The merger of equals between Anglo American and Teck Resources, valued at USD 53 bn, will create Anglo-Teck plc, which will be headquartered in Vancouver and have a primary listing on the London Stock Exchange. The deal aims to consolidate energy transition metals as the energy transition reshapes global demand. The new entity will become a top five global copper producer with a diversified portfolio, including iron ore, zinc, and platinum group metals, across the Americas, Africa, and Australasia, featuring notable Tier 1 copper assets in Chile. The deal establishes a strategic partnership to enhance operational synergies, strengthen their market position, and establish a global mining giant with an ESG focus.

Company overview – Anglo American

History

Founded in 1917 in South Africa, Anglo American began as a gold and diamond mining company before expanding into a diversified portfolio of commodities such as platinum group metals, coal, copper and zinc. Throughout the 20th century, Anglo became one of the world’s largest mining groups, acquiring and developing assets across Africa and globally.

Leadership and Structure

- Duncan Wanblad, CEO, former Chief Executive of the Base Metals Division at Anglo American, where he has worked since 2004.

- John Heasley, CFO

- Ruben Fernandes, COO

- Monique Carter, CPO

The company’s corporate offices are located in London and Johannesburg, with the post-merger entity (“Anglo Teck”) expected to be headquartered in Vancouver, Canada, while maintaining a primary listing on the London Stock Exchange (LSE) and secondary listings on the JSE, TSX, and NYSE. Shareholding is largely institutional, with approximately 98.9 million shares held by independent charitable trusts (“Investment Companies”), which receive dividends but have waived voting rights. Anglo holds interests and mining sites in Chile, Peru, Brazil, South Africa, Botswana, Namibia, Zimbabwe, Canada and Australia (Anglo American plc, 2025)[1].

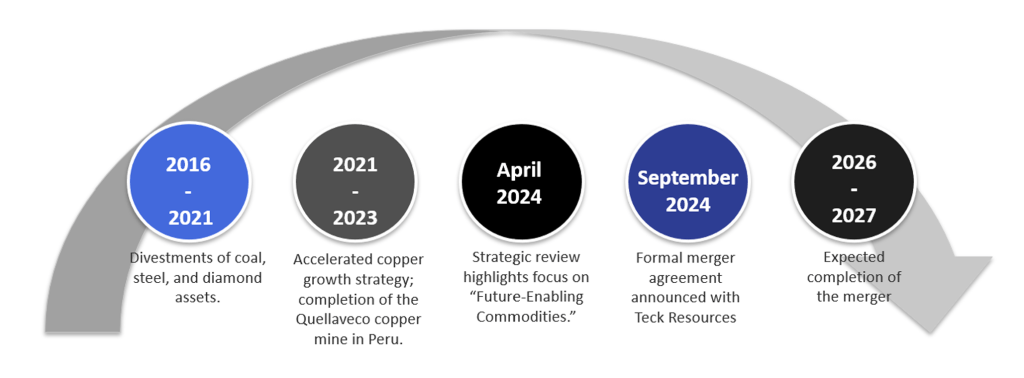

Anglo American Timeline Leading up to the Merger

- 2016 – 2020: Streamlined portfolio through divestments of coal, steel, and diamond assets.

- 2021 – 2023: Accelerated copper growth strategy; completion of the Quellaveco copper mine in Peru.

- April 2024: Strategic review highlights focus on “Future-Enabling Commodities” for energy transition, electrification and low-carbon economy.

- September 2025: Formal merger agreement announced with Teck Resources, creating a copper-dominant diversified miner.

- Expected completion: 2026 – 2027, pending shareholder and regulatory approvals.

Financial snapshot

As of FY2024, Anglo American reported revenue of approximately USD 27.3 bn and an underlying EBITDA of USD 8.5 bn, with an EBITDA margin near 30%. The company maintains an investment-grade balance sheet, with net debt/EBITDA at around 1.1x and total liquidity of over USD 10 bn. A market capitalization of USD 40.3 bn (as of 07/11/2025). Capital expenditures totalled USD 6.3 bn, split between sustaining (~65%) and growth (~35%) projects.

Company overview – Teck Resources

History

The company was founded in 1913 and began as Teck-Hughes, following the discovery of gold in 1912 by prospectors. In 1986 it began its association with Cominco, a consolidated portfolio of mines across Canada. Teck historically operated in Coal, Zinc and Copper, announcing a solar initiative in 2020. However, it sold most of its coal portfolio to Glencore in August 2024 in an effort to streamline more towards copper (Teck Resources Limited, 2025)[2].

Leadership and structure

- Jonathan Price, CEO & President, previously held senior finance, transformation and business-development roles at BHP Group, worked in mining-banking with ABN AMRO Bank and technical-production roles at INCO

- Crystal Prystai, CFO

- Dean Winsor, CPO

- Nicholas Hooper, Chief Corporate Development Officer

Headquartered in Vancouver, Canada where the merged company Anglo Teck would move to, however keeping a primary listing on the LSE. Teck holds interests in mines located in Chile, Peru, USA and its native Canada, almost all of which have copper as their main product.

Glencore’s April 2023 hostile takeover bid for Teck Resources, valued at about USD 22.5 bn, proposed merging the firms before splitting them into “MetalsCo” for base metals and “CoalCo” for coal assets. Teck’s board rejected the offer, citing jurisdictional and environmental risks tied to Glencore’s coal and oil-trading exposure. A revised proposal, adding up to USD 8.2 bn in cash to reduce coal exposure, was also dismissed. The move drew political opposition in Canada, where officials framed Teck as a strategically vital domestic miner.

Teck Resources timeline leading up to the merger

- April 2023 – Teck rejects hostile takeover attempt from Glencore

- November 2023 – Teck announces plan to divest steelmaking coal business

- July 2024 – Regulatory approval to sell steelmaking coal business, announces deal completion

- May 2025 – Recommends shareholders reject “mini-tender offer” by TRC Capital – less relevant as this is a typical move by such a firm

- September 2025 – Teck announces a comprehensive operations review and action plan (incl. Quebrada Blanca)

- September 2025 – Teck formalizes merger agreement with Anglo American

Financial snapshot

Teck resources posted Q3 2025 revenue of CAD 3.39bn, with an adjusted EBITDA of CAD 1.17bn, a significant increase from Q3 2024. The EBITDA margin (although we are using adjusted values) is in line with the industry average of 35%. A market cap of USD 19.92bn (as of 07/11/2025) after a tumultuous year in the markets, amplified by ongoing trade disputes.

The black line represents Anglo American Stock’s performance in GBP; the red line represents Teck Resources performance over the 5 years period in CAD.

Market overview

Industry Overview

Looking at the global mining industry, it is clear that it stands at a decisive moment, reshaped by the accelerating energy transition and rising demand for critical minerals such as copper, nickel, zinc, and lithium that draws geopolitical attention. According to various sources, the global mining industry is valued more than USD 2.5 tn, with an expected CAGR of more than 5 percent through the next few years. According to the International Energy Agency (IEA)[3] copper demand could double by 2035, driven by electric vehicles, grid expansion, and renewable integration. Yet supply remains constrained by declining ore grades, long permitting timelines, and limited discoveries.

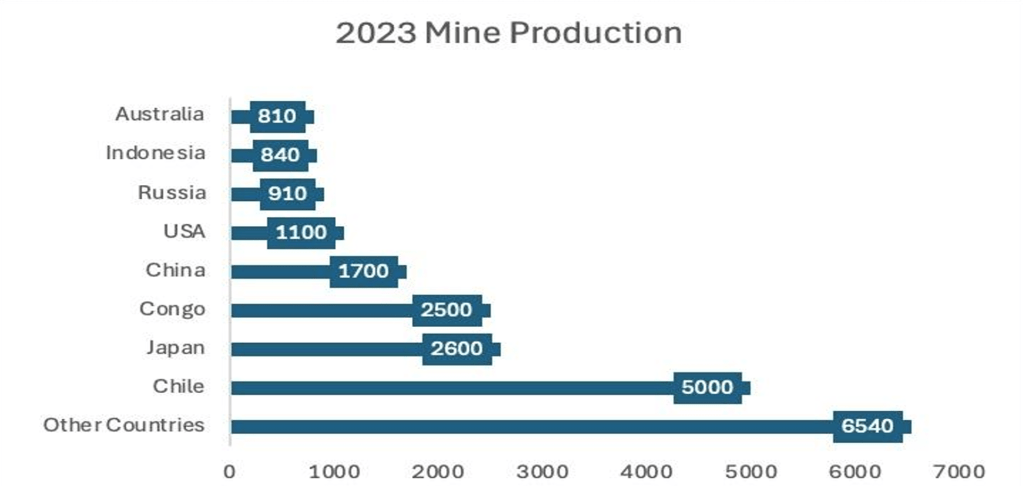

The sector continues to be dominated by diversified majors industries – BHP, Rio Tinto, Glencore, Anglo American, and Freeport-McMoRan – which together control around 40 percent of global copper production. Anglo and Teck, both included in the top ten producers, have one of the largest and most geographically balanced copper portfolios worldwide, with complementary exposure to Chile, Peru, and Canada.

Despite elevated commodity prices, structural challenges persist with capital expenditure at record highs and national resource policies that increase operational risk. The world could face a projected copper deficit of up to six million tons by 2035 according to S&P Global (2025)[4], making scale, diversification, and strategic consolidation essential to long-term resilience for countries that aim to secure their domestic supply. At the same time, geopolitical tensions are reshaping other critical mineral markets, most notably rare earths. Recent US tariffs on Chinese exports have accelerated efforts to diversify supply chains and reduce dependence on China, whose dominance in refining has long been a structural risk for Western industries. This shift has redirected capital toward non-Chinese producers—particularly in Australia. The trend aligns with the broader move toward securing future-facing minerals and reinforces how trade policy, supply-chain security and M&A dynamics are increasingly interconnected in the global mining sector.

M&A Outlook

Although there was minimal activity in the industry for a few years, there has been a fresh spate of consolidation in the mining industry around ‘future-facing’ metals. Worldwide mining mergers and acquisitions stood at almost USD 95 bn in 2024, with over one-third of these deals involving copper, according to PwC (2024)[5].

It is important to note that the attempted takeover of Anglo American by BHP belongs to this new wave of M&A activity in the sector, becoming one of the most closely watched events in the industry. Over several weeks, BHP submitted multiple proposals, each rejected by Anglo’s board, mainly due to concerns over deal structure and the required break up of its South African operations. Had it succeeded, the transaction would have been among the largest in mining history, combining major copper, iron ore, potash and coal assets. BHP’s pursuit reflected the growing urgency to secure future-facing metals—especially copper—needed for global electrification.

This testifies how the industry is now facing new growth after a decade of underinvestment. In fact, Private Equity and Sovereign Wealth funds are increasingly investing in the market, drawn by raising commodity prices.

The Anglo American-Teck merger is one such example. The merger will create synergies amounting to approximately USD 800 mn per year prior to taxes, along with an increment of USD 1.4 bn in EBITDA due to the integration of South American assets like Collahuasi and Quebrada Blanca. The new entity will make its way into the top producers in terms of copper with 72 percent of EBITDA being derived from copper mining, 22 percent derived from iron ore, and the other 6 percent derived from zinc.

It is important to note how mining M&A has increasingly acquired an overt political dimension, with governments that are now deeply involved in transactions that touch strategic minerals, national employment, critical supply chains, or cross-border ownership. Deals involving copper, lithium, rare earths, and nickel are scrutinized through national-security, industrial-policy, and resource-sovereignty lenses, often determining whether a transaction can proceed. As geopolitical tensions intensify, mining deals require careful stakeholder management, alignment with national priorities, and strong ESG credentials to navigate a landscape where political approval is as essential as financial logic.

Expected Future Developments in the Industry

In the coming decade, mining can look forward to a transition from its resource extraction business model to its role as an enabler for a low-carbon economy.

Technology innovation in mining related to automation, data analysis, and artificial intelligence will move exploration and processing in mining to become efficient and green. Additionally, governments are reemphasizing mineral security with legislation like the Inflation Reduction Act in the U.S., Critical Minerals Strategy of Canada, and Critical Raw Materials Act in the EU.

Investors are rewarding miners that are not only profitable but also demonstrate sound ESG credentials. The Anglo Teck mergers demonstrate how mergers are now based not only on size and technology but also sustainability to deliver materials for a decarbonized world.

Deal rationale

The merger to create ‘Anglo Teck plc’ presents a promising short- and long-term growth outlook for shareholders of both Anglo American and Teck. The transaction is driven by precise strategic alignment and synergies, which offer both immediate and longer-term financial benefits. Both boards have unanimously recommended the merger as being in the best interests of their shareholders. However, the merger requires approval from regulators in multiple countries, each with its own unique political considerations, posing practical challenges to integration and potentially exposing the deal to risks.

Financial Rationale

This deal will generate significant value in both the short and long term. In the short term, it is expected to deliver approximately USD 800 mn annually in recurring pre-tax synergies, achieved through increased procurement efficiency, overhead reduction, and commercial optimisation, directly enhancing free cash flow without diluting the deal through a premium. In the longer term, the merger will develop a unique copper hub with operational synergies between mines located adjacent to each other in Northern Chile (Collahuasi and Quebrada Blanca). This setup enables infrastructure sharing and mine plan coordination, contributing to an expected average annual EBITDA of around USD 1.4 bn and approximately 175,000 tonnes of additional copper annually from 2030. Finally, the deal supports a stronger balance sheet by diversifying into critical minerals such as iron ore and zinc, creating a more stable cash flow base to sustain dividends, regardless of commodity price volatility.

Strategic Rationale

The strategic alignment of the merger encompasses three dimensions: streamlining operations to capitalise on the expanding copper market; positioning as a defensive measure amidst industry consolidation; and aligning ESG goals. The primary objective is to establish a global leader in the copper sector. Anglo-Teck will become the fifth-largest copper producer worldwide, with an annual output of approximately 1.2 million tonnes, expected to grow by around 10% by 2027 through organic expansion. This will result in roughly 70% of the combined revenue being derived from copper, significantly higher than that of peers, with operational assets positioned side by side – creating a unique portfolio of low-cost copper assets with expansion potential. This aligns with both firms’ strategic view of copper as a critical mineral for electrification, with sustained demand expected over the coming decades.

Furthermore, the consolidation serves as a defensive strategy, as Anglo and Teck have previously faced hostile takeover attempts from larger rivals, BHP and Glencore, which sought to control strategic copper assets. The merger both provides a robust defence against further takeovers and positions the combined entity as a potential consolidator within the industry. Additionally, the entities are aligned with commitments to greener assets, as Anglo has divested from coal and shares a commitment to sustainable mining, which has prevented a hostile takeover by Glencore. Finally, the deal has a geopolitical ESG dimension, as it establishes a primary Western source of ethically sourced critical minerals, contrasting with state-backed competitors that are less aligned with global sustainability principles according to Cohen ( Forbes, 2025)[6].

Risks

A significant risk to the potential merger is the complexity of multi-jurisdictional regulatory approvals, which, as in the BHP hostile takeover, could impose conditions or delays on the deal that limit flexibility, such as China’s SAMR according to ION Analytics (2025)[7] requiring behavioural commitments for the Chinese market. In the worst case, Chinese regulators could delay the deal by 18 months, introducing uncertainty and creating an opportunity for a rival bidder to emerge. If this occurs, offering a premium combined with a relatively low break fee (USD 330 mn) could risk derailing the merger. Additionally, domestic politics in Canada and Britain may shift, potentially rendering deal conditions, such as the headquarters in Vancouver or the listing on the LSE, insufficient to avoid regulatory scrutiny, which could impact the deal.

Solution

Anglo and Teck may need to restructure the deal terms to obtain regulatory approval, such as moving from a merger of equals to a more limited joint venture or asset swap. If Canadian regulatory approval remains uncertain, the entities could pursue a joint venture for the Chilean assets to benefit from operational synergies and long-term growth advantages.

Deal structure

The merger between Anglo American and Teck Resources, valued at approximately USD 53bn, is structured as a merger of equals. Teck Resources has a market capitalization of around USD 21bn and Anglo American about USD 34bn, with both experiencing sharp share price increases after the announcement. The combined entity will be headquartered in Vancouver, maintain a primary London Stock Exchange listing, and seek additional listings subject to approvals. Post-acquisition ownership will be 62.4% for Anglo and 37.6% for Teck. The merger is expected to generate USD 800mn in pre-tax annual synergies and strategically optimises the firms’ copper portfolios, consolidating roughly 1.2mn tonnes of annual output with over 70% copper exposure across six major assets. The Vancouver headquarters supports alignment with Canadian regulatory expectations, while the London listing maintains UK engagement.

Because the transaction is fully equity-funded, Teck shareholders receive newly issued Anglo shares. This stock-for-stock structure preserves cash, avoids added leverage, supports an investment-grade balance sheet, and maintains liquidity for future copper capex. With no cash consideration or new debt, neither company’s reserves are drawn on, and long-term financial flexibility is retained. The equity issuance results in proportional dilution while preserving Anglo’s majority control consistent with the ownership split.

The merger-of-equals framework also shapes governance and decision-making. Despite the equal framing, the ownership split gives Anglo shareholders majority voting power, strengthened by Anglo’s block of non-voting charitable shares, which increases the relative influence of its free float. Governance is expected to combine leadership from both companies, with proportional board representation and a unified senior management team. Decision-making will integrate both firms’ strategic priorities while acknowledging Anglo’s voting majority.

Completion is expected between 2026 and 2027, contingent on regulatory approvals in Canada, the UK, the U.S., Chile and China. China’s SAMR poses the greatest risk of delay due to its history of imposing behavioural commitments and extending reviews. Accordingly, the timeline includes merger-control filings, shareholder votes, potential remedy discussions, and conditional clearances, all critical gating items given geopolitical sensitivities around copper supply chains.

The structure has significant long-term implications for control and financial positioning. By avoiding debt and preserving liquidity, the combined entity retains flexibility to fund major copper expansions and manage cyclicality. The all-equity structure ties voting power directly to economic ownership, reinforcing shareholder-control dynamics and strategic influence. Overall, the deal structure facilitates operational integration, regulatory alignment, and durable growth while maintaining capital-allocation flexibility.

Valuation of Teck Resources

The valuation football field for Teck Resources illustrates a clear disconnect between fundamental value and the company’s pre-announcement trading level. The aggregated intrinsic and market-based valuation methods cluster within a range of CAD 59.6 to CAD 68.4, forming a cohesive band of estimated fair value. By contrast, the pre-announcement share price of CAD 48.95, marked by the red vertical line, sits well below even the most conservative valuation point. This gap highlights the discount at which the market had been pricing Teck Resources before new information entered the public domain.

Within the intrinsic category, the DCF asset value anchors the lower end of the fair-value range, while the DCF equity value reaches the upper end. Both methods imply that the company’s long-term cash-flow potential supports a meaningfully higher valuation than the prevailing market price at that time. Trading and deal multiples broaden the perspective. Although some multiples-derived values extend far above the intrinsic range, their primary function here is corroborative: they reinforce the view that peers and precedent transactions have been valued at levels implying stronger upside for Teck Resources. Overall, the football field underscores a consistent message. Across methodologies, the company’s fundamental worth appeared significantly higher than the share price the market assigned ahead of the announcement.

Authorship Disclosure

Head of the Energy and Raw Materials Division: Maximilian Lenhard

Energy and Raw Materials Division Analysts: William Pigot, Luca Sagrillo, Michele Pinto

Valuation & Modelling Analyst: Luca Dennert

Bibliography

International Energy Agency. (2024). Copper – Analysis: Outlook for key energy-transition minerals. Retrieved from https://www.iea.org/reports/copper

S&P Global Commodity Insights. (n.d.). The future of copper: Will the looming supply gap short-circuit the energy transition? Retrieved from https://commodityinsights.spglobal.com/futureofcopper.html

PwC. (2024). Mine 2024: Preparing for impact [21st edition]. Retrieved from https://www.pwc.com/gx/en/mining/assets/pwc-global-mine-2024.pdf

U.S. Geological Survey. (2024). Mineral commodity summaries 2024: Copper. Retrieved from https://pubs.usgs.gov/periodicals/mcs2024/mcs2024-copper.pdf

Anglo American plc. (2025, September 9). Anglo American and Teck to combine through merger of equals to form a global critical minerals champion [Press release]. Retrieved from https://www.angloamerican.com/media/press-releases/2025/09-09-2025

Teck Resources Limited. (2025). Teck and Anglo American to combine through merger of equals to form a global critical minerals champion [Press release]. Retrieved from https://www.teck.com/news/news-releases/2025/teck-and-anglo-american-to-combine-through-merger-of-equals-to-form-a-global-critical-minerals-champion

S&P Global Market Intelligence. (2025). Anglo-Teck set to transform global copper-mining landscape post-merger. Retrieved from https://www.spglobal.com/market-intelligence/en/news-insights/research/2025/09/anglo-teck-set-to-transform-global-copper-mining-landscape-post-merger

Ion Analytics. (2025). Anglo-Teck merger to draw careful review from China’s SAMR. Retrieved from https://ionanalytics.com/insights/mergermarket/anglo-teck-merger-to-draw-careful-review-from-chinas-samr/

Cohen, A. (2025, October 9). The mining merger that could reshape mineral security. Forbes. Retrieved from https://www.forbes.com/sites/arielcohen/2025/10/09/the-mining-merger-that-could-reshape-mineral-security/

[1]Anglo American and Teck to combine through merger of equals to form a global critical minerals champion [Press release]. Retrieved from https://www.angloamerican.com/media/press-releases/2025/09-09-2025

[2]Teck and Anglo American to combine through merger of equals to form a global critical minerals champion [Press release]. Retrieved from https://www.teck.com/news/news-releases/2025/teck-and-anglo-american-to-combine-through-merger-of-equals-to-form-a-global-critical-minerals-champion

[3]International Energy Agency. (2024). Copper – Analysis: Outlook for key energy-transition minerals. Retrieved from https://www.iea.org/reports/copper

[4]S&P Global Commodity Insights. (n.d.). The future of copper: Will the looming supply gap short-circuit the energy transition? Retrieved from https://commodityinsights.spglobal.com/futureofcopper.html

[5]PwC. (2024). Mine 2024: Preparing for impact [21st edition]. Retrieved from https://www.pwc.com/gx/en/mining/assets/pwc-global-mine-2024.pdf

[6]Cohen, A. (2025, October 9). The mining merger that could reshape mineral security. Forbes. Retrieved from https://www.forbes.com/sites/arielcohen/2025/10/09/the-mining-merger-that-could-reshape-mineral-security/

[7]Ion Analytics. (2025). Anglo-Teck merger to draw careful review from China’s SAMR. Retrieved from https://ionanalytics.com/insights/mergermarket/anglo-teck-merger-to-draw-careful-review-from-chinas-samr/

You must be logged in to post a comment.