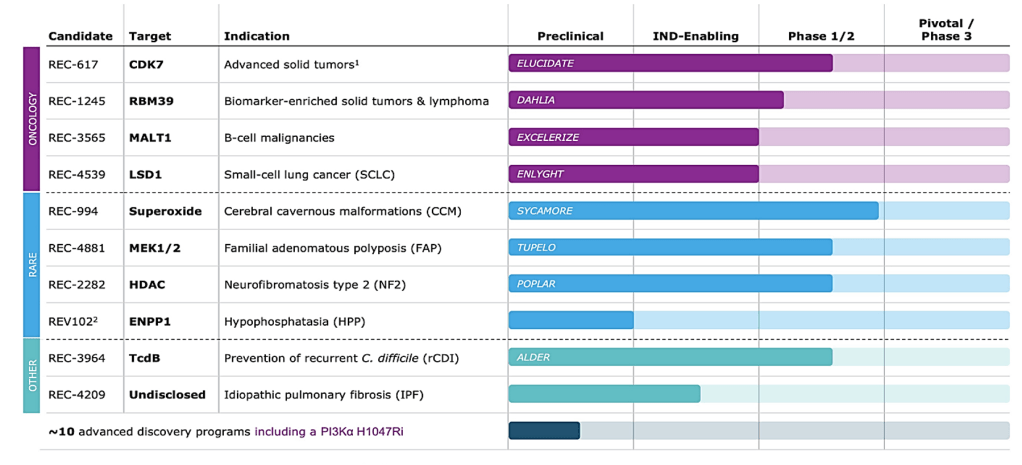

In terms of its drug discovery program, the company present the following pipeline:

| Source: Recursion Press Release |

Company Overview – Exscientia PLC

When Andrew Hopkins and Tim Guilliams launched Exscientia back in 2012, “AI drug discovery” was barely even buzzword-worthy. Yet, within a few short years, their vision transformed Exscientia from niche curiosity into a leading biotech/techbio firm. By 2018, Exscientia became the first firm to advance an AI-designed molecule into clinical trials, an industry milestone that, at the time, sounded suspiciously like science fiction.

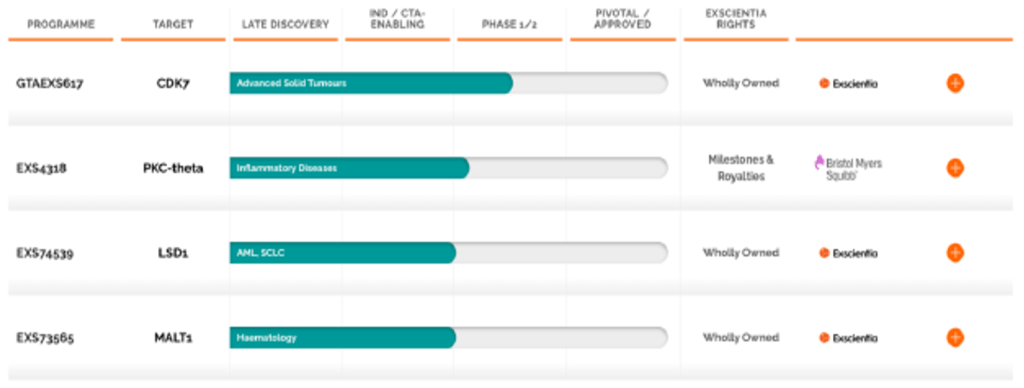

| Source: Exscientia Press Release |

The usual small-molecule drug discovery process involves high-throughput screening (HTS), which has an estimated hit rate of around .01%. Many parameters need to be considered at this stage of the process, from potency to physicochemical characteristics and safety need to be considered. The role of AI is to make several stages of this process simpler, and Exscientia was one of the first to do it in 2018. The Exscientia platform can analyse data from patient tissue samples to understand the mechanisms of disease at much more complex levels. This aids in the ability to identify potential biomarkers to predict a drug response.

A notable drug which Exscientia has discovered and developed for immune-mediated diseases is their PKC-theta inhibitor, EXS4318. The drug entered Phase 1 clinical trials in 2023 with positive early safety and efficacy results announced in mid-2024. Exscientia also partnered with Sanofi and Merck to work on small-molecule candidates.

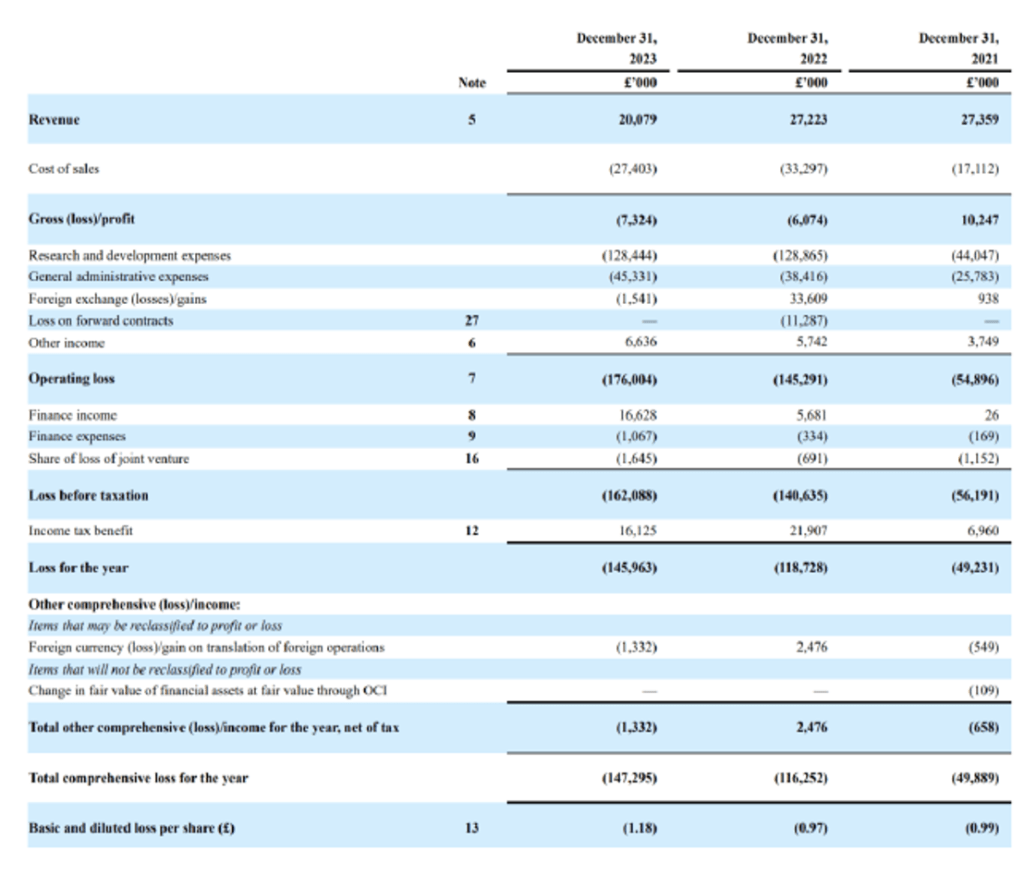

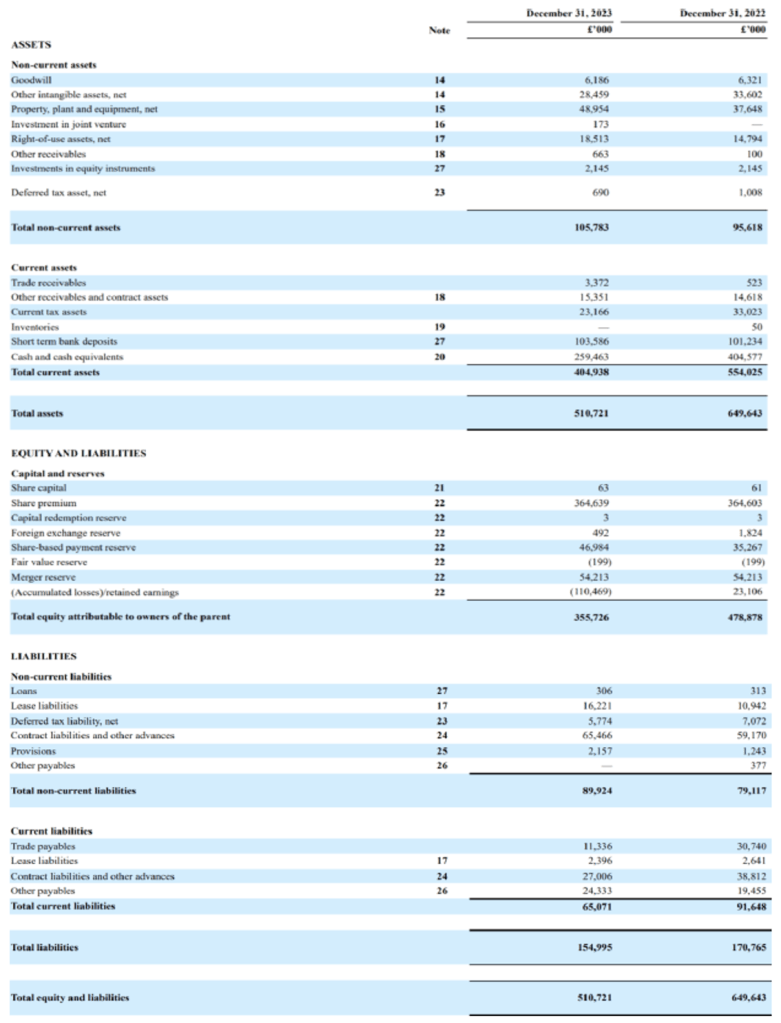

Exscientia’s financial statements just before they were acquired by Recursion provide an insight as to how the company was operated. One of the areas in which a Recursion acquisition can be beneficial is the possible general and administrative expenses, with which there may be good synergies. These expenses totaled $45M in 2023 and grew from $26M in 2021. Analysts expect the merger to further optimize these costs.

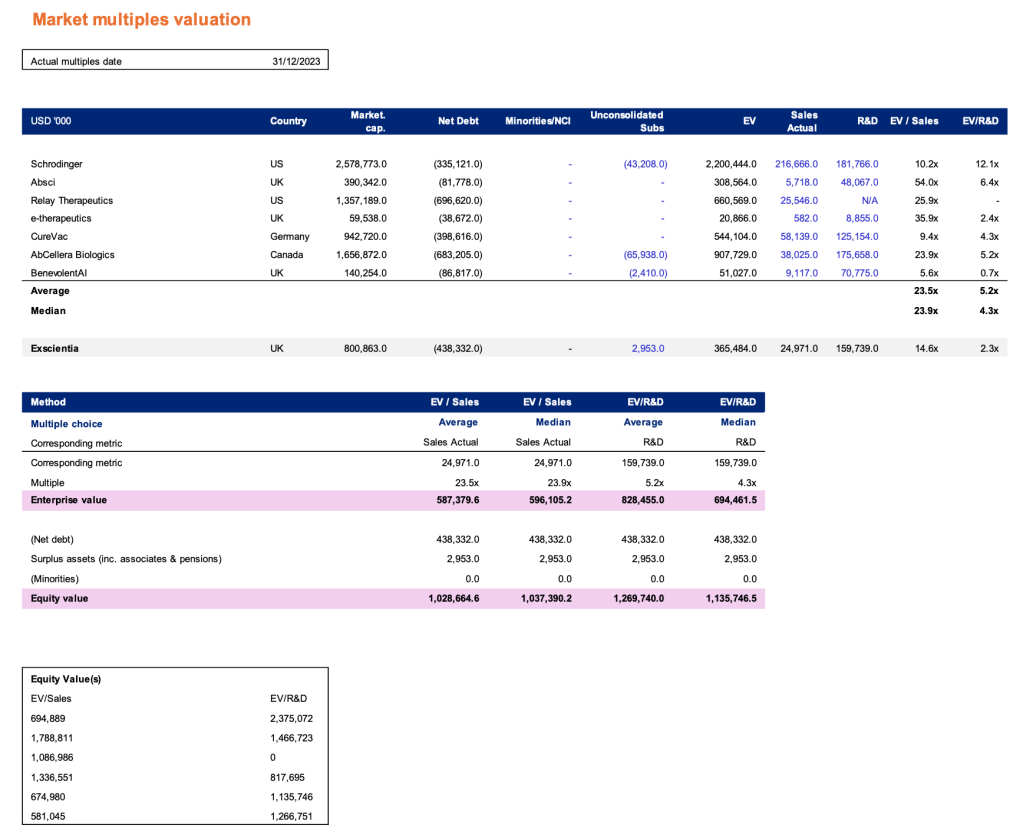

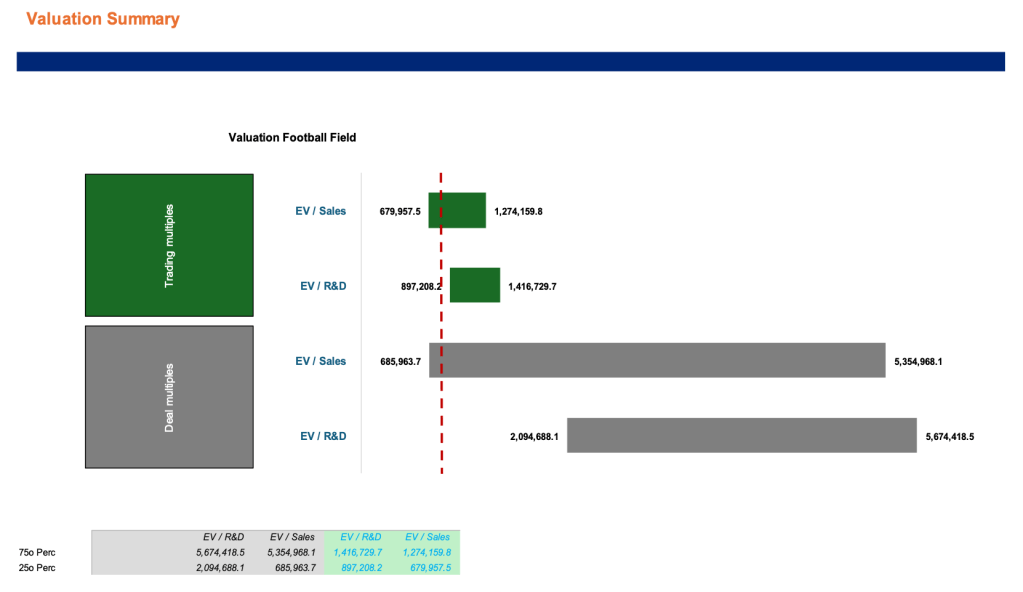

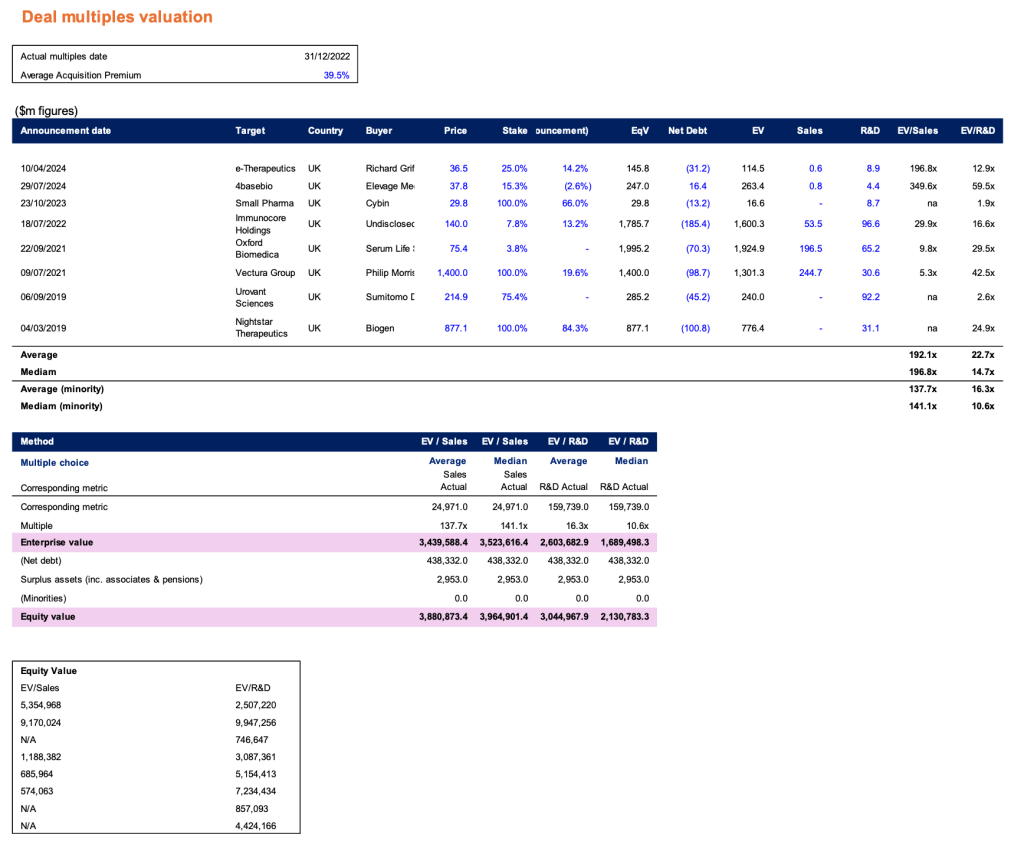

Valuation

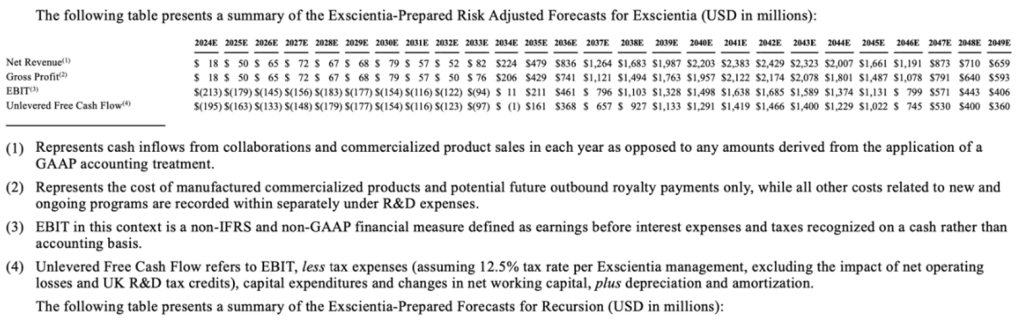

Centerview performed a DCF analysis based on data provided by Exscientia regarding the growth of future cash flows, simulated until December 31, 2049. Following this period there is a calculated decline of 60% in perpetuity. The cash flows were discounted to September 2024 (the time of the takeover) with an estimated weighted average cost of capital of between 14.5% and 17%.

Using the enterprise value given with the discounted cash flows, the implied equity value is achieved using Exscientia’s cash balance of $319 million and outstanding debt of $300,000. Considering both the total diluted shares outstanding as well as the impact of assumed equity raises, as stated in the Exscientia Internal Data, the result is an implied price per share of $3.90 – $6.60, rounded to the nearest $0.05.

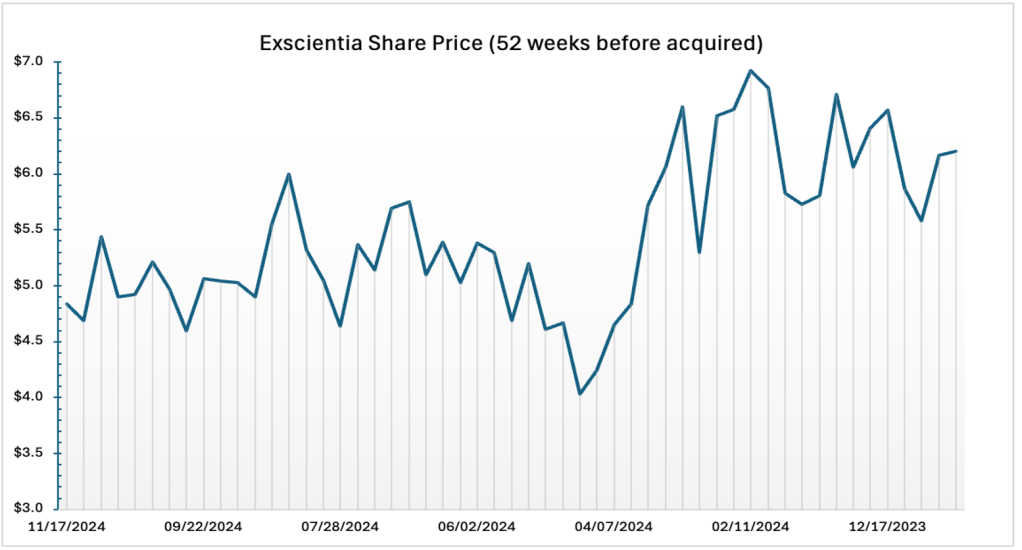

Other factors involved in the valuation process include Historical Stock Prices (over the previous 52-week period Exscientia shares hovered between $3.99 and $7.55) and Analyst Price Target Analysis. The analyst price targets ranged from $7.00 to $9.00.

| Source: Factset (2025) |

The table below is taken directly from the proxy statement filed with the SEC and includes the summary of the Exscientia-Prepared Risk Adjusted Forecasts. The Exscientia-Prepared Non-Risk Adjusted forecasts were not used by Centerview in their valuation as they were deemed too unrealistic and are not shown. The final valuation achieved by Centerview is $623.3M.

Market Overview

The pharmaceutical industry is undergoing a rapid transformation with AI and automation increasingly integrated into drug discovery workflows. Recursion and Exscientia are central to this shift, using AI to speed up development, reduce costs, and identify new drug targets. Recursion’s techbio model combines high-throughput automation and large-scale phenotypic data. Exscientia was the first to bring an AI-designed molecule to a clinical setting, highlighting the viability of these platforms.

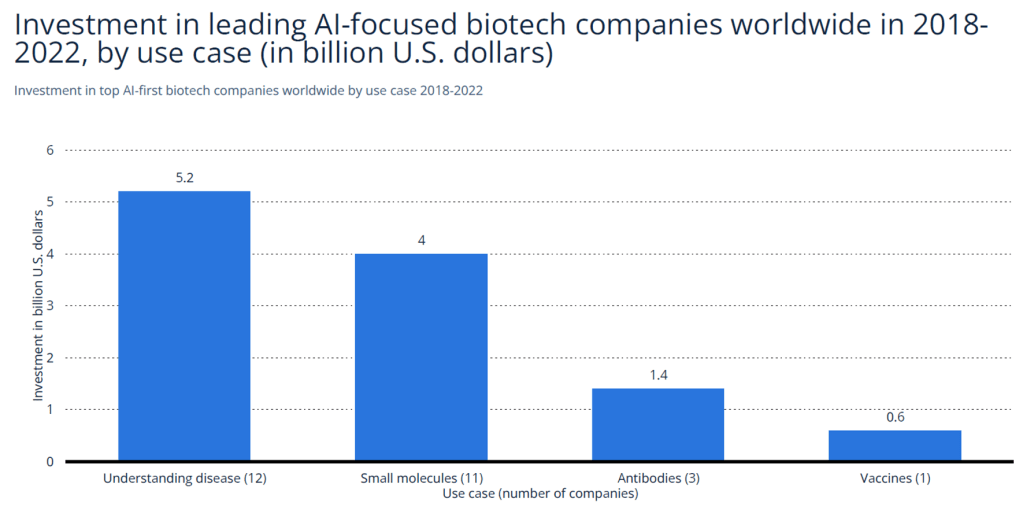

The market for AI in drug discovery was valued at $1.5 billion in 2023 and is forecasted to grow to $12.8 billion by 2032, reflecting a CAGR of nearly 30%. This growth is driven by an aging population, chronic disease burden, and greater demand for personalized medicine. The U.S. remains the largest regional contributor, followed by Europe and Asia-Pacific.

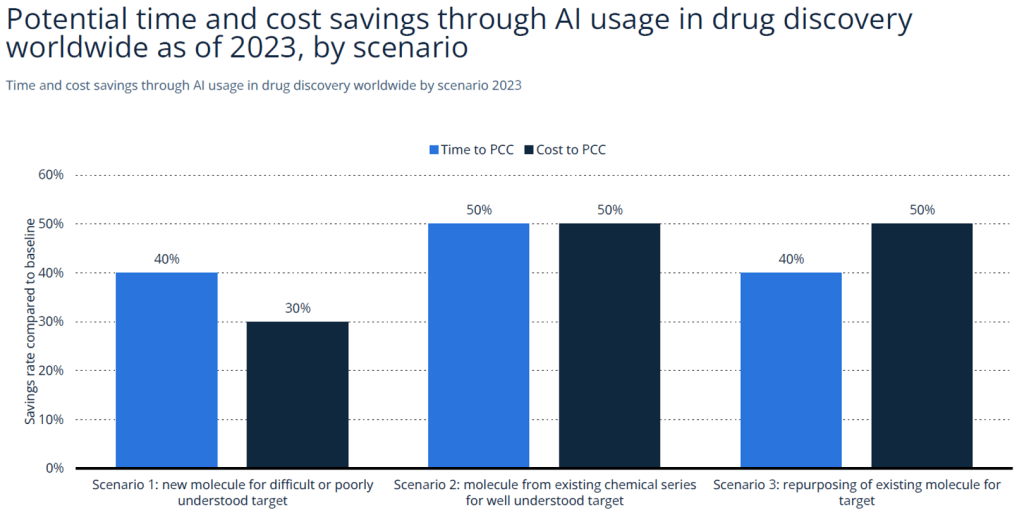

| Source: Statista (2023) |

Recursion’s core infrastructure, Recursion OS, uses machine learning and robotic labs to run millions of experiments per week. This has allowed it to compress early-stage discovery timelines from over 40 months to as few as 18. Its collaborations with Roche, Bayer, and post-merger Sanofi enhance its platform’s reach and credibility.

| Source: Statista (2022) |

Exscientia operates at a smaller scale, but with notable agility. With 392 employees in 2023, it competed with companies like Moderna and Jazz Pharmaceuticals, focusing on oncology and immunology. Through partnerships and innovation, it built a solid competitive edge.

| Source: Statista (2023) |

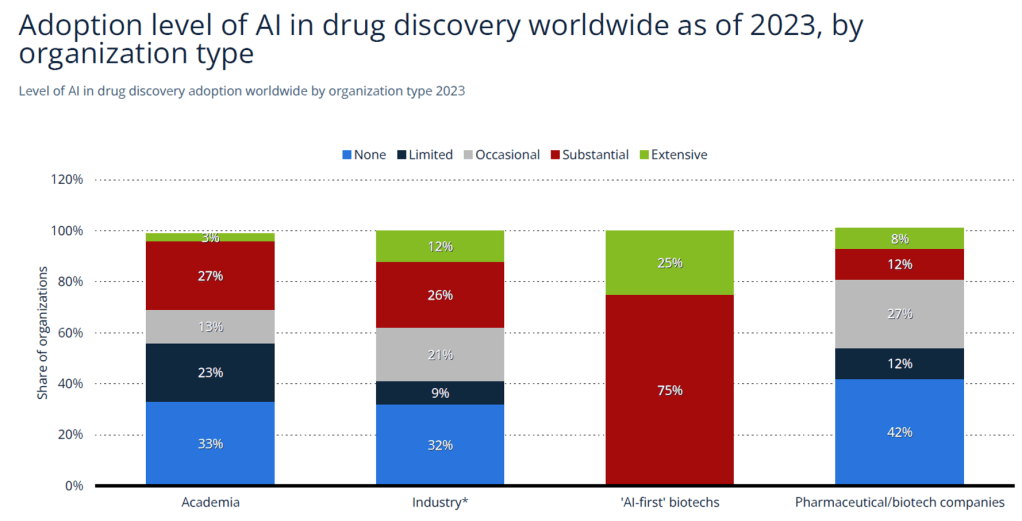

Over 800 companies are currently involved in AI-enabled drug discovery, and 1,900 investors are active in the space. 75% of ‘AI-first’ biotech firms report substantial use of AI, especially in small molecule development and disease understanding. This represents a major departure from traditional pharma firms, which report lower adoption.

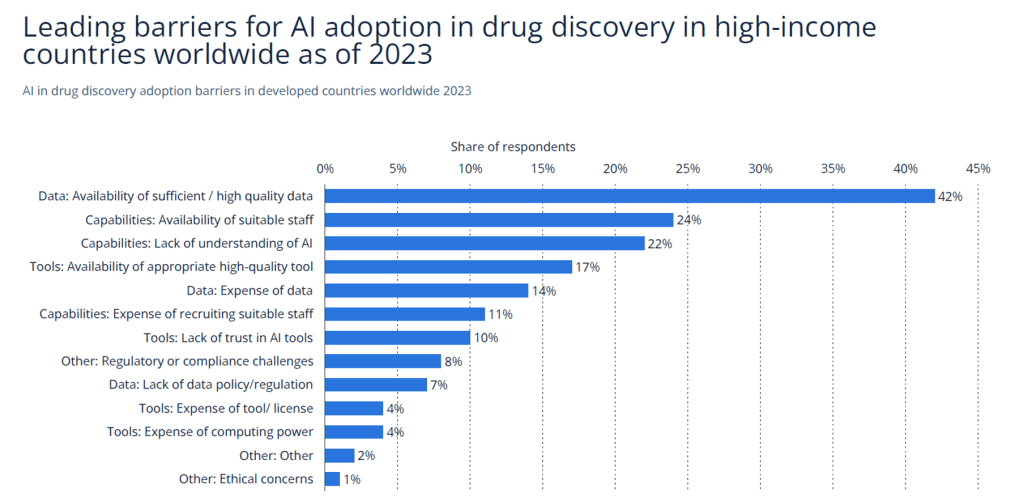

| Source: Statista (2023) |

Major barriers remain: 42% of respondents cite limited access to high-quality data as a major obstacle, followed by the lack of technical talent and insufficient regulatory clarity. These challenges highlight the need for robust infrastructure and talent pipelines.

Deal Rationale

“Through the proposed acquisition of Exscientia, Recursion expects to expand on its nascent chemistry capabilities, becoming a true end-to-end drug discovery company. And it isn’t end to end just for the sake of it, but rather it is diving into areas that are real challenges in drug discovery today.” claimed Najat Khan, Chief R&D Officer and CCO at Recursion, in September 2024.

Khan’s comment best summarizes the driving logic behind this merger, that is, the creation of an end-to-end, vertically integrated techbio drug discovery platform. By merging, the newly defined entity seeks to “combine Recursion’s expertise in biology with Exscientia’s focus on chemistry” into one seamless operation. Khan further added that the deal is “extraordinarily complementary,” which makes plenty of sense given the problems both companies are trying to solve: Recursion looks for first-in-class molecules, while Exscientia looks for best-in-class molecules. The convergence of these two approaches expands both the range of Recursion’s drug pipeline, as well as the scope of any potential molecules.

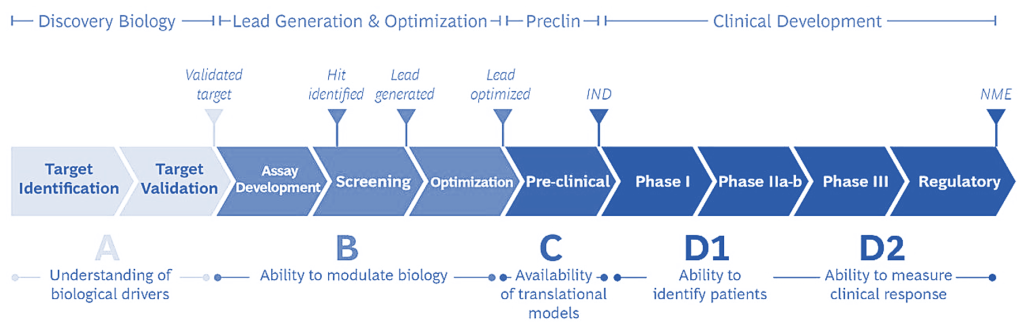

In drug discovery, lead optimization is one of the greatest challenges when it comes to small molecule design, which is where Exscientia’s precision chemistry comes into play; lead optimization is a chemistry-driven process, whereas the biological side relates to target identification, validation, and screening. This is why we say Recursion focuses on first-in-class molecules, while Exscientia researches best-in-class molecules by aiming to increase potency, selectivity and pharmacokinetics while reducing toxicity.

Steps in drug R&D

In theory, the combined Recursion + Exscientia platform offers the best of both worlds. Combining Recursion’s scaled biology exploration and translational capabilities with Exscientia’s precision chemistry design and small molecule automated synthesis.

The result is a first-of-its-kind full-stack AI drug discovery platform. It spans the entire process from target identification to clinical development, including hit discovery, lead optimization, automated chemical synthesis, predictive ADMET and translation, and biomarker selection. For Recursion OS, Exscientia’s complementary capabilities should be integrated at the level of patient connectivity, hit and target validation, and especially compound optimization.

Recursion and Exscientia are early AI drug discovery leaders. Now, they’re joining forces to stay ahead, but each alone is still relatively small in the context of drug development, with neither having a marketed drug yet. Merging instantly expands the pipeline and resources available. Recursion noted that acquiring Exscientia will “boost Recursion’s pipeline of drugs in development”, and, critically, provide the firm access to Exscientia’s four additional projects being carried out with big pharma partners Sanofi and Merck, with the new merged entity now having partnerships with Sanofi, Roche-Genentech, Merck and Bayer.

The new, combined drug pipeline is indeed formidable for an AI biotech and leading within the space, with Recursion having 7 programs under development and Exscientia another 4 for a combined 11 clinical and preclinical programs. Three programs stand out: REC-617, REC-994, and REC-4881, all backed by strong PK/PD data, and REC-994 showing promising early efficacy signals in phase 2 data. With eleven programs in its external pipeline across oncology, immunology and neuroscience, Recursion now has “more shots on goal”. We expect readouts for all other drugs in the pipeline within the next 18 months.

Recursion’s Pipeline

Strategically, the merger allows integration of Recursion’s datasets of imaging and genetic data with Exscientia’s data analysis platform.

Since both companies have such a strong focus on software, merging means sharing data and algorithms across two separate divisions, all in-house, which should create further synergies between the two firms and a tighter feedback loop that could accelerate the drug discovery process, improve success rates, and further cut costs by enhancing the Recursion OS platform. In similar fashion, the merger is also anticipated to bolster progress in Recursion’s four big pharma partnerships.

An underlying rationale is the fact that in AI drug discovery, scale matters. So does staying power. Cody Powers, life sciences consultant at ZS Associates commented: “Of the whole AI drug discovery, these were literally two of the first three companies to have clinical trial results.”

The Recursion + Exscientia deal is a bet on scale. More capital now, and more coming provided that investors like what they’re seeing of the techbio leader, could help Recursion outlast the rest of their competitors.

Operationally, teams in the US and UK provide access to top biotech talent. There may be some consolidation of projects and a reduction of overlapping roles, with the merger indicating an expected $100 million in annual synergies from reduced operational redundancies, streamlined infrastructure, optimized research workflows, elimination of duplicate technological investments and duplicate roles within the firm.

Deal Structure

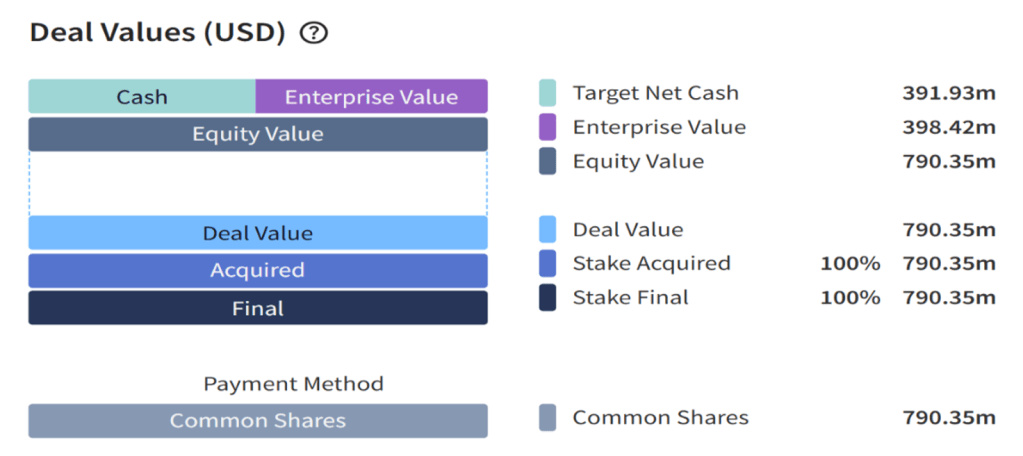

This deal represents a landmark consolidation for AI-driven drug discovery. As we know, Recursion Pharmaceuticals Inc., a clinical-stage biotech company based in the United States, acquired Exscientia PLC, a United Kingdom-based pioneer in AI-enabled drug design. The transaction was completed on November 20, 2024.

The acquisition was structured as an all-stock merger, with a final consideration of $790.35 million. Based on a fully diluted share count of 169,300,927 Exscientia shares, shareholders received 0.7729 shares of Recursion Class A common stock for each Exscientia share. At the time of the deal’s announcement, the implied transaction value stood at approximately $688 million, using Recursion’s one-day prior share price of $6.37. The initial headline valuation was approximately $833 million.

Upon completion, Recursion shareholders retained approximately 74% ownership of the combined entity, while Exscientia shareholders assumed the remaining 26%. Exscientia shares have since ceased trading and were formally delisted from Nasdaq. The merged company continues under the Recursion name and remains headquartered in Salt Lake City, Utah, while maintaining a significant operational footprint in Oxford, UK. The post-merger leadership structure integrates both firms: Recursion’s CEO Chris Gibson leads the unified entity, and Exscientia’s interim CEO and co-founder, David Hallett, now serves as Chief Scientific Officer.

| Source: MergerMarket (2025) |

The transaction was financed entirely through stock issuance. By opting for an equity-based structure, Recursion preserved cash resources and avoided incurring debt; a strategic decision aimed at maintaining flexibility to fund ongoing R&D efforts and support future growth initiatives. While tying shareholder returns to stock performance introduces a degree of volatility, it reflects mutual commitment to long-term value creation.

Corporate governance post-merger reflects an integrated leadership model. The unified company operates under the Recursion name and is headquartered in Salt Lake City, Utah, while retaining a strong operational base in Oxford, UK. Chris Gibson continues as CEO of the merged entity, and David Hallett, Exscientia’s interim CEO and co-founder, has assumed the role of Chief Scientific Officer. This structure ensures both continuity and the strategic integration of the two firms’ respective areas of excellence, biology and chemistry.

The deal received financial advisory support from Morgan Stanley on behalf of Recursion, while Centerview Partners acted as financial advisor to Exscientia. Legal representation was provided by Cooley LLP for Recursion and Slaughter & May for Exscientia. The transaction was contingent upon customary regulatory and shareholder approvals. It was also subject to legal sanctioning under UK law via the High Court of Justice in England and Wales, due to the structure of the transaction as a scheme of arrangement.

Timeline Highlights:

- August 8, 2024: The transaction was publicly announced by both companies, accompanied by investor briefings and strategic overviews.

- August–September 2024: Regulatory documentation and required filings were submitted to U.S. and UK authorities.

- October 2024: Shareholder meetings were held and approvals secured from both companies.

- November 15, 2024: The High Court of Justice in England and Wales approved the transaction under UK merger law.

- November 20, 2024: The merger officially closed, and Exscientia’s shares were removed from Nasdaq listings.

This merger establishes a new benchmark in the sector for cross-border integration and synergy realization in the biotech and techbio space. It is expected to serve as a foundation for future strategic consolidations and innovations across AI-enabled pharmaceutical development.

Despite the strategic promise we’ve already underlined, market sentiment has been mixed. As of April 9, 2025, Recursion Pharmaceuticals’ stock (NASDAQ: RXRX) is trading at $3.97 per share, a decline from $6.37 at the time of the merger announcement in August 2024.

Considerations by BSMAC: Deal Evaluation & Implications

Beyond strategy, the numbers also tell either a compelling story, or a cautionary one, depending on your level of optimism. AI biotech and techbio firms have been the “next big thing” for years now, and the merger of Recursion with Exscientia represents a critical juncture for the sector as a whole. With billions of dollars being poured into firms like Recursion and its peers but no marketable drugs yet produced, the space is now beginning a phase of consolidation and adapting to market expectations. Most of all, this reflects a tougher funding environment, and this merger draws parallels to past consolidations in other tech-driven fields such as genomics and biotech in the early 2000s, where companies realized that partnerships and mergers were necessary to facilitate their lofty goals.

From a business perspective, this merger also signifies a gradual shift in the business model of techbio firms. When AI drug companies like Recursion first began to emerge in the early 2010s, they were essentially service companies for big pharma, de-risking drug discovery by finding promising targets and selling them to pharma to continue carrying out the costly clinical development process.

While such deals are still on the table, somewhere along the way, these firms realized they could capture more value if they simply attempted to take their molecules through clinical development on their own. If Recursion commits to seeing their candidates through, and the pace of development matches the expected 2x or even 3x multiples they claim, Recursion and other firms in the space have the potential to become major players even by pharma standards in the next decade or so. A larger operation, such as the one established through this merger, could make a substantial difference.

As of 31 December 2024, Recursion had $603.0 million in cash and cash equivalents, with cash runway expected to extend into 2027. Revenue-wise, as Recursion has yet to launch a marketable drug, most cash flowing in comes from milestone payments paid by the firm’s big pharma partners, with $58.8 million in total revenue for FY 2024. Recursion expects another $200 million in milestone payments over the next 2 years, with total potential milestone payouts reaching $20 billion. Recursion expects each of its eleven pipeline programs to generate upwards of $1 billion in revenue if approved in the coming years. For Exscientia, this deal has some optimistic implications. Exscientia’s shareholders are essentially forgoing an immediate premium in exchange for ownership in the merged company and its future upside. This suggests that Exscientia’s investors believe in the long-term viability of the combination, provided the firm successfully manages execution risk.

However, on the other hand, this deal may also have been more or less of a lifeline for the firm. “Given the ownership structure, which is basically three quarters for Recursion shareholders, one quarter Exscientia shareholders, it’s hard for me to imagine that they would have done the deal in its current state without those two disappointing clinical trial outcomes for Exscientia [last year],” said Powers. “This is all, I think, managing expectations. (…) The first card flip was bad. And there was so much hype and anticipation that people were just very disappointed. But they’re basically saying, if the whole concept is that probabilities are improved, give us more end size. Don’t just judge us one by one readout. Let the end size play out first.”

Yes, the upside is massive. But so is the risk. Most notably, the AI drug discovery thesis remains unproven as highlighted throughout this article, with billions of dollars going into the space yet no drugs hitting the market, which would really be the ultimate proof that materializes the concept of AI drug discovery into something tangible for investors. If none of the combined pipeline candidates pan out, all they’ll have built is a more expensive failure. In fact, both Recursion and Exscientia have experienced setbacks: they were among the first AI firms to take drugs into the clinic, and early trial results all came back negative.

The merger doesn’t erase those failed experiments; it does give them more tries, but the science must ultimately deliver. Execution risk is another concern: integrating two organizations, aligning their workflows and cultures, and merging complex IT and data systems is a non-trivial task. There could be short-term disruption as teams integrate, which might slow down ongoing projects. Prioritizing which programs to push forward from the now-combined pipeline could also be contentious; decisions have to be made on resource allocation, and some less promising projects may be cut. There’s also market risk: this is an all-stock deal, so the value that Exscientia’s holders get (and Recursion’s holders retain) depends on Recursion’s stock performance, which has seen the market react somewhat negatively to the deal, though most experts agree that this merger is a logical next step in both companies’ future.

On the plus side, the risks are partly mitigated by the fact that both companies were already moving in this direction by developing their own drugs and no longer acting as service companies. They share a similar vision. That should make integration smoother, at least on paper. Both know the challenges intimately, and presumably merged with eyes open, likely after seeing that going it alone would be tougher. The $100 million in synergy savings also indicates they’ve identified overlapping functions that can be streamlined. One cross-border team instead of two separate ones. Less waste. Leaner operations. It’s a necessary survival tactic, and a smart one at that.

Another mitigating factor is the partnerships: even if internal programs struggle, the combined company has partnership deals that could yield billions in milestone payments, with $200 million expected to flow into the company within the next 2 years. These collaborations spread the risk and provide external validation of their platforms. Finally, if the merged company does achieve a clinical win, it would largely ease concerns about the viability of the AI drug discovery space and potentially usher in an era where AI biotech and techbio firms will have an increasingly larger role to play in the pharma industry.

Regardless of the overall outcome, this merger is a defining moment for both firms, and the industry will be watching closely. Everyone from investors to pharma partners, to patients waiting for new treatments, are eager to see if this grand experiment works for Recursion as a successful pure pharma AI play. The next 18-24 months will be particularly interesting as the combined entity reports on the progress of its 11 clinical trials, and we’ll see whether this marks the turning point for AI drug discovery, or ends as an instructive cautionary tale.

Appendix 1: Valuation

Appendix 2:

Authors: Dragos Filipas, Bruno Montanaro, Leonard Geissinger, Mark-Alexandru Timisan-Matei, Maximilian Lenhard, Razvan-Cristian Gliga.

Bibliography:

Kollewe, J. (2022, July 30). Andrew Hopkins of Exscientia: The man using AI to cure disease. The Guardian. Available at: https://www.theguardian.com/business/2022/jul/30/andrew-hopkins-of-exscientia-the-man-using-ai-to-cure-disease

Mullard, A. (2024, September 13). Creating an AI-first drug discovery engine. Nature Reviews Drug Discovery, 23, 734–735. Available at: https://www.nature.com/articles/d41573-024-00149-6

Recursion Pharmaceuticals. (2024). Recursion and Exscientia: Two leaders in the AI drug discovery space [Press release]. Available at: https://ir.recursion.com/news-releases/news-release-details/recursion-and-exscientia-two-leaders-ai-drug-discovery-space

Science.org. (n.d.). Eroom’s Law. Science. Available at: https://www.science.org/content/blog-post/eroom-s-law

Exscientia. (n.d.). Investor overview. Available at: https://investors.exscientia.ai/overview/default.aspx

Google Cloud. (n.d.). Recursion accelerates drug discovery with AI and Google Cloud. Available at: https://cloud.google.com/customers/recursion

ARK Investment Management LLC. (2025). Big ideas 2025. Available at: https://research.ark-invest.com/hubfs/1_Download_Files_ARK-Invest/Big_Ideas/ARK%20Invest%20Big%20Ideas%202025.pdf

U.S. Food and Drug Administration (FDA). (n.d.). Summary of NDA approvals & receipts, 1938 to present. Available at: https://www.fda.gov/about-fda/histories-fda-regulated-products/summary-nda-approvals-receipts-1938-present

Kremer, J. M., et al. (2021). COVID-19 vaccine hesitancy and vaccine passports: An online survey study. medRxiv. Available at: https://www.medrxiv.org/content/10.1101/2021.02.01.21250864v1.full-text

Diamond Hill Capital Management. (2008). International Perspective. Available at: https://www.diamond-hill.com/sitefiles/live/documents/2008_Diamond-Hill_International-Perspective.pdf

Mullard, A. (2020, March 4). The emergence of AI in drug discovery. Nature Reviews Drug Discovery, 19, 201–202. Available at: https://www.nature.com/articles/d41573-020-00059-3

Recursion Pharmaceuticals. (n.d.). Technology: BioHive. Available at: https://www.recursion.com/technology#biohive

Recursion Pharmaceuticals. (2023). Recursion presents Phase 2 data for REC-994 in CCM at late-breaking oral session [Press release]. Available at: https://ir.recursion.com/news-releases/news-release-details/recursion-presents-phase-2-data-rec-994-ccm-late-breaking-oral

Recursion Pharmaceuticals. (2023). Recursion reports interim Phase 1 clinical data for REC-617 [Press release]. Available at: https://ir.recursion.com/news-releases/news-release-details/recursion-reports-interim-phase-1-clinical-data-rec-617

Pharmaceutical Technology. (n.d.). REC-4881 by Recursion Pharmaceuticals for colorectal cancer: Likelihood of approval. Available at: https://www.pharmaceutical-technology.com/data-insights/rec-4881-recursion-pharmaceuticals-colorectal-cancer-likelihood-of-approval/

Exscientia. (n.d.). Pipeline overview. Available at: https://www.exscientia.com/pipeline/

Taylor, P. (2024, March 26). Recursion, Exscientia and AI drug discovery’s moment of truth. Pharmaphorum. Available at: https://pharmaphorum.com/digital/recursion-exscientia-and-ai-drug-discoverys-moment-truth

Pharmaceutical Technology. (2024, April 2). Recursion–Exscientia merger aims to redefine AI drug discovery. Available at: https://www.pharmaceutical-technology.com/news/recursion-exscientia-merger/

Scannell, J. W., et al. (2012). Diagnosing the decline in pharmaceutical R&D efficiency. Nature Reviews Drug Discovery, 11(3), 191–200. Available at: https://www.nature.com/articles/nrd3681

University of Utah, Biomedical Engineering Department. (2023, July 21). An interview with Chris Gibson. Available at: https://www.bme.utah.edu/2023/07/21/an-interview-with-chris-gibson/

Analysis Group. (2024). Biotech asset valuation methods. Available at: https://www.analysisgroup.com/globalassets/insights/publishing/2024-biotech-asset-valuation-methods.pdf

[1] One proxy variable for our increasing understanding of human genetic data is the growth of genome-wide association studies (GWASs). Analysis of the percentage of drug approvals for which the target of an NME had GWAS validation at the time of its entry into development, scaled relative to the total number of GWASs available at the time (which has increased substantially over the period), indicates a general increase since 2012.

You must be logged in to post a comment.