Prosus, one of the biggest technology investment companies in the world, has proposed to acquire Just Eat Takeaway.com, aiming to give birth to one of the principal global players in the food delivery sector, expanding its capillary presence in Europe, North America, South America, and many other key areas, with millions of active users and an extended network of partner restaurants.

Companies Overview – Prosus

Prosus, holding a primary listing on Euronext Amsterdam and a secondary listing on the Johannesburg Stock Exchange, is among the largest technology investors in the world with significant investments in emerging market technology firms, such as online rankings, food delivery, payments, and edtech. It was established in 2019 as a division of the South African conglomerate Naspers to tackle the enduring discount at which Naspers traded relative to its net asset value (NAV). To mitigate the issue of a conglomerate discount (the tendency of markets to value a diversified group of businesses at less than the sum of its parts) Naspers spun off Prosus, listing it on Euronext Amsterdam while retaining a controlling stake. The spin-off was designed to unlock value: investors can assess the spun-off entity based on its financial performance, risks, and growth potential, rather than as part of a larger structure where its value might be obscured.

This reduces information asymmetry and ensures that the company trades closer to its true intrinsic worth, without being influenced by the parent over-investing in divisions with relatively poor prospects. However, despite these efforts, mainly due to its complex corporate structure and Naspers’ continued control, Prosus fell into the same trap. It has become a conglomerate itself by investing in companies different by sector and geographical area and now trades at a significant discount to its NAV. As to what concerns ownership, Naspers Ltd. holds the largest stake with 41.43%, equivalent to 1,030,399 shares, while Prosus NV owns 3.35%, or 83,237 shares, with a recent increase.

Prosus N.V.’s financial performance over the past years shows a pattern of revenue growth: sales have continually increased, reaching €5.04 billion in March 2024 from €4.39 billion in March 2021. However, profitability remains a challenge at the operating level. EBIT has been negative for several years, indicating that core operations are struggling to generate sustainable profits. The company’s net income is mostly driven by equity earnings from affiliates, emphasizing a reliance on investments rather than operational efficiency.

Key financial ratios reinforce this observation. The gross margin has remained relatively stable, but high SG&A expenses continue to weigh on operating profitability. The net margin appears inflated, largely due to earnings from affiliates and singular gains rather than fundamental business strength. The volatility in return on equity and assets further suggests inconsistent profitability. While Prosus benefits from its investment holdings, its reliance on external earnings makes it vulnerable to fluctuations in affiliate performance and broader market conditions (a problem encountered also by Nasper’s).

Company Overview – Just Eat

Just Eat Takeaway.com was established in 2000 in the Netherlands by CEO Jitse Groen. He had the idea that food ordering should have been simple and easy during a family party. This led to the launch of the online food delivery platform, Thuisbezorgd.nl.

Thuisbezorgd.nl expanded rapidly in the Netherlands and internationally, rebranding to Takeaway.com in 2011. The company went public in 2016, after completing its IPO on Euronext Amsterdam. In 2020, after achieving significant European scale through a blend of acquisitions and organic growth, Takeaway.com merged with Just Eat, a successful food delivery company established in Denmark in 2001.

The merger valued Just Eat at approximately £6.2 billion and was part of a larger trend of consolidation within the food delivery sector. The combined entity aimed to leverage synergies and streamline operations, with the goal of enhancing customer service and expanding its delivery infrastructure. For what regards its ownership, Groen Jitse is the largest stakeholder, owning 7.34% of the company with 15,331 shares

Just Eat Takeaway.com N.V.’s financial statement reveals that the company is struggling with profitability despite generating significant revenue. The income statement indicates that sales have been increasing over the years, reaching €3.56 billion in 2024. However, the cost of goods sold (COGS) remains high, leaving a relatively low gross income of €548 million. Additionally, SG&A expenses are significant, amounting to €1.4 billion in 2024, which considerably burden on operating profitability. This is reflected in the EBIT, which remains negative at -€165 million for 2024, though it shows an improvement compared to previous years like 2022 (-€792 million). Net income remains deeply negative at -€488 million, highlighting continued losses.

Examining key financial ratios further supports this concern. The company’s profitability ratios, such as operating margin and net margin, remain in negative territory, suggesting that the company has yet to achieve operational efficiency. The five-year average net margin is a concerning -32.98%, with the 2024 figure still at -13.69 %. Return on equity and return on assets are also negative, reflecting poor returns for investors and inefficient asset utilization. Overall, while revenue growth is evident, Just Eat Takeaway.com continues to struggle with profitability, high costs and negative margins.

Valuation Overview

1. DCF Analysis:

The WACC of 6.1% is derived from the Cost of Equity of 6.3% (estimated using the CAPM model) and the after-tax Cost of Debt of 4.06%. This reflects a moderate risk profile and a balanced capital structure, with a debt-to-equity ratio of approximately 9.8%.

- Cost of Equity

The Beta of 0.480 has been obtained through the re-levering of an unlevered industry beta of 0.623, accounting for the company’s actual capital structure. This approach ensures a more reliable estimate by reducing firm-specific noise and incorporating sector-wide volatility—particularly relevant in the highly competitive and margin-sensitive food delivery industry. The Equity Risk Premium of 5.50% and risk-free rate of 2.65% are consistent with European market expectations and broadly accepted survey-based benchmarks, ensuring market-consistent inputs.

- Cost of Debt

The Cost of Debt was estimated at 4.00% before tax, derived from the Yield to Maturity (YTM) of comparable corporate bonds. This synthetic rating approach, rather than relying on historical borrowing costs, reflects the company’s current credit risk and interest coverage profile. Adjusting for the Italian tax rate of 24%, the after-tax cost of debt stands at 3.04%, aligning with valuation best practices that aim to capture the forward-looking market cost of debt capital.

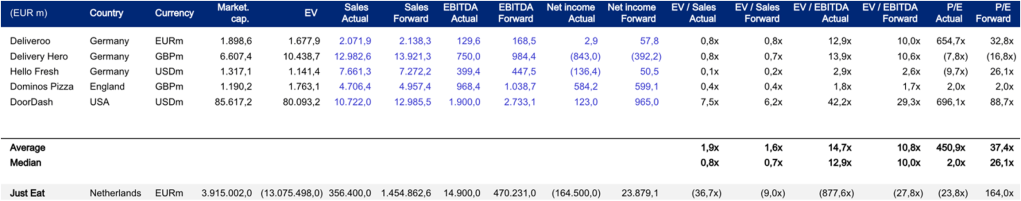

2. Comparable Company Analysis:

We selected a comparable universe of peer companies for Just Eat based on the following criteria:

- Geography of operations: Companies with operations primarily focused in the UK and Europe, particularly regions with strong online food delivery services.

- Business model: Each company has a similar business model in the online food delivery industry, with a focus on delivering food to customers via digital platforms.

- Size: Companies with similar market capitalisation, revenue, and enterprise value to Just Eat, indicative of comparable operational scale and market positioning.

3. Precedent Transaction Analysis:

Analysing five precedent transactions at the 75th percentile suggests the following implied values:

- EV/Sales: $16476,8 million

- EV/EBITDA: $2701,6 million

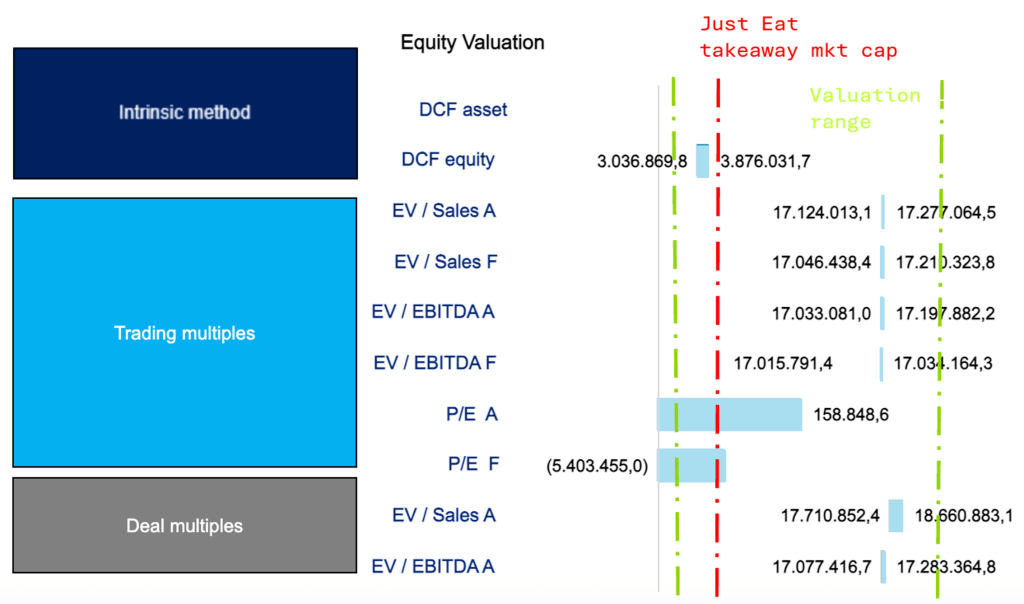

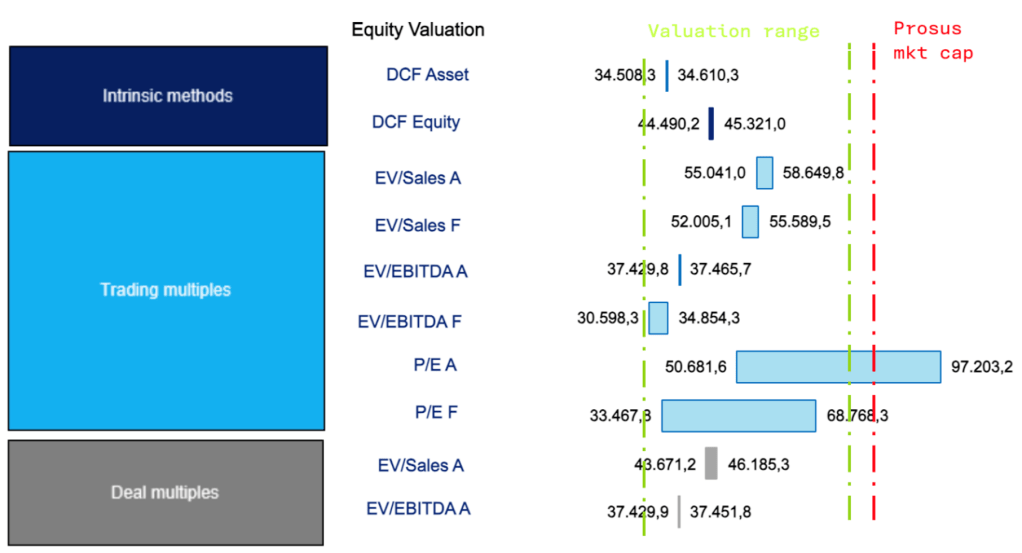

The analysis reveals a notable dispersion in implied values across the different methodologies, particularly evident in the wide range indicated by the Price-to-Earnings (P/E) multiples from the comparable company analysis. The EV/EBITDA multiples, derived from both comparable companies and precedent transactions, provide a more consistent valuation range. Notably, the implied equity value from the DCF analysis falls within the range suggested by the multiples-based valuations.

Market Overview

Market Size and Growth:

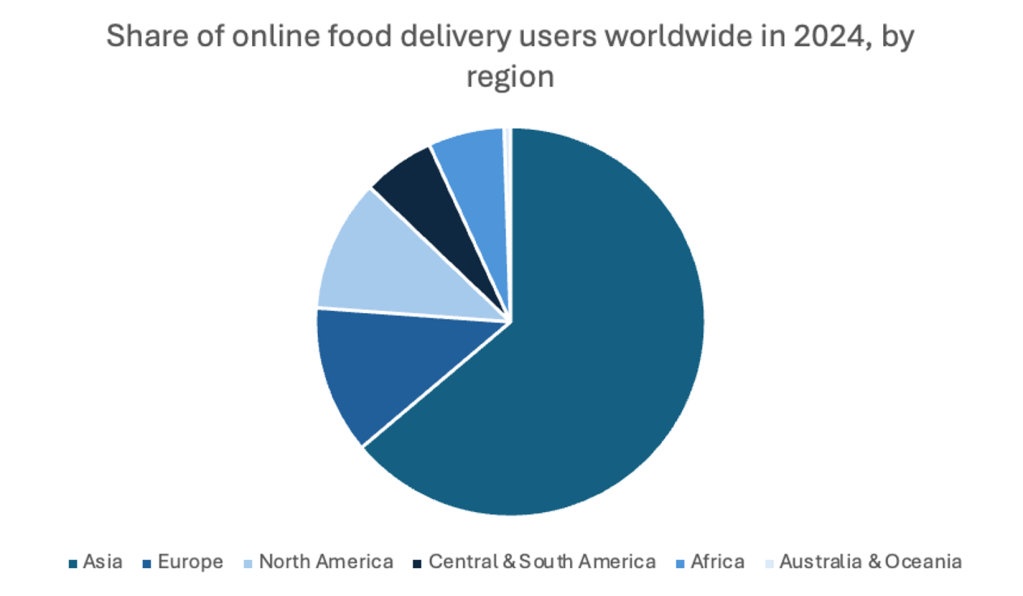

In recent years the global online food delivery market has demonstrated significant growth. In 2023, the market was valued at USD 242.09 billion and is expected to reach USD 746.55 billion by 2033, growing at a compound annual growth rate (CAGR) of 11.92% during the forecast period. Another estimate for 2024 places the market size at USD 380.43 billion, with a projected CAGR of 9.0% from 2025 to 2030.

Factors contributing to market growth include ease of online payments, changing consumer preferences, digitalisation and urbanization. Furthermore, expansion Opportunities including Emerging markets in Asia and Latin America offer significant growth potential.

The food delivery industry is dominated by several key players globally. Major Competitors include: DoorDash, which is leader by market share in the US; Zomato, Indian based and expanding in several other countries; Grab holdings, headquartered in Singapore and operating extensively across Southeast Asia; Delivery Hero, a German multinational managing brands such as Foodpanda and Glovo. DoorDash is the market share leader in the US (66%) followed by Uber Eats (23%), whereas Foodpanda is the major player in Asia and iFood in Brazil. The acquisition of Just Eat Takeaway.com established Prosus as the world’s fourth-largest food delivery company. The industry is featured by consistent entry barriers such as high operational costs and intense competition that make it challenging for new entrants to gain traction. Industry regulations focus on ensuring fair competition and consumer protection, antitrust laws role is to prevent market dominance and companies must comply with industry-specific regulations, such as food safety standards and data privacy laws.

Source: Statista

Source: Statista

Recent Developments and Trends:

Technological advancements are key factors. Mobile apps and digital platforms have played a major role in making ordering food online extremely more accessible. Further innovations in delivery technologies, such as autonomous vehicles and drones, are expected to transform and foster even more the industry potential. Shifts in consumer behaviour are also crucial in the development of the industry. Customers are prioritizing convenience, sustainability, and health-conscious choices, increasing demand for eco-friendly packaging and personalized meal plans.

Between March and May 2020, when lockdowns in Europe and the United States were the most severe, the food-delivery market spiked. The COVID-19 pandemic accelerated the shift to online ordering, forcing businesses to adapt quickly.

Autonomous delivery systems and subscription services are emerging trends, offering new opportunities for efficiency and customer satisfaction.

“Dark kitchens” represent an interesting innovation and emerging trend. Also called ghost kitchens, they market and produce delivery orders but have no physical restaurant or storefront attached.

Moreover, the industry is moving toward more sustainable practices, such as biodegradable packaging and optimized delivery routes.

M&A in the Industry:

Mergers and acquisitions are common in this industry, aiming at expanding market share and improving operational efficiency. They can lead to increased market share capture and growth opportunities by leveraging combined resources and expertise. These transactions reflect the dynamic nature of the food delivery industry, with companies continually seeking strategic partnerships and acquisitions to enhance their market positions, leading to improved operational efficiency and innovation, as companies leverage combined resources and expertise. Integrated platforms can streamline services: faster delivery, better tracking, and improved support resulting in a better user experience. Companies like Prosus and are expanding across the globe, using M&A to enter or strengthen their presence in new markets, accelerating the globalization of food delivery services, potentially damaging smaller local platforms. Finally, industry consolidation is a concrete effect of these mergers and acquisitions, larger players acquire smaller ones to increase market share and reduce competition. Overall, recent M&A in the food delivery industry highlight a trend toward consolidation and strategic expansion, which is expected to continue in 2025.

Deal rationale

The main rationale behind the acquisition, as stated by Fabricio Bloisi, Prosus’ CEO, is to create an “European tech champion”, which correlates with the company’s strategic focus of “expanding the total addressable market while increasing profitability”. Prosus is already largely positioned in the food delivery market, including full ownership of iFood (the largest food delivery service in Latin America), a 25% stake in India’s leading food delivery platform Swiggy, 28% of Delivery Hero operating in Europe, and 4% of Meituan in China. The acquisition of Just Eat Takeaway (JET), therefore, will consolidate the company’s position in Europe and provide geographic diversification, and will form the 4thlargest food delivery company in the world. The collection of graphs below shows the usage rate in 12 months of the main delivery apps per country in Europe where the acquisition of JET will most improve Prosus’ market share.

Source: Statista

The acquisition of JET evidently provides significant geographic diversification and addressable market expansion to Prosus, cementing a dominant position in Western Europe with coverage of Europe’s major food delivery markets. This is particularly relevant given that that Prosus’ existing representation in Europe lies in Delivery Hero, operating via Glovo, which does not have a significant market share in these countries.

Prosus’ iFood dominates the Brazilian market to the point where it has been sanctioned by the country’s Cade (the equivalent of the FTC) for abusing its market power. The delivery platform reportedly boasts over 51% of all traffic share in the sector, 87% of online food delivery bookings, and has grown to 100 million orders in 2024 with an annual increase of 31%. Such growth and market power are mainly due to iFood’s tech and AI optimization used not only to optimize B2B interactions, but also by suggesting new offers to restaurants based on consumer activity, streamlining order prioritisation and routing in logistics, creating user personalised recommendations, and enhancing fraud detection. Bloisi, who led iFood in the past, therefore aims to leverage the existing technology and strategy used in Prosus’ brands. These approaches have proven to be extremely effective in other markets to improve JET’s operational efficiency and grow its share of the European market.

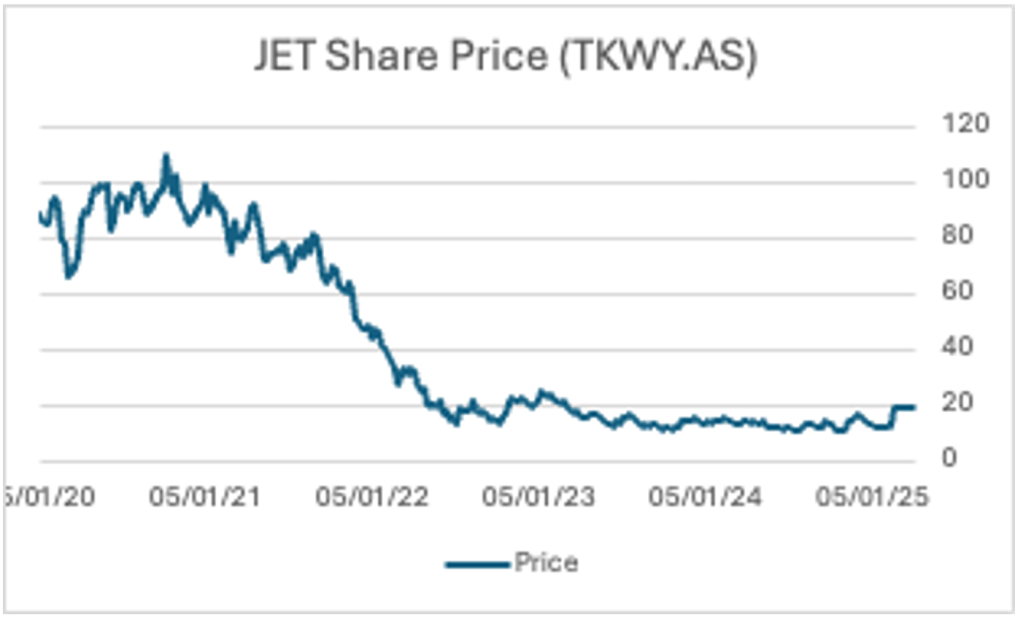

The acquisition comes after a rough period for JET. Before the announcement of the deal, JET shares had decreased over 88% from their 2020 peak during the pandemic (see graph below), and the company reported a net loss of $1.65bn in 2024, $1.16bn of which was related to Grubhub, which the company acquired for $7.3bn before selling it for $650mn. The deal then aligns with JET’s goal to regain profitability and growth, both of which will be further accelerated both by Prosus’ existing infrastructure and strategy and significant capital investment—a 70% premium on share price as of one month before the announcement.

Source: Morningstar

Following the acquisition, the horizontal operational synergies gained by JET when entering Prosus’ food delivery group will help cut costs through economies of scale, shared research and development, and the use of established AI capabilities such as logistics optimization and fraud detection. With a presence in every major continent’s food delivery market, Prosus will also further generate innovation sharing and global partnerships and increase their bargaining power. All of this, coupled with a large capital investment and vertical synergies such as integrating payments (fintech) and in-house logistics—all of which are already present in other Prosus operations—will likely generate significant growth; in fact, management expects year-on-year gross transaction value to increase by 4%-8%, though the deal is still pending finalisation. Moreover, as unprofitable operations such as Grubhub are shut down, and these synergies further materialize, margins are bound to increase.

On the other hand, the proposed deal has also been under heavy regulatory scrutiny by competition authorities prior to finalisation. The main concern that may arise is whether Prosus can exercise any significant influence in Delivery Hero through its 28% stake and position as its largest shareholder, and the possibility of access to commercially sensitive information. Although unlikely to be approved, behavioural remedies such as an agreement to refrain from accessing confidential information from Delivery Hero could be proposed to mitigate this issue, nonetheless, the key problem is not the size of Prosus’ stake in Delivery Hero, but the amount of influence it could have. Thus, this could be solved by demonstrating that Prosus’ representatives only participate on the general meeting, discussing the “appropriation of net retained profits”, the discharge and appointment of boards, the appointment of auditor, and capital or structural measures.

Deal Structure

Deal timeline & terms:

In the aftermath of the joint press announcement on 24 February 2025, whereby Prosus NV stated that it proposed to make an offer for all issued and outstanding ordinary shares in Just Eat Takeaway.com at €20.30 a share (cum dividend), the process of the transaction is now taking place as contemplated. On 24 March 2025, the Offer Memorandum was submitted to the Dutch Authority for the Financial Markets (AFM) for examination and approval in accordance with Article 7, paragraph 1 sub a of the Decree. The invitation is to formally open in Q2 2025, subject to AFM approval. The offer period is expected to be around 8 to 10 weeks. Normal regulatory checks and approvals will be applied throughout the period, and an Extraordinary General Meeting (EGM) of shareholders will be called to sanction the transaction. Subject to all usual conditions being satisfied, including receipt of requisite regulatory approvals, completion of the transaction is expected to take place by the end of 2025.

Deal type:

The transaction constitutes a strategic share purchase by way of public offer of all issued and outstanding ordinary shares of Just Eat Takeaway.com by MIH Bidco Holdings B.V., which is a wholly owned subsidiary of Prosus N.V. The offer price considered was €4.01bn ($4.2bn) on the acquisition of 197,679,516 shares at the offer price of €20.30 per share. The value of consideration – net debt included – is therefore €4.77bn ($4.99bn). The payment will be 100% cash. Prosus is making an offer of €20.30 per share, a price that is a 63% premium to the closing share price of Just Eat Takeaway.com as of February 21, 2025, i.e. before the announcement, and 49% over the 3-month volume-weighted average price (VWAP).

Effects of payment conditions :

For Just Eat Takeaway.com’s shareholders, the cash offer provides them with certainty of immediate liquidity, allowing them to achieve a substantial return on their investment without being exposed to future market risk. Such certainty is particularly welcome in the backdrop of recent underperformance, e.g., a €1.6 billion net loss in 2024. But cash payment of the purchase in full has a material impact on Prosus liquidity position. But the approach avoids dilution of existing shareholders’ equity, with no change in existing ownership structures.

Effects on share prices:

Shares price of Just Eat Takeaway surged more than 54% after the announcement, very closely following the offer price. The steep increase reflects investor faith and the estimated value of the takeover. Conversely, Prosus’s shares declined by about 6.3% on the news. This is largely due to investor concerns over the enormous cash outlay and integration risks of the takeover.

Financing structure:

The €4.01 billion transaction was funded entirely from Prosus’s available cash, which testifies to its solidity and strategic thinking. Prosus deployed €4.01 billion of its cash balances, supported by proceeds from Prosus’s giant stake in Tencent Holdings Ltd. The approach minimized dilution to existing shareholders and demonstrated Prosus’s capital efficiency skills. The tender offer structure allowed Prosus to acquire Just Eat Takeaway’s shares from the shareholders directly, making it more straightforward and removing regulatory challenges. Where in the event of termination of the transaction, Prosus will have to pay termination fee of €410 million and the seller would pay €41 million. Also, where Prosus subscribes for at least 95% of the Just Eat Takeaway shares, it has the option to initiate statutory squeeze-out proceedings to buy out the remaining percentage of the shares.

Governance:

The organizational structure is established to maintain continuity while streamlining Prosus’s strategic direction. The current management of Just Eat Takeaway, including CEO Jitse Groen, will continue in their roles. The company will retain its Amsterdam headquarters and its anchor brands. Two current Supervisory Board members of Just Eat Takeaway will continue as independent board members after the takeover. They will be tasked with overseeing compliance with non-financial covenants, and failure to comply will necessitate their affirmative vote. In addition, in 2023, before the acquisition, Just Eat Takeaway’s Supervisory Board also decided to reappoint CEO Jitse Groen and CFO Brent Wissink to the Management Board for a period of four years, thereby guaranteeing continuity of leadership during the transition phase. This governance model will seek to leverage the strength of Prosus’ resources without interrupting the operational experience and leadership which have been responsible for Just Eat Takeaway’s success.

Final considerations

Supportive Statements:

Strategically, the takeover makes sense. Being a significant investor in food ordering websites in emerging economies to start with, Prosus has been searching for opportunities to make its presence felt in developed economies. With its established market presence in Western Europe and North America, Just Eat Takeaway.com offers precisely that opportunity. The deal allows Prosus to geographically diversify and expand operationally its base outside Asia and Africa, where its investment universe—primarily, Tencent—has so far been concentrated. Additionally, the deal is also in line with Prosus’s long-standing investment strategy of taking a stake in underpriced assets and rerouting its money from winning investments (such as Tencent) to high-growth technology sectors. Prosus shows it is willing to invest aggressively in assets that it considers undervalued due to short-term underperformance and not structural weakness by making a 63% premium on its current share price offer for Just Eat Takeaway.com.

From the perspective of Just Eat Takeaway.com, the transaction provides immediate fiscal relief. The firm has been struggling with increasing losses and cost inefficiencies, particularly after it acquired Grubhub, which it subsequently sold at a massive loss. Being acquired by the larger Prosus group may assist Just Eat in deriving operating synergies as well, tapping into deeper levels of technology infrastructure, and a more stable source of capital, enabling it to return to profitability again.

Specifically, the retention of existing management, including CEO Jitse Groen and CFO Brent Wissink, suggests that Prosus appreciates the value of leadership continuity among its internal personnel. This is most likely to facilitate the ease of post-deal integration and retaining institutional memory to continue conducting business uninterrupted.

Concerns or Criticisms:

Despite these positives, there are some issues arising from this deal. To start with, the pesky issue of conglomerate discounting. Prosus was originally split from Naspers partly to eliminate the valuation discount generally put on diversified clusters of holdings. Ironically enough, Prosus now suffers from the same ailment. This transaction also introduces another large business to its already complex structure and diversifies its holdings further afield from its core holdings. Investors may view this as a shift away from simplicity and focus and ask themselves if the deal is as clean and valuable. In addition, the reality of the deal being financed in cash also creates liquidity concerns. Even with huge reserves, because of its holding in Tencent, to pay out over €4 billion in cash without issuing debt or equity can be dangerous. With no cost synergies of materials or rapid return to profitability for Just Eat Takeaway.com, this could put Prosus’s finances at risk. This is reflected in the 6.3% fall in Prosus’s share price on announcement. Industrially, the integration risk is also big. The food delivery market is very geographically localized in nature because there are differences in consumer tastes, regulatory environments, and competitive arenas that are radically different from place to place across countries. Baking Just Eat into Prosus’s larger food delivery division would potentially create co-ordination difficulties, cultural misunderstandings, or duplications in overlapping markets where it already owns interests in industry players like iFood and Swiggy. Also on its watch will be Just Eat’s historical failure to break even. While it has increased EBIT and reduced net losses, the business continues to lose money on the net margin line and to incur high SG&A costs. Prosus will not only need to eliminate these costs without reducing the quality of its services but also contend with rising regulatory headwinds surrounding the remuneration of delivery drivers, data protection, and the environment.

Areas for Potential Improvement and Risks to Be Mitigated:

To enable it to address its current challenges effectively, Prosus must prioritize several areas. Foremost among these are corporate simplicity and clarity. Through its actions of enhanced transparency and by simplifying portfolio and reporting structures—most significantly, by clearly separating strategic investments and operating subsidiaries—Prosus will enable investors to better comprehend the value proposition of the novel combined food delivery business.

Second, there needs to be strict capital discipline. Because of the colossal cash outlay, Prosus should avoid pursuing high-cost investments in this period and focus on the maximum return of its assets instead.

A similar priority is cost rationalization at Just Eat Takeaway.com. Operational efficiency must be a priority. This involves optimizing delivery logistics, leveraging technology to reduce COGS and SG&A, and examining partnerships or automation to reduce costs even more. Prosus’s food delivery experience and technology expertise will be assets in driving such efficiencies.

In addition, management of regulation complexity is also becoming more and more vital, specifically concerning the rights of employees and leadership. Prosus must shore up its compliance process. Even though the fact that Just Eat has semi-independent board members is a move in the right direction, even a stronger system of governance—with ESG at the forefront and active stakeholder involvement—would even more unwaveringly stick to its vow to operate its business ethically.

Lastly, Prosus must carefully manage stakeholder expectations. An integration plan with financial targets and synergy ambitions must be clearly communicated. Being open about the timeframe in which breakeven or profitability can be expected from Just Eat would go a long way in calming stakeholders’ nerves and providing confidence in the direction of the company’s strategy.

Appendix: Valuation

1. Discounted Cash Flow (DCF) Analysis:

The DCF method yields: Implied Asset Value: $34,610.3 million, Implied Equity Value: $45,321.8 million.

These values are derived using a Weighted Average Cost of Capital (WACC) of 9.3%. The WACC is calculated based on a Cost of Equity of 9.1% (derived using the Capital Asset Pricing Model – CAPM) and a pre-tax Cost of Debt of 3.98% (estimated using a synthetic credit rating).

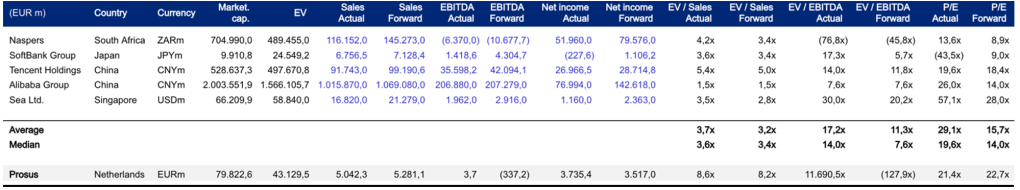

2. Comparable Company Analysis:

The selected comparable companies include Naspers, SoftBank Group, Alibaba Group, Sea Ltd. And Tencent Holdings. These companies are major participants in the global consumer internet and technology investment sector.

3. Precedent Transaction Analysis:

Analyzing five precedent transactions at the 75th percentile suggests the following implied values: EV/Sales: $46,185.3 million, EV/EBITDA: $37,451.8 million

The analysis reveals a notable dispersion in implied values across the different methodologies, particularly evident in the wide range indicated by the Price-to-Earnings (P/E) multiples from the comparable company analysis. The EV/EBITDA multiples, derived from both comparable companies and precedent transactions, provide a more consistent valuation range. Notably, the implied equity value from the DCF analysis ($45,321.8 million) falls within the range suggested by the multiples-based valuations.

Authors: Ruggero Chiostrini, Teresa Zito, Edouard Bougnoux, Filippo Bulgerelli, Filippo Fiordelisi, Marcos Caiado.

Bibliography:

Reuters. (2025, February 24). Prosus to buy Just Eat to create a European food delivery ‘champion’. Reuters. https://www.reuters.com/markets/deals/prosus-buy-just-eat-takeawaycom-create-european-food-delivery-firm-2025-02-24/

Lunden, I. (2022, August 2). Uber exits Zomato investment for over $390 million. TechCrunch. https://techcrunch.com/2022/08/02/ubers-ride-with-indian-food-delivery-firm-zomato-comes-to-an-end/

Ahuja, K., Chandra, V., Lord, V., & Peens, C. (2021, September 22). Ordering in: The rapid evolution of food delivery. McKinsey & Company. https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/ordering-in-the-rapid-evolution-of-food-delivery

The Brainy Insights. (2024, July). Online Food Delivery Market Size by Service Type (Platform to Consumer and Restaurant to Consumer), Channel Type (Mobile Applications and Websites), Payment Method (Cash on Delivery and Online Payment), Regions, Global Industry Analysis, Share, Growth, Trends, and Forecast 2024 to 2033. https://www.thebrainyinsights.com/report/online-food-delivery-market-12992

Grand View Research. (n.d.). Online Food Delivery Services Market Size, Share & Trends Analysis Report By Type (Restaurant-to-Consumer, Platform-to-Consumer), By Channel (Website/Desktop, Mobile Applications), By Payment Method, By Region, And Segment Forecasts, 2025 – 2030. https://www.grandviewresearch.com/industry-analysis/online-food-delivery-services-market

Statista. (n.d.). Most popular food delivery apps in Brazil. Retrieved April 13, 2025, from https://www.statista.com/statistics/748291/most-popular-food-delivery-apps-brazil/

Statista. (n.d.). Online food delivery bookings by brand in Brazil. Retrieved April 13, 2025, from https://www.statista.com/forecasts/1226560/online-food-delivery-bookings-by-brand-in-brazil

Setti, R. (2024, September 3). iFood bate 100 milhões de pedidos em um mês, volume recorde e salto anual de 30%. O Globo. https://oglobo.globo.com/blogs/capital/post/2024/09/ifood-bate-100-milhoes-de-pedidos-em-um-mes-volume-recorde-e-salto-anual-de-30percent.ghtml

Prosus. (2024). Annual Report 2024. https://www.prosusreport2024.com/pdf/performance-review.pdf

Statista. (n.d.). Key figures on food delivery app iFood in Brazil. Retrieved April 13, 2025, from https://www.statista.com/statistics/1051639/brazil-key-figures-food-delivery-app-ifood/

Brower, D. (2025, March 1). Prosus to acquire Just Eat Takeaway in €4bn deal. Financial Times. https://www.ft.com/content/9b3af18a-e499-4baf-92d8-930ad39f26b9

Mergermarket. (n.d.). Prosus NV to acquire Just Eat Takeaway.com NV. Retrieved April 13, 2025, from https://mergermarket.ionanalytics.com/deal/mna/1536005

Prosus. (2025, February 24). Prosus to acquire Just Eat Takeaway.com. https://www.prosus.com/news-insights/regulatory-updates/2025/prosus-to-acquire-just-eat-takeaway

Mergermarket. (n.d.). Prosus NV company profile. Retrieved April 13, 2025, from https://mergermarket.ionanalytics.com/?name=%7B%221447997%22%3A%22Prosus%20NV%22%7D&selectedContentId=1004204266&intelligencePageNumber=5

Lee, M. (2025, February 24). Prosus’ $4.3 billion all-cash offer for Just Eat Takeaway: A strategic move in European food delivery. AInvest. https://www.ainvest.com/news/prosus-4-3-billion-cash-offer-eat-takeaway-strategic-move-european-food-delivery-2502/

Just Eat Takeaway.com. (2025, February 24). Just Eat Takeaway.com and Prosus agree on recommended EUR 20.30 per share all-cash offer. https://newsroom.justeattakeaway.com/en-WW/247234-just-eat-takeaway-com-and-prosus-agree-on-recommended-eur-20-30-per-share-all-cash-offer-equivalent-to-eur-4-1bn-for-100-of-the-shares

IB Insights. (2025, March 2). Prosus to acquire Just Eat Takeaway. https://ib-insights.com/2025/03/02/prosus-to-acquire-just-eat-takeaway/

Mergermarket. (n.d.). Homepage. https://www.mergermarket.com

Brower, D. (2025, March 1). Prosus to acquire Just Eat Takeaway in €4bn deal. Financial Times. https://www.ft.com/content/9b3af18a-e499-4baf-92d8-930ad39f26b9

Reuters. (2025, February 24). Prosus to buy Just Eat Takeaway.com to create European food delivery firm. https://www.reuters.com/markets/deals/prosus-buy-just-eat-takeawaycom-create-european-food-delivery-firm-2025-02-24/

Invezz. (2025, February 24). Prosus’ $4.3B takeover bid fuels a 5.4% surge in Just Eat stock. TradingView News. https://www.tradingview.com/news/invezz%3Aeb2f424b4094b%3A0-prosus-4-3b-takeover-bid-fuels-a-54-surge-in-just-eat-stock/

The Guardian. (2025, February 24). Just Eat Takeaway agrees to €4.1bn takeover by Prosus. https://www.theguardian.com/business/2025/feb/24/just-eat-takeaway-prosus-deal-delivery-hero

MarketScreener. (2025). Prosus N.V. proposed to acquire Just Eat Takeaway.com N.V. from Jitse Groen and others for €4 billion. https://in.marketscreener.com/quote/stock/PROSUS-N-V-66148584/news/Prosus-N-V-proposed-to-acquire-Just-Eat-Takeaway-com-N-V-from-Jitse-Groen-and-others-for-4-billio-49139901/

eMarketer. (2025). Prosus’ Just Eat Takeaway acquisition strategy. https://www.emarketer.com/content/prosus-just-eat-takeaway-acquisition-strategy

Euronews. (2025, February 24). Shares soar in Just Eat Takeaway.com as Prosus announces acquisition. https://www.euronews.com/business/2025/02/24/shares-soar-in-just-eat-takeaway-com-as-prosus-announces-acquisition

TechCentral. (2025, February 24). Prosus in blockbuster R79-billion Just Eat acquisition. https://www.techcentral.co.za/article/prosus-in-blockbuster-r79-billion-just-eat-acquisition-2025-02-24/

Reuters. (2025, February 24). Prosus to buy Just Eat to create a European food delivery ‘champion’. Reuters. https://www.reuters.com/markets/deals/prosus-buy-just-eat-takeawaycom-create-european-food-delivery-firm-2025-02-24/

The Brainy Insights. (n.d.). Online Food Delivery Market Report. Retrieved April 13, 2025, from https://www.thebrainyinsights.com/report/online-food-delivery-market-12992

Statista. (n.d.). Online food delivery services in the U.S. Retrieved April 13, 2025, from https://www.statista.com/topics/3294/online-food-delivery-services-in-the-us/

Ahuja, K., Chandra, V., Lord, V., & Peens, C. (2021, September). Ordering in: The rapid evolution of food delivery. McKinsey & Company. https://www.mckinsey.com/~/media/mckinsey/industries/technology%20media%20and%20telecommunications/high%20tech/our%20insights/ordering%20in%20the%20rapid%20evolution%20of%20food%20delivery/ordering-in-the-rapid-evolution-of-food-delivery_vf.pdf

Reuters. (n.d.). Just Eat Takeaway.com NV Company Profile. Retrieved April 13, 2025, from https://www.reuters.com/company/just-eat-takeaway-com-nv/

Mergermarket. (n.d.). Predictive M&A Intelligence for Origination. Retrieved April 13, 2025, from https://www.mergermarket.com

Morningstar. (2025, February 24). Prosus agrees to acquire Just Eat Takeaway for EUR4.1 billion in cash. https://www.morningstar.co.uk/uk/news/AN_1740380513220947200/prosus-agrees-to-acquire-just-eat-takeaway-for-eur41-billion-in-cash.aspx

You must be logged in to post a comment.