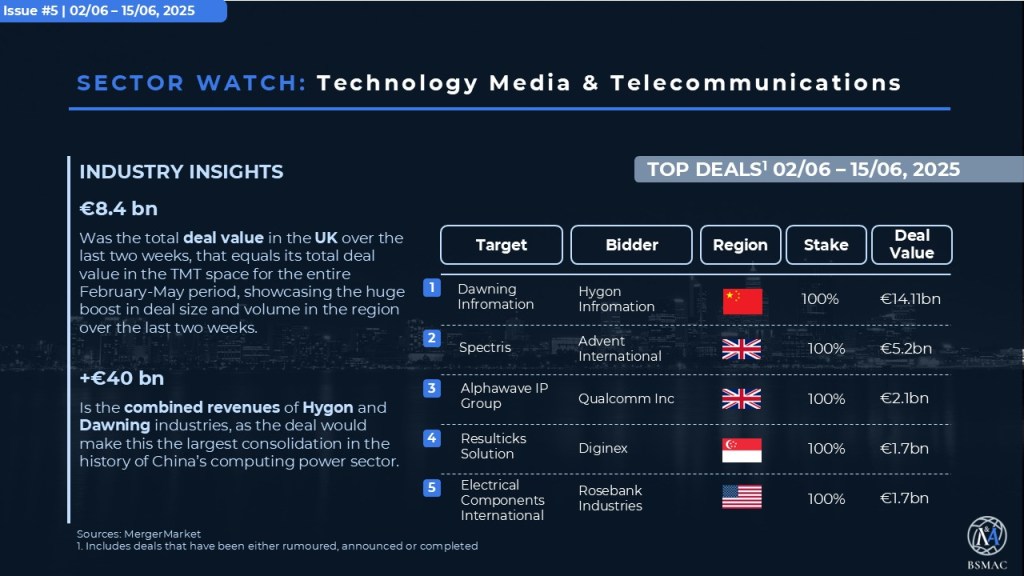

The fifth edition of M&A Pulse captures a period marked by high-value transactions in FIG and TMT, with strategic repositioning by global players. Notable moves include Dai-ichi Life’s entry into Trucordia, M&G’s €25.2bn divestment, and Qualcomm’s €5.2bn acquisition of Diginex, signaling confidence in AI and semiconductor verticals.

Across Healthcare and Industrials, blue-chip buyers such as Sanofi, Eli Lilly, and Toyota Industries pursue targeted asset plays, while Energy dealflow focuses on transmission infrastructure and royalty assets—reflecting the persistent shift toward long-duration, yield-generating platforms.

This article is also available on LinkedIn.

Authors: Marco Lodrini, Giovanni Maria Fusco, Riccardo Consalvo, Felix Lehtonen, Ruggero Chiostrini, Francesco Savelli, Emilio Cornejo, Dragos Octavian Filipas.

You must be logged in to post a comment.