COMPANIES OVERVIEW

Synopsys Inc.

Founded by Aart de Geus, David Gregory and Bill Krieger in 1986 in Research Triangle Park, North Carolina, Synopsys Inc. was initially established as Optimal Solutions and changed its name in 1987, shifting to Mountain View, California. In February 1992, it went public through an IPO, and since then its stock has been trading on the Nasdaq Global Select Market (SNPS.O).

Today, Synopsys is a key Silicon Valley supplier to the chip industry, specialized in semiconductor design and software, mostly semiconductor electronic design automation (EDA), with market presence mainly in US (48% of FY23 revenues) and China (15% of FY23 revenues). With a market capitalization of $90bn, Synopsis has made a few acquisitions in the silicon and design verification space since the 2010s and the announced acquisition of Ansys Inc. is set to become the company’s largest deal, as well as the biggest acquisition in the technology sector since chipmaker Broadcom took over software maker VMware last November in a $69bn deal. This transaction is a signal of Synopsys’s health, further underlined by the 15% increase in revenues in the last fiscal year (from $5.0bn in FY22 to $5.8bn in FY23) and the expansion of the labor force up to 20,300 employees (+6.84% from 2022). The tie-up comes at a time when leading companies like Nvidia and Intel are designing much more complex chips made of multiple pieces, as well as the massive computing systems that house the chips.

Synopsys CEO Sassine Ghazi, who succeeded Aart de Geus in January 2024, explained that the goal of this bet is to expand Synopsys’s prominence in simulation software for chip designers, automobiles, airplanes. The market and clients are asking for “integrated solutions”, complementary offerings of tools to design the chips and software, mainly based on AI, for evaluating larger electronic systems where those chips end up. This acquisition is a logical next step to the successful, seven-year partnership with Ansys.

Ansys Inc.

Ansys, headquartered in Canonsburg, Pennsylvania, was founded in 1970 as Swanson Analysis Systems, Inc. (SASI), by John Swanson, a mechanical engineer who developed software in the 1960s for Westinghouse, to help analyze stresses on nuclear reactors. It went public on NASDAQ in 1996 and in the 2000s it acquired other engineering design companies, obtaining additional technology for fluid dynamics, electronics design, and physics analysis. Ansys became a component of the NASDAQ-100 index (ANSS.O), on December 23rd, 2019. With a market capitalization of $30bn, the company employs about 5,600 people and has seen a constant increase in revenues over the last two decades, recently recording +9.9% in FY23 compared to the previous year, reaching $2.3bn.

Today, the company still makes CAE/Multiphysics engineering simulation software used by engineers, designers and researchers across industries like aerospace, defense, automotive and energy. Ansys’s products compete with Autodesk’s Fusion 360, AutoCAD and Dassault Systems’ SolidWorks.

For decades, one of Synopsys’s closest rivals has been Cadence Design Systems and its interest in Ansys has animated the bid for the latter. Ajei Gopal, Ansys’s chief executive since 2017, was formerly an operating partner at private equity firm Silver Lake and had managed to build and maintain a strong relationship with the buyer company since he took on the new position seven years ago.

Synopsys’s acquisition of Ansys will merge the worlds of semiconductor design and physical simulation. However, some Synopsys shareholders raised concerns about the deal because Ansys had recently posted a slower revenue growth rate than Synopsys’s and the deal could also trigger regulators’ scrutiny. In any case, boards of both companies retained independent advisers to evaluate regulatory risks.

MARKET OVERVIEW

The acquisition of Ansys by Synopsys marks a significant move in the software technology sector. The transaction will create a massive new player in the business software industry, a sector that is already highly consolidated. The deal would bring together Synopsys’s semiconductor electronic design automation (EDA) tools with Ansys’ simulation and analysis portfolio. The EDA industry is already highly consolidated mainly in the hands of Synopsys and Cadence, both of which have similar market capitalizations. For its part, Synopsys is a mainstay of chip design companies such as Advanced Micro Devices (AMD.O), Intel and Nvidia but has also benefited from a growing trend of firms like Microsoft and Alphabet’s Google taking some chip design efforts in-house.

The technology industry flourished during the early pandemic years as companies accelerated their digital transformation efforts. However, the industry has encountered various challenges in the last couple of years. High inflation, elevated interest rates, and considerable macroeconomic and global uncertainties contributed to a softening of consumer spending, lower product demand, falling market capitalizations, and workforce reductions in 2022. Headwinds continued in 2023, with significant weakening of global tech spending and rising layoffs: last year saw the sharpest year-on-year contraction in tech M&A spending of the last 20 years, according to S&P Global. Global deal values dropped to ~$2.5tn in in 2023 vs ~$5.0tn in 2021. But there are now glimmers of hope that a tech comeback may be imminent. Looking forward in 2024, there are reasons for optimism about dealmaking in the technology sector. Advances in generative AI and other new technologies, more certainty around interest rates, record levels of capital to invest by private equity, and pent-up demand for dealmaking all point towards an increase in technology deal activity in 2024.

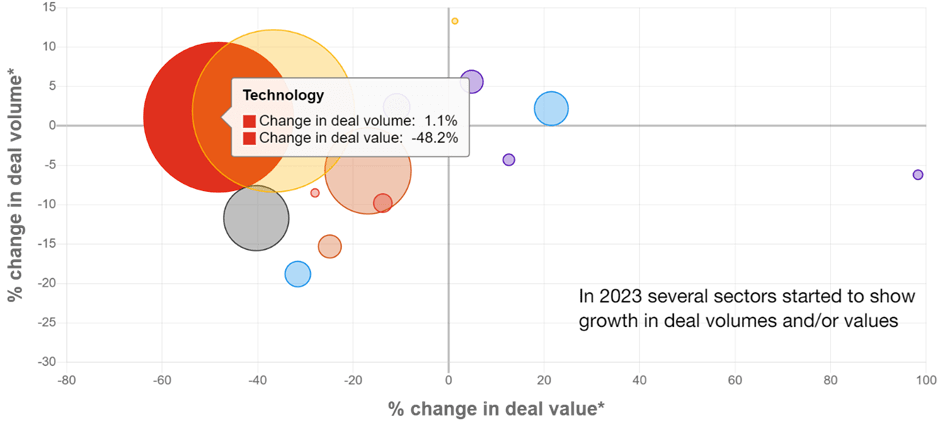

A more detailed analysis of the deals shows that deal values halved throughout 2023 compared to two years prior. The past year has also seen significant fluctuations in deal activity, with record deal volumes in the first half of 2023 (~8,500 deals announced), followed by a 31% decrease in the second half of the year. The decline in deal activity during H2 2023 is attributable to factors such as more restrictive monetary policy, the effects of inflation on consumers, geopolitical conflicts and a changing regulatory environment.

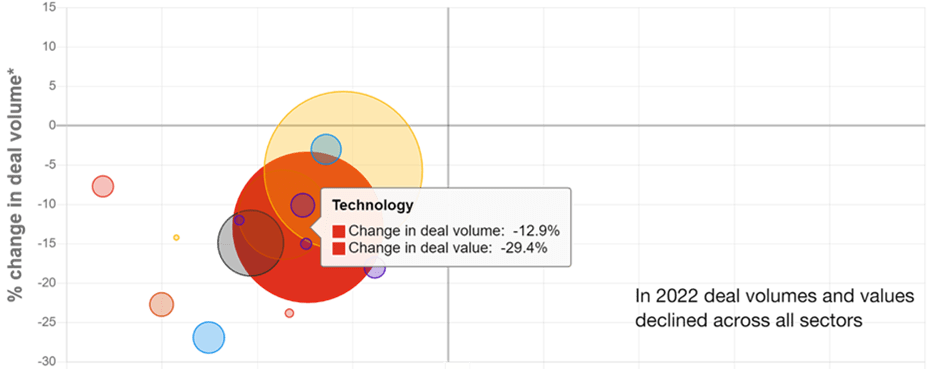

Year-over-year change in global deal volumes and values by sector, 2021-2023

Sources: LSEG and PwC analysis

Deal values decreased by 44% in 2023 compared to the prior year, primarily because of a predominance of smaller deals and lower valuations. Furthermore, the number of technology, media, and telecom sector (TMT) megadeals dropped from 42 in 2021 to 24 in 2022 and just 11 in 2023. Additionally, valuations of tech companies are often more sensitive to bank rates than in other industries, which has created a valuation gap between buyers and sellers. There is pent-up demand for new investment opportunities, and the growing backlog of tech and other companies waiting to go public likely means some of these will come to market in 2024. However, the window for IPOs will be narrow due to upcoming elections in the US, the UK and certain other countries. While waiting for a more receptive market, TMT companies have focused on strengthening their financials and developing alternative scenarios including potential sales. In addition to the challenge for tech companies of raising capital in the public equity markets, poor post-IPO performance in the sector has led to some material valuation declines and a growing trend of public-to-private deals.

In 2024 and beyond, tech leaders are expected to focus on several key strategies. Firstly, there is an anticipation of a comeback aided by investments in cloud computing, artificial intelligence (AI), and cybersecurity technologies. Enterprise spending on these areas is projected to drive significant growth in the tech market. Secondly, the spotlight is on generative AI, which is forecasted to undergo a transitional phase as companies explore its potential applications to enhance efficiency and productivity. As investment and experimentation in generative AI accelerate, legal and regulatory frameworks may evolve rapidly, paving the way for wider adoption in the second half of 2024 and into 2025. Moreover, the tech industry is facing a reckoning with regulations worldwide. Governments are evaluating the impact that massive tech platforms and social networks have on businesses and consumers. Anticipated regulations in the European Union and the United States are likely to emphasize data protection, harm reduction, ethical AI use, and commitment to sustainability goals.

Additionally, software remains a lucrative prospect for investors due to its subscription-based business models, offering predictable recurring revenues and cash flows. The software sector will continue to appeal to investors in the current lower-growth environment, continuing to dominate technology dealmaking activities throughout 2024. The global software market size was estimated at $589.6bn in 2022 and it is anticipated to reach $1,789.1bn by 2032, poised to grow at a CAGR of 11.74% during the ten-year forecast period.

DEAL RATIONALE

The rationale for this acquisition is multi-faceted, underpinning several motivations.

Combining Industry-Leading Skills to Fulfil Demand from Customers: Modern intelligent systems are so complicated that their proper functioning in real-world scenarios necessitates the combination of semiconductor design, simulation, and analysis. Ansys’s well-established simulation and analysis capabilities when combined with Synopsys’s EDA technology may provide clients a thorough, potent, and system-focused approach to innovation. All Ansys clients, even those outside the semiconductor sector, stand to gain from having access to a wide range of innovative products and technology.

Promoting Strategy and Growth in Attractive, Adjacent Areas: The companies of Synopsys and Ansys are very complimentary, and there are plenty of chances for growth. In addition to the highly desirable adjacent development industries of automotive, aerospace, and industrial, among others, where Ansys has an established presence and significant go-to-market expertise, the merger will strengthen Synopsys’s Silicon-to-Systems approach.

Complementary Fit: Since 2017, Synopsys and Ansys have enjoyed a prosperous and expanding cooperation based on a shared culture of honesty, superior execution, and client empowerment. It is anticipated that by combining their highly complementary technologies, clients would receive a more comprehensive, deeply integrated suite of software tools to address their most challenging design problems as well as significant insights from the model-based analysis of complex systems.

Significantly Expanding Total Addressable Market: It is anticipated that Synopsys’s total addressable market (TAM) would rise by 1.5 times, reaching around $28bn. The demand for the integration of electronics and physics across sectors is likely to accelerate due to megatrends, with a combined TAM expected to expand at a CAGR of ~11% from FY23 to FY28.

Bolstering Strong Financial Position and Outlook of Synopsys: It is anticipated that the combination would improve Synopsys’s financial standing. The merged business anticipates double-digit growth that leads the industry and is predicted to exceed TAM growth. In the first full year following closure, the transaction is anticipated to increase Synopsys’s unlevered free cash flow margins and its non-GAAP operating margin. After the second full year following the completion, the combination is expected to be significantly accretive to non-GAAP EPS.

Robust Balance Sheet Facilitating Quick Deleveraging: Within two years of completion, the combined firm should produce significant and continuous free cash flow, allowing for a quick deleveraging to less than 2x debt to Adjusted EBITDA, with a long-term leverage target of less than 1x. With its robust cash flow production and dedication to quickly de-lever, Synopsys anticipates maintaining investment grade credit ratings.

Providing Cost and Revenue Synergies: The combined company anticipates generating $400m in run-rate cost synergies by year three following the closing and $400m in run-rate revenue synergies by year four, with the potential to grow to more than $1bn annually over an extended period of time.

DEAL STRUCTURE

The definitive agreement signed in early January outlines the details of the merger between Synopsys and Ansys. This strategic move aims to leverage synergies between the two companies in the technology sector, particularly in the field of artificial intelligence (AI) and simulation software.

According to the agreement, Ansys will merge with and into a vehicle wholly owned by Synopsys. The newly formed entity will survive the merger as a wholly-owned subsidiary of Synopsys. Each share of Ansys common stock will be automatically converted into the right to receive $197 in cash and 0.3450 shares of Synopsys common stock. This arrangement results in an aggregate equity amount of approximately $35bn, financed through cash and debt. The agreed-upon per-share consideration includes a 29% premium over Ansys’s closing stock price before the announcement and a premium of approximately 35% to Ansys’s 60-day volume-weighted average price for the period ending on the same date.

The news resulted in stronger market performance for Synopsys as its shares rose as much as 4.6% before giving up some of those gains, and were trading 1.5% higher in the late afternoon after the deal’s announcement. The investors’ reaction is even more logical if we look at the fact that Ansys has gained momentum on the back of the huge interest in new AI needs, and that has certainly opened important discussions on how this technology will evolve and affect our lives in the medium-to-long term.

The integration plan focuses on maximizing synergies between Synopsys and Ansys while minimizing disruptions to operations. This includes aligning product portfolios, streamlining R&D efforts, and optimizing go-to-market strategies. The merger is expected to be accretive to earnings per share (EPS) starting in year two and will not affect previously announced share buyback programs or dividends. Synopsys anticipates expanding non-GAAP operating margins by 125 basis points and unlevered free cash flow (FCF) margins by 75 basis points, contributing to accelerated revenue growth and margin expansion in the future.

The transaction, unanimously approved by the boards of both companies, is expected to close in the first half of 2025, subject to regulatory approval and customary closing conditions. At closing, Ansys will be effectively delisted from NASDAQ and its president and CEO Ajei Gopal will join Synopsys’s executive team.

As the market eagerly awaits the completion of this transformative acquisition, the implications for the technology landscape are poised to be far-reaching. The combined expertise in AI and simulation software is expected to position the merged entity as a leader in the industry, with the potential to drive innovation and address emerging challenges.

Authors: Giulia Duca; Kashish Bhatia; Harshit; Pietro Micara; Francesco Rastelli.

Bibliography:

- https://www.reuters.com/markets/deals/synopsys-finalizes-35-bln-deal-buy-engineering-software-vendor-ansys-source-2024-01-16/

- https://www.cnbc.com/2024/01/16/synopsys-to-acquire-ansys-in-35-billion-graphics-software-deal.html

- https://www.cnbc.com/quotes/ANSS/

- https://www.cnbc.com/quotes/SNPS/

- https://www.nytimes.com/2024/01/16/technology/synopsys-ansys-35-billion-dollars.html

You must be logged in to post a comment.