The U.S. banking industry is undergoing structural change, as regional lenders seek to achieve scale, digital transformation, and cost efficiency amid tighter regulatory and capital requirements. Regulators are requiring regional banks: to hold more loss-absorbing capital and meet stricter stress-testing. This raises fixed compliance costs and makes scale increasingly important.

The deal aligns with the broader trend of regional bank consolidation in the United States. On September 8th, 2025, PNC Financial Services Group announced its agreement to acquire FirstBank Holding Company for approximately $4.1 billion in a cash and stock transaction (PNC Financial Services, 2025)[1], one of the largest U.S. regional bank consolidations of the decade. PNC anticipates notable synergies in operational efficiency, technology integration, and customer acquisition, furthering its strategic goal of becoming the leading coast-to-coast regional bank. Through the acquisition, PNC aims to triple its branch presence in the Rocky Mountain region (MergerMarket, 2025)[2], significantly expanding its footprint across Colorado and Arizona and enhancing its competitive positioning against national players such as Wells Fargo and JPMorgan Chase. The transaction is expected to close in early 2026, subject to regulatory approval.

PNC Financial Services Overview

History:

PNC Financial Services Group, Inc. (NYSE: PNC), founded in 1852 and headquartered in Pittsburgh, PA, is one of the largest diversified financial institutions in the United States, tracing its roots to mid-19th-century Pennsylvania institutions such as Pittsburgh Trust and Savings Company and Philadelphia’s Provident National Corporation, whose early leaders built the franchise by funding regional commerce and, from the 1980s onward, pursuing a multistate growth strategy across the Mid-Atlantic and Midwest (PNC Financial Services Group, 2025)[3].

Today, PNC is led by William S. “Bill” Demchak, chairman and CEO, a former JPMorgan structured-finance executive who joined as CFO in 2002 and became CEO in 2013, supported by Robert Q. Reilly, a PNC veteran since 1987 and CFO since 2013, who oversees finance, strategic planning and investor relations and helps shape the balance-sheet strategy, capital allocation and cost discipline underpinning the group’s expansion, and by Mark Wiedman, a longtime senior BlackRock executive appointed in 2025 as president of PNC Financial and PNC Bank, a move seen as both a bet on further consolidation and a step in succession planning (PNC Financial Services Group, 2025)[4]. PNC’s business model has evolved from a traditional regional lender into a national, diversified institution that still presents itself as locally focused and relationship-driven, anchored in core lending and deposits but supported by fee businesses such as asset management, treasury services and corporate banking, with a strong balance sheet and conservative risk culture treated as strategic assets.

Over time it has deepened its presence across key U.S. regions, serving consumers, small businesses and mid-market corporates and positioning itself as a provider of everyday banking, credit, payments and wealth solutions, while a significant minority stake in BlackRock long provided fee income and financial flexibility until its sale in 2020, when management converted the non-core investment into capital for core banking and future growth. Since then, PNC has accelerated its shift from a strong regional bank into a truly national player, sharpening its “Main Street” identity, investing heavily in technology, mobile and online platforms, data and process automation to combine the digital functionality of a national giant with the feel of a local bank, and expanding its footprint into the Sunbelt and other high-growth markets so that it now describes itself as a coast-to-coast franchise with a presence in most major U.S. metropolitan areas.

Business Strategy

PNC’s business strategy rests on a few consistent pillars that reinforce one another. First, the bank seeks to build scale, focusing on metropolitan areas with strong demographics with above-average growth. Rather than simply planting flags, PNC aims for meaningful local share in deposits and loans so it can spread fixed costs over a larger base, deepen relationships with households and mid-market corporates, and cross-sell products across retail, commercial, payments, wealth and treasury services. Growth here comes from a mix of organic expansion (new branches, targeted marketing, national digital reach) and selective transactions that bring established franchises explained in greater detail in M&A activity section (PNC Financial Services Group, 2024)[5].

Second, PNC invests aggressively in technology and digital channels. This includes modern mobile and online platforms for consumers and businesses, enhanced data and analytics for pricing, underwriting and customer engagement, and automation of back-office processes to lower unit costs and improve control. The strategic aim is to deliver a consistent, high-quality experience whether customers interact through a branch, relationship manager or app, while using technology to support scalable growth across a wide geographic footprint (PNC Financial Services Group, 2023)[6].

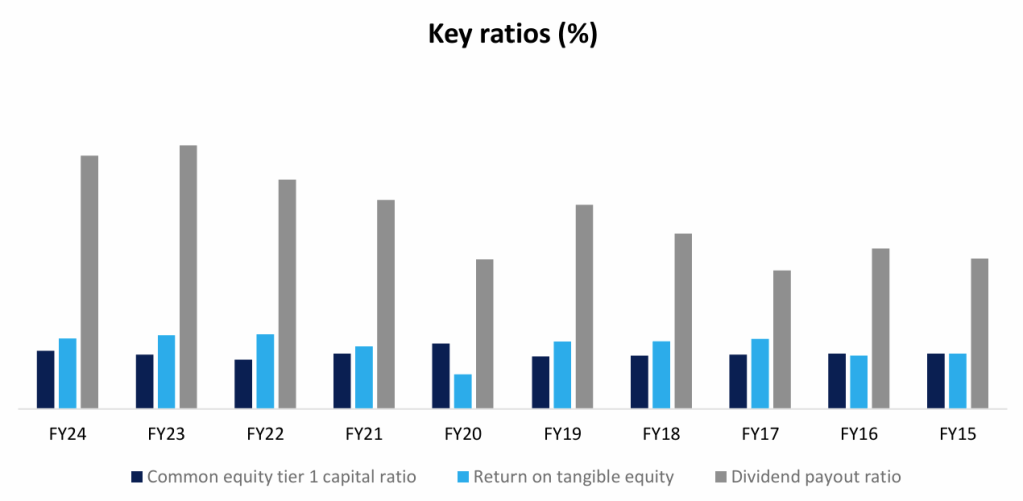

These investments also tie directly into the third pillar: conservative risk and capital management(see graph below). PNC emphasises strong capital ratios, diversified funding, disciplined credit standards and robust risk infrastructure, positioning itself as a steady operator through the cycle and preserving flexibility to act when opportunities arise (PNC Financial Services Group, 2025)[7].

Finally, the bank works to reinforce its community-bank ethos even as it grows. It does this through a regional management model that gives local leadership responsibility for “delivering the whole bank” in their markets, through targeted lending and investment commitments to low and moderate-income communities, and through visible philanthropic and development initiatives. Strengthens local relationships and helps differentiate PNC from more remote national competitors (PNC Financial Services Group, 2025)[8].

M&A Activity

Over the past two decades, the bank has done a series of increasingly larger acquisitions to diversify its footprint and deepen its presence in targeted metropolitan areas (PNC Financial Services Group, 2024)[9]. In 2004 it acquired United National Bancorp, based in New Jersey, for a mix of cash and 6.6 million PNC shares, reinforcing its position in central New Jersey and eastern Pennsylvania and adding a complementary book of retail and business customers (PNC Financial Services Group, 2004)[10]. The following year it moved into the Washington, D.C. market by agreeing to buy Riggs National Corporation. PNC paid roughly $20 per share, or about $652 million, in a combination of cash and stock. The Riggs transaction gave PNC an immediate platform in the capital region, including a long-established embassy and international banking franchise that dovetailed with its ambitions in corporate and institutional banking.

In 2006, it agreed to acquire Mercantile Bankshares Corporation, a $17 billion-asset banking group with around 240 offices across Maryland, Virginia, the District of Columbia, Delaware and southeastern Pennsylvania. PNC approximately paid $6.0 billion in stock and cash at $47.24 per share. Smaller acquisitions of Yardville National Bancorp in 2007 and Sterling Financial Corporation in 2008 further consolidated PNC’s presence in central Pennsylvania, New Jersey and surrounding areas.

In October 2008, PNC agreed to acquire National City for approximately $5.2 billion in PNC stock, plus about $384 million in cash payable to certain warrant holders. National City brought roughly $153 billion in assets and $101 billion in deposits, effectively doubling PNC’s size and creating the fifth-largest U.S. banking deposit franchise at the time. The deal greatly expanded PNC’s presence in Ohio, the broader Midwest and Florida, made it the largest bank in several core states and accelerated its transition from a regional to a national-scale super-regional.

In March 2012 it completed the purchase of RBC Bank (USA), the U.S. retail banking arm of Royal Bank of Canada, for approximately $3.47 billion in cash. The transaction added around $19 billion in deposits and $16 billion in loans, as well as a network of roughly 400 branches across the Southeast, including North Carolina, South Carolina, Georgia, Alabama and Florida (PNC Financial Services Group, 2011)[11].

The most consequential recent transaction prior to the FirstBank announcement was PNC’s acquisition of BBVA USA Bancshares, the U.S. subsidiary of Spain’s BBVA. Announced in November 2020, the all-cash deal was valued at $11.6 billion and funded from the proceeds of PNC’s divestiture of its BlackRock stake. BBVA USA added about $104 billion in assets, $86 billion of deposits and $66 billion of loans, along with 600-plus branches across Texas, Alabama, Arizona, California, Florida, Colorado and New Mexico (PNC Financial Services Group, 2020)[12].

Financial Analysis

The financials show a large, relatively stable earnings. Net interest income in 2024 was 12.5 billion, flat versus 2023, as higher loan and securities yields were offset by sharply higher funding costs: interest income rose from 22.5 to 24.4 billion, but interest expense climbed from 9.6 to 11.9 billion. That is reflected in a modest decline in net interest margin from 2.76 % in 2023 to 2.66 % in 2024, with consensus expecting a gradual rebuild to roughly 2.8-3.0% by 2026 as deposit repricing slows and asset yields continue to reset higher. The loan loss provision was 729 million in 2024, only slightly above 686 million in 2023, and net charge-offs are running at just over 1.0 billion on a multihundred-billion loan book, normalising credit conditions. Non-interest income continues to be an important contributor, growing from about 7.0 billion in 2023 to almost 7.0–7.8 billion in 2024, partially offsetting the higher funding and operating cost base. After 12.7 billion of non-interest expense, pretax income in 2024 was around 6.7 billion, producing consolidated net income of 5.4 billion and net income available to common shareholders of roughly 5.1 billion (Fig. 1), up from 4.7 billion in 2023. Given year-end assets of about 544 billion and common equity of roughly 47 billion, this implies a return on assets of 1% and a return on common equity of 11.32%.

Figure 1: Key metrics from the income statement of PNC

The balance sheet indicates a conservatively leveraged institution with strong capital ratios. Total assets rose from about 516 billion at the end of 2023 to 544 billion at year-end 2024, driven mainly by loan growth (net loans up from 287 to 301 billion) and a larger securities portfolio (investments up from 168 to 182 billion). On the liability side, deposits increased from 381 to 412 billion, while total debt actually declined from roughly 69 to 63 billion, meaning asset growth has been funded primarily by core customer deposits rather than wholesale borrowing. Total shareholders’ equity increased to about 52.6 billion in 2024, of which common equity represents around 47.0 billion and preferred stock 5.6 billion, giving an equity-to-assets ratio of 10.34%. Regulatory capital metrics in the guidance table reinforce the picture: the common equity Tier 1 ratio is shown at 11.89 % and the total capital ratio of 13.60 (FactSet, n.d.)[13]. Tangible book value per share has risen steadily, from 67.86 dollars in 2022 to 77.17 in 2023 and 92.06 in 2024 (Fig. 2).

From a liquidity perspective, the franchise looks well funded by stable customer deposits with ample secondary liquidity in the securities portfolio. Total deposits increased strongly in 2024, from 381 billion to 412 billion, outpacing loan growth and leaving the loan-to-deposit ratio of 74.16%. Cash and due from banks are modest at around 6.7 billion on the year-end balance sheet. The investment securities portfolio of 182 billion provides a substantial pool of high-quality liquid assets that can be pledged or sold if needed. The funding mix continues to be dominated by deposits, with debt funding accounting for a bit more than 60 billion, and the 2024 cash-flow statement shows that changes in deposits and securities purchases/sales are the main drivers of financing and investing cash flows. Net operating cash flow is negative in both 2023 and 2024, largely because of swings in working capital and balance-sheet growth rather than underlying earnings weakness, while net investing cash flow is positive in 2024 due to a net reduction in securities holdings.

Figure 2: Development of key ratios in the last 10 years

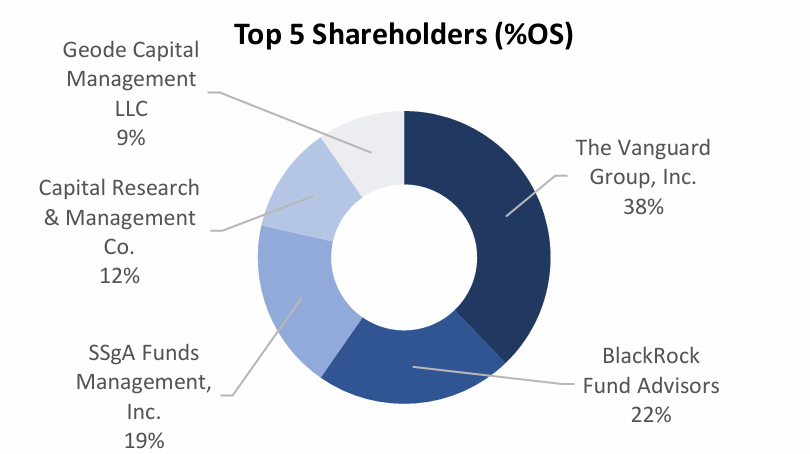

Currently, roughly 99% of PNC’s shares are held by institutional investors, with retail investors accounting for only about 1% of the ownership. This highly institutionalised shareholder base means the stock is dominated by long-only asset managers, pension funds, insurers and other professional investors, which tends to focus attention on capital returns, profitability and risk management over the medium term (Fig. 3).

Figure 3: Graph illustrates the first 5 shareholders in PNC

FirstBank Overview

History

FirstBank Holding Company, is listed (NYSE: OWLN) regional bank headquartered in Lakewood, Colorado, with a history that stretches back more than six decades. It was founded in 1963 by brothers George and Everett Williams, together with Denver attorneys Ira C. Rothgerber Jr. and William P. Johnson, as First Westland National Bank in the then-new Westland Shopping Centre on West Colfax Avenue. Roger Reisher, a Kansas City banker who moved to Colorado for the role, became the founding president and led the institution for the first 36 years of its existence, imprinting a culture that combined conservative banking with strong community ties (Colorado Business Hall of Fame, 2025)[14].

During the 1970s, the young bank quickly outgrew its original suburban Denver base. It added branches in growing Colorado communities such as Vail and Wheat Ridge, positioning itself as a convenient, locally focused bank for both Front Range households and mountain-town businesses. In 1978, the group consolidated under the FirstBank name, a brand it has retained ever since (Firstbank, 2023)[15].

The 1980s and 1990s marked FirstBank’s transition from a Denver-area lender into a larger regional franchise. In December 1985 it opened its first branch outside Colorado in Palm Desert, California, serving both year-round residents and seasonal visitors in the Coachella Valley. Through this period, the bank invested early in technology to support growth, introducing 24-hour telephone banking in 1989 and launching its first website in 1995, moves that positioned it as a relatively innovative player among mid-sized regional banks. By the early 2000s, FirstBank had become one of Colorado’s largest locally based banks by deposits.

A major strategic step came in 2007, when FirstBank entered Arizona, extending its footprint into another high-growth Western market. Over the following decade it continued to add locations in both Colorado and Arizona while refining its brand around the tagline “banking for good,” emphasising straightforward products, service consistency and community engagement. By the mid-2010s, the bank operated more than 100 branches and had become one of the largest privately held banks in the United States, with assets in the mid-teens billions and a dominant position in Colorado retail deposits.

FirstBank’s physical and cultural centre remained its Lakewood headquarters. In 2016, the bank completed a major expansion of its campus at 12345 West Colfax Avenue, adding a modern 127,000-square-foot glass building to the original 100,000-square-foot structure. The new facility was designed to house up to 1,400 employees and included amenities such as a fitness centre, full-service café, rooftop patio and collaborative workspaces, reflecting the bank’s ambitions to remain a leading employer as well as a leading bank in the region. In 2017 the expanded headquarters achieved LEED Gold certification, underscoring a growing emphasis on environmental and workplace standards (Denver Post, 2016)[16].

Alongside geographic growth, FirstBank built a reputation for philanthropy and community partnership. In 2010 it partnered with Community First Foundation (now Colorado Gives Foundation) to launch Colorado Gives Day, a 24-hour online giving initiative that has since grown into the state’s largest charitable giving movement, raising more than half a billion dollars for local nonprofits. The concept later expanded to Arizona Gives Day and Coachella Valley Giving Day, extending the bank’s philanthropic footprint beyond its home state. This “give where you live” ethos became a core part of the FirstBank brand and contributed to its recognition for corporate citizenship (Firstbank, 2023)[17].

In the 2010s and early 2020s, FirstBank continued to modernise its operations while leaning into demographic change. It broadened digital offerings and, in 2020, opened a Multicultural Banking Center in Lakewood to provide services in multiple languages, including Spanish, Korean, Vietnamese and several forms of Chinese, reflecting the increasingly diverse communities it serves. Leadership also transitioned from the founding generation to a new cohort of executives: long-time CEO John Ikard and president Dave Baker stepped down in 2017, and by 2024 the bank had appointed Kevin Classen as chief executive officer, with other senior roles filled by internal leaders such as Kelly Kaminskas and Adam Sands.

By mid-2025, FirstBank operated roughly 95–120 branches across Colorado and Arizona (Firstbank, 2025)[18], maintained close to $27–28 billion in assets, and ranked as the second-largest bank by deposits in Colorado, while remaining privately held under FirstBank Holding Company. Its long-standing focus on simple products, strong deposit franchises and community partnership made it an attractive target in a consolidating U.S. banking market.

Business Strategy

Before the acquisition, FirstBank’s strategy was built around combining a scaled, profitable regional franchise (Firstbank, 2024)[19].

Strategically, the group’s business model rests on a fairly traditional community-bank mix of products. FirstBank offers a broad suite of consumer deposit accounts, home equity loans, residential mortgages and rental property loans alongside a full range of commercial banking services: business financing, commercial real estate lending and treasury management. They are aimed at small and mid-sized businesses. That balance between core retail deposits and relationship-driven commercial lending is deliberately skewed toward customer deposits (Firstbank, 2024)[20].

The bank’s roots in West Tennessee remain central to its identity, but over time it has extended into middle and East Tennessee and adjacent states, building clusters of branches in attractive markets such as Nashville, Knoxville, Chattanooga and fast-growing suburban counties, as well as contiguous markets in Kentucky, Alabama and Georgia. Management repeatedly frames its long-term objective as scaling this regional foundation into the leading local bank in the Southeast (Firstbank, 2024)[21].

In its shareholder communications, the company emphasises “future-forward investments in talent, technology and banking innovations”. In practice, this means a focus on robust mobile and online banking for both consumers and businesses, digital payments and cash-management tools, and process automation in the back office to improve efficiency. The goal is not to become a purely digital bank, but to ensure that customers can choose between digital convenience and high-touch branch or relationship-manager service without sacrificing functionality in either channel.

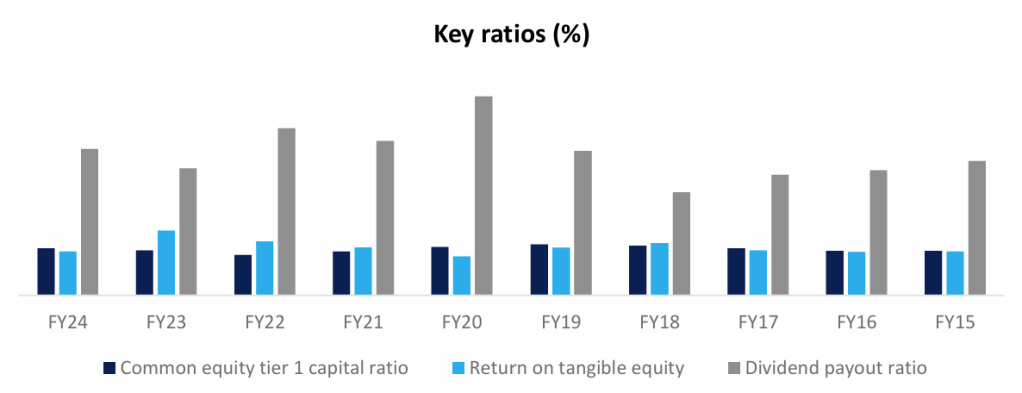

The bank’s filings highlight strong capital ratios, reflecting a focus on both credit quality and cost control. Firstbank issues regular dividends (see figure in financial analysis) and share-repurchase authorisations, which signal confidence in the franchise while maintaining flexibility to support organic growth and selective expansion (Firstbank, 2025)[22].

M&A Activity

Since its IPO in 2016, virtually every major deal has followed the same template: buy culturally compatible community or regional banks (or branch packages) in or around its home footprint (Firstbank, 2025)[23].

The first major post-IPO transaction was the acquisition of Clayton Bank and Trust and American City Bank, collectively known as the “Clayton Banks.” Announced in February 2017, the deal was structured as a stock purchase in which FirstBank acquired all of the outstanding shares of the two banks from their parent, Clayton HC, Inc., in a transaction valued at approximately $284.2 million. Clayton and American City together brought about $1.2 billion in assets, $1.05 billion in loans and $920 million in deposits as of year-end 2016. Strategically, the acquisition materially expanded FirstBank’s footprint in key Tennessee markets such as Knoxville, Jackson and Tullahoma, adding 18 branches in metropolitan (Firstbank, 2018)[24].

In November 2018, FB Financial followed up with a sizeable branch purchase from Atlantic Capital Bancshares, Firstbank agreed to acquire 14 from Atlantic Capital Bank, assuming approximately $602 million in deposits and purchasing about $381 million in loans.

In September 2019, the company announced the acquisition of FNB Financial Corp., parent of Farmers National Bank of Scottsville, Kentucky, in a deal valued at around $51.9 million. Farmers National contributed about $253 million in assets, $178 million in loans and $204 million in deposits as of mid-2019, with a high proportion of non-interest-bearing deposits and solid profitability. The acquisition gave FirstBank its first meaningful presence in south-central Kentucky.

In August 2020, FB Financial closed a merger with Franklin Financial Network, the parent of Franklin Synergy Bank. The transaction, originally announced in January 2020 at an implied value of roughly $590 million, was structured mostly in stock with a small cash component. At completion, the combined bank had approximately $11.0 billion in assets, $7.6 billion in loans held for investment and $9.1 billion in deposits on a pro forma basis.

Most recently, the merger with Southern States Bancshares extended that same strategy further into Alabama and Georgia. Announced in March 2025 at an implied value of about $381 million in an all-stock exchange, and completed on 30 June 2025, the deal added a roughly $2.8 billion-asset franchise headquartered in Anniston, Alabama, with 15 branches across Alabama and Georgia plus two loan-production offices in the Atlanta metropolitan area. Southern States’ core markets align directly with FB Financial’s stated growth corridors in the Southeast (Firstbank, 2025)[25].

Financial Analysis

Figure 4: Key metrics from the income statement of Firstbank

Over the last decade, FirstBank’s income statement reflects steady growth driven mainly by expanding loans and rising interest income, which nearly doubled between 2015 and 2024. For most of the period, funding costs stayed low, but beginning in 2022, and especially in 2023–24, deposit rates rose sharply, causing interest expense to surge and compressing net interest income from its 2022 peak.

Credit quality remained strong throughout, aside from a temporary spike in 2020, and noninterest income was stable. Operating expenses increased gradually due to expansion, wage growth, and higher technology and compliance costs.

As a result, net income grew steadily until 2019, dipped during the pandemic, then rebounded to record levels in 2021–22 before falling again in 2023–24 as higher funding costs offset the benefits of loan growth and solid asset quality (Fig. 4).

Over the past decade, FirstBank’s balance sheet has grown steadily, driven mainly by sustained loan expansion, from about $8.7 billion in 2015 to over $16 billion in 2024, and supported by conservative liquidity management. Securities and cash balances fluctuated more cyclically, rising notably in 2021 and 2023 as the bank strengthened liquidity during periods of market tightening.

Credit quality remained stable, with only gradual changes in fixed and intangible assets, reflecting a traditional branch-focused business model. On the liabilities side, deposits continued to anchor the balance sheet, growing strongly until 2021 and then stabilizing. Their composition shifted meaningfully in recent years, with interest-bearing deposits increasing as customers sought higher yields, while noninterest-bearing deposits declined. Borrowings, typically minimal, rose briefly in 2023 during industry-wide liquidity pressures before normalizing.

Equity increased consistently through retained earnings, highlighting strong internal capital generation over the decade.

Figure 5: Development of key ratios in the last 10 years

FirstBank’s capital, liquidity, profitability, and shareholder-return metrics collectively portray a disciplined and resilient institution.

The CET1 ratio has remained consistently strong, between 13% and 17% over the decade, signalling a solid capital foundation and prudent balance-sheet expansion.

Profitability, measured through return on tangible equity, shows a stable and healthy performance, ranging mostly between 14% and 17%, with a peak of 21% in 2023 as margins temporarily benefited from the rate environment. Even in more challenging years, returns remained comfortably within a strong regional-bank range.

Finally, the dividend payout ratio oscillates between 33% and 64%, indicating a balanced capital distribution strategy: generous in years of stronger earnings, more conservative when capital preservation was prudent, yet consistently supportive of shareholders without compromising capital strength.

Taken together, these metrics reflect a well-capitalized, liquid, and consistently profitable bank that manages both risk and shareholder returns with discipline across economic cycles.

Currently, roughly 98.4% of PNC’s shares are held by institutional investors, with retail investors accounting for only about 1.6% of the ownership.

Figure 6: Graph illustrates the first 5 shareholders in Firstbank

Market overview:

The U.S. banking sector has entered 2025 on a firmer footing after weathering the regional banking stress of early 2023 triggered by the rapid failures of Silicon Valley Bank, Signature Bank and later First Republic. These mid-sized lenders were hit by rising interest rates, losses on long-dated securities and sudden deposit runs, which shook confidence across the regional banking sector and sent funding costs sharply higher. Regulators stepped in with emergency liquidity backstops and arranged takeovers, stabilising the system but accelerating scrutiny of interest-rate risk, uninsured deposits and the resilience of regional banks’ business models.

Total industry net income reached $368.2 billion in 2024 (Fig. 7), a 5.6% increase from the prior year, with return-on-assets (ROA) climbing to 1.12%, according to the FDIC (FDIC, 2025)[26]. Aggregate deposits (Fig. 8) stood at approximately $17.7 trillion, up 11% from pre-pandemic levels, while the average net interest margin improved to 3.22% in Q4 2024. Balance sheets strengthened, with the sector’s average Tier 1 capital ratio at 12.4%, well above post-Basel III minimums (6%) (FDIC, 2025)[27].

Figure 7: Quarterly Net income of Commercial banks in since 2006

Figure 8: Aggregate US Deposits in the last 10 years

The profitability rebound was driven by stabilizing deposit costs and better asset repricing as the Federal Reserve paused rate hikes and initiated its first cuts in September 2024. Banks also benefitted from improving credit quality, with net charge-offs falling to 0.39% of total loans, reflecting a decrease from 0.47% in 2023, along with a moderation in unrealized securities losses, which declined 46% year-over-year. The sector’s resilience has provided super-regional banks with the confidence and capital base necessary to pursue renewed consolidation.

Macroeconomic conditions remain mixed. While GDP expanded by roughly 2.1% in 2024, business lending and CRE activity slowed amid tariff-related trade uncertainty following the 2024 election. Still, consumer credit growth has held up, supported by real wage gains and historically low unemployment of around 4% (EY, 2025)[28]. Against this backdrop, banks are emphasizing scale, stable funding, and digital competitiveness as the foundations for long-term resilience.

The defining feature of 2025’s banking landscape is the combination of regulatory loosening and strategic consolidation. Following years of heightened scrutiny under the 2021–2023 framework, the new administration has reversed course, introducing a more relaxed merger policy that has materially accelerated deal approvals.

In September 2024, the OCC and Department of Justice jointly issued updated merger review guidelines emphasizing transparency and market-concentration thresholds but shortening average approval times by over 35% (Manulife Investment Managers, 2024)[29]. The FDIC and Federal Reserve have since aligned their frameworks, resulting in a 64-day reduction in the median time to close a bank M&A deal (from 181 to 117 days) (Deloitte, 2025)[30].

These regulatory adjustments supported the pent-up M&A demand (Oak Capital Advisors, 2025)[31]. As of October 2025, 133 bank mergers had already been announced, matching the full-year 2024 total, with an aggregate deal value exceeding $60 billion, according to S&P Global Market Intelligence. The trend marks a sharp recovery from the record-low $4.2 billion total in 2023 (Fed, 2024)[32], when regulatory resistance and valuation gaps froze dealmaking.

A complementary piece of legislation, the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act of 2025), has further contributed to the reshaping of the competitive landscape by bringing non-bank payment issuers under federal oversight and allowing fintech companies to apply for OCC-chartered digital bank licenses (McKinsey, 2025)[33]. This effectively creates a new class of “tech-native banks,” intensifying competitive pressure on incumbents.

Technology remains the largest driver of cost escalation and consolidation (Deloitte, 2025)[34]. U.S. banks collectively spent $95 billion on IT and digital initiatives in 2024, which shows a 10% annual increase, while it is worth noting that the largest institutions outspend mid-tier peers by nearly 10-to-1. AI integration, cybersecurity, and real-time payments are now considered regulatory priorities rather than discretionary investments. According to Oliver Wyman, U.S. banks that fail to achieve AI readiness within five years risk a 25% efficiency-ratio gap versus peers, underscoring the significance of scale (S&P Global, 2025)[35].

Meanwhile, the market structure continues to polarize as roughly 45% of U.S. banking assets are concentrated within the four GSIBs (JPMorgan, Bank of America, Wells Fargo, and Citibank), while around 3,900 community banks compete for the remainder 55% (Bank Policy Institute, 2022)[36]. The new regulatory framework encourages consolidation among Category II–IV banks (assets between $100B–$700B), narrowing the compliance cost gap with the megabanks while avoiding systemically important designations. Analysts forecast that up to seven new large regionally concentrated banks with assets above $1 trillion could emerge within the next decade as a result.

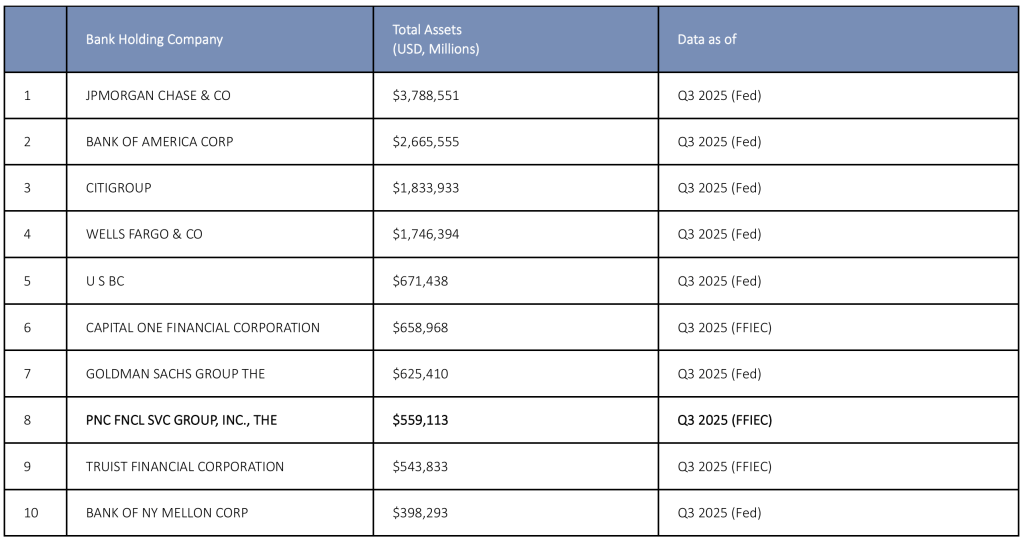

For reference, the table below shows the top 10 largest U.S. bank holding companies by asset size in the third quarter of 2025.

Sources: Federal Reserve, FFIEC[37].

The U.S. commercial banking market was valued at approximately $732.5 billion in 2025 and is projected to reach $915 billion by 2030 (CAGR 4.6%) (Mordor Intelligence, 2025)[38]. The sector comprises 4,036 FDIC-insured institutions operating 76,000 branches, though ongoing consolidation is gradually reducing the total number.

Profitability remains robust, with an average ROE near 12%, driven by steady net interest income and a growing share of fee-based revenues in wealth management and treasury services.

Regional bank M&A activity has surged following the regulatory pivot. The average U.S. bank deal in 2024–2025 was valued at $648 million, up from $631 million in 2023, with transactions above $1 billion now accounting for 27% of total deal volume (Cherry Bekaert LLP, 2025)[39].

Recent examples include Fifth Third’s $10.9B merger with Comerica, Pinnacle’s $7.9B merger with Synovus, and Old National’s $1.4B acquisition of Bremer Financial. These transactions highlight a race for geographic diversification and economies of scale, especially across high-growth Sunbelt and Mountain West markets.

The U.S. fintech market, valued at $73 billion in 2024, continues to expand at a projected 8-9% CAGR, driving traditional banks to form partnerships or acquisitions. Over 60% of banks now collaborate with fintech providers for digital onboarding, open-API infrastructure, and AI-driven customer analytics (Grand View Research, 2025)[40].

Meanwhile, commercial real estate (CRE) remains a key risk area, with delinquency rates rising to 1.57% in Q4 2024, up from 1.17% a year earlier, though loan-to-value ratios and reserves remain adequate. Roughly one-third increase that points to mounting repayment pressure on borrowers and higher credit costs for lenders. However, loan-to-value ratios and reserves remain adequate, suggesting that, for now, the impact is more likely to be felt through elevated provisions and subdued earnings rather than widespread solvency concerns.

Deal rationale:

PNC Financial Services Group’s acquisition of FirstBank Holding Company exemplifies the strategic consolidation trend reshaping the super-regional tier. The transaction, expected to close in early 2026, adds $26.8 billion in assets and 95 branches across Colorado and Arizona, positioning PNC as the largest bank in Denver with roughly 20% retail-deposit share and 14% branch share (PNC Financial Services, 2025)[41]. It more than triples PNC’s Colorado presence, taking the network from 40 to 120 branches, and lifts its Arizona footprint to more than 70 locations, effectively turning the Mountain West into one of PNC’s largest regional franchises. The consideration comprises approximately 13.9 million PNC shares, representing about 70% of total value, and $1.2 billion in cash, or 30%, implying a premium valuation relative to 2024 super-regional comparables.

From a strategic standpoint, the acquisition extends PNC’s national build-out into two high-growth Western markets with strong demographic inflows, secures around $27 billion of low-cost retail funding, and creates a substantial opportunity to cross-sell the group’s commercial, treasury and private-banking products into FirstBank’s entrenched customer relationships. It also delivers additional scale economies, allowing fixed technology, risk and compliance costs to be spread over a broader revenue base. PNC plans to retain all FirstBank employees and branches, integrating the community-banking model into its coast-to-coast platform; CEO William S. Demchak has described the transaction as “buying Colorado,” underscoring both FirstBank’s dominant retail position and the perceived cultural alignment. Within the industry, the deal is widely viewed as a disciplined but aggressive move to secure a scarce, high-quality franchise before rivals (Reuters, 2025)[42] such as Truist or U.S. Bancorp could act, using what may be a brief regulatory window for sizeable super-regional mergers and pushing PNC further toward its goal of operating as a national bank capable of competing with GSIBs and federally chartered fintechs in the coming decade (Harvard Law School, 2024)[43].

Financially, the merger is expected to be immediately accretive to earnings and to generate an internal rate of return of roughly 25% (PNC Financial Services, 2025)[44]. However, as John McDonald of Truist(Newdesk, 2025)[45] has noted, the target represents only about 5% of PNC’s market capitalisation, so the overall impact on the group is inherently modest. Investor concerns have instead focused on valuation and capital: the transaction entails about 3.8% tangible book value dilution with a 3.3-year earn-back period, which some see as steep for a bank of this size, and effectively implies a roughly 4% tangible book value hit for acquiring an institution that is about 5% of PNC’s scale (American Banker, 2025)[46]. McDonald has argued that shareholders worry PNC is paying a “Rocky Mountain high” price for FirstBank, questioning whether this is further evidence that industry-wide M&A pricing has become challenging as buyers pay full multiples for quality assets. Despite these reservations, he maintains a “Hold” rating on PNC, and the market reaction has been muted: the share price fell by around 0.5% on the 8 September announcement (Banking Dive, 2025)[47] and has traded broadly flat since, suggesting that investors recognise the strategic logic of the deal but remain cautious about the near-term financial trade-off and integration risks, including FirstBank’s CRE exposure.

Deal structure:

The PNC – First Bank deal is structured as a mix of cash (30%) and stock (70%), valued at approximately USD 4.1 billion. Announced via a press release on September 8th, the deal is expected to close in late 2026, subject to shareholder and regulatory approvals. Wells Fargo & Co. is acting as financial advisor to PNC, while FirstBank is advised by Morgan Stanley & Co. LLC and Goldman Sachs & Co. LLC.

Under the terms of the Agreement, the aggregate consideration comprises approximately 13.9 million shares of PNC common stock and USD 1.2 billion in cash from current excess liquidity, resulting in the announced implied transaction value of USD 4.1 billion. Each FirstBank shareholder may elect to receive either PNC shares or cash as payment, provided that the overall mix between stock and cash for the transaction will remain fixed.

The boards of directors of both institutions approved the deal. On 27 October, FirstBank’s director and CEO, Kevin T. Klassen, sent a letter to shareholders calling a special meeting for 14 November 2025 to vote on the merger proposal. In the document, the board unanimously recommended voting “for” the merger, which requires approval by holders of at least two-thirds of the voting power. Shareholders controlling approximately 45.7% of the company’s shares have already signed voting and support agreements committing to back the transaction.

After this meeting, the merger will proceed under standard U.S. regulatory review, including clearances from the FTC and the DOJ. In particular, the Federal Reserve and the Colorado Division of Banking.

The deal is expected to close in late 2026. No changes to the group’s senior management have been disclosed. Following completion, FirstBank will be fully integrated into PNC Bank, with governance and operational control remaining under PNC’s existing executive structure.

Valuation:

To frame our analysis, we first outline the valuation approach and then show how each method connects to the next before reconciling results. Our valuation is based on a DDM model, Company comparables, and Transaction comparables. The summary of the results is the football field below:

To make the intrinsic valuation transparent, we set out the key inputs and policies used in the model before moving to long-term anchors. Assumptions for the DDM are as follows: the U.S. statutory corporate tax rate is applied, and Basel Committee minimums for CET1, Tier 1, Total Capital, and Leverage ratios are used. Forecasts for 2025 to 2028 are set to the average of the prior three years to reflect business plan continuity. Average interest on interest-earning assets is expected to decline with anticipated Federal Reserve rate cuts, and a 0.3% decrease is applied to reflect a cautious Federal Open Market Committee stance. Average interest on interest-bearing liabilities follows the same approach, which implies a stable net interest margin over the next three years. Common and preferred stock issuance is assumed to be zero from 2025 to 2028, and the dividend payout is assumed to remain at 2024 levels, given the absence of new guidance. For the long term, the target CET1 ratio is set at 12%, which is 3% below FirstBank’s current level, reflecting uncertainty in interest rate trends and the expected policy direction of the Trump administration toward lower capitalization requirements. Total asset growth through 2031 is assumed to align with the 2024 to 2027 CAGR based on the preceding assumptions. Risk-weighted assets as a share of total assets are assumed to remain consistent with 2024. Return on assets is projected to increase to 1% by 2028, after reaching 0.92% by 2027, with operational profitability supported by economic growth in Arizona and Colorado.

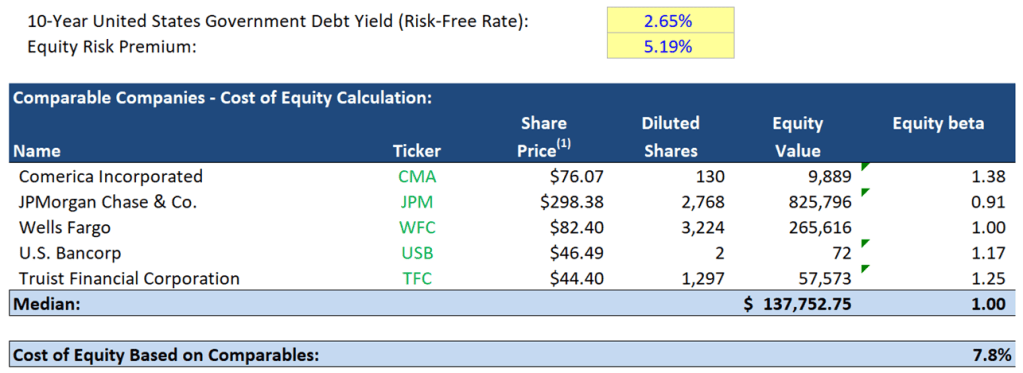

The cost of equity for FirstBank Holding Company was derived using the Capital Asset Pricing Model (CAPM) based on a set of comparable publicly traded U.S. regional banks. The peer group, comprising Comerica, JPMorgan Chase, Wells Fargo, U.S. Bancorp, and Truist Financial Corporation, was selected based on their retail-commercial banking focus, as well as, for the case of US Bank and Truist, their exposure to regional markets, reflecting FirstBank’s business model and risk profile. The median levered beta calculated across the selected peers was 1.0. For the risk-free rate, the average yield on the 10-year U.S. Treasury between 2015 and 2024 was used, equal to 2,65%. On the other hand, to capture market expectations, an equity market risk premium of 5,19% was applied, corresponding to the average S&P 500 value in the same period. Applying the CAPM formula:

The estimated Cost of Equity for FirstBank is 7.8%, reflecting the expected return required by investors for bearing the systematic risk of a mid-sized U.S. regional bank operating in similar markets and under comparable capital structures.

For the Company comparables, the analysis starts by selecting a peer group of large U.S. regional banks (USB, TFC, MTB, FITB) to serve as comparable companies for PNC and pulling market data on each peer’s adjusted equity value, total assets, and excess or deficit capital. For every peer, tangible book value per share is calculated and projected for FY24–26 using Street estimates and adjusted for items like AOCI, while “normalized” earnings are derived by stripping out one-offs and projecting clean EPS for the same years. Using current share prices, the bankers compute P/E multiples on normalized EPS for the last twelve months and forward periods, and also compute P/TBV multiples by dividing those prices by tangible book value per share. They then summarize these multiples across the group, maximum, 75th percentile, median, 25th percentile, and minimum, to establish a valuation range representative of banks with similar profiles. PNC’s own projected EPS and TBV are measured against this range to pick appropriate P/E and P/TBV multiples, and those selected multiples are applied to PNC’s forecasts to derive an implied equity value or target price, with the PNC row at the bottom showing the implied multiples and valuation outcome.

For Transaction Comparables, a set of precedent transactions involving U.S.-based regional banks was analysed. Chosen deals are similar to the PNC’s acquisition of FirstBank based on their announcement date and the deal size, whilst also involving the target companies with a similar profile to that of FirstBank – diversified regional U.S. banks with significant exposure to deposit-gathering operations and commercial lending. These criteria allowed us to find acquisitions with comparable deal rationale and profile. Analysis includes the acquisitions of Comerica by Fifth Third Bancorp (2025), Cadence Bank by Huntington Bancshares (2025), BBVA USA Bancshares by PNC Financial Services (2020), First Niagara Financial Group by KeyCorp (2015), and People’s United Financial by M&T Bank Corporation (2021).

Across the selected deals, purchase equity value ranged from $4.1 billion to $11.4 billion, whereas their announcement date ranged from 2015 to 2025, with two of them happening in 2025. After deriving median multiples from the transaction set, we obtain 1.6x P/TBV and 18.3x for P/E. Dispersion in the tangible book value ratio is narrower than that of P/E, with a CV of 8.5% for P/TBV as opposed to 41.1% for the P/E multiples. Although the spread in the P/E multiple is largely due to the 37.7x Trailing P/E multiple for M&T Bank Corporation’s acquisition of People’s United Financial.

In conclusion, the analysis indicates an implied value around 20% above the current offer price. This is a reasonable outcome, as it sits within the typical 20–30% premium range seen in comparable transactions. The relatively low expected synergies in this deal may also help explain the level of premium the buyer is prepared to pay.

Conclusion:

The FirstBank acquisition by PNC represents a merely strategic and geographical operation, which has been done to consolidate the group’s presence in the Mountain West market of Colorado and Arizona. PNC has decided to buy, rather than grow organically, into two regions with high future potential, which are expected to grow both economically and demographically. As shown by our valuation and by the premiums paid for similar businesses in the US this year. However, the premium appears to be rational and easily payable by PNC for the strategic relevance and the geographic positioning of the asset acquired. Moreover, the deal is deemed to be accretive from day one and comes with an estimated IRR of 25%, which further sweetens the transaction. Cost and revenue synergies will be limited, since PNC has chosen not to close any of the physical locations of FirstBank, but will be more than offset by the funding synergies coming from the low cost of deposits and IT integration. Moreover, the cultural fit of the two banks seems to be there, as they both center their strategies on the impact on their respective local communities. On the other hand, the risks are not to be overlooked. The high exposure of FirstBank’s portfolio to CRE and the housing market dynamics are a serious factor, and the negative impact of the deal on the TBV per share of PNC is currently scaring investors. On the reputational side, the choice of eliminating the FirstBank name and brand from the banking branches might create tensions with devoted customers. In the current context of overall uncertainty caused by a volatile macroeconomic scenario, the market has chosen to maintain a cautious approach to the deal, as PNC’s shares have traded stable since the announcement. Future catalysts will definitely be the approval decision of the transaction, the housing market, and the FOMC’s December decision. Overall, the transaction is part of the banking consolidation trend fostered by the new political environment, shaping up to be a defensive but necessary move: if PNC can replicate its integrative prowess, the reward paid could translate into lasting leadership in the Mountain West.

Authorship Disclosure

Head of the Financial Institutions Division: Marco Peron

Financial Institutions Division Analysts: Alexandre Keratishvili, Eleonora Sottile, Federico Trossero, Luigi Antonazzo, Panyarat Tangsripong

Valuation & Modelling Analyst: Luigi Wang

Bibliography:

1) The PNC Financial Services Group, Inc. (2025, September 8). EX-99.1 – 8K. PNC announces agreement to acquire FirstBank, significantly growing its presence in Colorado and Arizona. Retrieved from https://investor.pnc.com/sec-filings/all-sec-filings/content/0000713676-25-000062/a2025_0908xrlsxpncaquire.htm

2) MergerMarket. (n.d.). FirstBank – PNC Financial Services: M&A deal profile. Retrieved from https://mergermarket.ionanalytics.com/deal/mna/1563966

3) The PNC Financial Services Group, Inc. (n.d.). Corporate history. PNC Bank. Retrieved December 2, 2025, from https://www.pnc.com/en/about-pnc/company-profile/legacy-project/corporate-history.html

4) The PNC Financial Services Group, Inc. (n.d.). William S. Demchak – Chairman, president and chief executive officer. PNC Bank. Retrieved December 2, 2025, from https://www.pnc.com/en/about-pnc/company-profile/leadership-team/william-s-demchak.html

5) The PNC Financial Services Group, Inc. (2025, March 3). 2024 Annual report to security holders (ARS; includes 2024 Form 10-K). U.S. Securities and Exchange Commission. https://investor.pnc.com/sec-filings/all-sec-filings/content/0001628280-25-009250/pnc2024annualreport.htm

6) The PNC Financial Services Group, Inc. (2023, March 15). 2023 Proxy statement (DEF 14A). U.S. Securities and Exchange Commission. https://investor.pnc.com/sec-filings/all-sec-filings/content/0001193125-23-070779/0001193125-23-070779.pdf

7) The PNC Financial Services Group, Inc. (2025). The PNC Financial Services Group, Inc. 2024 Form 10-K [Annual report]. U.S. Securities and Exchange Commission. https://investor.pnc.com/sec-filings/all-sec-filings/content/0001628280-25-009250/pnc2024annualreport.htm

8) The PNC Financial Services Group, Inc. (n.d.). Community benefits [Webpage]. PNC Bank. Retrieved December 2, 2025, from https://www.pnc.com/en/about-pnc/corporate-responsibility/responsible-business/communities/community-benefits.html

9) The PNC Financial Services Group, Inc. (2025). The PNC Financial Services Group, Inc. 2024 Form 10-K [Annual report]. U.S. Securities and Exchange Commission. https://investor.pnc.com/sec-filings/all-sec-filings/content/0001628280-25-009250/pnc2024annualreport.htm

10) The PNC Financial Services Group, Inc. (2004, March 12). The PNC Financial Services Group, Inc. 2003 Form 10-K [Annual report]. U.S. Securities and Exchange Commission. https://investor.pnc.com/sec-filings/all-sec-filings/content/0001193125-04-040348/0001193125-04-040348.pdf

11) The PNC Financial Services Group, Inc. (2011, June 20). PNC announces agreement to buy RBC Bank (USA) [Press release]. https://pnc.mediaroom.com/index.php?item=74425&s=3473

12) The PNC Financial Services Group, Inc. (2020, November 16). PNC announces agreement to buy BBVA USA Bancshares, Inc. [Press release]. https://investor.pnc.com/news-events/financial-press-releases/detail/53/pnc-announces-agreement-to-buy-bbva-usa-bancshares-inc

13) FactSet. (n.d.). PNC Financial Services Group, Inc. Retrieved from https://my.apps.factset.com/workstation/navigator/company-security/snapshot/PNC-US

14) Colorado Business Hall of Fame. (n.d.). Roger Reisher. Retrieved December 2, 2025, from https://www.coloradobusinesshalloffame.org/roger-reisher.html

15) FirstBank. (2023, May 30). 60 things you may not know about FirstBank. Smart Cents by FirstBank. https://efirstbankblog.com/60-things-you-may-not-know-about-firstbank/

16) Rusch, E. (2016, June 24). FirstBank doubles down on Lakewood headquarters. The Denver Post. https://www.denverpost.com/2016/06/24/firstbank-doubles-down-on-lakewood-headquarters/

17) FirstBank. (2023, November 28). FirstBankers help spread “goodness” throughout our community [Blog post]. Smart Cents by FirstBank. https://efirstbankblog.com/firstbankers-help-spread-goodness-throughout-our-community/

18) FirstBank. (n.d.). About FirstBank. Retrieved December 2, 2025, from https://www.efirstbank.com/about-firstbank/about.htm

19) FB Financial Corporation. (2024). FB Financial Corporation 2023 annual report [Annualreport].AnnualReports.com. https://www.annualreports.com/HostedData/AnnualReportArchive/f/NYSE_FBK_2023.pdf

20) FB Financial Corporation. (2024). FB Financial Corporation 2023 annual report [Annual report]. AnnualReports.com. https://www.annualreports.com/HostedData/AnnualReportArchive/f/NYSE_FBK_2023.pdf

21) FB Financial Corporation. (2024). FB Financial Corporation 2023 annual report [Annual report]. AnnualReports.com. https://www.annualreports.com/HostedData/AnnualReportArchive/f/NYSE_FBK_2023.pdf

22) FB Financial Corporation. (2025). FB Financial Corporation 2024 Form 10-K [Annual report]. U.S. Securities and Exchange Commission. (Access via SEC or https://www.annualreports.com/Company/fb-financial-corporation)

23) FB Financial Corporation. (2025). FB Financial Corporation 2024 Form 10-K [Annual report]. U.S. Securities and Exchange Commission. https://www.sec.gov/Archives/edgar/data/1649749/000164974925000035/fbk-20241231.htm

24) FB Financial Corporation. (2018, November 13). FB Financial Corporation to acquire 14 branches from Atlantic Capital Bank [Press release]. FB Financial Investor Relations. https://investors.firstbankonline.com/news/press-release/2018/FB-Financial-Corporation-to-Acquire-14-Branches-from-Atlantic-Capital-Bank/default.aspx

25) FB Financial Corporation. (2025, March 31). FB Financial Corporation and Southern States Bancshares, Inc. announce definitive merger agreement [Form 8-K exhibit / press release]. U.S. Securities and Exchange Commission. https://www.sec.gov/Archives/edgar/data/1649749/000164974925000069/fbk-20250331.htm

26) Federal Deposit Insurance Corporation. (2025). Quarterly banking profile: Fourth quarter 2024. FDIC. https://www.fdic.gov/quarterly-banking-profile/quarterly-banking-profile-fourth-quarter-2024

27) Gruenberg, M. J. (2025). FDIC quarterly banking profile, first quarter 2025 [Speech]. Federal Deposit Insurance Corporation. https://www.fdic.gov/news/speeches/2025/fdic-quarterly-banking-profile-first-quarter-2025

28) EY. (2025). Global banking outlook 2025. EY. https://www.ey.com/content/dam/ey-unified-site/ey-com/en-cn/insights/financial-services/documents/ey-global-banking-outlook-2025-en.pdf

29) Manulife Investment Management. (n.d.). A brighter 2024 outlook for U.S. regional banks. Manulife Investment Management. https://www.manulifeim.com.sg/insights/a-brighter-2024-outlook-for-us-regional-banks.html

30) Deloitte. (n.d.). Banking and securities M&A outlook. Deloitte. https://www.deloitte.com/us/en/industries/financial-services/articles/banking-securities-mergers-acquisitions-outlook.html

31) Angel Oak Capital Advisors. (n.d.). The M&A rebound is here. Angel Oak Capital Advisors.

32) Federal Reserve Bank of Kansas City. (2024, December 11). Feature: Community bank mergers continue to slow. Federal Reserve Bank of Kansas City. https://www.kansascityfed.org/banking/community-banking-bulletins/feature-community-bank-mergers-continue-to-slow/

33) McKinsey & Company. (n.d.). The stable door opens: How tokenized cash enables next-gen payments. https://www.mckinsey.com/industries/financial-services/our-insights/the-stable-door-opens-how-tokenized-cash-enables-next-gen-payments

34) Deloitte. (n.d.). Bank consolidation: Merger of equals. Deloitte. https://www.deloitte.com/us/en/industries/financial-services/articles/bank-consolidation-merger-of-equals.html

35) Fernández, M., & Charnay, N. (2025, October 28). AI and banking: Leaders will soon pull away from the pack. S&P Global. https://www.spglobal.com/en/research-insights/special-reports/ai-and-banking-leaders-will-soon-pull-away-from-the-pack

36) Covas, F., Flowers, S., & Gross, B. (2024, July 22). Regional bank mergers would increase competition without increasing systemic risk. Bank Policy Institute. https://bpi.com/regional-bank-mergers-would-increase-competition-without-increasing-systemic-risk/

37) MX. (2025, July 30). Largest U.S. banks by total deposits (2025). MX. https://www.mx.com/blog/biggest-us-banks-by-deposits/

38) Mordor Intelligence. (n.d.). United States commercial banking market – Growth, trends, and forecasts. Mordor Intelligence. https://www.mordorintelligence.com/industry-reports/us-commercial-banking-market

39) Cherry Bekaert. (n.d.). Bank M&A trends and 2025 outlook. Cherry Bekaert LLP. https://www.cbh.com/insights/reports/bank-ma-trends-and-2025-outlook/

40) Grand View Research. (n.d.). U.S. open banking market size & outlook, 2025–2030. Grand View Research Horizon. https://www.grandviewresearch.com/horizon/outlook/open-banking-market/united-states

41) PNC Financial Services Group, Inc. (2025). PNC announces agreement to acquire FirstBank, significantly growing its presence in Colorado and Arizona [Press release]. https://investor.pnc.com/news-events/financial-press-releases/detail/666/pnc-announces-agreement-to-acquire-firstbank-significantly-growing-its-presence-in-colorado-and-arizona

42) Basil, A. K., & Anand, N. (2025, September 8). PNC’s $4.1 billion FirstBank deal adds steam to regional bank M&A. Reuters. https://www.reuters.com/legal/transactional/pncs-41-billion-firstbank-deal-adds-steam-regional-bank-ma-2025-09-08/

43) Goldfeld, V., Stagliano, M., & Andriola, M. (2024, January 19). Mergers and acquisitions—2024. Harvard Law School Forum on Corporate Governance. https://corpgov.law.harvard.edu/2024/01/19/mergers-and-acquisitions-2024/

44)The PNC Financial Services Group, Inc. (2025, September 8). The PNC Financial Services Group, Inc. https://investor.pnc.com/news-events/events-presentations/detail/20250908-pnc-announces-agreement-to-acquire-firstbank

45) TipRanks Auto-Generated Intelligence Newsdesk. (2025, September 8). PNC Financial’s FirstBank Acquisition: Strategic Expansion with Modest EPS Accretion and Hold Rating. https://www.tipranks.com/news/ratings/pnc-financials-firstbank-acquisition-strategic-expansion-with-modest-eps-accretion-and-hold-rating-ratings

46) American Banker. (n.d.). PNC wanted to move fast. FirstBank made it pay up. American Banker. https://www.americanbanker.com/news/pnc-wanted-to-move-fast-firstbank-made-it-pay-up

47) Mullen, C. (2025, September 8). PNC to acquire FirstBank in $4.1B deal. Banking Dive. https://www.bankingdive.com/news/pnc-colorado-firstbank-4-billion-acquisition/759461/

[1]The PNC Financial Services Group, Inc. (2025, September 8). EX-99.1 – 8K. PNC announces agreement to acquire FirstBank, significantly growing its presence in Colorado and Arizona. Retrieved from https://investor.pnc.com/sec-filings/all-sec-filings/content/0000713676-25-000062/a2025_0908xrlsxpncaquire.htm

[2]MergerMarket. (n.d.). FirstBank – PNC Financial Services: M&A deal profile. Retrieved from https://mergermarket.ionanalytics.com/deal/mna/1563966

[3] The PNC Financial Services Group, Inc. (n.d.). Corporate history. PNC Bank. Retrieved December 2, 2025, from https://www.pnc.com/en/about-pnc/company-profile/legacy-project/corporate-history.html

[4] The PNC Financial Services Group, Inc. (n.d.). William S. Demchak – Chairman, president and chief executive officer. PNC Bank. Retrieved December 2, 2025, from https://www.pnc.com/en/about-pnc/company-profile/leadership-team/william-s-demchak.html

[5] The PNC Financial Services Group, Inc. (2025, March 3). 2024 Annual report to security holders (ARS; includes 2024 Form 10-K). U.S. Securities and Exchange Commission. https://investor.pnc.com/sec-filings/all-sec-filings/content/0001628280-25-009250/pnc2024annualreport.htm

[6] The PNC Financial Services Group, Inc. (2023, March 15). 2023 Proxy statement (DEF 14A). U.S. Securities and Exchange Commission. https://investor.pnc.com/sec-filings/all-sec-filings/content/0001193125-23-070779/0001193125-23-070779.pdf

[7] The PNC Financial Services Group, Inc. (2025). The PNC Financial Services Group, Inc. 2024 Form 10-K [Annual report]. U.S. Securities and Exchange Commission. https://investor.pnc.com/sec-filings/all-sec-filings/content/0001628280-25-009250/pnc2024annualreport.htm

[8] The PNC Financial Services Group, Inc. (n.d.). Community benefits [Webpage]. PNC Bank. Retrieved December 2, 2025, from https://www.pnc.com/en/about-pnc/corporate-responsibility/responsible-business/communities/community-benefits.html

[9] The PNC Financial Services Group, Inc. (2025). The PNC Financial Services Group, Inc. 2024 Form 10-K [Annual report]. U.S. Securities and Exchange Commission. https://investor.pnc.com/sec-filings/all-sec-filings/content/0001628280-25-009250/pnc2024annualreport.htm

[10] The PNC Financial Services Group, Inc. (2004, March 12). The PNC Financial Services Group, Inc. 2003 Form 10-K [Annual report]. U.S. Securities and Exchange Commission. https://investor.pnc.com/sec-filings/all-sec-filings/content/0001193125-04-040348/0001193125-04-040348.pdf

[11] The PNC Financial Services Group, Inc. (2011, June 20). PNC announces agreement to buy RBC Bank (USA) [Press release]. https://pnc.mediaroom.com/index.php?item=74425&s=3473

[12] The PNC Financial Services Group, Inc. (2020, November 16). PNC announces agreement to buy BBVA USA Bancshares, Inc. [Press release]. https://investor.pnc.com/news-events/financial-press-releases/detail/53/pnc-announces-agreement-to-buy-bbva-usa-bancshares-inc

[13] FactSet. (n.d.). PNC Financial Services Group, Inc. Retrieved from https://my.apps.factset.com/workstation/navigator/company-security/snapshot/PNC-US

[14] Colorado Business Hall of Fame. (n.d.). Roger Reisher. Retrieved December 2, 2025, from https://www.coloradobusinesshalloffame.org/roger-reisher.html

[15] FirstBank. (2023, May 30). 60 things you may not know about FirstBank. Smart Cents by FirstBank. https://efirstbankblog.com/60-things-you-may-not-know-about-firstbank/

[16] Rusch, E. (2016, June 24). FirstBank doubles down on Lakewood headquarters. The Denver Post. https://www.denverpost.com/2016/06/24/firstbank-doubles-down-on-lakewood-headquarters/

[17] FirstBank. (2023, November 28). FirstBankers help spread “goodness” throughout our community [Blog post]. Smart Cents by FirstBank. https://efirstbankblog.com/firstbankers-help-spread-goodness-throughout-our-community/

[18] FirstBank. (n.d.). About FirstBank. Retrieved December 2, 2025, from https://www.efirstbank.com/about-firstbank/about.htm

[19] FB Financial Corporation. (2024). FB Financial Corporation 2023 annual report [Annualreport].AnnualReports.com. https://www.annualreports.com/HostedData/AnnualReportArchive/f/NYSE_FBK_2023.pdf

[20] FB Financial Corporation. (2024). FB Financial Corporation 2023 annual report [Annual report]. AnnualReports.com. https://www.annualreports.com/HostedData/AnnualReportArchive/f/NYSE_FBK_2023.pdf

[21] FB Financial Corporation. (2024). FB Financial Corporation 2023 annual report [Annual report]. AnnualReports.com. https://www.annualreports.com/HostedData/AnnualReportArchive/f/NYSE_FBK_2023.pdf

[22] FB Financial Corporation. (2025). FB Financial Corporation 2024 Form 10-K [Annual report]. U.S. Securities and Exchange Commission. (Access via SEC or https://www.annualreports.com/Company/fb-financial-corporation)

[23] FB Financial Corporation. (2025). FB Financial Corporation 2024 Form 10-K [Annual report]. U.S. Securities and Exchange Commission. https://www.sec.gov/Archives/edgar/data/1649749/000164974925000035/fbk-20241231.htm

[24] FB Financial Corporation. (2018, November 13). FB Financial Corporation to acquire 14 branches from Atlantic Capital Bank [Press release]. FB Financial Investor Relations. https://investors.firstbankonline.com/news/press-release/2018/FB-Financial-Corporation-to-Acquire-14-Branches-from-Atlantic-Capital-Bank/default.aspx

[25] FB Financial Corporation. (2025, March 31). FB Financial Corporation and Southern States Bancshares, Inc. announce definitive merger agreement [Form 8-K exhibit / press release]. U.S. Securities and Exchange Commission. https://www.sec.gov/Archives/edgar/data/1649749/000164974925000069/fbk-20250331.htm

[26] Federal Deposit Insurance Corporation. (2025). Quarterly banking profile: Fourth quarter 2024. FDIC. https://www.fdic.gov/quarterly-banking-profile/quarterly-banking-profile-fourth-quarter-2024

[27] Gruenberg, M. J. (2025). FDIC quarterly banking profile, first quarter 2025 [Speech]. Federal Deposit Insurance Corporation. https://www.fdic.gov/news/speeches/2025/fdic-quarterly-banking-profile-first-quarter-2025

[28] EY. (2025). Global banking outlook 2025. EY. https://www.ey.com/content/dam/ey-unified-site/ey-com/en-cn/insights/financial-services/documents/ey-global-banking-outlook-2025-en.pdf

[29] Manulife Investment Management. (n.d.). A brighter 2024 outlook for U.S. regional banks. Manulife Investment Management. https://www.manulifeim.com.sg/insights/a-brighter-2024-outlook-for-us-regional-banks.html

[30] Deloitte. (n.d.). Banking and securities M&A outlook. Deloitte. https://www.deloitte.com/us/en/industries/financial-services/articles/banking-securities-mergers-acquisitions-outlook.html

[31] Angel Oak Capital Advisors. (n.d.). The M&A rebound is here. Angel Oak Capital Advisors.

[32] Federal Reserve Bank of Kansas City. (2024, December 11). Feature: Community bank mergers continue to slow. Federal Reserve Bank of Kansas City. https://www.kansascityfed.org/banking/community-banking-bulletins/feature-community-bank-mergers-continue-to-slow/

[33] McKinsey & Company. (n.d.). The stable door opens: How tokenized cash enables next-gen payments. https://www.mckinsey.com/industries/financial-services/our-insights/the-stable-door-opens-how-tokenized-cash-enables-next-gen-payments

[34] Deloitte. (n.d.). Bank consolidation: Merger of equals. Deloitte. https://www.deloitte.com/us/en/industries/financial-services/articles/bank-consolidation-merger-of-equals.html

[35] Fernández, M., & Charnay, N. (2025, October 28). AI and banking: Leaders will soon pull away from the pack. S&P Global. https://www.spglobal.com/en/research-insights/special-reports/ai-and-banking-leaders-will-soon-pull-away-from-the-pack

[36] Covas, F., Flowers, S., & Gross, B. (2024, July 22). Regional bank mergers would increase competition without increasing systemic risk. Bank Policy Institute. https://bpi.com/regional-bank-mergers-would-increase-competition-without-increasing-systemic-risk/

[37] MX. (2025, July 30). Largest U.S. banks by total deposits (2025). MX. https://www.mx.com/blog/biggest-us-banks-by-deposits/

[38] Mordor Intelligence. (n.d.). United States commercial banking market – Growth, trends, and forecasts. Mordor Intelligence. https://www.mordorintelligence.com/industry-reports/us-commercial-banking-market

[39] Cherry Bekaert. (n.d.). Bank M&A trends and 2025 outlook. Cherry Bekaert LLP. https://www.cbh.com/insights/reports/bank-ma-trends-and-2025-outlook/

[40] Grand View Research. (n.d.). U.S. open banking market size & outlook, 2025–2030. Grand View Research Horizon. https://www.grandviewresearch.com/horizon/outlook/open-banking-market/united-states

[41] PNC Financial Services Group, Inc. (2025). PNC announces agreement to acquire FirstBank, significantly growing its presence in Colorado and Arizona [Press release]. https://investor.pnc.com/news-events/financial-press-releases/detail/666/pnc-announces-agreement-to-acquire-firstbank-significantly-growing-its-presence-in-colorado-and-arizona

[42] Basil, A. K., & Anand, N. (2025, September 8). PNC’s $4.1 billion FirstBank deal adds steam to regional bank M&A. Reuters. https://www.reuters.com/legal/transactional/pncs-41-billion-firstbank-deal-adds-steam-regional-bank-ma-2025-09-08/

[43] Goldfeld, V., Stagliano, M., & Andriola, M. (2024, January 19). Mergers and acquisitions—2024. Harvard Law School Forum on Corporate Governance. https://corpgov.law.harvard.edu/2024/01/19/mergers-and-acquisitions-2024/

[44] The PNC Financial Services Group, Inc. (2025, September 8). The PNC Financial Services Group, Inc. https://investor.pnc.com/news-events/events-presentations/detail/20250908-pnc-announces-agreement-to-acquire-firstbank

[45] TipRanks Intelligence Newsdesk. (2025, September 8). PNC Financial’s FirstBank Acquisition: Strategic Expansion with Modest EPS Accretion and Hold Rating. https://www.tipranks.com/news/ratings/pnc-financials-firstbank-acquisition-strategic-expansion-with-modest-eps-accretion-and-hold-rating-ratings

[46] American Banker. (n.d.). PNC wanted to move fast. FirstBank made it pay up. American Banker. https://www.americanbanker.com/news/pnc-wanted-to-move-fast-firstbank-made-it-pay-up

[47] Mullen, C. (2025, September 8). PNC to acquire FirstBank in $4.1B deal. Banking Dive. https://www.bankingdive.com/news/pnc-colorado-firstbank-4-billion-acquisition/759461/

You must be logged in to post a comment.