INTRODUCTION

Announced on December 22, 2023, Bristol-Myers Squibb (BMS) declared the successful finalization of its takeover of Karuna Therapeutics, Inc. (Karuna) on March 18, 2024. Gordon Dyal & Co. and Citi are serving as buy-side financial advisors to Bristol Myers Squibb, while Goldman Sachs & Co. LLC is serving as exclusive sell-side financial advisor and fairness opinion provider to Karuna.

Following the completion of the acquisition, trading of Karuna shares on the Nasdaq Global Select Market has halted, and Karuna is now fully owned by BMS.

Bristol Myers Squibb has finalized the acquisition of Karuna at $330.00 per share in cash, amounting to a total equity value of $14.4 billion, entirely paid in cash. The agreement received unanimous approval from both the Bristol Myers Squibb and Karuna Boards of Directors.

COMPANIES’ OVERVIEW

Bristol-Myers and Squibb

“Bristol Myers Squibb is a global biopharmaceutical company whose mission is to discover, develop and deliver innovative medicines that help patients prevail over serious diseases.”

The transaction will be treated as an asset acquisition, leading to a one-time, non-deductible Acquired In-Process Research and Development (Acquired IPR&D) charge of approximately $12 billion, impacting both the first quarter and full-year GAAP and non-GAAP EPS by approximately $5.93.

As per its customary practice, Bristol Myers Squibb typically updates its financial outlook once per quarter. Therefore, when assessing the company’s financial outlook provided on February 2, 2024, investors and analysts should consider the aforementioned impacts. Bristol Myers Squibb intends to offer an updated financial outlook upon reporting its first-quarter 2024 results on April 25, 2024.

Karuna

“Karuna is a biopharmaceutical company driven to discover, develop and deliver transformative medicines for people living with psychiatric and neurological conditions.”

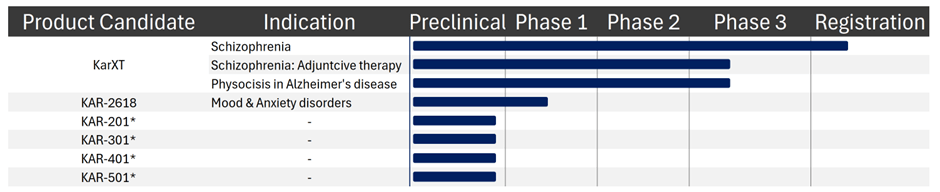

At the forefront of its portfolio is KarXT (xanomeline-trospium), an antipsychotic exhibiting a unique mechanism of action (MoA) along with distinct efficacy and safety profiles. The U.S. Food and Drug Administration (FDA) has accepted Karuna’s New Drug Application (NDA) for KarXT for the treatment of schizophrenia in adults, with a Prescription Drug User Fee Act (PDUFA) date set for September 26, 2024. KarXT is undergoing registrational trials for adjunctive therapy to standard-of-care agents in schizophrenia, as well as for treating psychosis in Alzheimer’s disease patients. Bristol Myers Squibb views KarXT as a substantial revenue-generating opportunity and acknowledges the potential of Karuna’s early-stage and pre-clinical pipeline.

Data: Karuna’s Corporate Site; *Indication for these drugs is undisclosed

INDUSTRY OVERVIEW

M&A activity in the healthcare industry at large—including pharmaceuticals and life sciences (PLS) and healthcare services (HCS)—exhibited resilience throughout 2023. Thus, dealmaking is predicted to further heighten, building upon the momentum observed towards the latter part of 2023 and in the initial weeks of 2024.

Data: PwC

Projections indicate that large-cap pharma firms will persist in their pursuit of midsize biotech companies to address gaps in their pipelines ahead of impending patent expirations. Investor attention remains drawn towards GLP-1 drugs, utilized for managing diabetes and promoting weight loss, alongside a sustained emphasis on precision medicine, which are expected to drive M&A activity throughout 2024. Private equity (PE) entities possess substantial capital reserves, poised to facilitate acquisitions or partnerships within the healthcare sector. Furthermore, several investment funds are nearing the end of their designated hold periods for certain assets within their portfolios, potentially leading to an increased availability of assets in the market during 2024.

Despite cautious optimism surrounding the gradual reopening of the IPO market in 2024, ongoing market volatility coupled with upcoming elections in various countries may limit the available window for successful exits, prompting some companies to delay until 2025. Consequently, M&A transactions and divestitures are anticipated to remain the primary strategies for both exiting and raising capital within the healthcare sector in 2024.

Crucially, according to PwC’s 27th Annual Global CEO Survey, 54% of Health Industries CEOs intend to pursue at least one acquisition within the next three years.

DEAL RATIONALE

This strategic move aims to strengthen Bristol Myers Squibb’s position in neuroscience, leveraging Karuna’s novel treatments and pipeline.

On Bristol Myers Squibb’s side, BMS sees Karuna Therapeutics as a great chance to expand and diversify the portfolio in the space of antipsychotic drugs, as said by Christopher Boerner CEO: “This transaction fits squarely within our business development priorities of pursuing assets that are strategically aligned, scientifically sound, financially attractive, and have the potential to address areas of significant unmet medical need”. With BMS, Karuna’s lead asset – KarXT is expected to become a multibillion-dollar drug across several indications. Notably, it could help patients with schizophrenia, psychosis and agitation from Alzheimer’s disease. KarXT should drive sales through the late 2020s and the next decade, when two of BMS’s top drugs, blood cancer treatment Revlimid and blood thinner Eliquis face generic competition upon losing patent protection in the coming years.

On Karuna’s side, Bill Meury, President and CEO of the company, believes that with Bristol Myers Squibb’s long-lasting expertise in developing and commercializing medicines on a global scale, KarXT and the other assets of the company will be well-positioned in the market to reach those living with schizophrenia, and Alzheimer’s disease psychosis.

DEAL STRUCTURE

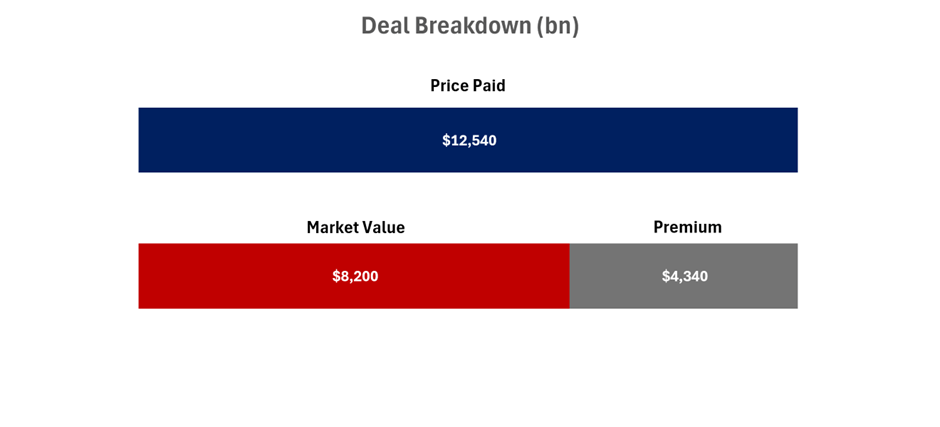

Bristol Myers Squibb has agreed to acquire all outstanding shares, 38 million common stocks of Karuna Therapeutics at $330 per share in cash, a roughly 53% premium to its closing price on Dec. 21, 2023. This deal, amounting to approximately $14.0 billion in total equity value, was approved by the boards of both companies. The share price of Karuna Therapeutics has increased by $102 after the announcement. The acquisition has been financed primarily through new debt and is expected to close in the first half of 2024.

In an acquisition transaction, the purchase consideration can be categorized as cash, stock, or a combination. Risk-averse types of shareholders would prefer cash rather than stock as the purchase consideration because cash is tangible, and the value received post-closing is guaranteed. In most cases, an all-cash deal will result in a higher valuation than an all-stock deal as the proceeds from the sale would be a fixed amount and the target can’t participate in the further operation of the entity. However, an acquisition paid in all-cash has an immediate tax consequence, as a taxable event has been triggered.

Authors: Pietro Micara, Aahana Mishra, Federico Manera, Dragos Filipas, Bruno Montanaro.

Sources: Business Wire, PwC, Reuters, Karuna Corporate Site, Bristol Myers Squibb Corporate Site.

You must be logged in to post a comment.