Introduction: The Merge of Two French Behemoths

On December 9th, 2021, a seismic shift occurred in the European media landscape when Vivendi announced its acquisition of a 17.9% stake in Lagardère from Amber Capital. This huge deal not only marked the cessation of Lagardère’s autonomy but also signaled a transformation in the power dynamics of the French media industry. This article will comprehensively explore this transformative operation and examine its implications for the entire sector.

Our discussion will primarily focus on Vivendi and Lagardère, two French powerhouses with significant influence in the cultural and media sectors. Before we delve into the granularities of the transaction and its financial repercussions, let’s first acquaint ourselves with the existing corporate structure of these two conglomerates.

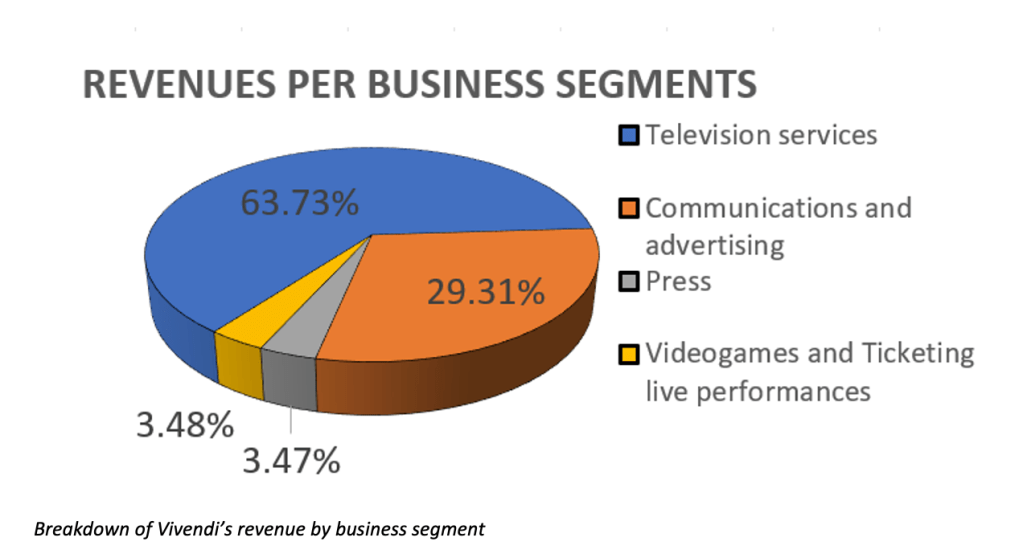

Vivendi, on one side, is a vast conglomerate operating in four primary areas, boasting a total revenue of €9.6 billion. Its reach extends to Television services (€5.8 billion), Communications and Advertising (€2.8 billion), Press (€0.3 billion), Video games (€0.3 billion), and Video Games + Ticketing + Live performances (€0.2 billion). Besides these core businesses, Vivendi maintains minority stakes in several European media and telecommunications sectors, including Telecom Italia, FLEntertainment, and Berlusconi’s MediaForEurope. In addition, until 2021, Vivendi retained complete control over the Universal Music Group, a premier record company. A spinoff reduced its ownership to a mere 10% stake, providing crucial financial support for future acquisition.

Breakdown of Vivendi’s revenue by business segment

On the other side, Lagardère generates €7.0 billion in revenue and operates across three divisions: Publishing (€2.7 billion), Travel Retail (€3.9 billion), and News + Live Entertainment (€0.3 billion). The parallels between the two conglomerates present opportunities for synergies and future growth within the combined entity. Furthermore, both companies share a unique characteristic – family-controlled entities. This attribute is crucial for understanding the rationale behind this purchase.

The Final Step of a Patient Creeping Takeover

A closer look at this merger reveals a story more complex than a typical business transaction. This deal represents a power struggle between two industrial powerhouses, each guided by influential families with contrasting fortunes. Vincent Bolloré skillfully transformed his father’s modest paper and packaging business into the colossal Bolloré Group, a diverse conglomerate with logistics, media, and energy storage operations. Conversely, Arnaud Lagardère struggled to maintain his family’s legacy, witnessing the gradual disintegration of his industrial empire.

This transaction, thus, symbolizes the end of Lagardère’s saga, which was emblematic of contemporary French capitalism. The final scene of this dramatic story is set to unfurl on June 14th, as Margrethe Vestager, the European Commissioner for Competition, is expected to announce its final decision on the acquisition. This verdict will likely mark the completion of a long-drawn and meticulously planned creeping takeover of Vincent Bolloré’s.

The process was set in motion in April 2020 when Vivendi disclosed to the French Market Authority (AMF) that it had crossed the 10% ownership threshold. The company gradually bolstered its position in Lagardère throughout the year, achieving a 26.7% stake by the year’s close. A year later, on December 9, 2021, Vivendi declared the acquisition of 24 million shares from Amber Capital at €24.10 per share, escalating its stake in Lagardère to 45.13%. Simultaneously, the group has initiated a public tender offer for all of Lagardère’s shares at the same price offered to Amber Capital. On February 21, 2022, the offer price was revised to €25.5 per share. As of today (May 2023), Vivendi currently holds 57.7% of Lagardère’s share capital. On this deal, Vivendi has been advised by BNP Paribas, CIC, Natixis CIB, Societe Generale, and Lazard for this tender offer. The enterprise value projected by the bankers using the sum-of-the-parts methodology fluctuates between €4.8 billion to €5.91 billion. The evaluation of previous comparable transactions for each sector in which Lagardère is presently led to the following EV/EBITDA multiples: 20.1x for Travel Retail, 11.5x for Publishing, and 4.0x for the other activities in the Media sector.

In recent interviews with BFM Business on April 23rd and 24th, Yannick Bolloré (Chairman of the Supervisory Board of Vivendi) and Arnaud Puyfontaine (Chairman and CEO of Vivendi) outlined their vision for the future of the conglomerate. Both leaders underscored Vivendi’s intention to preserve Lagardère’s distinct structure while capitalizing on synergies with the parent group. They also confirmed that Lagardère would remain a separately listed entity.

However, such declarations have been met with skepticism from numerous analysts, primarily due to Vincent Bolloré’s known aggressive financial strategy and active involvement in his ventures. In addition, some consolidation within the group seems inevitable to perform synergies expected from the deal. From an operational standpoint, this obligation will likely lead to structural simplifications and integration of Lagardère into Vivendi’s business.

The implications of this acquisition are far-reaching and complex. With Lagardère’s assets poised to become a part of the giant Vivendi conglomerate, each division of Lagardère will likely experience significant changes. While the future structure of Lagardère within Vivendi remains uncertain, the potential for significant synergies across the divisions is clear. In the coming parts, we will review the potential implications of this combination for each division, starting from the Media, News, and Advertising businesses which represent the most prominent activity of the group.

Media: Creating a Powerful Group Aiming for Competitive Edge in France

This transaction has significantly impacted the French media and TV and radio markets. This combination will give birth to a new company able to compete with the French leaders of traditional media: TF1, M6, and Altice Media. Furthermore, this deal will unearth opportunities for enhanced cross-promotion across various media platforms and facilitate mutualization and new cross-platform program development.

In the audio-visual segment, the group will agglomerate Vivendi’s Canal+ TV channels (C8, CStar, CNews, Canal+, Canal+ Thematiques), Lagardère’s radio stations (Europe1, Europe2, and RFM), as well as Vivendi’s movie studios (OCS, StudioCanal, SAM Productions). In the newspaper and magazine segment, the new conglomerate will consolidate Prisma Media (France’s premier magazine publisher) with Lagardère News magazines, which include Paris Match, Le Journal du Dimanche, Elle, and its international variants.

These media can furthermore rely on the powerful distribution capabilities of Canal+ Group, which has carved a niche for itself as a pivotal player in French media, amassing a clientele of over 9.5 million paying subscribers in the country. The company has built a robust catalogue of proprietary series and movies over the years and secured the broadcast of major sporting events through direct acquisitions of rights and distribution agreements. The company is also attempting to replicate this model in different parts of the world (Eastern Europe, Southeast Asia, and Sub-Saharan Africa).

In addition to these businesses, the conglomerate encompasses a complementary division with more attractive margins: the Advertising activity. This sector also drives the group’s growth and ensures the business model’s financial sustainability. This synergistic relationship fosters vertical integration of the value chain, granting access to a comprehensive suite of services such as media planning, digital marketing, and public relations for clients. In the French market, Havas occupies the second-largest agency position after Publicis. On a global scale, WPP, Omnicom, and Publicis are the top three contenders in the market, with revenues of $17.85 billion, $14.29 billion, and $13.5 billion, respectively, in FY 2021. Havas claimed the 8th position in FY2022, with $3.1 billion in revenue.

We will further review another division that may beneficiate from enhanced value creation: the Events, Live Performances, and Ticketing division.

Live Performance: Straightforward Synergies and Rapid Consolidation to be Expected.

The division is brimming with opportunities for consolidation and synergy. Vivendi and Lagardère hold assets in this field that could be strategically integrated to form a robust entity.

Vivendi has carved out a significant presence in ticketing and event management, with a diverse client base spanning museums, fairs, and theatres. The company also owns and operates prestigious festivals such as Glastonbury Festival, Tomorrowland, and Mallorca Live. Moreover, Vivendi Village is instrumental in managing the African Cup of Nations in Ivory Coast and owns the event and concert venues like L’Olympia in Paris. This is complemented by a network of cinemas across Africa. On the other hand, Lagardère holds or manages numerous venues, including the Casino Paris, Arena du Pays d’Aix, and the Arkéa Arena.

By leveraging synergies between these operations, the combined entity could realize substantial cost savings and significantly improve the division’s asset turnover ratio. Furthermore, these added venues could serve as extra distribution channels for the media ventures of both groups. The fusion of Vivendi’s and Lagardère’s assets in the events, ticketing, and live performance sector offers tremendous potential. The combined resources and expertise will likely enhance operational efficiency and spur the development of innovative revenue models. This blend of activities lays the foundation for a diverse and comprehensive service portfolio that reaches an expanded audience, elevating the value proposition for both conglomerates. Whereas this combination promises advanced integration among the different segments of the two groups, there is one sector in which the mixture will not be possible: Publishing.

Publishing: The Puzzle of Hachette and Editis

Among the various assets acquired, the most strategic piece appears to be Hachette, the publishing arm of Lagardère. The group is one of the jewels that has drawn Vincent Bolloré’s attention. Since publishing accounts for over 55% of Lagardère’s revenue, it is a cornerstone of the group’s portfolio and a lucrative target for Bolloré. The breakdown of the publishing division’s revenue shows General Literature contributing approximately 41%, followed by Illustrated Books (17%), Education (13%), and Partworks (11%). The remaining subdivision accounts for 17% of the publishing revenue. Acquiring this publishing titan will equip Vivendi to challenge the industry leaders worldwide.

However, to achieve this goal, the group must abandon some of its own assets, including its publishing subsidiary Editis. Understanding why Hachette is preferred over Editis requires a closer look at the two entities’ market positions. Both are powerhouses in French-speaking markets, overseeing the entire book value chain, from rights acquisition to marketing, distribution, and direct sales to retail customers.

The decision to keep Hachette and sell Editis appears primarily influenced by the two publishers’ relative size and international reach. With revenue of €2.7 billion, Hachette dwarfs Editis, which garners only €0.8 billion. Moreover, Hachette’s influence extends beyond French-speaking territories: the company has a significant market share in the UK (second-largest player) and the US (fourth-largest player). Overall, more than two-thirds of Hachette’s revenue is generated outside France.

On the international competition, Pearson maintains an unparalleled leadership position in the sector at a macroscopic level, followed by RELX, which concentrates on scientific, technical, and medical materials. Thomson Reuters ranks third, trailed by Penguin Random House, and then Hachette Livre in fifth place. The industry is forecast to grow at a modest CAGR of 1.22% over the next four years, indicative of a low-growth market influenced by surging paper costs. While e-books have yet to eclipse their print counterparts as initially projected, the audiobook market continues to outpace the general book market, with Amazon’s Audible holding a 63.4% market share in the US audiobook market. In this market, Vivendi’s challenge is now to find an appropriate buyer for Editis, which must be divested to respect European Commission’s requirements.

As reported by BFM Business, several companies, including Mondadori, Reworld, and Québécor, have expressed interest in acquiring Editis. Market whispers hint at Czech Media Invest as the likeliest candidate to purchase the French publisher. This proposition offers a substantial advantage for regulators as billionaire Daniel Křetínský owns the financial resources to ensure Editis’ long-term development and stimulate healthy competition between Editis and Hachette in French-speaking markets. After the publishing business, the activity that represents the most significant potential for the future is the Travel Retail division which may constitute a major asset for the future.

Travel Retail: Unearthing Vivendi’s Potential Gold Mine

Over the years, the Travel Retail division has proven to be a robust revenue generator for the group, maintaining steady revenues and impressive profitability. Despite the challenges imposed by the pandemic, this sector is now on a fast track to recovery, fueled by the revival of international travel. International arrivals have already reached a staggering 117 million worldwide, a number set to climb higher. Market research firm Nextmsc projects a compound annual growth rate (CAGR) of 18.9% for 2022-2030.

Before the pandemic struck, Dufry, operating in over 400 locations and boasting a revenue of $8.69 billion, was the sector’s heavyweight. Following closely behind was Lotte Duty-Free, a Korean company with significant influence in the Asian market. Other dominant players in Asia included Shilla Duty-Free and China Duty-Free, the latter specializing in luxury brands. Taking the fifth spot, Lagardère Travel Retail boasted a significant footprint in the Western world, making it a force to be reckoned with.

This division operates an array of shops in critical airports, railway, and subway stations across Europe in locations that include Rome-Fiumicino, Salzburg Airport, and Paris Charles-de-Gaulle. It runs brands such as Relay, Discover, Tech2go, and Marche and manages several franchise shops featuring renowned brands like Victoria’s Secret, Nespresso, Costa Coffee, Burger King, and Hermes. However, the future of Lagardère’s Travel Retail arm (which contributed around 40% of pre-pandemic revenue) under Vivendi’s umbrella remains to be determined.

Vivendi may divest from the retail travel business to fund additional acquisitions and improve its balance sheet. Given the sector’s heightened merger and acquisition activity. In recent months, Duffry has acquired Autogrill for roughly €2.44 billion, suggesting great selling potential for the division. Alternatively, Vivendi could bolster its position by seeking further acquisitions and fostering a growth-driven strategy for the travel retail business. It’s important to note that such a strategy would necessitate significant capital investment and a substantial cash reserve.

What’s Next for Vivendi and Bolloré?

Although the potential for value creation is vast, the materialization of synergies is still being determined. It will depend on factors such as regulatory approval, management decisions, and market conditions. This operation is a real challenge in many aspects and opens new horizons for the future of Vivendi and its main shareholder. Tenacious market speculations have gained momentum for the last months, hinting at the prospect of a complete acquisition and subsequent delisting of Vivendi by Vincent Bolloré himself. Such a maneuver would consolidate Bolloré’s command over the company and ease the transformation process to perform synergies.

This potential reorganization might not be confined to Vivendi alone but could also encompass other entities under Vincent Bolloré’s ownership. The billionaire’s stakes are currently orchestrated through a cascade of holdings, including notably Groupe Bolloré and Compagnie de l’Odet. It’s plausible that the billionaire may restructure the overall ownership of its participations in the coming months and possibly delist specific units.

These transformations allows Vincent Bolloré to prepare his succession plan and transmit his empire to his progeny: Yannick Bolloré, Cyrielle Bolloré, Marie Bolloré, and Sebastien Bolloré. Recently, the Bolloré Group has divested its logistics arms in two phases. Initially, Bolloré Africa Logistics was sold to MSC for an aggregate value of €5.7 billion, followed by the disposal of the remaining logistics operations to CMA CGM for €4.65 billion. It’s worth noting that in 2022, the Bolloré Group already amassed over €5.9 billion from the demerger of Universal Music Group and its consequent initial public offering on Euronext Amsterdam. These transactions have given the billionaire a large cash pool, which could potentially be deployed to purchase Vivendi’s residual free float, currently valued at roughly €6.0 billion. Moreover, the mountain of cash generated by the cessions also paves the way for further expansion and potential new acquisitions.

Despite the potential for development, the consolidation also has ignited a discourse on media concentration in France, prompting the French Senate to establish a special commission of inquiry dedicated to scrutinizing media concentration. This deal has notably triggered apprehensions about its potential implications on information freedom, especially considering that Vincent Bolloré has previously faced allegations of actively swaying the editorial direction of the media outlets he controls.

A novel structure has been implemented to protect Europe 1 within the Lagardère group to alleviate these concerns. This new entity, under the form of Commandite Par Action (Partnership Limited by Shares), is designed to amplify the independence of the radio broadcaster under Arnaud Lagardère’s stewardship. However, the efficacy of this setup in maintaining the identity and integrity of Europe 1 still needs to be substantiated. It’s crucial to highlight that, in anticipation of the takeover, the editorial line of Europe 1 has already been adjusted to encourage more collaboration with Vivendi’s CNews.

Sources: Bloomberg, Vivendi, Forbes, Reuters, Statista

Authors: Yuxi CHENG, Lorenzo Passioni

Editor: Paul THIRIOT

You must be logged in to post a comment.