On September 29, 2025, Electronic Arts (EA) announced that it would be taken private by a consortium led by Public Investment Fund (PIF), together with Silver Lake and Affinity Partners, in an all-cash transaction that puts EA’s Enterprise Value at €47bn. The deal, expected to be executed in Q1 of fiscal year 2027, will be the largest leveraged buyout (LBO) transaction to date.

Surprisingly, the deal rationale besides economic interests hides various broader political goals, marking the transaction as a geopolitical move as well. the announcement comes at a time when gaming has grown into the world’s largest entertainment medium, shaping global culture and influencing how billions spend their time online. As digital ecosystems evolve, controlling major publishers increasingly means controlling vast social spaces, data-rich communities, and highly engaged user networks. Investors and governments alike now view gaming as a strategic asset, blurring the lines between entertainment, technology, and geopolitical influence.

By exiting the public market after more than three decades, EA would gain greater flexibility to restructure its operations and pursue long-term growth across live services, AI-driven game development, and cross-platform integration. For the acquiring group, the transaction would grant exposure to an established gaming leader with strong recurring revenue and a large player ecosystem, positioned at the intersection of entertainment and technology.

Strategically, the move highlights a continuing wave of consolidation in the gaming industry, following transactions such as Microsoft’s purchase of Activision Blizzard. It is also a continuation of Saudi Arabia’s efforts to expand its influence in global media and technology investments, aligned with the Kingdom’s Vision 2030 diversification agenda.

TARGET OVERVIEW

Electronic Arts Inc., commonly known as EA, is one of the world’s most successful video game publishers, famous for its sports titles, simulation games, and online live-service franchises.

Founded in May 1982 by Trip Hawkins in California (“Electronic Arts,” n.d.)[1], Electronic Arts emerged as a software company that treated video games as an inspired art form. It was originally called Amazin’ Software, but it chose to change its name to Electronic Arts, reflecting the belief that game developers are “software artists” and that video games are a form of art. The early years of EA consisted of small-scale operations with direct-to-retailer sales, leading it to develop its first games by the beginning of 1983 to usher in a new frontier of interactive entertainment. During the 1980s and the early 1990s, EA acquired a unique reputation for crediting developers as creative talent on the packaging of games and promoting them as artists.

As the video game market matured, EA entered a phase of major expansion. In 1991, Trip Hawkins stepped down as CEO and was succeeded by Larry Probst, who led the shift of EA from personal computer games to developing games for major console makers, creating long-standing franchise relationships. Throughout the 1990s and 2000s, EA went on an acquisition spree aimed at securing a leading position in the growing gaming landscape. These included the 1997 acquisition of Maxis, the developer of “The Sims”, and later on, BioWare and DICE, expanding EA’s reach in the simulation and first-person shooter genres. The company’s sports titles, particularly Madden NFL and FIFA, became annual bestsellers, establishing EA Sports as a household name and a leader of that market segment, which today still is the most relevant for the company.

By the late 2000s and early 2010s, EA began seriously revamping its strategy to react to the uprising digital era. Consequently, the company started laying more emphasis on digital distribution and online services due to the increased adoption of broadband internet and mobile devices. In 2011, it launched Origin, a digital distribution platform that allows PC gamers to enjoy their favourite titles through direct downloads and in-game connectivity; key features that nowadays are fundamental in online games. Thanks to these initiatives, EA’s business model transformed from relying mostly on the one-time sale of games to a “live-services” model, where players engage with games over very long periods of time through downloadable content, in-game purchases, and subscription services (such as EA Play).

One of the defining developments in EA’s modern history came on September 29th, 2025, when it announced plans to go private in a €47bn deal (EA, 2025)[2], led by a consortium that includes Saudi Arabia’s Public Investment Fund, Silver Lake, and Affinity Partners. The proposed acquisition, when completed, would mark a major strategic inflection point for EA, freeing it from quarterly public market pressure and allowing it to make long-term investments in new technologies, artificial intelligence, and immersive entertainment experiences.

Structure

As of 2025, EA remains listed on the NASDAQ (ticker: EA), though its ownership is heavily concentrated among institutional investors. The Vanguard Group holds approximately 10.4%, followed by SSgA Funds Management (6.8%), BlackRock Fund Advisors (5.8%), and Capital Research & Management (3.9%). The Public Investment Fund (PIF) has already accumulated nearly 10%, underlining its strategic interest in the company ahead of the buyout.

Insider ownership remains low, at under 11%, consistent with EA’s profile as an institutionally held global corporation. Andrew Wilson, who has served as CEO and now Chairman since 2013, leads the company’s executive team along with key executives (EA, 2025)[3] such as Laura Miele, President of EA Entertainment, Technology & Central Development, and Stuart Canfield, Executive Vice President and CFO.

Figure 1: Public Share Ownership Breakdown

Main Shareholders

Business Overview

EA’s operations span all major gaming platforms (console, PC, and mobile), and the company maintains a strong presence across North America, Europe, and Asia-Pacific. Its business is divided into two core divisions:

- EA Sports: the company’s sports simulation arm, produces annualized franchises such as “Madden NFL”, “EA Sports FC” (formerly “FIFA”), and “F1”. These titles maintain a tight relationship with real-world sports leagues and athletes, securing EA’s dominance in the sports gaming niche.

- EA Entertainment, which includes “The Sims”, “Battlefield”, “Apex Legends”, and “Star Wars Jedi”, represents the broader entertainment ecosystem that caters to diverse audiences and offers diverse monetization models.

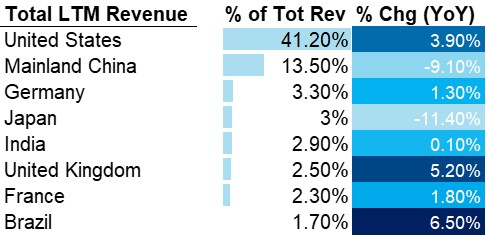

EA’s total LTM revenue stands at 6.1bn €, with the United States contributing 41% of total revenue, followed by China (3.9%), Germany (3.3%), Japan (3.0%), and the United Kingdom (2.5%). Here are represented the most relevant geographies, associated with percentages of EA revenues:

Figure 2: Geographic breakdown of EA’s LTM revenue

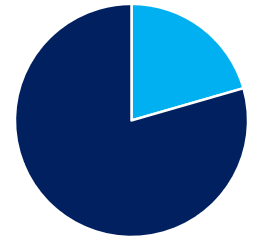

EA is among the top global players in console gaming software, as shown below. EA accounts for approximately 20.5% of total console software revenue, placing it among the top five industry leaders, which together capture nearly 98.6% of the market. This concentration reflects both high barriers to entry and the importance of established intellectual property and development ecosystems.

Revenue Share in Console Games Software

Rest of Industry (79.46%); EA (20.54%)

Figure 3: Revenue share in the Console Games Software subsector, comparison of EA and the rest of the industry

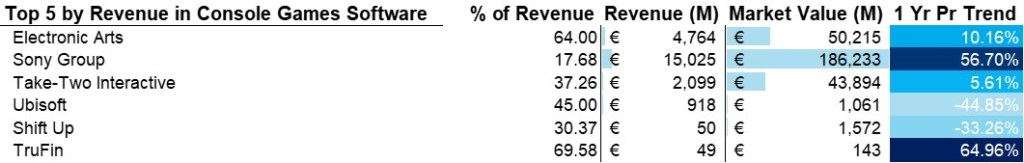

Within this competitive landscape, EA’s scale and concentration is evident. Among the 5 top players in the industry, EA is the leader, coming from the Console Games Software segment with 64%, as can be seen below:

Figure 4: Top 5 players by revenue in the in the Console Games Software subsector

Recent Financial Performance

EA’s financials for the fiscal year ending March 2025 reflect solid performance amid a competitive environment. While sales decreased slightly to 6.1bn € (down 0.8% YoY), profitability remained robust, underpinned by expanding gross margin, which rose to 78.4%, continuing an upward trend from 76.3% the previous year, while EBITDA margin remained stable at 25.4%. On the other hand, return on equity decreased to 16.1%, indicating sustained profitability, albeit slightly below the 17.2% achieved in 2024.

Figure 5: EA’s Income Statement evolution from FY2021 to FY2025

Figure 6: Net income and return on equity evolution from FY2021 to FY2025

From a balance sheet perspective, EA maintains a strong financial position, with LT D/E ratio at 27.4% and net leverage ratio at -0.2x, underscoring a net cash position. The company’s balance sheet strength provides flexibility for both organic expansion and potential acquisitions.

These figures overall showcase EA’s ability to keep a healthy financial situation and stable margins amid slowed top-line growth and uncertain market conditions.

As can be seen below, Console Games Software represents 64% of total revenue, reaffirming the dominance of EA’s flagship titles such as “EA Sports FC” and “Madden NFL”. Online Game Websites and Software contribute a further 20.7%, driven primarily by live-service models and in-game monetization. Finally, Handheld and Smartphone Games Software accounts for 15.3% of total revenue.

Figure 7: Sector breakdown of EA’s LTM revenue

BUY-SIDE OVERVIEW

Silver Lake

Overview and Investment Strategy

Silver Lake Management LLC is a large-scale tech investor focused on control and significant minority stake deals across software, media/entertainment, fintech, infrastructure, and AI solutions. Silver Lake emphasizes partnering with founder/CEO-led platforms and doing complex public-to-privates as the main pillar of their investment strategy.

The consortium is expected to invest in EA with Silver Lake Partners VII (SLP VII) (Silver Lake, 2024)[4], their 17.4 bn € flagship fund closed in May 2024.

Portfolio Comparables

- Endeavor (WME Group) (PE Insights, 2024)[5] €21.7bn take-private: a defining Silver Lake investment and now full take-private completed in 2025, the firm backed Endeavor through multiple stages, supporting its acquisition of IMG, UFC, and later integrating media and sports entertainment assets under one global platform

- Zuora (Zuora, 2025)[6]: taken private alongside GIC in 2025 for €1.5bn (Investing.com, 2024)[7], this subscription management software provider reflects Silver Lake’s interest in vertical SaaS with recurring revenue and predictable, cash-generating growth

- Unity Technologies (Silver Lake, 2017)[8]: earlier stake (€347m) in the 3D game-engine leader, highlighting Silver Lake’s experience in gaming and developer platforms

Public Investment Fund (PIF)

Overview and Investment Strategy

PIF is Saudi Arabia’s sovereign wealth fund with over 781.3 bn € in AUM, and it is mandated under Vision 2030 (Vision 2030, n.d.)[9] to diversify the Kingdom’s economy and establish leadership positions in entertainment, technology, and gaming through sector-specific vehicles (PIF, n.d.)[10] like Savvy Games Group (portfolio company).

PIF is participating directly in the EA consortium and rolling over its ~9.9% EA stake (Argaam, 2025)[11] into the deal.

Portfolio Comparables

- Scopely (PIF, 2023)[12]: acquired by Savvy Games Group for 4.3 bn € in 2023, Scopely is a major US mobile gaming studio (produced titles like “Marvel Strike Force” and “Stumble Guys”)

- Public-market stakes and activity across global gaming, such as historical stakes in Nintendo (6.3%) (Tech in Asia, 2024)[13], Capcom (5%), Activision Blizzard (2%), and many more (Reuters, 2025)[14], reflecting the broader sector and historical presence (Compendio, 2025)[15]

Affinity Partners

Overview and Investment Strategy

Affinity Partners is a relatively new private equity firm founded in 2021 by Jared Kushner (Reuters, 2025)[16] (President Trump’s son-in-law), with backing from Gulf sovereigns, including PIF, QIA, and Lunate. It focuses on mid- to large-cap growth and buyout opportunities in US and Israeli tech, consumer, and media sectors, often facilitating cross-border expansion and partnerships with regional capital.

The EA investment is being made from Affinity’s debut fund (Fund I), whose investment period has been extended to 2029 (Investing.com, 2024).[17]

Portfolio Comparables

- EGYM (TechCrunch, 2023)[18]: (Series F, ~€195.3m, 2023) a fitness-tech platform which demonstrates Affinity’s preference for tech-enabled consumer/health

MARKET OVERVIEW

The gaming and interactive entertainment industry is shifting from years of rapid growth fueled by the Covid-19 pandemic into a phase of more stable and sustainable expansion. Following an increase in development costs, pressures to consolidate, and shifts in player behavior, major publishers have been forced to adapt their business models. Currently, digital distribution, live-service ecosystems, and subscription models define much of the market, extending the lifecycle of flagship franchises. At the same time, AI advancements, together with cloud streaming and cross-platform functionality, are reshaping both the development process and how players access content, while the regulatory scrutiny around monetization and data privacy is intensifying. In this environment, leading companies are using their scale, proprietary IP, and diversified revenue streams to reinforce their competitive position in a sector that is maturing yet still highly innovative.

Industry Analysis

The global gaming and interactive entertainment industry generated approximately €190bn in revenue in 2024 (Paizanis et al., 2024)[19], showing a recovery after the slowdown caused by the pandemic and a shift to more sustainable growth. The market is projected to expand at a 5% CAGR through 2028, reaching roughly €228bn, making gaming one of the most resilient segments of the wider media and entertainment economy. While this is a decrease compared to the 13% CAGR between 2017 and 2021, the sector still outperforms most traditional entertainment media, supported by consumer engagement and innovation in monetization and content delivery.

Figure 8: Sector breakdown of global gaming revenue

Additionally, the growth model of the industry is changing, and companies are trying to balance rising development costs with changing player behavior. From 2017 to 2023, AAA development budgets increased by over 300%1 and sales/marketing expenses more than doubled, yet the number of major game releases declined significantly. As a result, publishers are working towards scalable IP, live-service ecosystems, and recurring revenue streams rather than relying on one-off premium launches.

The largest source of revenue is consumer spending, including full-game sales, downloadable content, subscriptions, and in-game purchases. For consoles, digital transactions and in-game spending account for almost 80% of total revenue, reflecting the drastic decrease in physical distribution. Mobile gaming, on the other hand, is driven by in-app advertising and microtransactions centered around the free-to-play model. Notably, a significant transformation is also underway in monetization models with subscriptions such as Xbox Game Pass, PlayStation Plus, and Apple Arcade converting one-time purchasers into long-term users in order to provide recurring revenue and stabilize cash generation.

Regulatory Reforms

The gaming industry has been facing increasing regulatory attention over the past years. Governments are aiming to oversee monetization practices, consumer data protection, and labor standards. In Europe, the Digital Services Act (DSA) and Digital Markets Act (DMA) (European Commission, 2022)[20] are reshaping platform governance, potentially reducing Apple and Google’s dominance in mobile distribution and payments. On a national level, gambling-style monetization is being targeted, with Belgium and the Netherlands banning loot boxes, which has caused global publishers to redesign the in-game structure. Meanwhile, the growing unionization of developers in North America and Europe, seen at Sega of America and Activision Blizzard (Piqueno IV, 2024)[21], is an important step in regularizing labor conditions within the sector.

Geographic Focus

The global gaming industry is concentrated in a few dominant regions but is undergoing a steady shift toward emerging markets. North America and East Asia continue to drive the sector as a result of the mature ecosystems, strong IP portfolios, and high consumer willingness to spend. The US and China together generate nearly 50% of worldwide gaming revenue, with the US leading in console and subscription-based gaming and China leading in mobile and online PC platforms.

Going forward, however, emerging economies are expected to be at the base of future expansion. It is estimated that 43% of gamers in emerging markets, notably Brazil, India, Mexico, and Turkey, plan to increase their playtime, compared to only 19% in developed economies (“Electronic Arts,” n.d.)1.

This gap reflects both rising disposable incomes and the accessibility of mobile platforms. To capture this opportunity, publishers are adapting to local conditions through flexible pricing, ad-supported titles, and hybrid monetization models aimed at lower-income but fast-growing audiences.

A standout development is the rise of Saudi Arabia as both an emerging gaming market and a major global investor. Under its Vision 2030 diversification program, the Kingdom is channeling significant capital through the Public Investment Fund (PIF) and its Savvy Games Group, which has invested more than €33bn in global gaming assets (Reuters, 2022)[22]. These include the acquisitions of Scopely and Niantic’s gaming arm, as well as strategic stakes in Nintendo, Capcom, and Embracer Group. Beyond investments, the Kingdom wants to establish itself as a development, e-sports, and content-production hub: gaming is poised to occupy a major role in its post-oil economy.

Technological Advancements

Cloud and Immersive Technologies

Cloud gaming revenues are projected to rise from €398m in 2024 to €806m by 2028, while AR and VR gaming software revenues are expected to grow from €1bn to €2bn. Despite this expansion, both segments remain niche relative to the +€170bn broader market, limited by high infrastructure costs, hardware barriers, and content availability (“Electronic Arts,” n.d.)1.

Artificial Intelligence and Production Efficiency

Generative AI is quickly becoming the most notable technological development in gaming; 65% of AAA publishers are planning on raising development budgets by 6%-10% to integrate GenAI tools, while only 5% expect any budget reduction (“Electronic Arts,” n.d.)1. Additionally, among mid-sized (AA) and independent studios, more than 70% expect to increase spending moderately to accelerate adoption. AI is mainly being used to automate tasks such as playtesting, quality assurance, localization, and procedural asset design, enabling larger, more dynamic worlds and personalized gameplay.

User-Generated Content (UGC)

Developer payouts on UGC platforms, driven by ecosystems like Roblox and Fortnite Creative, increased from €95m in Q2 2020 to €2bn in Q2 2024, showing the rising importance of creator-driven engagement models that extend game lifecycles and reduce reliance on traditional content pipelines (“Electronic Arts,” n.d.)1.

M&A Activity

The gaming industry experienced an increase in M&A activity in 2024, marking a reversal from the stagnation of the previous year. A total of 198 deals were announced, representing a 21% increase in volume and a 39% rise in disclosed deal value compared to 2023 (Drake Star, 2024)[23]. Aggregate disclosed value reached €9bn, up from €7bn the year before. While the volume remained below the 2021 peak, the return of strategic acquisitions and sponsor-led buyouts shows renewed confidence in the sector’s fundamentals.

This was largely driven by the reactivation of private equity and the return of large-cap buyers after a year of rate sensitivity, valuation uncertainty, and post-pandemic content saturation. Improved clarity on interest rate direction allowed both financial sponsors and strategic acquirers to re-enter the market. Several of the largest deals involved public-to-private transactions and consolidation plays focused on content IP, mobile distribution, and platform integration.

Segment-wise, the PC/Console sector led the year with 53 M&A deals, followed by Mobile (38 deals) and Platform/Tools (32 deals), with transactions tilted more towards late-stage or profitable targets with existing monetization pipelines. Geographically, North America accounted for €5bn of total deal value, more than half of the global total. Asia and other markets contributed €3bn, while Europe lagged at €1bn, despite several headline-grabbing transactions. Notably, cross-border deal flow remained robust, with several Asian and Middle Eastern buyers acquiring Western targets.

Top 5 M&A Deals of 2024

- EQT acquired Keywords Studios (outsourcing and services) for €2bn (PE Insights, 2025)[24], the year’s largest gaming transaction

- Playtika acquired SuperPlay for up to €2bn, including a €600m upfront payment and €1bn in earnouts (Playtika, 2023)[25]

- Tencent/Miniclip acquired Easybrain for €1bn, adding Sudoku.com and other high-performing casual titles to their mobile portfolio (Embracer Group, 2024)[26]

- CVC Capital Partners acquired Jagex, the developer of RuneScape, for €940m, securing a strong foothold in persistent online multiplayer games (Taylor, 2024)[27]

- Modern Times Group (MTG) acquired Plarium from Aristocrat for up to €533m (MTG, 2024)[28]

DEAL RATIONALE

Overview

The deal represents a great opportunity for the Saudis to diversify their economy away from oil (Superjoost, 2025)[29], and at the same time, the acquisition is an invaluable chance for EA to regain market share and increase its growth rate from an average of 2.2% from 2023 to 2025to about 5% between 2026 and 2030 under Silver Lake’s guidance.

Nevertheless, the transaction should not be viewed just from these two lenses, given its size, complexity, and actors involved. The consortium is composed of three members, each bringing a unique and invaluable contribution to the table:

- PIF, backed by the Saudi government, brings the resources needed for massive operations such as this one. On top of that, its involvement allows the consortium to raise significantly more capital from banks as well

- Silver Lake lends operational credibility, given its expertise in the private equity industry and the TMT landscape

- Affinity Partners (through its founder, Kushner) has the political connections needed to help the deal close successfully (slated by Q1 2027) and surpass the regulatory and political hurdles a deal of this kind may face

Buyer’s rationale

According to Mergermarket, the agreement between the three buyers (PIF, Silver Lake, and Affinity Partners) entails that PIF will be the majority shareholder of Electronic Arts (Tono Gil, 2025)[30], Silver Lake will be the largest minority shareholder, followed by Affinity Partners with approximately a 5% stake in the company.

Given the post-deal equity structure, the buyer’s rationale can be mainly explained by the Kingdom’s interest, which is to reduce its revenue dependence on oil (in line with the government’s strategy to render Saudi Arabia a global hub for the games and esports sector by 2030). Nevertheless, the transaction is also a chance for the Saudis to expand their cultural influence globally and perform a demonstration of soft power (McGregor, 2025)[31], improving the country’s reputation (tarnished mainly by issues regarding human rights and governance).

Furthermore, building on the €4bn Scopely acquisition consummated in 2023 via its portfolio company Savvy Games, PIF is showing concrete intention in creating a bigger unified platform (Kim, 2025)[32] comprising not just EA, but also well-regarded brands such as Niantic and Pokémon Go, operating across all gaming segments. In fact, as Scopely, Niantic, and Pokémon Go were acquired to amplify PIF’s mobile gaming offering (16% of net bookings), EA will significantly strengthen the gaming offering under the PIF umbrella in the console (65% of net bookings)and PC (20% of net bookings)segments.

On this integration, tech-PE-giant Silver Lake could be of great help to EA, given its deep expertise and extensive network of relationships within the sector.

As EA struggled to grow in the PC and mobile segments in recent years, with an average annual growth rate of 2.2% from 2023 to 2025, Silver Lake and PIF will likely refocus EA’s strategy around console due to reasons such as industry headwinds owing to softer consumer spending and an increasingly precarious global trade environment, but also because of the rise of new competitors like Epic Games (Fortnite) and miHoYo (Genshin Impact). For geographical expansion, the US market will likely be the main target area considering the economy’s growth rate and size, as well as the Saudis’ ambitions within the region, as shown by the amount of assets held by PIF in the country totaling €20bn in 2025, more than doubling in value from about €9bn in 2023.

Despite the size of debt raised (€17bn), which is expected to lead to an increase in annual interest expense of about €1bn (accounting for about 70% of EBITDA), from 2027 until the end of the forecast period, current EA’s profitability (constant around 20% EBIT margin) and cash flow generation capacity (€1bn of FCFE in 2025) should allow the acquired company to service its debt and keep its DSCR in a range between 3.3x and 3.9x from 2027 (the year the increase in interest expense kicks in) to 2030 (end of the forecast period).

Seller’s rationale

From a management perspective, selling the firm made sense after considering both the pressure from shareholders that wanted to see higher growth in the mobile and PC segments and the compliance with quarterly earnings, which hampered the company’s ability to focus properly on its long-term strategy and competitiveness.

The take-private deal will allow the firm to reorient its attention towards its core business and reposition itself in the market. Nevertheless, some experts argue that with a strong focus on being dedicated to the repayment of debt in the short term, the firm may face challenges in executing its repositioning strategy.

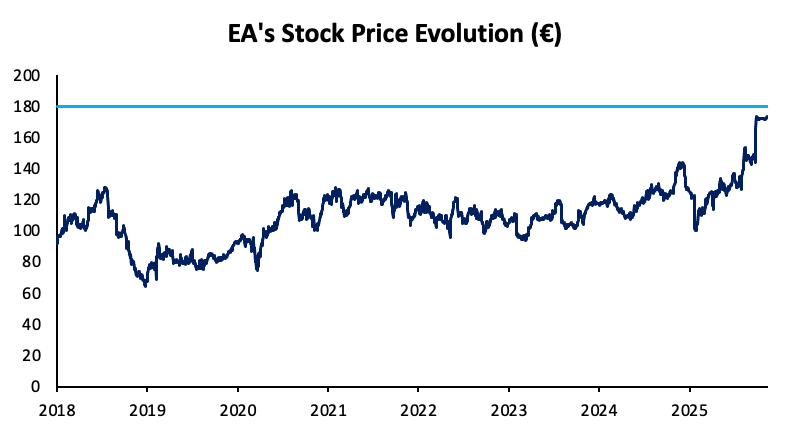

On a final note, the price at which EA was sold can be considered a bargain for the management team, after factoring in the company’s lackluster performance in recent years and the current economic landscape, with a premium of 25% (EA, 2025)[33] over EA’s unaffected share price of €145 at market close on September 25, 2025, translating into a share price of €180 and a €47bn EV, the company was valued at approximately 21 times its adjusted (adding back non-recurring charges and SBC) FY 2025 EBITDA.

| Take-Private Stock Price |

Figure 9: Historical evolution of EA’s stock price

Notably, similar EBITDA multiples were also paid by PIF and Microsoft respectively for the acquisitions of Scopely and Activision Blizzard in 2023, reflecting the strong interest in the company and the many improvement opportunities ahead.

DEAL STRUCTURE (SEC, 2025)[34]

Deal Timeline & Terms

On September 29, 2025, EA and the PIF-led consortium announced a definitive agreement to take EA private, with a formal merger agreement being filed with the SEC, defining an expected closing by Q1 FY2027, contingent on regulatory approvals. The agreement outlines an outside date of September 28, 2026, by which an €870m termination penalty is triggered if the buyers fail to close the transaction. However, the outside date is subject to extensions. If all non-regulatory conditions are met by September 25, 2026, the outside date automatically extends to December 28, 2026, and is also subject to further prolongations through mutually agreed 45-day extensions.

Regulatory approval is needed from the Committee on Foreign Investment in the US (CFIUS). A traditional CFIUS approach to a deal like this would likely contemplate restricting the transaction, as was the case with TikTok and Musical.ly in 2020. Given the sensitive data collected by modern gaming companies such as EA, it is likely that we will see at least some sort of intervention to insulate the data of American citizens from foreign state-linked parties. Furthermore, many analysts have argued that the involvement of Jared Kushner, President Donald Trump’s son-in-law, is merely a play on securing a softer CFIUS approach to this transaction.

However, interestingly, China is involved as well, since EA has a subsidiary in China, due to which the Chinese government can review and potentially slow down the transaction closing through its antitrust merger regulator, SAMR. That is, in the larger trade war space, China could leverage this transaction and the control it has over it to pressure President Trump.

Deal Type

The transaction is an all-cash leveraged buyout (LBO), taking EA private, as it will delist after the deal closes. The acquisition vehicle for the transaction is the newly created Oak-Eagle AcquireCo Inc., a Delaware company that is wholly owned by the merger vehicle Oak-Eagle MergerCo Inc. The transaction will thus be, as is usual for LBOs, a statutory stock merger, where the surviving entity is EA, and the ultimate parent is Oak-Eagle AcquireCo.

Payment Terms

The equity value of the offer is approximately €46bn, with net debt taking the enterprise value to circa €47bn. The €180 per share offer represents a 25% premium on the pre-announcement price of €145 per share. EA’s shareholders will be pleased with the cash received, as it allows for immediate liquidity without market exposure, during a time when EA has experienced mixed earnings and faced delays with multiple of its franchises. The merger agreement also contains anti-dilution adjustments, such as, in the case of a stock split or stock dividend between signing and closing, which would have an effect on EA shares, the price of €180 is subject to change to preserve economic equivalence. This will also happen in the case of any corporate action diluting value.

Financing Structure (Ruckin et al., 2025)[35]

The transaction is financed via a combination of cash from the consortium and debt, fully and solely contributed by a JPMorgan-Chase-arranged bank syndicate. The equity portion, which includes the cash and a roll-over of PIF’s existing 9.9% stake in EA, makes up approximately €30bn, or around 65% of EV, and the debt provided by JPMorgan Chase accounts for the remaining €17bn, or 35% of EV. The 9.9% equity rollover by PIF sees its EA shares transferred into the new holding company. It is crucial to note that from the €17bn of debt financing, €14bn is expected to be provided at close, and each of the consortium members is expected to fund their equity component entirely from capital under their respective control.

The debt organised by JPMorgan Chase has been provided through a consortium of at least 15 banks, some of which will take on a 10% share of the deal, or €2bn each. JPMorgan will keep around 40% to itself, according to people familiar with the transaction. Once the underwriting group is in place, the banks plan to sell the debt in leveraged loan and high-yield bond markets in early 2026. The cross-border, dual-currency financing is structured with a €2bn term loan A that will target take-and-hold strategy investors. The financing is also set to include a €7bn term loan B, €2bn of unsecured bonds, €4bn of secured bonds, and a €2bn liquidity facility. This composition is still subject to market conditions and set to potentially change.

Governance

Current CEO Andrew Wilson will remain in charge post-close, and no immediate leadership/governance changes have been announced. The company will remain headquartered in Redwood City, California, and keep all its core development teams. Two current EA board members are expected to transition to the private company board, with the rest of the seats filled by the representatives of the consortium members. Notably, the new ownership is planning on pushing through further R&D investment, especially on AI-powered development tools, which aligns with EA’s existing partnerships with companies such as Stability AI.

From a legal standpoint, EA will now operate by the bylaws of Oak-Eagle, and the “Continuing Employees” retain no worse compensation and benefits for at least one-year post-closing. That is, EA must keep the base salary, target bonus, and all vacation and other benefits of all continuing employees for at least 12 months post-closing.

VALUATION

To complete a comprehensive valuation of Electronic Arts, we leveraged multiple methodologies: Discounted Cash Flow Analysis (DCF), (Trading) Comparable Companies Analysis, and Precedent Transactions Analysis.

DCF Analysis

The DCF analysis, using a WACC of 8.4%, derived from a cost of equity of 8.9% and a cost of debt of 4.10%, and an exit multiple for terminal value of 31.4x (EV/EBITDA LTM multiple), provides a baseline Enterprise Value of around €40bn. However, the result of this intrinsic valuation is lower than the output of market and transaction comparisons, making it a conservative estimate.

The Beta we used to calculate the cost of equity is 0.65, and it was sourced from an industry average for global gaming and interactive entertainment companies, rather than EA’s standalone historical beta.

Figure 10: Summary results of the EA’s asset-side DCF

Sensitivity Analysis

Available below is the analysis of the changes to Enterprise Value under the asset-side DCF with respect to changes in WACC for a given EV/EBITDA terminal multiple. The lower bound WACC of 8% shows an Enterprise Value of €40bn, whereas the upper bound gives a valuation of €39bn.

Figure 11: Sensitivity analysis of EA’s EV to terminal EV/EBITDA multiple and WACC

Comparable Companies Analysis

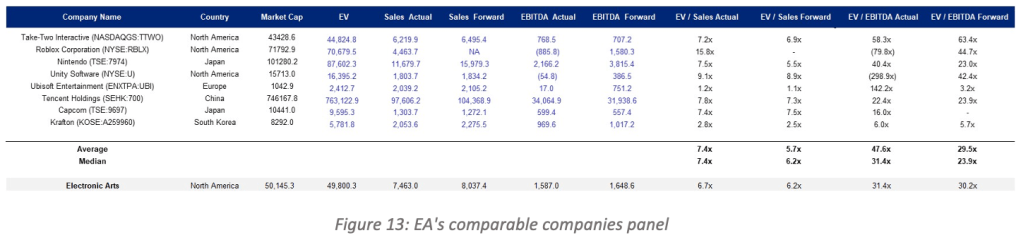

To more accurately reflect market sentiment and sector dynamics, comparable company analysis and precedent transactions were applied. Here, multiples such as EV/Sales and EV/EBITDA were benchmarked against a set of global publicly traded peers.

Given EA’s diversified revenue base, the comparable companies used in the analysis focus on global gaming publishers and interactive entertainment firms.

Rationale for Comparable Selection

The peer set includes publishers with substantial digital distribution, a similar core business to EA, and with multi-year revenue visibility.

For the purpose of our analysis, we excluded certain comparables that had negative values would have distorted the average and misrepresented the realistic valuation range, especially for a mature target like EA.

Due to EA’s stable, recurring revenue mix, EV/Sales emerges as the most meaningful benchmark.

Upper-quartile EV/Sales multiples in the peer group exceed 7.0x, and when applied to EA’s revenue base, they generate an EV above €40bn, converging toward the €47bn valuation that emerged from the LBO transaction. Trading multiples suggest Enterprise Values in the range of approximately €33-64bn, with EV/Sales Actual and Forward multiples of 7.4x and 5.7x outlining an Enterprise Value of €47bn and €39bn, respectively.

Precedent Transaction Analysis

We conducted an analysis on several M&A transactions in the 3-year period preceding EA’s acquisition. Past deals suggest an Enterprise Value close to €20bn, because of lower multiples due in part to the lack of comparable acquisitions in terms of deal value and IP portfolio, elements that would justify a higher valuation.

Multiples coherent with the deal size and relevance of Electronic Arts within the industry could be assumed in the acquisition of Activision Blizzard in 2023: EV/Sales of 8.3x and EV/EBITDA of 22.0x. These multiples yield a valuation similar to the one obtained through publicly traded comparables, outlining an Enterprise Value of around €47bn, justified by the company’s scale and strategic position.

Relevant Precedents

Activision Blizzard’s acquisition by Microsoft for €59bn is the most relevant precedent transaction.

The deal demonstrated that publishers with diversified, franchise-heavy portfolios and massive player ecosystems command:

- Premiums of 40%-60% (compared to the undisturbed share price one month before the announcement);

- Valuation multiples above historical averages.

The scale and structure of this transaction placed upward pressure on the implied fair value of remaining top-tier publishers, EA being the closest comparable in terms of profile and IP depth.

Football Field

Using a football field, the EV estimated with each valuation methodology can be compared (results are expressed in €m, and the width represents 25th – 75th percentile, with outliers removed):

The limited number of companies in the space and of precedent transactions of comparable scale mean the Enterprise Value derived from multiples spans a broader range, reflecting higher uncertainty. Activision Blizzard’s acquisition offers a good reference point for a deal this large, where strategic factors heavily influence the implied multiples, often resulting in values outside the narrower DCF range.

In conclusion, although DCF offers a conservative lower-bound valuation, and despite other methods offering heterogeneous results, the EV of €47bn that was paid by the PIF-led consortium reflects both market realities and strategic considerations and is well supported by trading and deal multiples.

FINAL CONSIDERATIONS

The transaction can be represented as a rational but ambitious bet: sponsors are paying a premium multiple in line with other gaming deals, like Microsoft’s acquisition of Activision Blizzard, to back a market leader whose fundamentals and recurring-revenue profile can support a record LBO leverage, in exchange for the opportunity to reshape EA into the cornerstone of a global, Saudi-backed gaming and interactive entertainment platform.

The key execution risks do not lie in EA’s core business, but more in navigating regulatory issues and geopolitics, integrating with PIF’s broader gaming ecosystem, and balancing aggressive investment in technology with disciplined balance sheet management.

Authors:

- Division Head: Lorenzo Montagner

- Analysts: Giacomo Capuani, Joana Hristanova, Steven Iallonardo, Felix Lehtonen, Edoardo Simonetti

- V&M Member: Alessandro Sultan

BIBLIOGRAPHY

- Electronic Arts in it.wikipedia.org. Retrieved from: https://it.wikipedia.org/wiki/Electronic_Arts

- EA Announces Agreement to be Acquired by PIF, Silver Lake, and Affinity Partners for $55 Billion (29/09/2025) in ir.ea.com. Retrieved from: https://ir.ea.com/press-releases/press-release-details/2025/EA-Announces-Agreement-to-be-Acquired-by-PIF-Silver-Lake-and-Affinity-Partners-for-55-Billion/default.aspx

- ea.com. Retrieved from: https://www.ea.com/executives

- Silver Lake Closes $20.5 Billion Fundraise for SLP VII (08/05/2024) in Silverlake.com. Retrieved from: https://www.silverlake.com/silver-lake-closes-20-5-billion-fundraise-for-slp-vii/

- Silver Lake completes $25bn take-private of Endeavor, rebrands it as WME Group in pe-insights.com. Retrieved from: https://pe-insights.com/silver-lake-completes-25bn-take-private-of-endeavor-rebrands-it-as-wme-group/

- Silver Lake and GIC Complete Acquisition of Zuora (14/02/2025) in zuora.com. Retrieved from: https://www.zuora.com/press-release/silver-lake-gic-zuora/

- Silver Lake Announces Strategic Investment in Unity Technologies (24/05/2017) in Silverlake.com. Retrieved from: https://www.silverlake.com/silver-lake-announces-strategic-investment-in-unity-technologies/

- Zuora accetta un’offerta di acquisto da 1,7 miliardi di dollari da Silver Lake e GIC (17/10/2024) in investing.com. Retrieved from: https://it.investing.com/news/company-news/zuora-accetta-unofferta-di-acquisto-da-17-miliardi-di-dollari-da-silver-lake-e-gic-93CH-2543268

- Public Investment Fund Program 2021-2025 in vision2030.gov.sa. Retrieved from: https://www.vision2030.gov.sa/media/mdppqvmv/v2030_pif_2025_en.pdf

- Develop Saudi Arabia’s Innovation Capabilities by Localizing the Technology Sector and Developing the Telecom & Media Sector in pif.gov.sa Retrieved from: https://www.pif.gov.sa/en/strategy-and-impact/the-program/telecom-media-and-technology/

- PIF joins consortium to acquire Electronic Arts in $55B deal (29/09/2025) in argaam.com. Retrieved from: https://www.argaam.com/en/article/articledetail/id/1846299

- Savvy Games Group completes acquisition of Scopely for $4.9 billion (12/07/2023) in pif.gov.sa. Retrieved from: https://www.pif.gov.sa/en/news-and-insights/newswire/2023/savvy-games-group-completes-acquisition-of-scopely-for-fourty-nine-billion/

- Saudi cuts Nintendo stake from 7.5% to 6.3% (13/11/2024) in techinasia.com. Retrieved from: https://www.techinasia.com/news/saudi-cuts-nintendo-stake

- ‘Pokemon Go’ maker Niantic to sell game division to Saudi-owned Scopely for $3.5 billion (12/03/2025) in reuters.com. Retrieved from: https://www.reuters.com/markets/deals/pokemon-go-maker-niantic-sell-game-division-saudi-owned-scopely-35-billion-2025-03-12/

- All The Gaming Companies Saudi Arabia Owns Or Has Invested In (Chris Compendio, 30/09/2025) in gamespot.com. Retrieved from: https://www.gamespot.com/gallery/all-the-gaming-companies-saudi-arabia-owns-or-has-invested-in/2900-7081/

- Kushner’s Affinity’s assets jump to $4.8 billion after Gulf cash injection (28/03/2025) in reuters.com. Retrieved from: https://www.reuters.com/business/finance/kushners-affinitys-assets-jump-48-billion-after-gulf-cash-injection-2025-03-28/

- Kushner’s Affinity Partners raises $1.5 billion, extends fund investment period to 2029 (20/12/2024) in investing.com. Retrieved from: https://www.investing.com/news/stock-market-news/kushners-affinity-partners-raises-15-billion-extends-fund-investment-period-to-2029-93CH-3784150

- EGYM, the Munich-based smart fitness startup, raises $225M from Jared Kushner’s Affinity Partners (05/07/2023) in techcrunch.co. Retrieved from: https://techcrunch.com/2023/07/05/egym-the-munich-based-smart-fitness-startup-raises-225m-from-jared-kushners-affinity-partners/

- Paizanis, G., Pagano, E., Schonfeld, R., Schmidt, N. (2024, December). Leveling Up for the New Reality: The Gaming Report. In BCG. Retrieved from: https://www.bcg.com/publications/2024/leveling-up-new-reality

- European Commission (2022). The Digital Services Act package | Shaping Europe’s digital future. In European Commission. Retrieved from: https://digital-strategy.ec.europa.eu/en/policies/digital-services-act-package

- IV, A. P. (2024, March 27). Sega Employees Ratify First-Of-Its-Kind Gaming Union Contract Following Industry Layoffs. In Forbes. Retrieved from: https://www.forbes.com/sites/antoniopequenoiv/2024/03/27/sega-employees-ratify-first-of-its-kind-gaming-union-contract-following-industry-layoffs/

- Reuters. (2022, September 29). Saudi wealth fund’s Savvy Games Group to invest $37.8 billion. In Reuters. Retrieved from: https://www.reuters.com/world/middle-east/saudi-wealth-funds-savvy-games-group-invest-378-billion-2022-09-29/

- Drake Star Global Gaming Report Q4 2024: Gaming M&A returns to growth in 2024. (2024). In Drakestar.com. Retrieved from: https://www.drakestar.com/news/global-gaming-report-q4-2024

- EQT to acquire Keywords in £2.2bn deal – Private Equity Insights. (2025). In Pe-Insights.com. Retrieved from: https://pe-insights.com/eqt-to-acquire-keywords-in-2-2bn-deal/

- Playtika Enters into Agreement to Acquire SuperPlay, Creator of Hit Mobile Games Dice Dreams and Domino Dreams | Playtika. (2023). By Playtika. Retrieved from: https://investors.playtika.com/news-releases/news-release-details/playtika-enters-agreement-acquire-superplay-creator-hit-mobile/

- Embracer Group divests Easybrain to Miniclip for a consideration of USD 1.2 billion – Embracer Group. (2024, November 14). By Embracer Group. Retrieved from: https://embracer.com/releases/embracer-group-divests-easybrain-to-miniclip-for-a-consideration-of-usd-1-2-billion/

- Taylor, D. (2024, February 9). Carlyle confirms sale of Jagex, developer of Runescape. By Tech.eu. Retrieved from: https://tech.eu/2024/02/09/carlyle-confirms-sale-of-jagex-developer-of-runescape-to-cvc-capital-partners-in-11b-deal/

- MTG acquires Plarium, developer of global #1 mobile RPG RAID: Shadow Legends and strengthens mobile gaming position. (2024, November 11). By MTG. Retrieved from: https://www.mtg.com/press-releases/mtg-acquires-plarium-developer-of-global-1-mobile-rpg-raid-shadow-legends-and-strengthens-mobile-gaming-position/

- Superjoost (2025, October 5). Electronic Arts’ $55B buyout doesn’t add up. In Substack.com. Retrieved from https://superjoost.substack.com/p/electronic-arts-55b-buyout-doesnt

- Tono Gil (2025). Electronic Arts deal to test whether FSR hurdles are exclusive to takeovers of EU companies. Mergermarket. Retrieved from https://mergermarket.ionanalytics.com/content/1004390079?source=news&q=ea

- Nesta McGregor (2025). From real sport to esports – why Saudi Arabia spent $55bn on EA. In BBC.com. Retrieved from https://www.bbc.com/sport/football/articles/c0jq24yy4z9o

- Joseph Kim (2025, October 13). Exposing the EA-Saudi Deal: Why the $55B ‘LBO’ Breaks Every Private Equity Rule | Pixels & Profits. In Gamemakers.com. Retrieved from https://www.gamemakers.com/p/exposing-the-ea-saudi-deal-why-the

- EA Press Release. (2025). In News.ea.com. Retrived from https://news.ea.com/press-releases/press-releases-details/2025/EA-Announces-Agreement-to-be-Acquired-by-PIF-Silver-Lake-and-Affinity-Partners-for-55-Billion/default.aspx

- SEC Filing (2025, September 28). Electronic Arts Inc.’s Agreement and Plan of Merger. Retrieved from https://www.sec.gov/Archives/edgar/data/712515/000114036125036415/ef20056167_ex2-1.htm

- Ruckin, C., Gowri Gurumurthy, & Amodeo, J. (2025, October 16). JPMorgan’s $20 Billion EA Financing to Be Split among Banks. Bloomberg.com; Bloomberg. Retrieved from. https://www.bloomberg.com/news/articles/2025-10-16/jpmorgan-s-20-billion-ea-financing-to-be-split-among-banks?embedded-checkout=true

[1] Electronic Arts in it.wikipedia.org. Retrieved from: https://it.wikipedia.org/wiki/Electronic_Arts

[2] EA Announces Agreement to be Acquired by PIF, Silver Lake, and Affinity Partners for $55 Billion (29/09/2025) in ir.ea.com. Retrieved from: https://ir.ea.com/press-releases/press-release-details/2025/EA-Announces-Agreement-to-be-Acquired-by-PIF-Silver-Lake-and-Affinity-Partners-for-55-Billion/default.aspx

[3] ea.com. Retrieved from: https://www.ea.com/executives

[4] Silver Lake Closes $20.5 Billion Fundraise for SLP VII (08/05/2024) in Silverlake.com. Retrieved from: https://www.silverlake.com/silver-lake-closes-20-5-billion-fundraise-for-slp-vii/

[5] Silver Lake completes $25bn take-private of Endeavor, rebrands it as WME Group in pe-insights.com. Retrieved from: https://pe-insights.com/silver-lake-completes-25bn-take-private-of-endeavor-rebrands-it-as-wme-group/

[6] Silver Lake and GIC Complete Acquisition of Zuora (14/02/2025) in zuora.com. Retrieved from: https://www.zuora.com/press-release/silver-lake-gic-zuora/

[7] Zuora accetta un’offerta di acquisto da 1,7 miliardi di dollari da Silver Lake e GIC (17/10/2024) in investing.com. Retrieved from: https://it.investing.com/news/company-news/zuora-accetta-unofferta-di-acquisto-da-17-miliardi-di-dollari-da-silver-lake-e-gic-93CH-2543268

[8] Silver Lake Announces Strategic Investment in Unity Technologies (24/05/2017) in Silverlake.com. Retrieved from: https://www.silverlake.com/silver-lake-announces-strategic-investment-in-unity-technologies/

[9] Public Investment Fund Program 2021-2025 in vision2030.gov.sa. Retrieved from: https://www.vision2030.gov.sa/media/mdppqvmv/v2030_pif_2025_en.pdf

[10] Develop Saudi Arabia’s Innovation Capabilities by Localizing the Technology Sector and Developing the Telecom & Media Sector in pif.gov.sa Retrieved from: https://www.pif.gov.sa/en/strategy-and-impact/the-program/telecom-media-and-technology/

[11] PIF joins consortium to acquire Electronic Arts in $55B deal (29/09/2025) in argaam.com. Retrieved from: https://www.argaam.com/en/article/articledetail/id/1846299

[12] Savvy Games Group completes acquisition of Scopely for $4.9 billion (12/07/2023) in pif.gov.sa. Retrieved from: https://www.pif.gov.sa/en/news-and-insights/newswire/2023/savvy-games-group-completes-acquisition-of-scopely-for-fourty-nine-billion/

[13] Saudi cuts Nintendo stake from 7.5% to 6.3% (13/11/2024) in techinasia.com. Retrieved from: https://www.techinasia.com/news/saudi-cuts-nintendo-stake

[14] ‘Pokemon Go’ maker Niantic to sell game division to Saudi-owned Scopely for $3.5 billion (12/03/2025) in reuters.com. Retrieved from: https://www.reuters.com/markets/deals/pokemon-go-maker-niantic-sell-game-division-saudi-owned-scopely-35-billion-2025-03-12/

[15] All The Gaming Companies Saudi Arabia Owns Or Has Invested In (Chris Compendio, 30/09/2025) in gamespot.com. Retrieved from: https://www.gamespot.com/gallery/all-the-gaming-companies-saudi-arabia-owns-or-has-invested-in/2900-7081/

[16] Kushner’s Affinity’s assets jump to $4.8 billion after Gulf cash injection (28/03/2025) in reuters.com. Retrieved from: https://www.reuters.com/business/finance/kushners-affinitys-assets-jump-48-billion-after-gulf-cash-injection-2025-03-28/

[17] Kushner’s Affinity Partners raises $1.5 billion, extends fund investment period to 2029 (20/12/2024) in investing.com. Retrieved from: https://www.investing.com/news/stock-market-news/kushners-affinity-partners-raises-15-billion-extends-fund-investment-period-to-2029-93CH-3784150

[18] EGYM, the Munich-based smart fitness startup, raises $225M from Jared Kushner’s Affinity Partners (05/07/2023) in techcrunch.co. Retrieved from: https://techcrunch.com/2023/07/05/egym-the-munich-based-smart-fitness-startup-raises-225m-from-jared-kushners-affinity-partners/

[19] Paizanis, G., Pagano, E., Schonfeld, R., Schmidt, N. (2024, December). Leveling Up for the New Reality: The Gaming Report. In BCG. Retrieved from: https://www.bcg.com/publications/2024/leveling-up-new-reality

[20] European Commission (2022). The Digital Services Act package | Shaping Europe’s digital future. In European Commission. Retrieved from: https://digital-strategy.ec.europa.eu/en/policies/digital-services-act-package

[21] IV, A. P. (2024, March 27). Sega Employees Ratify First-Of-Its-Kind Gaming Union Contract Following Industry Layoffs. In Forbes. Retrieved from: https://www.forbes.com/sites/antoniopequenoiv/2024/03/27/sega-employees-ratify-first-of-its-kind-gaming-union-contract-following-industry-layoffs/

[22] Reuters. (2022, September 29). Saudi wealth fund’s Savvy Games Group to invest $37.8 billion. In Reuters. Retrieved from: https://www.reuters.com/world/middle-east/saudi-wealth-funds-savvy-games-group-invest-378-billion-2022-09-29/

[23] Drake Star Global Gaming Report Q4 2024: Gaming M&A returns to growth in 2024. (2024). In Drakestar.com. Retrieved from: https://www.drakestar.com/news/global-gaming-report-q4-2024

[24] EQT to acquire Keywords in £2.2bn deal – Private Equity Insights. (2025). In Pe-Insights.com. Retrieved from: https://pe-insights.com/eqt-to-acquire-keywords-in-2-2bn-deal/

[25] Playtika Enters into Agreement to Acquire SuperPlay, Creator of Hit Mobile Games Dice Dreams and Domino Dreams | Playtika. (2023). By Playtika. Retrieved from: https://investors.playtika.com/news-releases/news-release-details/playtika-enters-agreement-acquire-superplay-creator-hit-mobile/

[26] Embracer Group divests Easybrain to Miniclip for a consideration of USD 1.2 billion – Embracer Group. (2024, November 14). By Embracer Group. Retrieved from: https://embracer.com/releases/embracer-group-divests-easybrain-to-miniclip-for-a-consideration-of-usd-1-2-billion/

[27] Taylor, D. (2024, February 9). Carlyle confirms sale of Jagex, developer of Runescape. By Tech.eu. Retrieved from: https://tech.eu/2024/02/09/carlyle-confirms-sale-of-jagex-developer-of-runescape-to-cvc-capital-partners-in-11b-deal/

[28] MTG acquires Plarium, developer of global #1 mobile RPG RAID: Shadow Legends and strengthens mobile gaming position. (2024, November 11). By MTG. Retrieved from: https://www.mtg.com/press-releases/mtg-acquires-plarium-developer-of-global-1-mobile-rpg-raid-shadow-legends-and-strengthens-mobile-gaming-position/

[29] Superjoost (2025, October 5). Electronic Arts’ $55B buyout doesn’t add up. In Substack.com. Retrieved from https://superjoost.substack.com/p/electronic-arts-55b-buyout-doesnt

[30] Tono Gil (2025). Electronic Arts deal to test whether FSR hurdles are exclusive to takeovers of EU companies. Mergermarket. Retrieved from https://mergermarket.ionanalytics.com/content/1004390079?source=news&q=ea

[31] Nesta McGregor (2025). From real sport to esports – why Saudi Arabia spent $55bn on EA. In BBC.com. Retrieved from https://www.bbc.com/sport/football/articles/c0jq24yy4z9o

[32] Joseph Kim (2025, October 13). Exposing the EA-Saudi Deal: Why the $55B ‘LBO’ Breaks Every Private Equity Rule | Pixels & Profits. In Gamemakers.com. Retrieved from https://www.gamemakers.com/p/exposing-the-ea-saudi-deal-why-the

[33] EA Press Release. (2025). In News.ea.com. Retrived from https://news.ea.com/press-releases/press-releases-details/2025/EA-Announces-Agreement-to-be-Acquired-by-PIF-Silver-Lake-and-Affinity-Partners-for-55-Billion/default.aspx

[34] SEC Filing (2025, September 28). Electronic Arts Inc.’s Agreement and Plan of Merger. Retrieved from https://www.sec.gov/Archives/edgar/data/712515/000114036125036415/ef20056167_ex2-1.htm

34 Ruckin, C., Gowri Gurumurthy, & Amodeo, J. (2025, October 16). JPMorgan’s $20 Billion EA Financing to Be Split among Banks. Bloomberg.com; Bloomberg. Retrieved from. https://www.bloomberg.com/news/articles/2025-10-16/jpmorgan-s-20-billion-ea-financing-to-be-split-among-banks?embedded-checkout=true

You must be logged in to post a comment.