This shift is particularly pronounced in premium and prestige beauty, now one of the world’s most resilient and fastest-growing consumer segments. Despite persistent inflation and declining real disposable incomes across major economies, demand for high-end cosmetics, skincare, and fragrance continues to outperform the broader consumer landscape. Individuals are more willing to trade down in essentials than in products tied to wellbeing, confidence, or social identity. Premium beauty has therefore become a form of “affordable luxury”, emotionally charged, culturally relevant, and structurally supported by strong brand loyalty and recurring purchase behavior.

The announcement of L’Oréal’s acquisition of Kering Beauté in late 2025 immediately captured the attention of the global luxury and beauty community, not simply because two French powerhouses were involved, but because the transaction signifies a deeper transformation reshaping how consumers engage with identity, self-expression, and aspiration. In recent years, beauty has evolved from a product category into a cultural and emotional infrastructure. As digital visibility, curated personas, and aesthetic signalling become central to everyday life, consumers increasingly use beauty and luxury goods as tools to construct narratives about who they are and how they wish to be perceived

These behavioral dynamics interact with macroeconomic forces that favour long-term industry growth. The rise of Gen Z consumers in North Asia, North America, and Europe, and the rapid diffusion of beauty-tech applications, have collectively strengthened the sector’s foundation. At the same time, luxury conglomerates are undergoing a strategic convergence: scale, horizontal integration, and science-driven innovation are now essential to maintaining desirability and global reach. Beauty, with its capital-light economics and high operating margins, has become a central battleground for competitive advantage.

It is within this broader social, cultural, and macroeconomic context that the L’Oréal-Kering Beauté acquisition emerges as an emblematic event. The transaction is not merely a reallocation of assets between two global leaders: it reflects a structural reorganization of the luxury and beauty ecosystem, where technology, identity, and emotional value increasingly shape strategic decisions. Understanding the deal, therefore, requires looking beyond the transaction itself, and instead recognising the evolving forces that make prestige beauty one of the most influential and strategically critical sectors of the global luxury economy.

Kering Beauté S.A.S.

History

Kering began as François Pinault’s timber-trading business in the early 1960s and, over the following decades, evolved into a diversified retail conglomerate. Between the 1960s and 1990s, the group expanded from timber and building materials into specialized retail, including department stores (Printemps), mail-order catalogues (La Redoute), furniture (Conforama), and cultural/electronics chains (Fnac).

In the late 1990s and early 2000s, Pinault-Printemps-Redoute (PPR) pivoted decisively toward luxury by taking control of Gucci Group and, through it, Houses such as Yves Saint Laurent, Bottega Veneta, Balenciaga, and Alexander McQueen. This shift was reinforced through the 2000s and early 2010s as PPR progressively exited mass retail and non-core activities.

In 2013, the Group rebranded as Kering, a move that formally marked its transition from a diversified retail conglomerate to a focused, pure-play luxury group. Subsequent steps broadened the luxury platform into jewelry (Boucheron, Pomellato, Qeelin), eyewear (the in-house eyewear platform launched in 2014, later acquiring Lindberg and Maui Jim), and, more recently, beauty.

As for ownership, the Pinault family holds the largest stake with 42.34%, equivalent to roughly 52 million shares (worth about €16.0 billion at the time of the Kering Beauté-L’Oréal deal, based on an October 2025 Kering share price of around €307) (Kering, 2024)[1].

Business Strategy

Kering’s strategy has been consistent: focus on a limited number of high-potential Houses, protect brand equity, and internalize more of the value chain in key adjacencies (notably eyewear and, until the sale, beauty). The Group reports across Gucci, Yves Saint Laurent, Bottega Veneta, Other Houses (mainly jewelry and smaller fashion maisons), and Kering Eyewear & Corporate (which includes Kering Beauté).

The objective of the beauty platform is straightforward: build a profitable, capital-light adjacency that reinforces the desirability of Kering’s fashion Houses and generates recurring, high-margin growth.

M&A Activity

On the beauty side, the pivotal deal was the 2023 acquisition of Creed for €3.52 billion (CNBC., 2025)[2]. Creed brought Kering an established, ultra-premium fragrance maison with strong heritage, high margins, and significant cash generation. The acquisition gave Kering Beauté immediate scale and credibility in prestige fragrance, rather than forcing the Group to build a platform entirely from scratch. More broadly, Kering has a solid M&A track record in adjacent categories, notably in jewelry (Boucheron, Pomellato, Qeelin) and eyewear (the creation of Kering Eyewear in 2014, followed by bolt-on acquisitions such as Lindberg and Maui Jim). Within Kering Beauté specifically, Creed serves as the cornerstone asset, complemented by the early development of couture-linked fragrance projects (for example, high-end Bottega Veneta fragrances) that could, over time, migrate into a new licensing framework under L’Oréal.

Financial Analysis (Group Level)

At the Group level, Kering’s 2020-2024 revenue trajectory reflects both the shock of the pandemic and a later normalization of luxury demand. Sales increased from €13.10 billion in 2020, a pandemic low point characterized by widespread store closures and travel bans, to a peak of €20.35 billion in 2022 as the US, Europe, and China reopened, and luxury spending rebounded. After that peak, revenues slipped to €19.57 billion in 2023 and €17.19 billion in 2024 as growth cooled and the macro environment became more difficult: higher inflation, the knock-on effects of the Ukraine war on European consumer confidence, and a slower luxury cycle in China all put pressure on Gucci, Kering’s largest House (Kering, 2024)[1].

Figure 1. The graph illustrates the trajectory of Kering’s sales for the past 5 years

Geographically, the Group remains well diversified, with around 30% of sales in Asia-Pacific, 29% in Western Europe, 24% in North America, 8% in Japan, and 9% in the rest of the world. This spread is structurally supportive, but the softer Asia cycle in 2024 amplified the impact of Gucci’s deceleration and made the downturn in Group revenues more visible (Kering, 2024)[1].

Figure 2. The graph illustrates the geography of Kering’s sales for 2024

Within this picture, the Kering Eyewear & Corporate segment, which includes Kering Beauté, stands out as a growth and profit engine. Segment revenue increased from €1.57 billion in 2023 (around 8.00% of Group sales) to €1.94 billion in 2024 (about 11.3% of Group sales), a rise of roughly 24% in a year when Group revenue declined by 12%. Of the 2024 total, approximately €1.58 billion came from Kering Eyewear, €323 million from Kering Beauté (principally Creed), with the remaining €35 million linked to other corporate items (Kering, 2024)[1].

Profitability improved even more sharply. Segment EBITDA rose from €276.00 million in 2023 to €456.00 million in 2024, an increase of about 65%, lifting the EBITDA margin from roughly 18% to 24%. Recurring operating income moved from €7.00 million to €112.00 million, with the margin rising from around 0.50% to 5.80%. This step-up reflects the inherently high-margin nature of eyewear and ultra-premium fragrance, the contribution of Creed, and early operating leverage as the platform scales and fixed costs are spread over a larger revenue base (Kering, 2024)[1].

In 2024, the segment deployed approximately €2.50 billion of operating investments, predominantly related to strategic real estate acquisitions in New York and Milan to secure flagship-grade locations for the Houses. Excluding these property transactions, adjusted operating investments amounted to about €298.00 million, representing an increase of €41.00 million YoY and corresponding to roughly 15% of segment revenue. These investments support continued growth in eyewear, corporate infrastructure (systems, digitalization, innovation), and the full-year development of Creed. Corporate operating expenses were lower than in 2023, reflecting efficiency measures that helped translate revenue growth into stronger profit (Kering, 2024)[1].

L’Oreal

History

L’Oréal traces its origins to 1909, when French chemist Eugène Schueller began formulating and selling innovative hair dyes to Parisian hairdressers. He created one of the first safe, synthetic hair-color formulas, initially operating almost alone, visiting salons, demonstrating the products, and reinvesting the proceeds into further research.

In the following decades, the company industrialized and expanded beyond hair dye. It opened its first factory near Paris, built a dedicated sales force to serve professional hairdressers, and gradually entered skin and makeup categories. After World War II, L’Oréal accelerated its internationalization, first across Europe and then into North America, Latin America, and Asia, systematically building a portfolio of brands in haircare, skincare, makeup, and fragrances, while remaining focused exclusively on beauty.

Over time, L’Oréal became a publicly listed global group with a diversified shareholder base but a stable reference shareholder. As of 31 December 2024, L’Oréal’s market capitalization was €182.60 billion across 534,312,021 shares, with the Bettencourt Meyers family holding the largest stake at 34.79% (L’Oréal, 2024)[3].

The Group’s 2024 sales of €43.486 billion were broadly diversified by region: Europe 33%, North America 27%, and North Asia 24% (the remaining ~16% is mainly Latin America and SAPMENA‑SSA). By category, L’Oréal remains a skincare-led portfolio: 39% Skincare & sun protection, 19% Makeup, 16% Haircare, and 14% Fragrances, with the balance from other categories (e.g., hair color and adjacent offerings). This mix embeds a strong premiumization engine (skincare and prestige fragrance) while maintaining breadth across mass and professional channels (L’Oréal, 2024)[3].

Figure 3. The graph illustrates the portfolio of L’Oreal as of 2024

Business Strategy

L’Oréal is a company concentrated on beauty and structured around four main business areas, each targeting a distinct segment of the market. At the mass end, the Consumer Products division focuses on accessible beauty and personal care, offering haircare, skincare, makeup, and hygiene products that are sold primarily through supermarkets, drugstores, and other mass retailers. At the upper end of the price spectrum, L’Oréal Luxe concentrates on luxury skincare, makeup, and fragrances, distributed via perfumeries, department stores, travel retail, and selected e-commerce partners. Dermatological Beauty covers science-backed, often dermatologist-recommended skincare, mainly sold through pharmacies, dermo-pharmacies, and medical channels. Finally, the Professional Products division addresses salon professionals with specialized haircare, technical color ranges, treatments, and styling products designed specifically for hairdressers and professional environments.

Strategically, the Group is built around a “brand ladder” that runs from mass to ultra-premium. In the core beauty categories, such as haircare, skincare, makeup, and fragrance, L’Oréal seeks to maintain a presence at multiple price levels, from entry to luxury, so that it can capture a wide spectrum of consumers as they trade up over time. This is underpinned by substantial, long-term investment in research and development. Laboratories in different regions work on new active ingredients, textures, and delivery systems, while a global industrial network allows the Group to scale successful innovations quickly and consistently across markets.

Beauty Tech has become a critical layer in this model. L’Oréal increasingly relies on data-driven media planning, digital services such as online diagnostics, virtual try-on tools, and AI-based product recommendation engines to deepen engagement and improve conversion in both online and offline channels.

M&A Activity

Over the past two decades, L’Oréal has relied on selective acquisitions to complement its organic growth and to sharpen its positioning in high-potential segments. The Group typically targets brands that fill a clear gap in category, price point, channel, or geography, and then scales them using its global R&D, industrial, and distribution platforms.

In 2006, L’Oréal acquired The Body Shop for €940 million, aiming to deepen its presence in ethical, naturally positioned beauty with a global network of standalone stores. Strategically, the transaction provided early exposure to fair-trade sourcing and sustainability-led branding, long before these themes became mainstream in the industry.

The 2014 acquisition of NYX Professional Makeup, of which the price is not disclosed, was executed to enhance L’Oréal’s exposure to digitally native, social media-driven consumers. Integrated within the Consumer Products division while maintaining its professional brand positioning, NYX was subsequently scaled internationally, with L’Oréal leveraging influencer-led and online marketing to reinforce its presence among younger, trend-sensitive consumer segments.

In 2016, L’Oréal acquired IT Cosmetics for €1 billion to strengthen its offering at the convergence of makeup and skincare in the prestige segment. The brand’s “problem–solution” positioning around complexion and skin concerns made it a natural fit for L’Oréal Luxe. Post-acquisition, the Group utilized its department store and specialty retail partnerships, together with its global marketing infrastructure, to extend IT Cosmetics beyond its US core market and broaden its product portfolio.

The 2017 acquisition of CeraVe, valued at €1.2 billion, further consolidated L’Oréal’s push into science-based, dermatologist-endorsed skincare. Integrated into what is now the Dermatological Beauty division, CeraVe provided a robust platform in barrier-repair and sensitive-skin care, distributed primarily through pharmacies and mass retailers. L’Oréal supported the brand with substantial investment in medical detailing, pharmacist education, and international roll-out, transforming CeraVe into a global growth driver within a structurally attractive category.

More recently, the 2023 acquisition of Aēsop for €2.1 billion added a “new luxury” asset characterized by experiential retail, sensorial formulations, and strong appeal among urban, design-oriented consumers. The strategic rationale was to reinforce L’Oréal’s positioning in ultra-premium, lifestyle-driven beauty. Since closing, the Group has focused on disciplined geographic expansion and store network development, while preserving Aēsop’s distinctive aesthetic, service model, and product philosophy.

Announced in 2025, the acquisition of Kering Beauté (including Creed) together with 50-year beauty licenses for key Kering Houses, such as Gucci, Bottega Veneta, and Balenciaga, fits squarely within this pattern. The transaction reinforces L’Oréal Luxe’s leadership in prestige and ultra-premium fragrance, locks in a multi-decade pipeline of couture-linked launches, and allows both Creed and the Kering Houses’ beauty lines to benefit from L’Oréal’s industrial, innovation, and distribution infrastructure. Implementation is expected to emphasize the protection of brand equity.

Overall, L’Oréal’s recent M&A activity, particularly the acquisition of Kering Beauté and the associated long-term beauty licenses, is fully aligned with the Group’s long-standing strategy: reinforce leadership in high-growth beauty segments, secure long-term brand equity, and strengthen its portfolio with scalable, globally resonant prestige assets. These moves not only consolidate L’Oréal’s competitive advantage across luxury fragrances and beauty but also lay the groundwork for sustained top-line momentum and margin resilience. This strategic positioning provides the backdrop for the financial performance discussed in the following section.

Financial Analysis

In 2024, L’Oréal generated sales of €43.5 billion, underpinned by a broadly diversified geographic footprint and a portfolio tilted toward structurally attractive categories. Europe accounted for 33% of revenues, North America for 27%, and North Asia for 24%, with the remaining approximately 16% coming mainly from Latin America and the SAPMENA SSA region (South Asia Pacific, Middle East, North Africa, and Sub-Saharan Africa). This spread helps mitigate local shocks, but also exposes the Group to divergent regional cycles, as seen recently in North Asia (L’Oréal, 2024)[3].

By category, L’Oréal remains fundamentally skincare-led. Around 39% of sales stem from skincare and sun protection, 19% from makeup, 16% from haircare, and 14% from fragrances (L’Oréal, 2024)[3], with the balance coming from hair color and adjacent products. This mix is an important driver of both growth and resilience: skincare and prestige fragrance.

Between 2020 and 2024, Group sales rose from €28 billion to €43.5 billion, a cumulative increase of about 55%, corresponding to a compound annual growth rate of roughly 11.6% (L’Oréal, 2024)[3]. Several factors explain this trajectory. First, premiumization has been a persistent tailwind, as consumers have increasingly traded up within product ranges to higher-priced serums, treatments, and luxury fragrances.

Figure 4. The graph shows the sustained increase in L’Oreal’s sales for the period of the past 5 years, reflecting the mix of premiumization and disciplined cost control.

Second, the business mix has shifted toward faster-growing, higher-value segments such as Dermatological Beauty and L’Oréal Luxe, which outpaced the Group average and lifted the overall quality of the portfolio. Third, geographic expansion in emerging markets, especially in Asia and Latin America, supported volume growth as modern retail and e-commerce penetration increased and the middle class broadened. Finally, channel shifts toward e-commerce, direct-to-consumer platforms, and travel retail improved visibility and accessibility of brands, reinforcing both volume and pricing power.

Over the same period, EBITDA increased from €6.83 billion to €10.27 billion, a rise of 50% and a compound annual growth rate of around 10.8%. EBITDA margins remained robust despite significant external pressures. The margin stood at roughly 24.4% in 2020, dipped to about 22.3% in 2022, and then recovered toward 23.6% by 2024 (L’Oréal, 2024)[3]. The temporary decline reflected inflation in raw materials, packaging, and logistics, as well as elevated investments in marketing and Beauty Tech. The subsequent recovery illustrates L’Oréal’s ability to offset cost inflation through a combination of price increases, mix improvement, and productivity gains in manufacturing and overheads, without sacrificing its innovation pipeline or the visibility of its brands.

The deceleration in reported growth in 2024, when sales rose by around 6% compared with higher double-digit rates in 2021 and 2022, is largely attributable to a more challenging environment in North Asia (L’Oréal, 2024)[3]. Regulatory changes, shifts in local consumption patterns, and channel destocking, especially in certain prestige and dermo franchises, constrained growth in that region. However, solid momentum in Europe and North America, where employment and consumer spending remained relatively resilient and demand for premium skincare and fragrance continued to grow, mitigated the impact.

Market Overview

The modern beauty industry is the product of long-term cultural practices combined with major industrial advances. What began as simple rituals and natural preparations evolved rapidly in the twentieth century with the development of modern chemistry, mass production, and the rise of global brands that shaped the sector for decades.

The early 2000s marked a step-change. The spread of the internet, social media, and e-commerce lowered barriers to entry and gave consumers more influence, enabling a surge of indie and celebrity-backed brands that challenged established players. At the same time, the idea of “beauty” expanded to include wellness, identity, and self-expression.

More recently, the industry has settled into a hybrid model in which scientific innovation, transparency, and omnichannel distribution coexist with fast trend cycles and influencer-driven product discovery. Together, these forces have created a highly fragmented yet remarkably resilient market landscape.

Competitive Landscape

The world’s leaders in the beauty and well-being sector: L’Oréal, Estée Lauder, Unilever Personal Care, P&G Beauty, Shiseido, Coty, LVMH Perfumes & Cosmetics, and Puig (Statista, 2024)[4], stay on top because of their ability to combine strong brands with capabilities that smaller players cannot easily match. L’Oréal remains the global leader thanks to its large research network, consistent investment in product science, and a portfolio that covers every price point, from mass to luxury. Estée Lauder, LVMH, Shiseido, and Puig are more focused on prestige beauty, where consumers pay a premium for strong brand identities, quality, and the emotional value attached to luxury skincare and fragrances. Unilever and P&G, on the other hand, lead in everyday personal care categories; their constant presence in supermarkets and pharmacies gives them an advantage.

When comparing peers, a clear pattern emerges. Prestige-focused players enjoy high margins because customers are willing to pay more for luxury products, but they rely on a smaller set of hero brands. More diversified groups like L’Oréal, Unilever, and P&G are less exposed to trends in any single category, which makes their growth more stable across markets and channels.

Barriers to entry explain why this leadership structure does not change. In particular, the development of safe and effective formulae, especially within skincare, requires scientific testing, regulatory approval, and manufacturing capabilities costly and take several years to develop. Access to distribution is another structural constraint: earning space in Sephora, pharmacies, or mass retail chains requires either a well-known brand or strong commercial partnerships. Even digital channels are not truly “easy”: customer acquisition online is expensive, and without a trusted brand, it is hard to retain consumers

Recent M&A transactions

M&A in beauty and luxury is increasingly focused on three KPIs: growth visibility, margin quality, and cultural relevance; buyers are not attracted just to big brands, but to those that can deliver fast and have predictable expansion with strong financials.

On the growth side, acquirers prioritise brands that sell consistently, retain customers over time, and do not rely on expensive marketing to expand their reach. These characteristics are often found in younger brands that have built a direct relationship with their audience. This explains why a brand like Rhode is compelling: it shows strong commercial traction, appeals to a younger and highly engaged consumer group, and generates a significant share of its sales through its own channels, all of which support durable growth. Such a brand gives an acquirer instant access to Gen-Z demand without them having to build that relevance themselves.

On the margin side, luxury fragrance and premium skincare continue to stand out. These categories represent structurally high gross margins, with low promotional pressure and strong pricing power. Assets such as Creed are illustrative: niche and luxury fragrances have high revenue productivity per point of sale and robust global demand, particularly in the US, China, and the Middle East. The addition of these types of brands enhances a buyer’s margin mix and provides long-term value even in the context of slowing volume growth.

Taken together, these indicators show where the market is heading. High-growth skincare brands help buyers secure relevance with the next wave of consumers, while luxury fragrance houses and long-term licenses strengthen a portfolio’s profitability and brand value. The interest of e.l.f. in Rhode or the move from L’Oréal on Creed are clear examples of this broader M&A logic (Vogue, 2025)[5].

Market Dynamics: Drivers

Input costs: Beauty formulas rely heavily on vegetable-oil derivatives because most products are built on emulsions that need oils, surfactants, and stabilisers. Palm oil became the dominant feedstock simply because it is the most efficient to produce, thanks to its high chemical versatility and its safety for skin.

Packaging is similarly shaped by function and cost. PET and other petrochemical resins are light, durable, and meet strict safety requirements. Glass is used for fragrances and high-end skincare because it is inert and protects sensitive formulas, while aluminium is preferred for aerosols and protective tubes. These materials matter because they link beauty to global commodity markets: palm oil to agricultural cycles in Southeast Asia, and PET, glass, and aluminium to energy and petrochemical prices. Understanding this input structure explains why cost volatility can quickly impact margins and pricing across the industry.

The World Bank forecasts widespread commodity price decreases into 2026, after the steep rises of 2022-23. Category volatility still exists at the category level due to the susceptibility of palm oil prices to changes in biofuel policy and to disruptions in freight and shipping that interrupt PET costs.

Figure 5. The graph illustrates the commodity prices from 2010 and the forecasts of the World Bank

Rates and financing: The ECB’s move into an easing cycle, with the deposit rate at 2.50% since 12 March 2025, has improved funding conditions and alleviated consumer credit pressures relative to the peak in 2023 (World Bank, n.d.)[6]. While beauty demand tends to be less rate-sensitive than durables, lower borrowing costs further support consumption and corporate financing flexibility.

Supply and demand: travel retail normalization and ongoing premiumization trends underpin product mix and margins. Although some prestige brands are still affected by softness in China, mainly in the luxury segment, the medium to long-term growth outlook remains firm, supported by rising middle-class consumption and brand investment.

Macroeconomic influence: The IMF’s forecast of roughly 3.2% global GDP growth in 2025 (IMF, 2025)[7] matters less for beauty than the policy mixes behind it. When central banks ease monetary policy by lowering rates, financial conditions improve, credit becomes cheaper, equity markets strengthen, and household wealth rises. This typically boosts demand for prestige beauty and luxury goods, which are highly sensitive to wealth effects and consumer confidence, especially in the US and China. Fiscal policy shapes the market from another angle. Tax incentives, income support, or higher public-sector wages lift real disposable income, helping sustain categories like beauty, while tighter fiscal conditions encourage “trading down” for middle-income consumers and make the industry more dependent on high earners and tourism. Disinflation also helps. As inflation cools and real wages recover, consumers are keener to buy premium items. Moreover, brands benefit from more stable input costs and stronger pricing power.

Overall, the luxury and beauty sectors respond not just to GDP growth, but to how monetary and fiscal policy influence real incomes, wealth, and confidence, factors that shape consumers’ willingness to spend on premium products.

Growth Prospects

Wellness and ingestible beauty are expanding quickly. This is because ingredient science evolved beyond traditional vitamins. Biotech now enables the production ofhigh-purity collagen peptides, fermented hyaluronic acid, microencapsulated probiotics, and bioavailable mineralsthat demonstrate measurable effects on hydration, elasticity, hair strength, and women’s health (Asserin et al., 2015)[8].

In derm-beauty, the scenario is similar. Biotech labs can now engineer postbiotic complexes, short-chain peptides, growth-factor mimetics,microbiome-supporting actives that target skin repair and barrier function more precisely than older cosmetic ingredients.

These innovations matter because they make beauty products behave more like healthcare: ingredients work better, many formulas are clinically tested, and biotech actives offer results people can see. This helps brands charge premium prices and earn consumer trust in categories where performance is what truly drives choice.

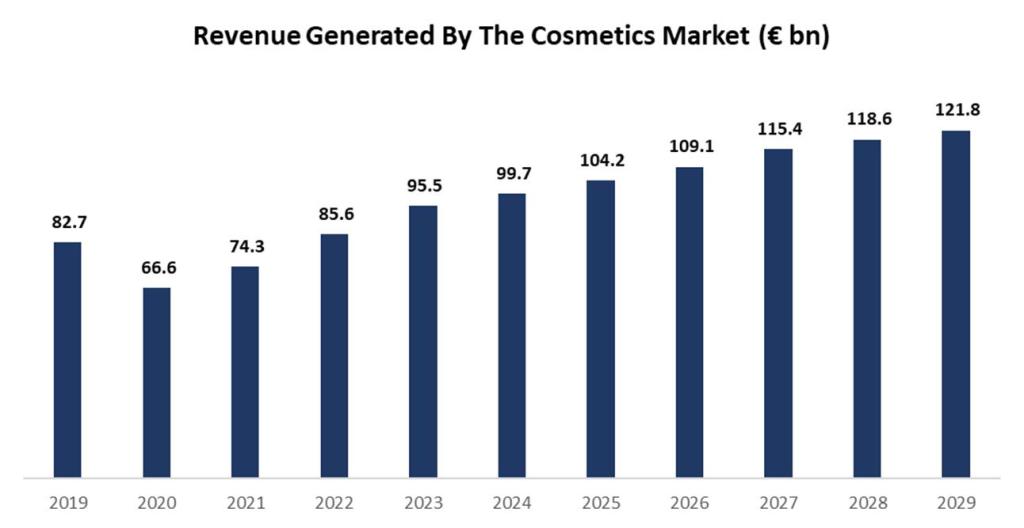

Figure 6. The graph illustrates the progression of revenue generated in the cosmetics market over the span of 11 years. Source: Statista. Revenue Generated by the Cosmetics Market

Key Trends

Virtual try-on, augmented-reality tools that let consumers digitally test makeup, hair color, or skincare effects on their own face before purchasing, are relatively new trends in Tech & Digitalisation and are now standard across both DTC and retail.

For example, L’Oréal’s ModiFace powers AR/VTO across brands and retail partners; since 2023-24, usage has surged, improving conversion and basket size. Meanwhile, new REACH rules introduce a ban on microplastics in both rinse-off and leave-on products, including cosmetic microbeads. These particles were historically added to beauty formulas for practical reasons such as providing exfoliation, improving texture, helping pigments blend, or giving products a smoother, more uniform finish. But because they do not biodegrade and easily enter waterways after use, they contribute to long-term environmental pollution. The EU’s new restrictions aim to phase out intentionally added microplastics, pushing brands to reformulate and accelerating the industry’s shift toward cleaner and more sustainable ingredients.

Premium and wellness-adjacent beauty segments continue to outperform the mass market. Growth remains steady in Europe and the US, while the Chinese prestige segment is softer but showing a gradual recovery. Among large consumer goods’ portfolios, wellness and self-care lines have emerged as key high-growth priorities.

Historical Growth of the Global Beauty Market

Understanding today’s beauty industry requires looking at how the market has evolved over the past three decades and, especially, how it accelerated and structurally changed in the 2010s and 2020s.

In the early 2000s, the global beauty market was valued at roughly €220-250 billion, driven largely by North America, Western Europe, and Japan. Growth remained steady but relatively linear, reflecting a market dominated by mass retail, department stores, and a small number of powerful multinational groups.

During the 2010s, the industry entered a new phase. The rise of Asian consumers, the explosion of K-beauty and J-beauty, and the rapid adoption of e-commerce pushed the global market to approximately €350 billion by 2019. At the same time, new indie brands, celebrity-led labels, and social-media-driven discovery reshaped category dynamics, particularly in colour cosmetics and skincare.

The COVID-19 pandemic (2020-2021) created an unprecedented short-term shock: makeup declined sharply due to reduced mobility, while skincare, haircare, and wellness-adjacent categories surged, reflecting a shift toward self-care and at-home treatments. By 2022, the market not only recovered but surpassed pre-pandemic levels, reaching around €390 billion, supported by pent-up demand and a strong rebound in prestige beauty.

Since 2022, global demand has continued to expand, with the market estimated at €430-450 billion in 2023–2024 (Euromonitor / industry estimates). Growth remains driven by three broad geographic engines:

- Asia-Pacific: the largest and fastest-growing region, underpinned by Chinese prestige beauty (despite short-term volatility), rising middle classes in Southeast Asia, and strong innovation cycles in Korea and Japan.

- North America: resilient growth fuelled by premium makeup, dermo-cosmetics, and the continued strength of specialty retailers (e.g., Ulta, Sephora).

- Europe: stable but slower; momentum is concentrated in luxury fragrance, pharmacy skincare, and travel retail.

Across regions, the beauty market’s recent trajectory reflects deeper structural shifts: a move toward premiumisation, scientific and dermatological positioning, hybrid wellness-beauty propositions, and socially amplified brand building. These forces have made the industry more global, more fragmented, and more competitive, but also exceptionally resilient, with positive growth forecasts for the remainder of the decade.

Deal Rationale

Transaction Overview

On 19 October 2025, L’Oréal S.A., the world’s leading beauty group, announced the acquisition of Kering Beauté A.S. from Kering S.A. for an enterprise value of €4 billion, to be paid entirely in cash. The perimeter includes the Creed fragrance house; the beauty and fragrance licenses for Gucci, Bottega Veneta, and Balenciaga; and the creation of a 50:50 wellness and longevity joint venture between the two groups. The deal awaits regulatory clearance and is expected to close by H1 2026.

Strategic Motivation

For L’Oréal, this marks a defining step in the premiumization of its Luxe Division (FY 2024 revenue ≈ €15.4 billion; operating margin 22.1 %), strengthening its position in the fast-growing ultra-luxury segment. The integration of Creed, a €250-270 million revenue brand with ~40 % EBITDA margin, brings one of the highest-yielding assets in global perfumery into L’Oréal’s portfolio (L’Oréal, 2025)[9]. Kering and L’Oréal Forge Alliance in Beauty and Wellness).

The transaction also secures multi-decade exclusive licenses for Gucci, Bottega Veneta, and Balenciaga. The Gucci license, reverting from Coty in 2028, could add €700-800 million in retail sales and €250-300 million in wholesale turnover, according to Bernstein (Oct 2025). Collectively, these brands extend L’Oréal’s reach across the €75 billion prestige fragrance market, growing at ~7-8 % CAGR (2023-2028E) (L’Oréal, 2025)[9].

For Kering, the sale is a capital-reallocation exercise: monetizing assets acquired in 2023 (Creed ≈ €3.5 billion) at roughly a 15 % uplift. Proceeds of €4 billion will strengthen liquidity, reduce leverage (net debt to ~€6 billion) (Reuters, 2025)[10], and free up management bandwidth for its core fashion houses, Gucci, Saint Laurent, and Bottega Veneta, while preserving a residual economic interest through ongoing license royalties.

Synergies and Value Creation

Operational and financial synergies should ramp up through FY 2026-2028. Barclays Research projects €80-100 million in annual run-rate savings by 2028 from manufacturing optimization, procurement consolidation, and shared marketing.

Creed’s 40% EBITDA margin versus L’Oréal Luxe’s 22% implies a ~1800 bps uplift. Post-integration, this could raise L’Oréal Luxe’s operating margin by 100-120 bps, equivalent to €150-200 million incremental EBIT per annum (A Luxury Lifestyle Team , 2025)[11].

Figure 7. The Graph shows that Creed operates with an estimated EBITDA margin of around 40 %, far above the 22 % reported by L’Oréal Luxe and the roughly 27 % achieved by Kering Beauté. This strong profitability explains the acquisition’s expected earnings accretion and reinforces L’Oréal’s focus on high-margin luxury assets.

With additional license revenues, L’Oréal could generate €600-700 million extra Luxe revenue by 2028, around +4% versus 2024.

At ~40× EV/EBITDA (assuming €100 million EBITDA), the valuation looks rich but defensible given Creed’s scarcity and the long-dated licensing pipeline. By comparison, recent luxury-beauty transactions (Aesop, La Prairie, Byredo) closed at 30-35×.

For Kering, the divestment cuts net debt/EBITDA from 2.3× to ~1.5× and should reduce annual interest outlays by €80-100 million. Future royalties (estimated €120-150 million annually post-2028) offer low-volatility income aligned with beauty’s secular growth (Barclays Bank Ireland PLC., n.d.)[12].

Financial Impact

L’Oréal expects the deal to be EPS-accretive by FY 2027 (+€0.10-0.12 per share; ≈ +2 % vs. 2024 baseline) on incremental EBIT of €180 million. The implied ROIC (8.5-9.0% by 2028) exceeds its 6.5 % WACC, confirming value creation.

Pro forma leverage remains conservative at < 1.2× Net Debt/EBITDA, with interest coverage > 20×, well within A/A1 credit metrics, while Kering’s gross cash will rise toward €7 billion, affording €3-4 billion in optionality for share buybacks or capex (L’Oréal, 2025)[9].

Risks and Challenges

The main execution risk lies in L’Oréal’s ability to scale Creed while preserving the brand’s aura of rarity, which has historically been the core driver of its pricing power. In its official acquisition announcement, L’Oréal stated that Creed’s performance is rooted in “a unique heritage and a highly selective distribution model”(L’Oréal, 2023)[13], making the brand particularly sensitive to changes in volume ambition or distribution breadth. L’Oréal’s Universal Registration Document reiterates that maintaining strict prestige positioning is essential for long-term value creation, which highlights how over-distribution, especially through L’Oréal’s extensive global retail network and travel retail channels, could quickly undermine Creed’s exclusivity narrative and compress margins. The high-end fragrance segment consistently shows that once niche maisons lose distribution discipline, elasticity shifts sharply, eroding both perceived authenticity and sustainable pricing.

A second source of execution risk relates to the upcoming Gucci Beauty license transition. Kering stated in its official announcement of Kering Beauté that the strategic intent is to “regain full control over brand image, product development and distribution in beauty”(Kering, 2023)[14]. However, the transfer of Gucci Beauty from Coty when the license expires in 2028 entails rebuilding product pipelines, supply chain capabilities, marketing assets, and global market activation from the ground up. Coty has developed Gucci Beauty for more than a decade, which means that transferring operational know-how, reformulation platforms, and retail relationships is inherently complex. Any misalignment during this multi-year transition risks temporary brand dislocation, especially in key markets such as China and the U.S., where beauty is closely linked to overall house momentum. Coty itself has highlighted in its filings the scale of its prestige fragrance manufacturing footprint, suggesting that replacing such infrastructure internally will require careful sequencing (Coty Inc, 2023)[15].

Finally, both L’Oréal and Kering have noted that the transaction remains subject to regulatory approvals across multiple jurisdictions. L’Oréal’s deal documentation explicitly refers to “customary regulatory clearances” (L’Oréal, 2023)[13], and cross-border beauty acquisitions have historically faced extended review phases, particularly in the EU and China. Any delay would push closing beyond the expected H1 2026 window, postponing integration milestones and slowing synergy realization. Taken together, these factors make execution discipline crucial to preserving Creed’s ultra-premium positioning and ensuring that the strategic rationale behind the acquisition fully materializes.

Market and Investor Reaction

The market endorsed the logic on announcements. Kering rose ≈ 5 % to €436; L’Oréal gained ≈ 1.1 % to €455 (Reuters, 2025)10.

Figure 8. The graph shows the five-day trading window surrounding the announcement of L’Oréal’s €4 billion acquisition of Creed and related long-term licenses from Kering (T = announcement day). Kering’s shares rose by roughly 5 %, reflecting balance sheet relief and focus on core fashion, while L’Oréal gained about 1 %, signaling investor confidence in its luxury-beauty strategy.

Conclusion

The €4 billion L’Oréal–Kering Beauté transaction exemplifies strategic clarity and disciplined capital allocation on both sides. For L’Oréal, the deal brings ~2% EPS accretion, +100–150 bps margin uplift, and stronger control of high-equity fragrance assets. For Kering, it delivers an estimated 15% ROI on Creed, ~0.8× deleveraging, and over €100 million in recurring royalties (Morningstar, 2025)[16].

Beyond the headline metrics, the transaction subtly reshapes the European luxury ecosystem. It reinforces L’Oréal’s leadership in global prestige beauty at a time when scale, supply chain resilience, and brand stewardship are increasingly decisive competitive advantages. For Kering, the carve-out marks a deliberate refocus on fashion and leather goods, strengthening its balance sheet while giving the group cleaner strategic optionality. If executed with discipline, particularly exploiting Creed’s distribution strategy and the future Gucci Beauty transition, the deal has the potential to stand out as one of the most strategically coherent luxury transactions of the decade.

Deal Structure

Deal timeline & terms

On October 19, 2025, L’Oréal and Kering announced a binding agreement under which L’Oréal will acquire Kering Beauté SAS, including the House of Creed, and receive 50-year exclusive licenses for Gucci (effective after Coty’s current license expires), Bottega Veneta, and Balenciaga (Mergermarket, 2025)[17].

No public source has identified additional bidders or disclosed competing offer terms, and neither company has commented on the number of parties involved; moreover, according to coverage based on Wall Street Journal reporting, Kering had entered advanced discussions with L’Oréal on the transaction, subject to no rival bidder intervening. As a result, the process is understood, based on what is publicly available, to have progressed primarily on a bilateral basis, with L’Oréal ultimately securing exclusive negotiations and reaching an agreement.

The transaction value is €4 billion, all payable in cash only at closing, which is expected in H1 2026, subject to customary approvals and conditions. There is no CVR (Contingent Value Rights) (Mergermarket, 2025)[17] component to the upfront payment. The parties also disclosed an exclusive wellness/longevity venture (planned 50/50 JV) as part of the alliance. Coty’s existing Gucci license runs until 2028; after the alliance was announced, a Coty subsidiary filed suit in the U.K. related to the Gucci transition.

Deal type

What makes the agreement particularly noteworthy is its dual structure. In fact, the transaction constitutes a strategic asset acquisition combined with long-term licensing and joint-venture formation.

As part of the transaction framework, L’Oréal agreed to assume full ownership of Kering’s beauty operations, which encompass the Creed fragrance house as well as the broader Kering Beauté platform. The consideration for the transfer has been set at €4 billion (approximately $4.66 billion) (Mergermarket, 2025)[17], to be funded entirely in cash. The handover of assets, personnel, and brand rights is scheduled to take place only once all regulatory clearances have been secured, a milestone that both companies expect to reach during the first half of 2026.

The deal also grants L’Oréal the right to enter into 50-year exclusive licenses for the creation, development, and distribution of fragrance and beauty products for Gucci, Bottega Veneta, and Balenciaga (Mergermarket, 2025)[17]. The Gucci license will become effective after the expiration of Coty’s current agreement in 2028, in full respect of the existing contractual obligations. The Bottega Veneta and Balenciaga licenses will commence upon closing of the transaction.

In addition to the sale of Creed and the establishment of these licenses, L’Oréal will pay ongoing royalties to Kering for the use of its brands. A strategic committee will be established to ensure coordination between Kering’s fashion houses and L’Oréal, and to monitor the execution of the partnership.

Beyond beauty, the agreement also introduces an exclusive 50/50 joint venture between Kering and L’Oréal to explore business opportunities in luxury wellness and longevity, combining L’Oréal’s innovation and R&D capabilities with Kering’s deep understanding of luxury clientele (Mergermarket, 2025)[17].

Through this structure, the transaction represents a strategic convergence between the world’s largest beauty group and a leading luxury conglomerate, designed to accelerate global growth in high-potential categories such as ultra-luxury fragrance and holistic beauty.

L’Oréal will also pay royalties to Kering for the use of those brand licenses, while Kering retains no operational ownership of the beauty assets but will benefit from the long-term royalty stream. The exact percentage or royalty structure remains a confidential aspect of the agreement between the two companies, which do not disclose it in the deal documents.

Effects of payment conditions

For Kering: the all-cash proceeds are intended to de-lever the group; reporting around the announcement highlighted net debt of about €9.5 billion at end-June 2025 (Kering, 2025)[18], and the management stated the sale would result in a net gain before tax in the results.

For L’Oréal: the cash consideration is partly financed with euro bonds and internal cash, preserving equity (no dilution) while modestly increasing leverage in line with the long-dated license economics.

Financing Coordinators: Société Générale, Natixis, JP Morgan, and Citi are acting as Global Coordinators. Standard Chartered, ING, Barclays, and HSBC act as Active Joint Bookrunners.

Effects on share prices

Around the announcement (October 20-22, 2025), Kering shares rose as investors welcomed deleveraging and portfolio refocus (reports cited ~4-7% intraday/closing gains) (Reuters, 2025)10.

The day after the announcement, L’Oreal’s shares rose a modest 0.6%, in line with the 0.5% increase for the Paris CAC 40 index.

Financing structure

L’Oréal’s €4 billion cash payment is supported by a €3 billion, triple-tranche euro bond plus existing cash. On November 12, 2025, L’Oréal priced €3 billion of bonds across three tranches:

- A €850 million 2-year floating rate bond paying a coupon of 3M + 20bps p.a.

- A €1,000 million 5-year fixed rate bond paying a coupon of 2.750% p.a

- A €1,150 million long 10-year fixed rate bond paying a coupon of 3.375% p.a.

The net proceeds from the issuance of the Notes will be used for general corporate purposes, including to finance part of the acquisition of Kering Beauté (L’Oréal, 2025)[19].

The Notes, which are rated AA (Stable) by S&P and Aa1 (Stable) by Moody’s, will be admitted to trading on Euronext Paris from the settlement date, which is scheduled to be 19 November 2025. Sector trades and capital markets reports confirm the M&A financing use-of-proceeds and tight pricing at launch. Kering will retain royalties from the 50-year licenses and will apply cash proceeds toward debt reduction and strategic refocus on core fashion brands.

Governance

Until closing, Creed remains under Kering Beauté governance; post-closing, it will be integrated into L’Oréal Luxe.

Nathalie Berger-Duquene was appointed CEO of Creed effective May 6, 2025; she reports to Raffaella Cornaggia (CEO, Kering Beauté) and is based in London. Leadership continuity is expected to carry through the transition.

The alliance also establishes a strategic committee to coordinate between Kering brands and L’Oréal and monitor the partnership. In particular, the Strategic Committee, comprising senior executives from both L’Oréal and Kering, will be created to coordinate cross-brand strategy, monitor the 50-year licensing agreements, and supervise compliance with brand guidelines and sustainability commitments. It will report annually to both Boards and will be responsible for aligning innovation pipelines and communication strategies across the beauty Maisons.

Final considerations

Supportive statements

This deal makes strong strategic sense for L’Oréal.

Figure 9. The graph shows that L’Oréal leads the global beauty market with revenues exceeding USD 47 billion in 2024, nearly double that of its closest competitor,Unilever. This dominant scale underpins the company’s strategic rationale for further expansion through acquisitions such as Kering Beauté.

By acquiring Kering’s beauty division, which includes the heritage fragrance house Creed, and obtaining 50-xyear exclusive licenses for the creation, development, and distribution of beauty and fragrance products for brands such as Gucci, Bottega Veneta, and Balenciaga, L’Oréal gains access to the ultra-premium luxury beauty segment and strengthens its position as the world’s leading luxury beauty company. For Kering, the deal is equally logical. The group monetizes its beauty activities and can refocus on its core luxury fashion and leather goods business, while still benefiting from a long-term royalty income stream through the granted licenses. From an operational point of view, the advantages are clear. L’Oréal’s global scale in the beauty segment, its R&D capabilities, and its extensive distribution network will give the acquired brands the opportunity to accelerate growth far beyond what Kering Beauté could achieve on its own.

Figure 10. The graph shows the consistent mid-single-digit growth of the global cosmetics market, averaging around 4-6 % annually over the last decade. This stable expansion provides a solid foundation for strategic investments by industry leaders such as L’Oréal, which seeks to outperform the market through acquisitions like Kering Beauté.

Key risks and integration challenges

Valuation risk

The transaction is valued at approximately €4 billion for the beauty division (including Creed and long-term licenses), which sets high expectations. Kering Beauté generated around €323 million in sales in 2024; therefore, the anticipated growth, margin expansion, or cost synergies must be substantial for L’Oréal to justify the premium.

Brand Dilution and Integration Risk

Creed is a niche luxury fragrance house with a strong heritage and aura of exclusivity. Folding it into a large corporate structure like L’Oréal risks diluting that identity, especially if distribution becomes too broad or its premium positioning is compromised.

Strategic Trade-Offs for Kering

From Kering’s perspective, while the deal eases debt pressure and allows the group to refocus, it also means giving up direct ownership of a potentially high-growth beauty business. If beauty rebounds while fashion faces headwinds, Kering might regret the decision.

Financing and Leverage Risk

Finally, the financing approach introduces additional risk: L’Oréal is reportedly planning to issue up to €3 billion of bonds to fund part of the acquisition, increasing financial leverage and the cost of financing. Any delays in achieving synergies or margin improvement would elongate the pay-back period and reduce ROI.

Conclusion

In conclusion, this deal between L’Oréal and Kering has the potential to redefine the luxury beauty landscape. While strategic rationale and operational scale favour L’Oréal, the elevated acquisition multiple, the relatively modest revenue base of the target, and the significant financing requirements mean that the realisation of value is not guaranteed. If L’Oréal can deliver a strong growth in sales, expand margins, and achieve the expected synergies, while also preserving the premium positioning of the acquired brands, the ROI could be impressive. However, failure to execute or to maintain brand exclusivity could lead to a long payback period and diluted returns. Ultimately, discipline in execution, clear governance, and careful integration will determine whether the ambitious price paid translates into long-term value creation for shareholders.

Valuation

Premise

To estimate the valuation of Kering Beauté, in the context of its acquisition by L’Oreal, we used Kering S.A. as a valuation proxy: since Kering Beauté is a division that does not publish standalone financials, Kering’s consolidated metrics were used as a representative basis for valuation, adjusted by reference to peers in the luxury and beauty industry.

Comparable Company Analysis

We conducted a CCA using a peer group of leading global luxury and cosmetics companies. The selected peers are: Christian Dior, Hermès International, LVMH, Ferrari, Compagnie Financière Richemont, and Prada, and they all operate in the high-end fashion, luxury, and beauty segment; they share similar brand positioning, global geographical presence, risk profiles, and financial metrics.

The peer groups trade at an average EV/EBITDA multiple of 15.3x and a P/E multiple of 30.0x on an actual basis, with forward multiples of 14.7x EV/EBITDA and 27.9x P/E, reflecting strong market confidence in the luxury sector’s pricing power.

Kering, with an enterprise value (EV) of approximately €53 billion, trades at 11.4x EV/EBITDA and 34.0x P/E: this indicates a discount on enterprise value metrics but a premium on earnings multiples. These factors indicate a discrepancy of the group from others, highlighting strong profitability but slower top-line growth compared to peers.

Given that Kering Beauté is a newly established and rapidly expanding division focusing on high-margin luxury fragrances and skincare, applying the sector median forward EV/EBITDA multiple of 14.7x suggests a fair enterprise value range that aligns closely with established peers in the luxury beauty segment. This implies potential upside relative to Kering’s consolidated valuation, reflecting the attractiveness of the beauty segment’s margin profile and growth trajectory compared to Kering’s core fashion brands.

Precedent Transaction Analysis

We also conducted a PTA to benchmark Kering Beauté’s potential valuation against recent transactions in the high-end beauty sector. We considered five acquisitions of luxury and premium brands over the past five years: Aesop (L’Oréal, 2023), Tom Ford Beauty (Estée Lauder, 2023), House of Creed (Kering, 2023), Prada (Versace, 2025), Occitane (Occitane International SA, 2024), and Lalique Group (Dharampal Satyapal Ltd, 2024).

The observed transaction multiples range between 2.0x-11.6x EV/Sales and 16.2x-24.0x EV/EBITDA, with an average EV/Sales of 4.4x and an average EV/EBITDA of 20.2x. The median EV/EBITDA multiple of 20.3x was selected as the most representative benchmark for high-end fragrance and skincare businesses.

Applying the median EV/EBITDA multiple (20.3x) to Kering Beauté’s estimated forward EBITDA, derived from Kering’s beauty division growth projections, implies an enterprise value broadly in line with recent market benchmarks. This multiple-based valuation suggests a premium justified by the segment’s strong margins, brand equity, and growth potential, as well as the average acquisition premium of ~40% observed across comparable deals.

Discounted Cash Flow

The DCF analysis was structured using two complementary breakdowns: one based on revenue by product segment (fragrances, skincare, makeup…) and one by geographic area (Europe, North America, Asia-Pacific). The two models were then consolidated to derive an integrated cash flow projection reflecting both product diversification and regional growth trends.

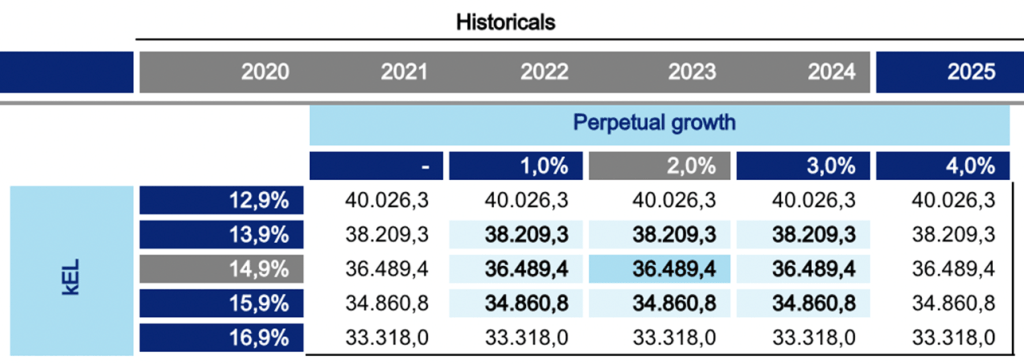

The valuation provides an equity value range of €34.9-38.2bn, assuming a WACC of 11.1% and a perpetual growth rate of 2%. This intrinsic valuation range is consistent with the results obtained from the CCA and PTA analyses.

Valuation Summary

The valuation results obtained using the above methodologies suggest that L’Oréal’s acquisition of Kering Beauté is strategically and financially justified when considering the parameters of the current beauty sector. The deal’s implied valuation aligns with the median EV/EBITDA multiple of ~20x observed in similar transactions in the market and slightly above the market trading range of ~14-15x derived from the CCA. Comparing the deal with historical M&A activity in the beauty sector, the implied valuation for Kering Beauté remains in line with industry benchmarks.

Furthermore, intrinsic models are lower than market multiples, mainly due to the decline in profitability recorded by Kering over the past year and the modest growth prospects of the beauty sector (Statista), which reduce the stand-alone value of Kering Beauté; this makes the implied acquisition premium more consistent with the synergies and the increased strategic value resulting from the integration into the L’Oréal portfolio.

Authorship Disclosure

Head of the Retail & Consumer Goods Division: Ruggero Chiostrini

Retail & Consumer Goods Division Analysts: Emma Griggio, Teresa Zito, Velina Ilieva, Filippo Bulgarelli, Filippo Fiordelisi

Valuation & Modelling Analyst: Gabriele Audano

Bibliography

- Kering. (2024). Kering 2024 Financial Document. https://www.kering.com/api/download-file/?path=Kering_2024_Financial_Document_885917e81b.pdf

- CNBC. (2025, October 20). Kering agrees to sell beauty unit to L’Oréal for $4.7 billion as De Meo trims debt. Retrieved from https://www.cnbc.com/2025/10/20/kering-agrees-to-sell-beauty-unit-to-loreal-for-4point7-billion.html

- L’Oréal. (2024). Universal Registration Document 2024. https://www.loreal-finance.com/fr/system/files?file=2025-03/LOREAL_DEU_2024_UK.pdf

- Statista. (2024). Largest Beauty Companies in the World 2024. https://www.statista.com/

- Vogue. (2025, May). With Rhode Acquisition, e.l.f.’s CEO Wants to Build the Next-Gen Beauty Group. https://www.vogue.com/article/with-rhode-acquisition-elfs-ceo-wants-to-build-the-next-gen-beauty-group

- World Bank. (n.d.). Commodity Markets Research. https://www.worldbank.org/en/research/commodity-markets

- International Monetary Fund (IMF). (2025, October 14). World Economic Outlook: October 2025. https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

- Asserin, J., Lati, E., Shioya, T., & Prawitt, J. (2015). Effect of oral collagen peptides on skin moisture. Journal of Cosmetic Dermatology, 14(4), 291–301. https://doi.org/10.1111/jocd.12174

- L’Oréal Finance. (2025). Kering and L’Oréal Forge Alliance in Beauty and Wellness. https://www.loreal-finance.com/eng/press-release/kering-and-loreal-forge-alliance-beauty-and-wellness

- Reuters. (2025, October 19). Kering to Sell Beauty Unit to L’Oréal for $4.68 Billion. https://www.reuters.com/business/kering-sell-beauty-unit-loreal-466-billion-2025-10-19/

- A Luxury Lifestyle Team. (2025, October 21). Kering and L’Oréal unveil 50-year licensing pact. A Luxury Lifestyle. https://aluxurylifestyle.com/fashion/kering-and-loreal-unveil-50-year-licensing-pact/?utm_source=chatgpt.com

- Barclays Bank Ireland PLC. (n.d.). \Users\ruggerochiostrini\Downloads\Annual%20report.%20Barclays.%20https:\www.barclays.ie

- L’Oréal. (2023, June 26). Press release. https://www.loreal.com/

- Kering. (2023, February 14). Kering press release. https://www.kering.com/

- Coty Inc. (2023). Annual report FY2023. https://www.coty.com/

- Morningstar. (2025). L’Oréal Purchase of Kering Beauty Boosts Fragrance Portfolio, but the Deal Is Pricey. https://global.morningstar.com/en-eu/stocks/loreal-purchase-kering-beaut-boost-fragrance-portfolio-deal-is-pricey

- Mergermarket. Deal #7634. Retrieved November 26, 2025. https://www.mergermarket.com/Common/Mergermarket/Deals/DealsSearchResults.aspx?extern=19&id=7634

- Kering. (2025, October 22). Revenue for the third quarter of 2025. https://www.kering.com/api/download-file/?path=Kering_Press_release_Q3_revenue_2025_22_10_2025_fdfaf3ca07.pdf

- L’Oréal. (2025, November 12). L’Oréal successfully prices a €3 billion triple-tranche bond. Euronext / L’Oréal. https://live.euronext.com/en/products/equities/company-news/2025-11-12-loreal-successfully-prices-3-billion-euro-triple-tranche

[1] Kering. (2024). Kering 2024 Financial Document. https://www.kering.com/api/download-file/?path=Kering_2024_Financial_Document_885917e81b.pdf

[2] CNBC. (2025, October 20). Kering agrees to sell beauty unit to L’Oréal for $4.7 billion as De Meo trims debt. Retrieved from https://www.cnbc.com/2025/10/20/kering-agrees-to-sell-beauty-unit-to-loreal-for-4point7-billion.html

[3] L’Oréal. (2024). Universal Registration Document 2024. https://www.loreal-finance.com/fr/system/files?file=2025-03/LOREAL_DEU_2024_UK.pdf

[4] Statista. (2024). Largest Beauty Companies in the World 2024. https://www.statista.com/

[5] Vogue. (2025, May). With Rhode Acquisition, e.l.f.’s CEO Wants to Build the Next-Gen Beauty Group. https://www.vogue.com/article/with-rhode-acquisition-elfs-ceo-wants-to-build-the-next-gen-beauty-group

[6] World Bank. (n.d.). Commodity Markets Research. https://www.worldbank.org/en/research/commodity-markets

[7] International Monetary Fund (IMF). (2025, October 14). World Economic Outlook: October 2025. https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

[8] Asserin, J., Lati, E., Shioya, T., & Prawitt, J. (2015). Effect of oral collagen peptides on skin moisture. Journal of Cosmetic Dermatology, 14(4), 291–301. https://doi.org/10.1111/jocd.12174

[9] L’Oréal Finance. (2025). Kering and L’Oréal Forge Alliance in Beauty and Wellness. https://www.loreal-finance.com/eng/press-release/kering-and-loreal-forge-alliance-beauty-and-wellness

[10] Reuters. (2025, October 19). Kering to Sell Beauty Unit to L’Oréal for $4.68 Billion. https://www.reuters.com/business/kering-sell-beauty-unit-loreal-466-billion-2025-10-19/

[11] A Luxury Lifestyle Team. (2025, October 21). Kering and L’Oréal unveil 50-year licensing pact. A Luxury Lifestyle. https://aluxurylifestyle.com/fashion/kering-and-loreal-unveil-50-year-licensing-pact/?utm_source=chatgpt.com

[12] Barclays Bank Ireland PLC. (n.d.). \Users\ruggerochiostrini\Downloads\Annual%20report.%20Barclays.%20https:\www.barclays.ie

[13] L’Oréal. (2023, June 26). Press release. https://www.loreal.com/

[14] Kering. (2023, February 14). Kering press release. https://www.kering.com/

[15] Coty Inc. (2023). Annual report FY2023. https://www.coty.com/

[16] Morningstar. (2025). L’Oréal Purchase of Kering Beauty Boosts Fragrance Portfolio, but the Deal Is Pricey. https://global.morningstar.com/en-eu/stocks/loreal-purchase-kering-beaut-boost-fragrance-portfolio-deal-is-pricey

[17] Mergermarket. Deal #7634. Retrieved November 26, 2025. https://www.mergermarket.com/Common/Mergermarket/Deals/DealsSearchResults.aspx?extern=19&id=7634

[18] Kering. (2025, October 22). Revenue for the third quarter of 2025. https://www.kering.com/api/download-file/?path=Kering_Press_release_Q3_revenue_2025_22_10_2025_fdfaf3ca07.pdf

[19] L’Oréal. (2025, November 12). L’Oréal successfully prices a €3 billion triple-tranche bond. Euronext / L’Oréal. https://live.euronext.com/en/products/equities/company-news/2025-11-12-loreal-successfully-prices-3-billion-euro-triple-tranche

You must be logged in to post a comment.