BAE Systems, a listed United Kingdom-based defence, aerospace, and security company, agreed to acquire Ball Aerospace & Technologies Corp, the United States-based manufacturer of spacecraft, components and instruments for national defence, civil space, and commercial space applications, from Ball Corp, the United States-based manufacturer of metal and plastic packaging, primarily for beverages and foods in an USD 5.6 billion all-cash transaction on August 17th, 2023.

COMPANIES OVERVIEW

BAE Systems

BAE Systems is a global company that specializes in providing advanced technology-led products and services for the military, security, and space sectors.

BAE Systems’ core Business Areas are

– Defence, the company develops, engineers, manufactures, and supports products and systems to deliver military capability.

– Aerospace, the UK-based firm operates in the aerospace domain, working on innovative technologies that enhance operational effectiveness.

With a skilled workforce of over 93,000 people across approximately 40 countries, BAE Systems collaborates with customers and local partners worldwide. Their commitment to technology and innovation drives their strategy and innovation, making them a major player in the defence and aerospace industry.

The company’s areas of focus are Autonomous Technologies, Space Innovation (essential for military and economic advantage on the global stage), and Advanced Manufacturing. Digital Integration is another of the main aims of the company, in fact BAE Systems has a history of digitally integrating naval vessels and combat jets.

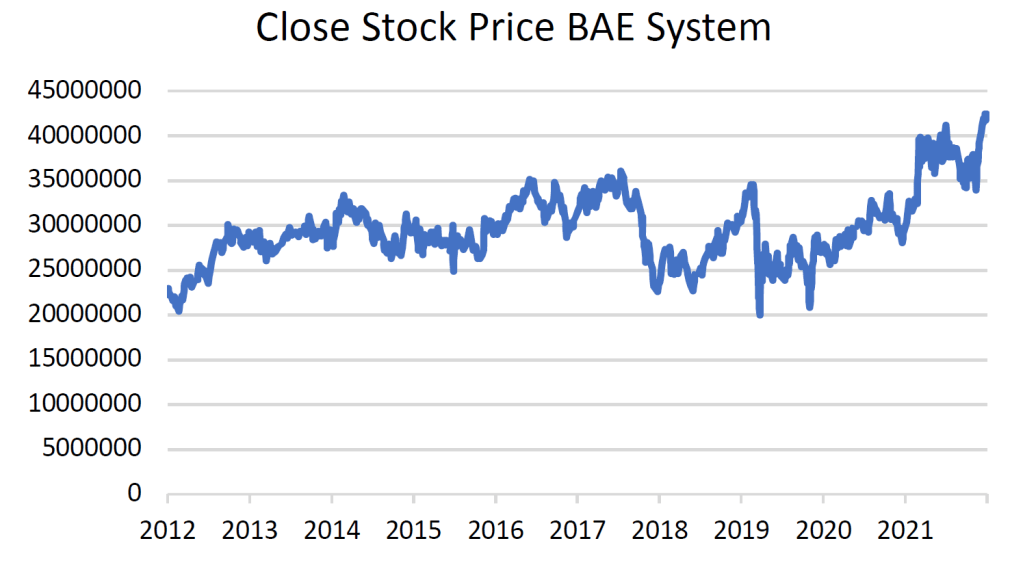

In FY22, BAE Systems demonstrated strong financial performance, closing the year with earnings at $55.7 billion, almost doubling from FY21’s $23 billion. Their Return on Equity (ROE) was 27.5% and Return on Assets (ROA) stood at 15.1%, both reflect the company’s financial health. The Return on Invested Capital (ROIC) for BAE Systems for the fiscal year 2022 is 7%, but even more notable is the +74% on their stock price achieved during FY22.

Ball Aerospace

Ball Aerospace & Technologies Corp. is a prominent player in the aerospace industry. Headquartered in Broomfield, Colorado; the company is a market leader in the spacecraft, defence, and scientific instruments industries.

The American company was born in 1956, when it began building pointing controls for military rockets. Initially known as Ball Brothers Research Corporation, one of its starting achievements was securing a contract to construct some of NASA’s first spacecraft, including the Orbiting Solar Observatory satellites. The legacy of cooperation with aerospace and defence organisations continued over the years, Ball Aerospace has been involved in numerous technological and scientific projects, consistently providing aerospace technology to NASA and related industries.

Ball Aerospace features a vast basket of divisions, the most notables are Spacecraft and Satellites, and the company also manufactures satellites and spacecraft for national defence, civil space, and commercial space applications. Other important competencies are Space-based instruments and sensors, critical for scientific research and exploration, RF and Microwave Technologies, the company specializes in cutting-edge radio frequency (RF) and microwave technologies, Data Exploitation Solutions and Aerospace Components.

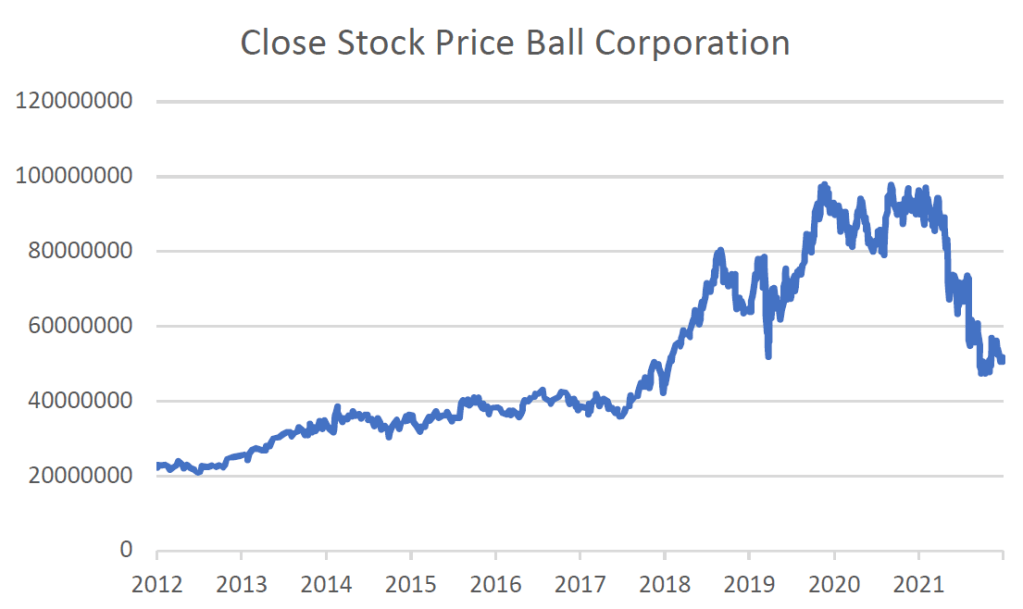

Now looking at the FY22, the registered revenue was approximately $2 billion. The Net Income experienced a notable growth from $2.1 billion in FY21 to $7.83 billion in FY22. As for the ratios, the company in the FY22 had ROA (Return on Assets) of 21.9% and ROE (Return on Equity) of 34.7%, which testify the financial health of Ball Aerospace. ROIC (Return on Invested Capital) was 3,7%. Is also worth noticing the performance off the stock price, which registered a crazy 25.5% increase during FY22.

DEAL-SPECIFIC MARKET OVERVIEW

Aerospace and defence industry

The worldwide aerospace and defence industry is expected to grow at a compound annual growth rate (CAGR) of around 8.2% between 2022 and 2030, from its estimated valuation of USD 750 billion

in 2022 to USD 1388 billion by 2030. The industries that design, develop, produce, and maintain aircraft, spacecraft, missiles, and military equipment are included in this category and they are essential for the development of national security, global economy, and technology. The aerospace business serves both military and civilian goals, whereas the defence sector principally concentrates on military capabilities and national security.

The aerospace and defence industry are being driven by rising demand for air travel, technological developments, expanding space operations, rising military modernization, and increased investment in the sector. The major participants include Airbus Group, The Boeing Company, United Technologies Corporation, General Electric Company, Safran S.A., and Rolls-Royce Holdings Plc. North America became the biggest region in the aerospace industry in 2023, accounting for nearly 35% of the worldwide market share, and is expected to be the fastest-growing area throughout the forecast period.

Key trends shaping the aerospace and defence industry include:

1. Talent management: companies are dealing with work force problems as demand rises and worker expectations shift. The International Civil Aviation Organization predicts that demand for air travel will increase by 4.3% each year over the next 20 years.

2. Supply chain complexity: the complexities of the global supply chain ask for a variety of solutions. For example, by the mid-2030s, it is expected that over 200,000 aircraft would take off and land globally.

3. Digital transformation: adoption of digital technology has the potential to boost industrial development and efficiency. The Department of Défense (DoD) has authorized a budget of around USD 722 billion for FY 2022, an increase of USD 17 billion from USD 705 billion in 2020.

4. Product innovation: being driven by evolving client desires and sustainability concerns. The aviation sector is expected to create $1.5 trillion in GDP and 15.5 million direct jobs for the global economy by 2036.

5. Defence and commercial spending: industry spending promotes growth and innovation. US military expenditure grew to USD 801 billion from USD 778.23 billion the previous year, representing an almost 2.9% increase.

The booming global economy and growing middle-class populations are driving up demand for commercial aviation and new aircraft. However, environmental concerns, notably about emissions, impede market expansion. To meet emission reduction targets, the industry must implement low emission fuels, airframe and engine modifications, operational efficiencies, and demand restraint solutions. Increased defence spending presents opportunities for market expansion, notably in nations such as the United States, China, and India. However, constraints such as regulatory compliance and technical complications may stifle expansion.

Looking ahead to 2024, the aerospace and defence sector may confront a variety of challenges and possibilities influenced by geopolitical factors, innovation, and market demand. Adaptability, agility, and embracing technology improvements will be critical to success. Accelerating product development through digital technologies, responding to changing consumer wants, staying ahead of technology breakthroughs, and investing in cyber resilience are all strategic imperatives for industry companies looking to succeed in an ever- changing global environment.

DEAL RATIONALE

The acquisition of Ball Aerospace by BAE Systems represents a significant strategic move, marking a pivotal enhancement of BAE’s capabilities and market position. This deal is poised to deepen BAE’s relationships with key customers such as NASA, enriching its environmental monitoring and surveillance capabilities in response to the challenges posed by climate change. Ball Aerospace, with its expertise in satellite systems, geospatial intelligence, and tactical solutions, aligns well with BAE’s strategic objectives, propelling the company deeper into the crucial domains of space and C4ISR (command, control, communications, computers, intelligence, surveillance, and reconnaissance).

Financial and Strategic Growth Perspectives

From a financial perspective, this acquisition stands as a primary growth driver for BAE Systems. Charles Woodburn, BAE’s CEO, highlighted the potential for Ball Aerospace’s sales to increase by 10% annually over the next five years, signifying a substantial revenue growth trajectory. This is expected to positively impact BAE’s profits from the first year after completion. With Ball Aerospace generating $1.98 billion in revenue in 2022, making up 13% of Ball’s consolidated net sales, there is an anticipation for sales to escalate to around $4 billion by the end of the decade.

For 2024, BAE Systems has set ambitious targets, foreseeing sales, and underlying operating profits to rise by 10-12% and 12-14%, respectively. This includes nearly a full year’s contribution from Ball Aerospace following the acquisition. This strategic integration and financial outlook underscore the rationale behind the acquisition, signaling a period of sustained growth and strengthened leadership for BAE Systems in the aerospace and defense sectors.

Strategic Rationale

• Industry Convergence and Innovation Leadership: The acquisition places BAE Systems at the forefront of the aerospace and defense industry’s evolution, integrating space and cyber domains. By incorporating Ball Aerospace’s advanced space technologies, BAE Systems diversifies its product portfolio and secures a leadership position in the converging sectors of defense, space, and cyber technologies.

• Strategic Alignment with Future Defense Needs: Ball Aerospace’s advanced sensors, spacecraft, and payload technologies align with the anticipated future requirements of defense and intelligence communities for space-based capabilities, ensuring BAE Systems’ crucial role in delivering next-generation defense solutions.

Financial Rationale

• Growth Through Innovation: Leveraging Ball Aerospace’s robust R&D capabilities, BAE Systems is set for accelerated innovation, aiming for long-term financial success by developing technologies that address emerging threats and opportunities in the space and cyber domains.

• Synergies Beyond Cost Savings: The acquisition brings significant cost optimizations and opens potential revenue synergies through cross-selling and the integration of complementary technologies, expanding new markets and customer segments.

Operational Rationale

• Enhancing BAE’s Global Strategy: This acquisition not only extends BAE Systems’ global footprint but strategically strengthens its position in crucial U.S. markets, aligning with the U.S. government’s focus on space security and defense.

• Cultural and Technological Integration: The successful merger focuses on integrating corporate cultures and technologies, fostering a unified vision for innovation and growth, ensuring the combined entity maximizes its potential.

• Commitment to Sustainability and Corporate Responsibility: Integrating Ball Aerospace’s environmentally conscious technologies with BAE Systems’ operations will enhance the combined entity’s commitment to sustainability, highlighting the importance of corporate responsibility in today’s business environment.

To sum up, the acquisition of Ball Aerospace by BAE Systems represents a strategic endeavor to bolster BAE’s position in the aerospace and defense sectors, particularly focusing on the burgeoning space industry. This deal is expected to diversify BAE’s product offerings, access new markets and customers, achieve financial growth through operational synergies, and enhance its technological capabilities and potential for innovation. This comprehensive rationale underscores the strategic, financial, and operational benefits envisaged from this acquisition, positioning BAE Systems for continued growth and leadership in an evolving industry landscape.

DEAL STRUCTURE

In February 2024, BAE Systems completed the 100% cash acquisition of US-based Ball Aerospace from Ball Corporation. It’s the largest acquisition in the history of BAE System: the transaction closed at a purchase price of $5.6 billion (approximately £4.4 billion), which has been funded through existing cash and new external debt. The transaction will be treated as an asset purchase for federal tax purposes, with an expected net present value tax benefit of c.$750m, making the underlying economic consideration for the business c.$4.8bn. Ball Aerospace’s parent company Ball Corporation said the price represents 19.6x Ball Aerospace’s LTM comparable EBITDA (as of June 30, 2023).

BAE Systems has stumped up $1.5bn in cash to fund this and has a $4bn bridge loan in place to cover the rest, with the help of Bank of America and Citigroup as a group of advisors. Finance director Brad Greve said the company expects to replace this via the bond markets “in due course”.

Net debt stood at around £2.5bn at the end of last year, or £1bn excluding leases, but cash generation was strong at approximately £4.1bn placing the business in a strong position to manage the financing associated with the acquisition. For BAE Systems, the addition of Ball Aerospace means revenue and underlying operating profit growth are expected to nudge up, by 10-12 per cent and

11-13 per cent, respectively (£28billion in revenues and £3billion in annual profits). Guidance is for earnings per share to be lower at 6-8 per cent, though, which UBS analysts attribute to integration costs. Free cash flow is expected to fall from £2.6bn to £1.3bn.

Ball Corporation will utilize the approximately $4.5 billion of after-tax cash proceeds to reduce leverage, return value to shareholders and embark on the next step in their journey with greater financial flexibility and a focused purpose of advancing sustainability through aluminum packaging solutions that support a world free from waste. Specifically, the company will use approximately $2 billion of the after-tax proceeds to reduce net debt and use approximately $2 billion of the after-tax proceeds to return value to shareholders via share repurchases and utilize the remaining proceeds to further strengthen the balance sheet.

Ball Aerospace will be called Space & Mission Systems and become the fourth operating sector of BAE Systems. The business is headquartered in Colorado, with more than 5,200 employees, adding additional capabilities to design, build and operate satellites and satellite systems to BAE Systems’ multi-domain portfolio and increase their exposure to high priority areas of the US Department of Defense budget.

Authors: Emilio Cornejo, Verdant Majmudar, Tommaso Belotti, Tommaso Denaro, Gianfranco Sovrenigo

You must be logged in to post a comment.